Life insurance premium journal entry information

Home » Trending » Life insurance premium journal entry informationYour Life insurance premium journal entry images are available in this site. Life insurance premium journal entry are a topic that is being searched for and liked by netizens today. You can Find and Download the Life insurance premium journal entry files here. Find and Download all free vectors.

If you’re searching for life insurance premium journal entry pictures information linked to the life insurance premium journal entry keyword, you have visit the ideal blog. Our site always provides you with suggestions for downloading the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

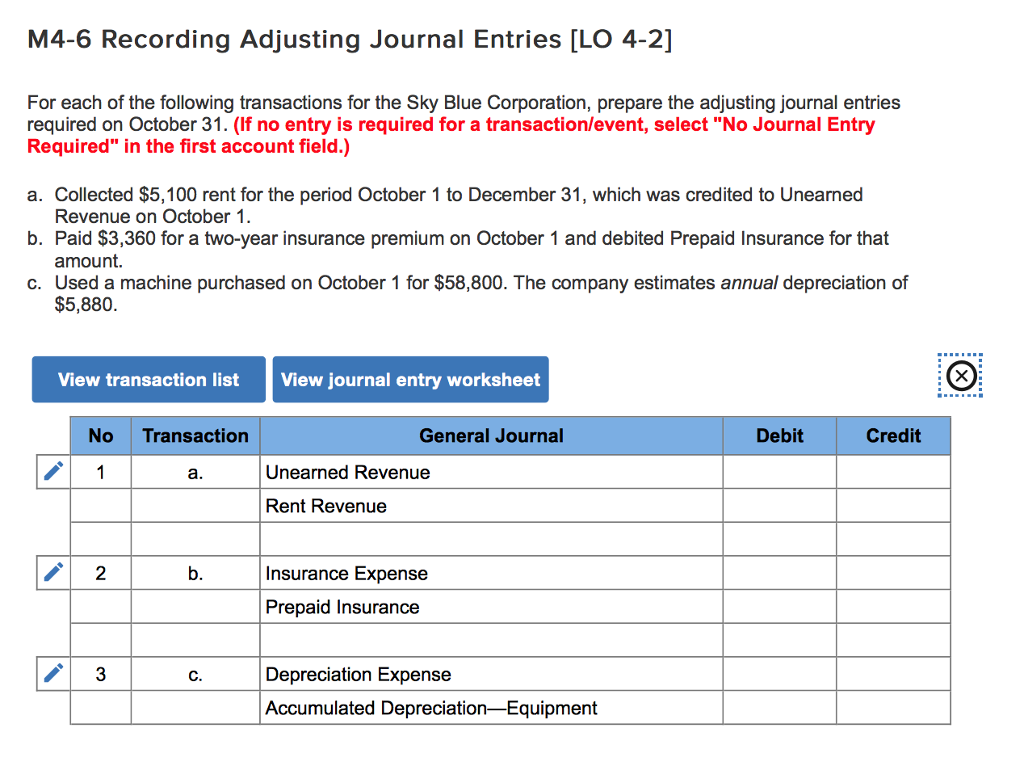

Life Insurance Premium Journal Entry. Insurance expense journal entry at the end of each month, the company usually make the adjusting entry for insurance expense to recognize the cost of that has expired during the period. Dr prepaid insurance xxx cr cash on hand/in bank xxx to record payment of life insurance. Their accounts team would prepare the following calculation and journal entry. At that time, the cash surrender value is $3,000.

