Life insurance questions Idea

Home » Trend » Life insurance questions IdeaYour Life insurance questions images are available. Life insurance questions are a topic that is being searched for and liked by netizens today. You can Get the Life insurance questions files here. Find and Download all free images.

If you’re looking for life insurance questions images information connected with to the life insurance questions topic, you have pay a visit to the right site. Our site frequently gives you suggestions for seeking the highest quality video and picture content, please kindly search and find more enlightening video articles and graphics that match your interests.

Life Insurance Questions. What if my policy lapses? Tell me what is a life insurance? Term life insurance or permanent? All the life insurance interview questions fall into four basic categories:

![8 of the most common life insurance questions [updated 2020] 8 of the most common life insurance questions [updated 2020]](https://onestoplifeinsurance.com/wp-content/uploads/2017/01/8-of-the-most-common-life-insurance-questions-answered.png) 8 of the most common life insurance questions [updated 2020] From onestoplifeinsurance.com

8 of the most common life insurance questions [updated 2020] From onestoplifeinsurance.com

I have a fairly stable job and earn the bulk of my family’s income. Can you have multiple life insurance policies? For most, term life insurance will be the preferred choice because it offers the most significant benefit amount for the lowest price. A life insurance application will ask about current conditions that you have, past conditions you may have had, and also attempts to assess your bmi to spot the potential for future issues. Affordable, flexible term life insurance at your pace. Tell me what is a life insurance?

The other never talked about dying.

Based upon your medical status the life insurance company will classify you into a health rating class. Life insurance doesn’t have to be confusing. One of the easiest life insurance questions to ask when selling is one that gets them thinking about the future and their current debt. One grandfather drove a hearse. Although outstanding debts are less prevalent among the elderly, it’s still a common stressor. Life insurance sales question “when you buy a life insurance policy, what do you want it to accomplish?” this is a great question because it allows the client to describe their goals as to what they really want.

Source: blog.modernadvisor.ca

Source: blog.modernadvisor.ca

Affordable, flexible term life insurance at your pace. Why buy life insurance young? Discussing your own funeral plans can be an uncomfortable topic and some try to avoid it. If you understand these questions and are prepared to answer them, you will save time and avoid extreme frustration while applying for life insurance. Company name death benefit year issued beneficiary will the insurance being applied for replace, change or affect any of the insurance noted above?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Sean is a smoker and travels frequently to developed countries to host scuba diving tours. Term life insurance generally provides coverage at a more affordable cost for a set period of time, while permanent life insurance provides coverage as long as required premiums are paid. What if my policy lapses? What is a life insurance premium? When you get that answer, you more easily can design a customized life insurance policy more suited to their needs.

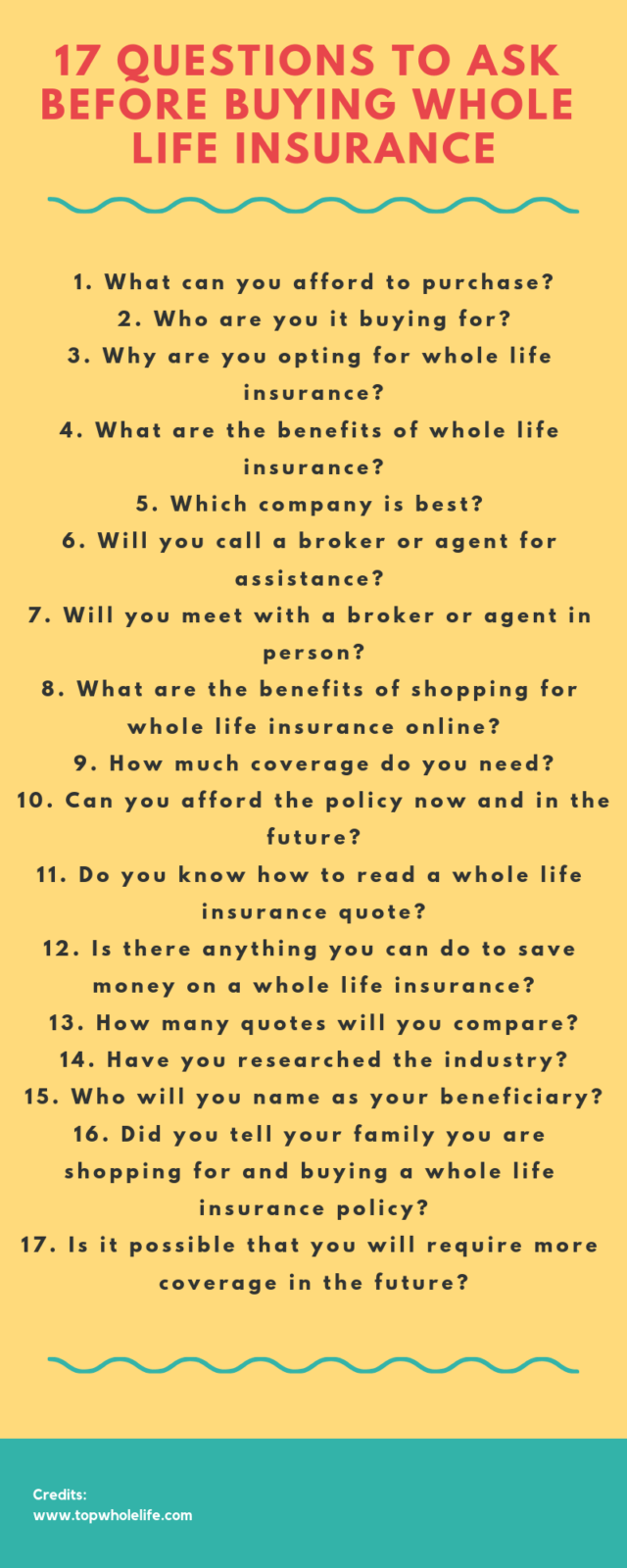

Source: topwholelife.com

Source: topwholelife.com

Although outstanding debts are less prevalent among the elderly, it’s still a common stressor. Design and composition by greenleaf book group llc This question has been debated for as long as life insurance been around. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Although outstanding debts are less prevalent among the elderly, it’s still a common stressor.

