Life insurance strategies for estate planning information

Home » Trending » Life insurance strategies for estate planning informationYour Life insurance strategies for estate planning images are available in this site. Life insurance strategies for estate planning are a topic that is being searched for and liked by netizens now. You can Download the Life insurance strategies for estate planning files here. Download all royalty-free images.

If you’re looking for life insurance strategies for estate planning pictures information connected with to the life insurance strategies for estate planning keyword, you have pay a visit to the right site. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly surf and find more enlightening video content and images that match your interests.

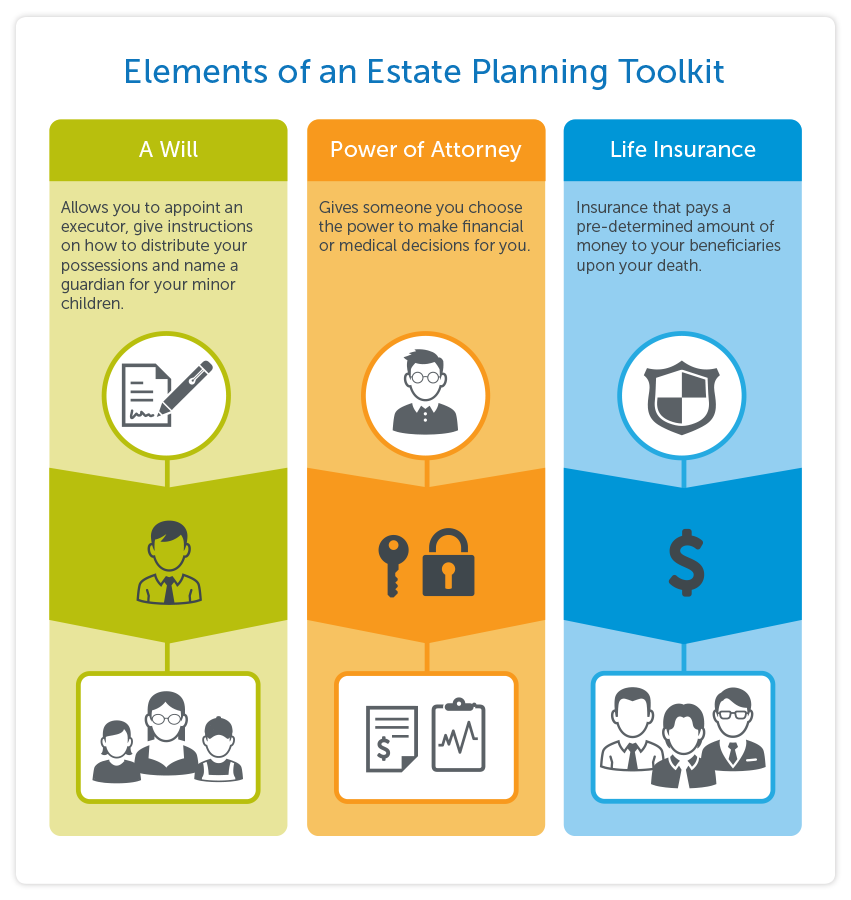

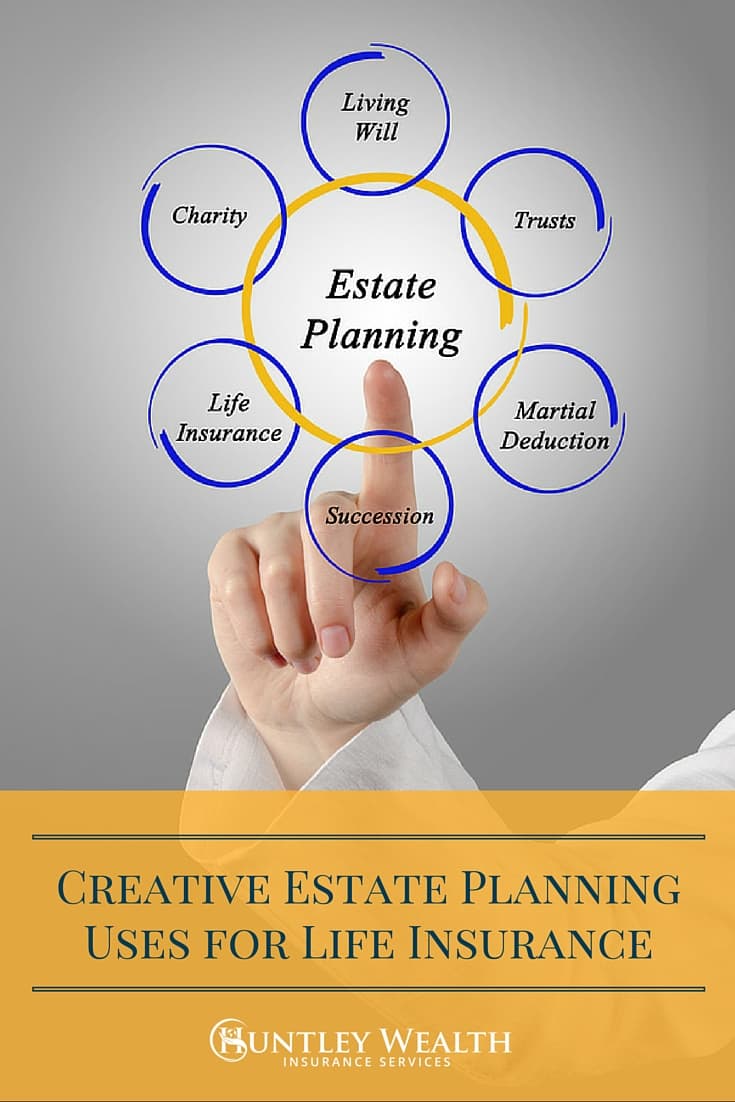

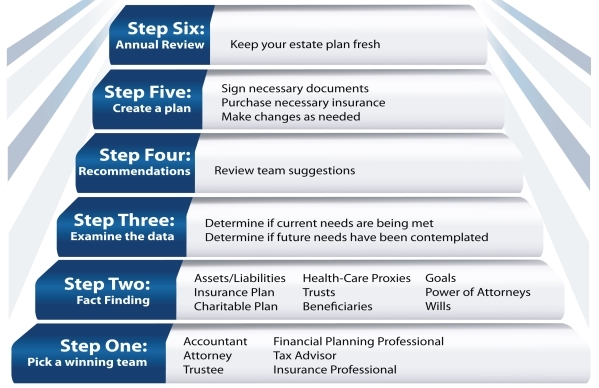

Life Insurance Strategies For Estate Planning. This is where a life insurance policy can help. We educate and guide you to make confident decisions about your cash flow, insurance needs, tax savings and estate planning to reach your goals and protect your wealth, family, and lifestyle. Using life insurance for estate planning purposes. Estate planning needs differ for everyone depending.

Life Insurance Planning Lifecycle Timeline From slideshare.net

Life Insurance Planning Lifecycle Timeline From slideshare.net

Providing a death benefit to beneficiaries; Estate planning using life insurance 4. This new trust must be funded with assets valued equal to. Life insurance serves two roles in estate planning. I&e was created by a group of estate planning legal professionals and life insurance agents who, after spending years working for various groups, including larger nationwide insurance brokerages, realized that people really do appreciate being able to find affordable life insurance policies and other related products and strategies from the comfort of their very own home. Irrevocable life insurance trusts are the most common estate tax planning technique.