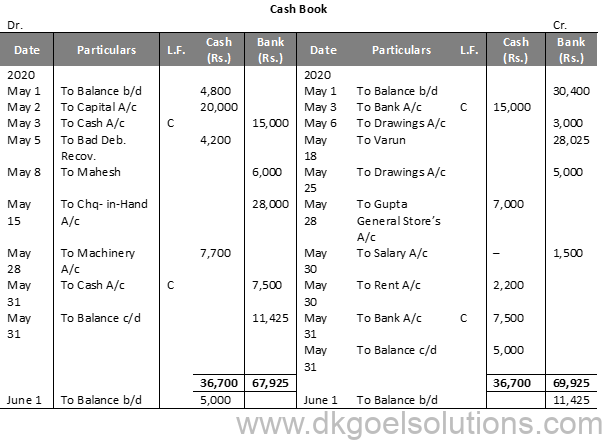

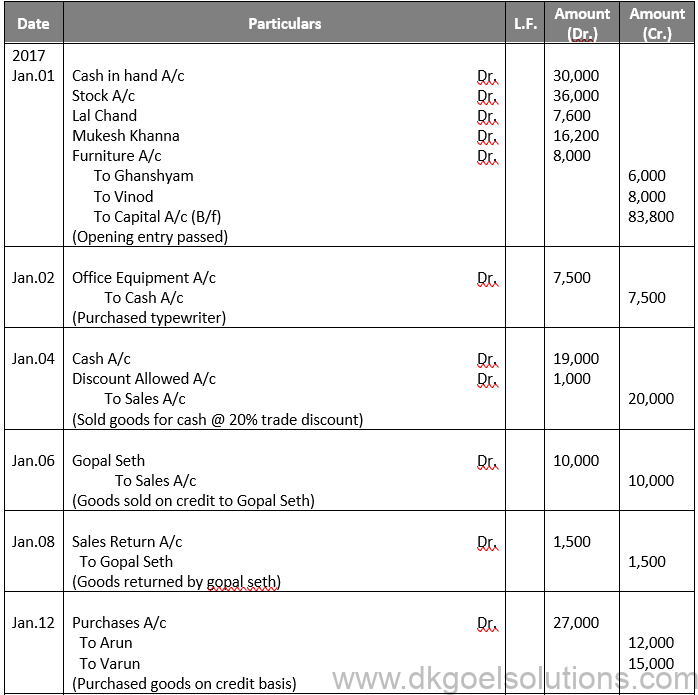

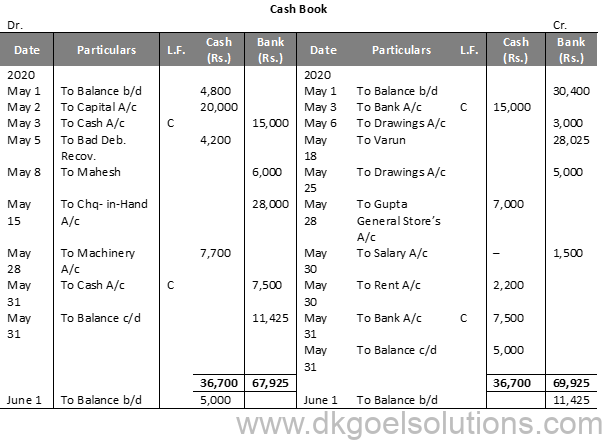

DK Goel Solutions Class 11 Chapter 11 Books of Original From dkgoelsolutions.com

DK Goel Solutions Class 11 Chapter 11 Books of Original From dkgoelsolutions.com

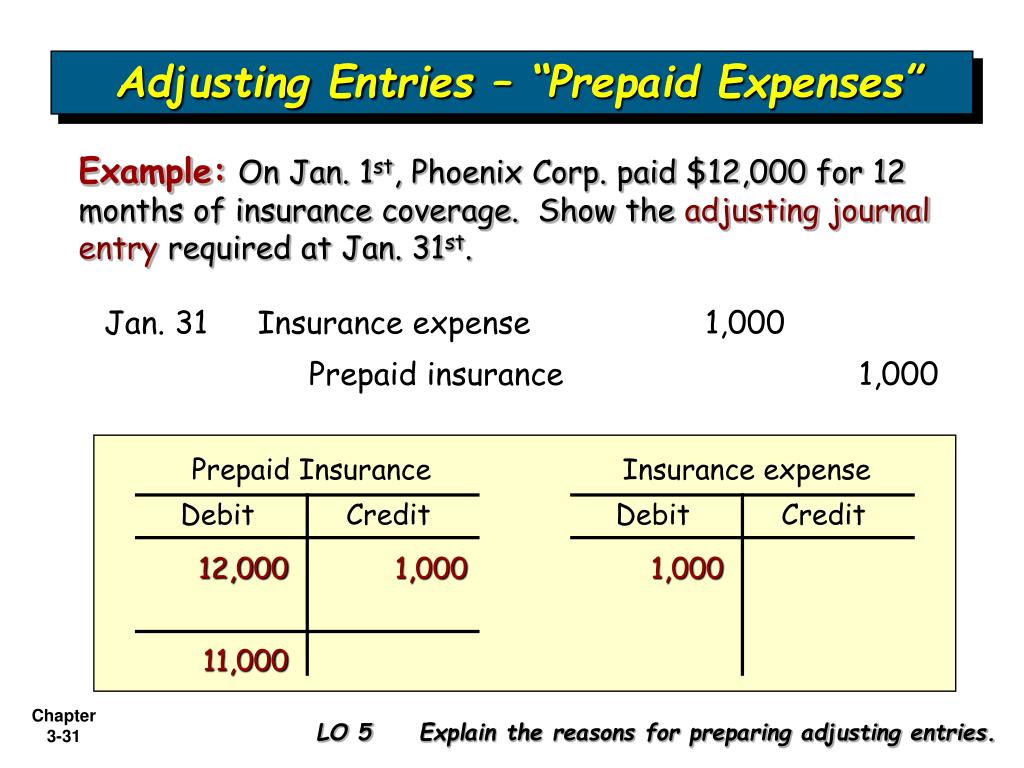

Since you are using cash, your cash will fall and prepaid insurance will rise but total assets will stay the same. A) upon payment of the life insurance: Accounting entries accounting entry or journal entry is a record of a business transaction that includes at least one debit and one credit and shows the monetary transactions in balance on a specified date financial accounting in insurance companies simple accounting entry insurer a receives $2000 annual premium on a life insurance. Debit insurance expense for x months in the new policy period, credit accrued payables. 24 purchased goods for rs. The following journal entry will be passed and reflected in the books of accounts of xyz company.

The amount of cover left for the next financial year:

24 purchased goods for rs. The following journal entry will be passed and reflected in the books of accounts of xyz company. The company has paid $10,000 of the insurance premium for the entire year at the beginning of the first quarter. Debit insurance expense for x months in the new policy period, credit accrued payables. Life insurance premium expense account: The idea here is that the insurance premium is amortised for the period covered and expenses on a monthly basis till the value is written off to the profit or loss account.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