Source: lsminsurance.ca

Source: lsminsurance.ca

!is workbook is a companion to questions and answers on life insurance, published by life insurance sage press in 2010. Life insurance doesn’t have to be confusing. Affordable, flexible term life insurance at your pace. The following test is broken into 5 sections:1. Why buy life insurance young?

Source: doi.sc.gov

!is workbook is a companion to questions and answers on life insurance, published by life insurance sage press in 2010. What if my policy lapses? Affordable, flexible term life insurance at your pace. One of the easiest life insurance questions to ask when selling is one that gets them thinking about the future and their current debt. How much life insurance do i need?

Source: youtube.com

Source: youtube.com

What is the total amount of life insurance on your life (including any provided by your employer)? Tell me what is a life insurance? How much life insurance do i need? Life insurance sales question “when you buy a life insurance policy, what do you want it to accomplish?” this is a great question because it allows the client to describe their goals as to what they really want. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: slideshare.net

Source: slideshare.net

Life insurance doesn’t have to be confusing. The other never talked about dying. Tell me what is a life insurance? What is a life insurance premium? How much life insurance do i need?

Source: formsbirds.com

Source: formsbirds.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Affordable, flexible term life insurance at your pace. Life insurance sales question “when you buy a life insurance policy, what do you want it to accomplish?” this is a great question because it allows the client to describe their goals as to what they really want. Life insurance is an insurance coverage that pays out a certain amount of money to the insured or their specified beneficiaries upon a certain event such as death of the individual who is insured. This is what they taught us about death and grief.

Source: maritzabaez.com

Source: maritzabaez.com

!is workbook is a companion to questions and answers on life insurance, published by life insurance sage press in 2010. Are you a smoker or tobacco user? When you get that answer, you more easily can design a customized life insurance policy more suited to their needs. For most, term life insurance will be the preferred choice because it offers the most significant benefit amount for the lowest price. Design and composition by greenleaf book group llc

Source: clips-khrime.blogspot.com

Source: clips-khrime.blogspot.com

Term life insurance generally provides coverage at a more affordable cost for a set period of time, while permanent life insurance provides coverage as long as required premiums are paid. Sean is a smoker and travels frequently to developed countries to host scuba diving tours. Can you have multiple life insurance policies? Design and composition by greenleaf book group llc Are you a smoker or tobacco user?

Source: metlife-prod.adobecqms.net

Source: metlife-prod.adobecqms.net

This is what they taught us about death and grief. If you understand these questions and are prepared to answer them, you will save time and avoid extreme frustration while applying for life insurance. Discussing your own funeral plans can be an uncomfortable topic and some try to avoid it. Term life insurance or permanent? Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

![Life Insurance Questions To Ask Clients [For Agents Only] Life Insurance Questions To Ask Clients [For Agents Only]](http://davidduford.com/wp-content/uploads/2018/11/questions-sell-insurance.jpg) Source: davidduford.com

Source: davidduford.com

Life insurance is an insurance coverage that pays out a certain amount of money to the insured or their specified beneficiaries upon a certain event such as death of the individual who is insured. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. What is a life insurance premium? Term life insurance or permanent? Life insurance is an insurance coverage that pays out a certain amount of money to the insured or their specified beneficiaries upon a certain event such as death of the individual who is insured.

Source: snanthonyinc.com

Source: snanthonyinc.com

Are you a smoker or tobacco user? When you get that answer, you more easily can design a customized life insurance policy more suited to their needs. To order more copies of questions and answers on life insurance, contact emerald book company at po box 91869, austin, tx 78709, 512.891.6100. Term life insurance or permanent? Discussing your own funeral plans can be an uncomfortable topic and some try to avoid it.

![8 of the most common life insurance questions [updated 2020] 8 of the most common life insurance questions [updated 2020]](https://onestoplifeinsurance.com/wp-content/uploads/2017/01/8-of-the-most-common-life-insurance-questions-answered.png) Source: onestoplifeinsurance.com

Source: onestoplifeinsurance.com

Contact a farmers agent to learn about life insurance. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Term life insurance or permanent? For most, term life insurance will be the preferred choice because it offers the most significant benefit amount for the lowest price. One of the easiest life insurance questions to ask when selling is one that gets them thinking about the future and their current debt.

Source: neamb.com

Source: neamb.com

What is a life insurance premium? Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Contact a farmers agent to learn about life insurance. This question has been debated for as long as life insurance been around. Why buy life insurance young?

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

Why buy life insurance young? Contact a farmers agent to learn about life insurance. Are you a smoker or tobacco user? Sean is a smoker and travels frequently to developed countries to host scuba diving tours. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance questions by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.