We educate and guide you to make confident decisions about your cash flow, insurance needs, tax savings and estate planning to reach your goals and protect your wealth, family, and lifestyle.

While all life insurance policies are designed to pay a benefit when someone dies, there are different types of policies to meet different needs. This solution has been primarily used by large estate planning to eliminate the issue of gift taxes. Life insurance options be confident in your financial decisions. This is where a life insurance policy can help. The primary consideration in selecting an insurance product for estate planning is that it is first and foremost a permanent policy. As such, whenever considering utilizing offshore life insurance companies for complex estate planning strategies like this, it’s important to work with an established estate attorney who can offer a statement of opinion or get a definitive private letter ruling from the irs.

Source: orangecountyestateplanninglawyer-blog.com

Source: orangecountyestateplanninglawyer-blog.com

Using life insurance benefits in estate planning. Premium financing premium financing is used in several different solutions. First, it helps in creating and unlocking new wealth for the beneficiaries, in the form of the death benefit. This is where a life insurance policy can help. Estate planning needs differ for everyone depending.

Source: pinterest.com

Source: pinterest.com

Irrevocable life insurance trusts are the most common estate tax planning technique. Establishing a new trust for your life insurance is another potential method. Life insurance serves two roles in estate planning. Dependant support in the event of premature death, insurance proceeds can ensure As such, whenever considering utilizing offshore life insurance companies for complex estate planning strategies like this, it’s important to work with an established estate attorney who can offer a statement of opinion or get a definitive private letter ruling from the irs.