Debit insurance expense for x months in the new policy period, credit accrued payables. When the invoice is entered, debit insurance expense for x months in the new policy period with the balance debited to prepaid insurance. Bank for payments to an insurance company for business insurance. Premium paid on the life policy of the proprietor should not be debited to insurance premium account. At that time, the cash surrender value is $3,000.

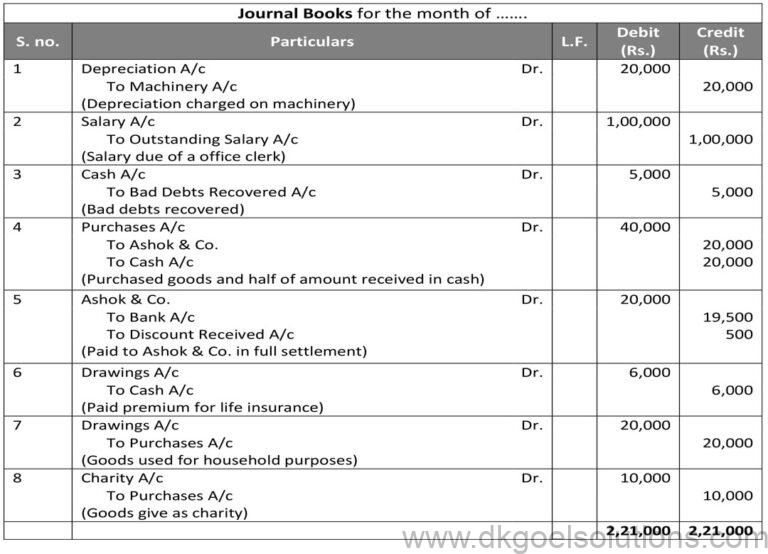

Source: dkgoelsolutions.com

Source: dkgoelsolutions.com

Some insurance payments can go on to the profit and loss report and some must go on the balance sheet. • earned premium for the month is $100. Prepare the journal entry for a life insurance premium of $5,000 if the cash surrender value increased during the year from $500 to $900. Dr prepaid insurance xxx cr cash on hand/in bank xxx to record payment of life insurance. Some insurance payments can go on to the profit and loss report and some must go on the balance sheet.

Source: imbillionaire.net

Source: imbillionaire.net

How to post lic premium paid entries in tally under gst. The entry will be dr insurance premium and cr bank account. Dr insurance company (debtor) $1,500 dr accumulated depreciation $500 cr equipment $2,000 dr bank $1,500 cr insurance company $1,500 hope that helps. Not all insurance payments (premiums) are deductible* business expenses. • each claim is worth $10, half paid in the month of reporting, half in the subsequent month.

