Life insurance replacement regulation protects the interest of information

Home » Trending » Life insurance replacement regulation protects the interest of informationYour Life insurance replacement regulation protects the interest of images are ready in this website. Life insurance replacement regulation protects the interest of are a topic that is being searched for and liked by netizens now. You can Get the Life insurance replacement regulation protects the interest of files here. Find and Download all royalty-free photos and vectors.

If you’re searching for life insurance replacement regulation protects the interest of images information connected with to the life insurance replacement regulation protects the interest of keyword, you have visit the ideal site. Our site always provides you with hints for viewing the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that fit your interests.

Life Insurance Replacement Regulation Protects The Interest Of. The term replacement of a life insurance policy. (1) to regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. Florida�s replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy. (b) the substitution in regulation 3.1 in part 3a for the definition fund member policy of the following definition:

Lapsed Life Insurance Policy Life insurance policy From pinterest.com

Lapsed Life Insurance Policy Life insurance policy From pinterest.com

Agents and carriers may not place their financial interest ahead of the consumer’s interest in making the recommendation.” the rule requires that agents and carriers act with “reasonable diligence, care, and skill” in making. Proposed regulations from the u.s. Florida�s replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy. Remember, on replacement, the incontestability and suicide clauses start over, which may be detrimental to the insured. Frequently asked questions regarding first amendment to regulation 187. Who is required to be a member of the association?

Life and annuity insurance industry over the next few years.

(1) to regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. (1) to regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. (1) regulate the activities of insurers and agents with respect to the replacement of existing life insurance and annuities; Florida�s replacement rule sets forth the requirements and procedures to be followed by insurance companies and insurance producers when a proposal is being made to a client who plans to replace existing life insurance contract(s) with the proposed new life insurance policy. The term replacement of a life insurance policy. Life insurance replacement regulation protects the interest of.

Source: lestwinsworld.com

Source: lestwinsworld.com

The rule demands more simplicity and transparency within the annuity and life insurance sales experience to prevent what some call “consumer financial exploitation.” The benefit is required to be either one of love and affection due to the relationship the policyholder has to the insured. (5) life insurance proposed to replace life insurance under a binding or conditional receipt issued by the same insurer; Agents and carriers may not place their financial interest ahead of the consumer’s interest in making the recommendation.” the rule requires that agents and carriers act with “reasonable diligence, care, and skill” in making. Rhode island life insurance, the care that protects life insurance rhode quotes.

Source: takeitpersonelly.com

Source: takeitpersonelly.com

The insurance regulatory and development authority act 1999, to protect the interests of the policyholders, to regulate, promote and ensure orderly growth of the insurance industry and for matters connected therewith or incidental thereto. The insurance regulatory and development authority act 1999, to protect the interests of the policyholders, to regulate, promote and ensure orderly growth of the insurance industry and for matters connected therewith or incidental thereto. As used in this part means, except as exempted in section 51.3 of this part, that a new life insurance or new annuity contract are to be purchased and delivered or issued for delivery in new york and it is known to the department licensee that, as part of the transaction, existing life insurance policies or annuity contracts. The rules regarding replacement are designed to protect the interests of life insurance and annuity purchasers. (6) a policy or contract used to fund:

Source: pinterest.com

Source: pinterest.com

An insurable interest exists for the purposes of life insurance when (at the time the policy is entered into) the policyowner has a reasonable expectation that he or she will benefit from the continued life and health of the person the policy covers. The benefit is required to be either one of love and affection due to the relationship the policyholder has to the insured. As you were a child, your parents must have had already bought you an insurance plan, but as you enter into a more challenging environment, you must need your own rhode. Life insurance replace regulations do the following: An insurable interest exists for the purposes of life insurance when (at the time the policy is entered into) the policyowner has a reasonable expectation that he or she will benefit from the continued life and health of the person the policy covers.

Source: ihpadvisors.blog

Source: ihpadvisors.blog

The general public is hereby informed that irda is a regulatory body established by an act of parliament, i.e. (a) an employee pension benefit plan or employee welfare benefit plan that is covered by the employee retirement income security act of 1974 (29 u.s.c. Frequently asked questions regarding first amendment to regulation 187. (2) to protect the interests of life insurance and annuity purchasers by establishing minimum If you provide financial support, or provide such services as child care, cooking, and cleaning for your family, life insurance can help replace those contributions to the family if you should die.