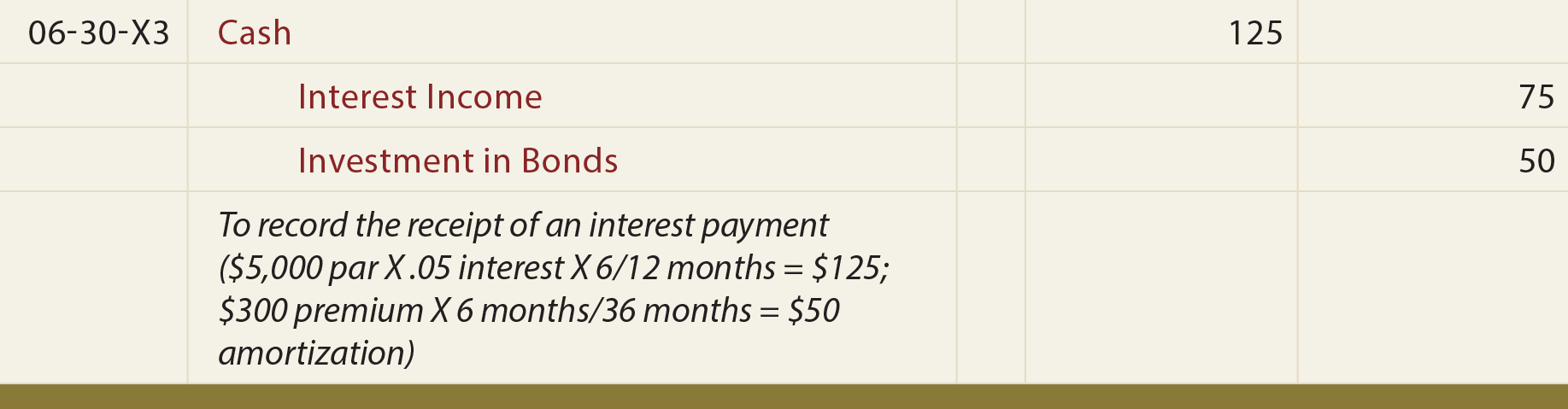

Source: principlesofaccounting.com

Source: principlesofaccounting.com

Learn life insurance accounting journal entr. $3,200 conclusion the use of life insurance may be a key financial decision for your business. 8,000 for cash at a trade discount of 10% and a cash discount of 2%. As the policy premium is on the life of the proprietor (personal expense) and not the expense related to. Founder of accounting basics for students

Source: dkgoelsolutions.com

Source: dkgoelsolutions.com

$5,020 balance sheet* cash account: The entry will be dr insurance premium and cr bank account. Dr prepaid insurance xxx cr cash on hand/in bank xxx to record payment of life insurance. 25 received cash from vijay at a cash discount of 5% in full settlement of his account. • earned premium for the month is $100.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

The company has paid $10,000 of the insurance premium for the entire year at the beginning of the first quarter. $5,000 life insurance income account: • each claim is worth $10, half paid in the month of reporting, half in the subsequent month. • no bulk reserve is necessary (beyond that which may be implicit in the ibnr calculation). A) upon payment of the life insurance:

Source: insurancebae.blogspot.com

Learn life insurance accounting journal entr. It is an expense of personal nature any any expense for. When a business owns a life insurance policy (boli) for a key officer, it pays the premiums itself and names the actual business as the beneficiary should the. Paid insurance premium ₹1000 on the life policy of a proprietor. At that time, the cash surrender value is $3,000.

Source: biz.libretexts.org

A) upon payment of the life insurance: If you are paying cash, you are again increasing one asset account at the expense of the other because both cash and prepaid insurance are assets. Accounting entries accounting entry or journal entry is a record of a business transaction that includes at least one debit and one credit and shows the monetary transactions in balance on a specified date financial accounting in insurance companies simple accounting entry insurer a receives $2000 annual premium on a life insurance. 8,000 for cash at a trade discount of 10% and a cash discount of 2%. Insurance premium recording journal entries for insurance premiums are also similar.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