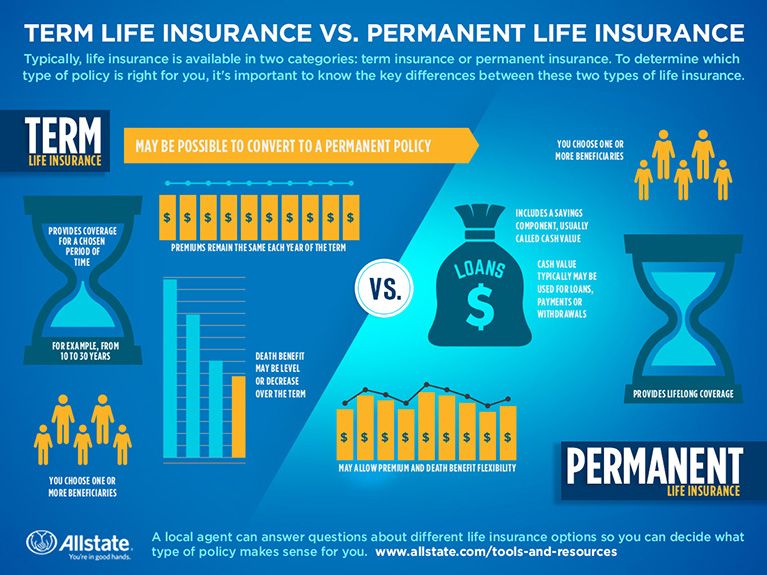

Source: allstate.com

Source: allstate.com

Agents and carriers may not place their financial interest ahead of the consumer’s interest in making the recommendation.” the rule requires that agents and carriers act with “reasonable diligence, care, and skill” in making. The new york state department of financial services (the “department”) promulgated the first amendment to insurance regulation 187 (11 nycrr 224), suitability and best interest in life insurance and annuity transactions. (a) an employee pension benefit plan or employee welfare benefit plan that is covered by the employee retirement income security act of 1974 (29 u.s.c. Replacing an existing policy with another should be done for only. Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk.

Source: financialexpress.com

Source: financialexpress.com

Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk. (1) to regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. “all recommendations by agents and insurers must be in the best interest of the consumer and. The new york state department of financial services (the “department”) promulgated the first amendment to insurance regulation 187 (11 nycrr 224), suitability and best interest in life insurance and annuity transactions. The general public is hereby informed that irda is a regulatory body established by an act of parliament, i.e.

Source: dreamstime.com

Source: dreamstime.com

Replacing an existing policy with another should be done for only. (6) a policy or contract used to fund: Similarly, buying general insurance policies like motor insurance, home insurance, travel, and health should be a priority. (1) regulate the activities of insurers and agents with respect to the replacement of existing life insurance and annuities; The new york state department of financial services (the “department”) promulgated the first amendment to insurance regulation 187 (11 nycrr 224), suitability and best interest in life insurance and annuity transactions.

Source: dreamstime.com

Source: dreamstime.com

The term replacement of a life insurance policy. Although a replacement could improve coverage or lower the premium amount, life insurance contracts include certain restrictions that might put an unwary policyholder at greater risk. Replacing an existing policy with another should be done for only. The goals of the irdai are to safeguard the interests of insurance policyholders, as well as to initiate different policy measures to help sustain growth in the indian insurance sector. (1) regulate the activities of insurers and agents with respect to the replacement of existing life insurance and annuities;

-kK0E–621x414@LiveMint.jpg “Buying insurance? Tick these life, health cover boxes”) Source: livemint.com

Life insurance replacement regulation protects the interest of. (2) to protect the interests of life insurance and annuity purchasers by establishing minimum Who is required to be a member of the association? Under which every life insured is indebted to or a surety of the policyholder whose insurable interest as policyholder arises solely from that indebtedness or suretyship; The naic consumer credit insurance model regulation (#370) protects the interests of debtors and the public by providing a system of rate, policy form, and operating standards for the.

Source: outlookindia.com

Source: outlookindia.com

The new york state department of financial services (the “department”) promulgated the first amendment to insurance regulation 187 (11 nycrr 224), suitability and best interest in life insurance and annuity transactions. Life and annuity insurance industry over the next few years. The naic consumer credit insurance model regulation (#370) protects the interests of debtors and the public by providing a system of rate, policy form, and operating standards for the. The life insurance in the state of rhode should be on your list when you want to spend a peaceful life in the state. (1) regulate the activities of insurers and agents with respect to the replacement of existing life insurance and annuities;

Source: pinterest.com

Source: pinterest.com

Remember, on replacement, the incontestability and suicide clauses start over, which may be detrimental to the insured. Frequently asked questions regarding first amendment to regulation 187. Agents and carriers may not place their financial interest ahead of the consumer’s interest in making the recommendation.” the rule requires that agents and carriers act with “reasonable diligence, care, and skill” in making. Rhode island life insurance, the care that protects life insurance rhode quotes. It is a tough ask to discuss financial.