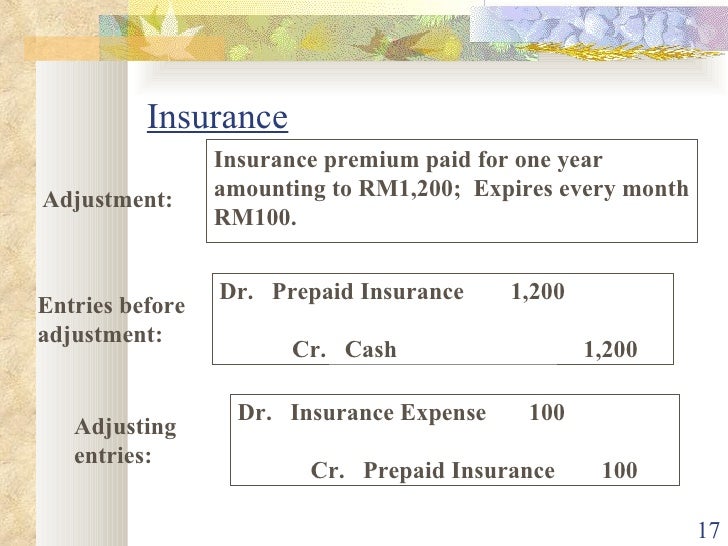

Insurance expense journal entry at the end of each month, the company usually make the adjusting entry for insurance expense to recognize the cost of that has expired during the period. Likewise, the company can make insurance expense journal entry by debiting insurance expense account and crediting prepaid insurance account. As the prepaid amount expires, the balance in prepaid insurance is reduced by a credit to prepaid insurance and a debit to insurance expense. A basic insurance journal entry is debit: The journal entry would be:

Source: zadishqr.blogspot.com

Premium paid on the life policy of the proprietor should not be debited to insurance premium account. Prepare the journal entry for a life insurance premium of $5,000 if the cash surrender value increased during the year from $500 to $900. Not all insurance payments (premiums) are deductible* business expenses. Premium paid on the life policy of the proprietor should not be debited to insurance premium account. Since you are using cash, your cash will fall and prepaid insurance will rise but total assets will stay the same.

Source: zadishqr.blogspot.com

Source: zadishqr.blogspot.com

• the initial ibnr is set based on 30% of earned premium, run off evenly over the following three months. When a business owns a life insurance policy (boli) for a key officer, it pays the premiums itself and names the actual business as the beneficiary should the. If you are paying cash, you are again increasing one asset account at the expense of the other because both cash and prepaid insurance are assets. It is an expense of personal nature any any expense for. 24 purchased goods for rs.

Source: dkgoelsolutions.com

Source: dkgoelsolutions.com

Dr prepaid insurance xxx cr cash on hand/in bank xxx to record payment of life insurance. 24 purchased goods for rs. Bank for payments to an insurance company for business insurance. Debit insurance expense for x months in the new policy period, credit accrued payables. Insurance expense journal entry at the end of each month, the company usually make the adjusting entry for insurance expense to recognize the cost of that has expired during the period.

Source: theintactone.com

Source: theintactone.com

Life insurance premium expense account: $5,000 life insurance income account: Life insurance premium expense account: Dr insurance company (debtor) $1,500 dr accumulated depreciation $500 cr equipment $2,000 dr bank $1,500 cr insurance company $1,500 hope that helps. Accounting entries accounting entry or journal entry is a record of a business transaction that includes at least one debit and one credit and shows the monetary transactions in balance on a specified date financial accounting in insurance companies simple accounting entry insurer a receives $2000 annual premium on a life insurance.

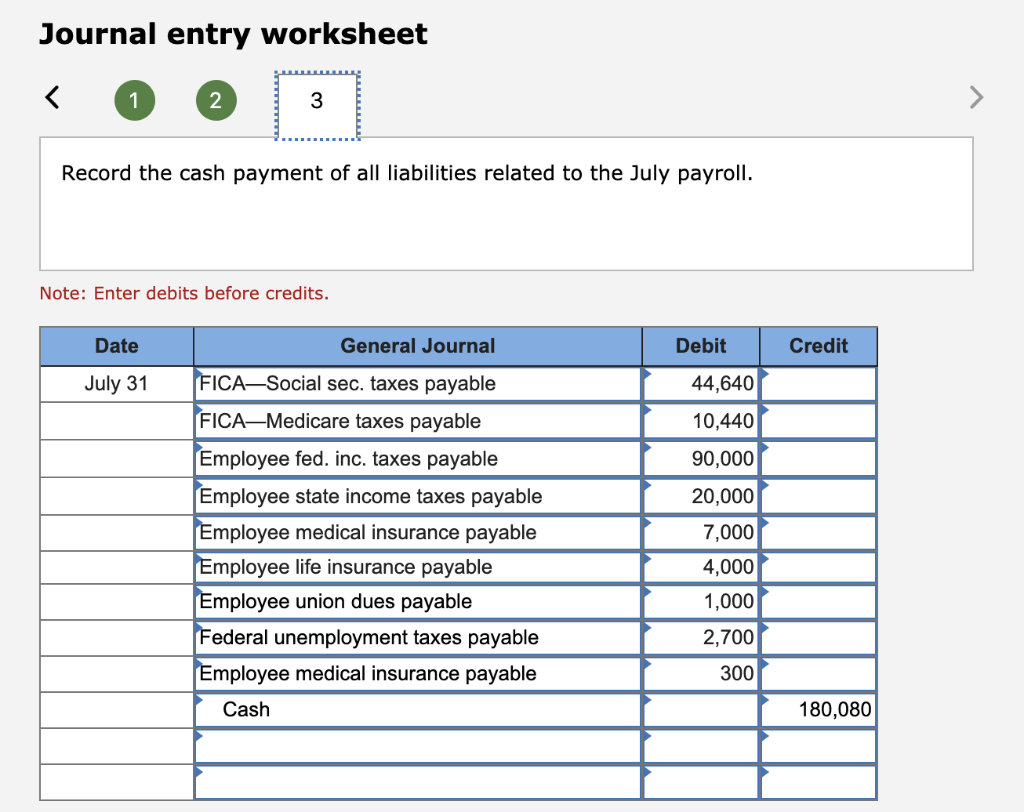

Source: chegg.com

Source: chegg.com

The entry will be dr insurance premium and cr bank account. • earned premium for the month is $100. 25 received cash from vijay at a cash discount of 5% in full settlement of his account. One objective of the adjusting entry is to match the proper amount of insurance expense to the period indicated on the income statement. $5,000 life insurance income account:

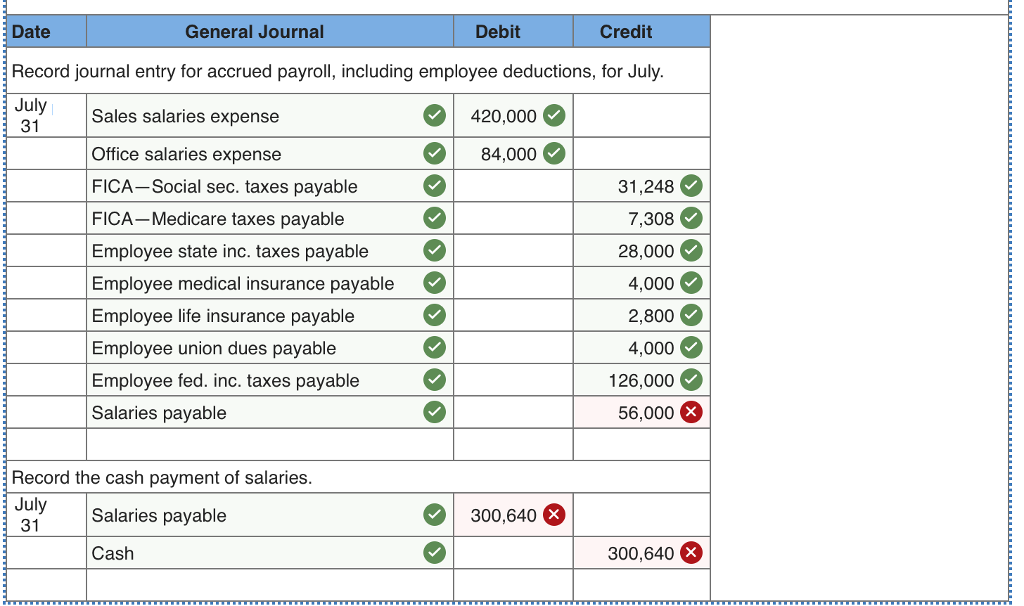

Source: coursehero.com

On a monthly basis, i will dr insurance expense. A) upon payment of the life insurance: $5,020 balance sheet* cash account: The following journal entry will be passed and reflected in the books of accounts of xyz company. Learn life insurance accounting entries in tally erp 9.