Source: grosvenor-insurance.com

Source: grosvenor-insurance.com

The rules regarding replacement are designed to protect the interests of life insurance and annuity purchasers. (5) life insurance proposed to replace life insurance under a binding or conditional receipt issued by the same insurer; Life and annuity insurance industry over the next few years. (1) regulate the activities of insurers and agents with respect to the replacement of existing life insurance and annuities; Treasury department and irs, published in today’s federal register, provide guidance for the computation and reporting of life insurance reserves to account for the changes to section 807, as amended by pub.

Source: vinzite.com

Source: vinzite.com

Extends new york regulation 187 to cover annuities, life insurance contracts, and fraternal certificates. As used in this part means, except as exempted in section 51.3 of this part, that a new life insurance or new annuity contract are to be purchased and delivered or issued for delivery in new york and it is known to the department licensee that, as part of the transaction, existing life insurance policies or annuity contracts. Under which every life insured is indebted to or a surety of the policyholder whose insurable interest as policyholder arises solely from that indebtedness or suretyship; The rules regarding replacement are designed to protect the interests of life insurance and annuity purchasers. The goals of the irdai are to safeguard the interests of insurance policyholders, as well as to initiate different policy measures to help sustain growth in the indian insurance sector.

(a) an employee pension benefit plan or employee welfare benefit plan that is covered by the employee retirement income security act of 1974 (29 u.s.c. In a press release, naic describes it like this: Older couples also may consider life insurance to protect a surviving spouse against the possibility of the couple’s retirement savings being depleted by unexpected medical costs. The goals of the irdai are to safeguard the interests of insurance policyholders, as well as to initiate different policy measures to help sustain growth in the indian insurance sector. (1) regulate the activities of insurers and agents with respect to the replacement of existing life insurance and annuities;

Source: pinterest.com

Source: pinterest.com

(b) the substitution in regulation 3.1 in part 3a for the definition fund member policy of the following definition: The new york state department of financial services (the “department”) promulgated the first amendment to insurance regulation 187 (11 nycrr 224), suitability and best interest in life insurance and annuity transactions. The life insurance in the state of rhode should be on your list when you want to spend a peaceful life in the state. Treasury department and irs, published in today’s federal register, provide guidance for the computation and reporting of life insurance reserves to account for the changes to section 807, as amended by pub. The insurance regulatory and development authority act 1999, to protect the interests of the policyholders, to regulate, promote and ensure orderly growth of the insurance industry and for matters connected therewith or incidental thereto.

Source: pinterest.com

Source: pinterest.com

Life insurance replace regulations do the following: In a press release, naic describes it like this: (2) to protect the interests of life insurance and annuity purchasers by establishing minimum The rule requiring insurers to act in the best interest of the consumer will likely become the standard for the u.s. (b) the substitution in regulation 3.1 in part 3a for the definition fund member policy of the following definition:

Source: pinterest.com

Source: pinterest.com

Rhode island life insurance, the care that protects life insurance rhode quotes. (1) regulate the activities of insurers and agents with respect to the replacement of existing life insurance and annuities; (1) to regulate the activities of insurers and producers with respect to the replacement of existing life insurance and annuities. The term replacement of a life insurance policy. Life insurance replace regulations do the following:

Source: pinterest.jp

Source: pinterest.jp

:life, accident, health and hospital insurance guarantee association protect the interests of policyholders when insurers become insolvent and help detect and prevent insurance company impairments. The new york state department of financial services (the “department”) promulgated the first amendment to insurance regulation 187 (11 nycrr 224), suitability and best interest in life insurance and annuity transactions. As you were a child, your parents must have had already bought you an insurance plan, but as you enter into a more challenging environment, you must need your own rhode. An insurable interest exists for the purposes of life insurance when (at the time the policy is entered into) the policyowner has a reasonable expectation that he or she will benefit from the continued life and health of the person the policy covers. It is a tough ask to discuss financial.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance replacement regulation protects the interest of by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.