Source: coursehero.com

Since you are using cash, your cash will fall and prepaid insurance will rise but total assets will stay the same. $5,020 balance sheet* cash account: Journal entry when prepaid insurance is paid prepaid insurance is debited, which indicates the creation of an asset in the balance sheet. Likewise, the company can make insurance expense journal entry by debiting insurance expense account and crediting prepaid insurance account. Life insurance premium expense account:

Source: slideshare.net

Source: slideshare.net

• when the insurance contract is signed • when the premium is due from the policyholder • when the premium is received • when the insurance policy becomes effective The following journal entry will be passed and reflected in the books of accounts of xyz company. Not all insurance payments (premiums) are deductible* business expenses. $5,020 balance sheet* cash account: Learn life insurance accounting entries in tally erp 9.

Source: chegg.com

Source: chegg.com

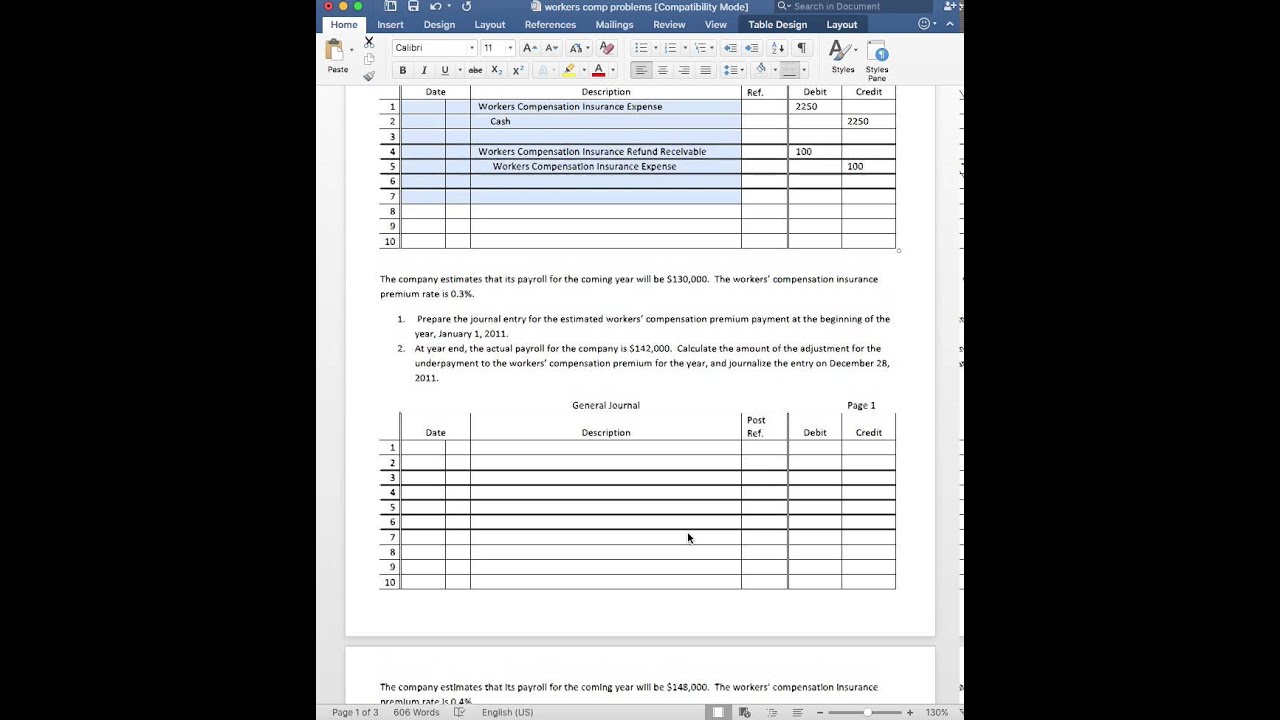

22 paid for shyam sunder’s life insurance premium rs. On a monthly basis, i will dr insurance expense. How to post lic premium paid entries in tally under gst. When a business owns a life insurance policy (boli) for a key officer, it pays the premiums itself and names the actual business as the beneficiary should the. Insurance expense journal entry at the end of each month, the company usually make the adjusting entry for insurance expense to recognize the cost of that has expired during the period.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance premium journal entry by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.