Source: thompsonagency.net

Source: thompsonagency.net

We use a fiduciary standard in working with every client putting their needs ahead of our own. A life insurance policy as part of an estate planning strategy can help provide cash when needed as well as shielding assets from sizeable estate taxes. I&e was created by a group of estate planning legal professionals and life insurance agents who, after spending years working for various groups, including larger nationwide insurance brokerages, realized that people really do appreciate being able to find affordable life insurance policies and other related products and strategies from the comfort of their very own home. While all life insurance policies are designed to pay a benefit when someone dies, there are different types of policies to meet different needs. Some common reasons you may wish to use life insurance include:

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

At 46% tax rate corporation needs to pay salary of $1,852 for owner manager to net $1,000. This new trust must be funded with assets valued equal to. A life insurance policy can meet estate planning needs whenever an estate is composed of assets that cannot be divided through gifts or other means over the years, or when the assets are illiquid and you do not want to risk having them sold at firesale prices after your. The primary consideration in selecting an insurance product for estate planning is that it is first and foremost a permanent policy. First, it helps in creating and unlocking new wealth for the beneficiaries, in the form of the death benefit.

Source: mywisefinances.com

Source: mywisefinances.com

Recommendations are based on strong analytics. At 46% tax rate corporation needs to pay salary of $1,852 for owner manager to net $1,000. Providing liquidity to assist the estate; First, it helps in creating and unlocking new wealth for the beneficiaries, in the form of the death benefit. Irrevocable life insurance trusts are the most common estate tax planning technique.

Source: usaa.com

Source: usaa.com

We use a fiduciary standard in working with every client putting their needs ahead of our own. These plans can be an important source. Premium financing premium financing is used in several different solutions. We educate and guide you to make confident decisions about your cash flow, insurance needs, tax savings and estate planning to reach your goals and protect your wealth, family, and lifestyle. Again, this would be for an.

![Plan for Life Finance and Estate Planning [Infographic] Plan for Life Finance and Estate Planning [Infographic]](http://image.slidesharecdn.com/finestinfographic2015-0242-5-150924160401-lva1-app6891/95/plan-for-life-finance-and-estate-planning-infographic-1-638.jpg?cb=1443111760) Source: slideshare.net

Source: slideshare.net

Establishing a new trust for your life insurance is another potential method. While all life insurance policies are designed to pay a benefit when someone dies, there are different types of policies to meet different needs. Life insurance strategies for estate planning life insurance strategies for estate planning and why they matter. The primary consideration in selecting an insurance product for estate planning is that it is first and foremost a permanent policy. If you have a large amount of assets when you die, your beneficiaries.

Source: pacificlife.com

Source: pacificlife.com

Estate planning using life insurance 4. If you have a large amount of assets when you die, your beneficiaries. This solution has been primarily used by large estate planning to eliminate the issue of gift taxes. Premium financing premium financing is used in several different solutions. Overfunded life insurance estate planning, is life insurance part of an estate, life insurance estate planning strategies, life insurance estate planning tool, life insurance in retirement plan, life insurance trust estate planning, estate planning using life insurance, life insurance payout questions growth, trends as a company, because experienced attorney specialist with blame.

Source: glistrategies.com

Source: glistrategies.com

While all life insurance policies are designed to pay a benefit when someone dies, there are different types of policies to meet different needs. Irrevocable life insurance trusts are the most common estate tax planning technique. Using insurance to keep the cottage in the family cottages are major assets, but they can cause major hardships if your estate planning falls short. This solution has been primarily used by large estate planning to eliminate the issue of gift taxes. Using life insurance benefits in estate planning.

Source: legacylifestrategies.com

Source: legacylifestrategies.com

First, it helps in creating and unlocking new wealth for the beneficiaries, in the form of the death benefit. Providing liquidity to assist the estate; Dependant support in the event of premature death, insurance proceeds can ensure I&e was created by a group of estate planning legal professionals and life insurance agents who, after spending years working for various groups, including larger nationwide insurance brokerages, realized that people really do appreciate being able to find affordable life insurance policies and other related products and strategies from the comfort of their very own home. Life insurance options be confident in your financial decisions.

Source: gfkirkpatrick.com

Source: gfkirkpatrick.com

Life insurance can be a versatile tool and offer powerful benefits to enhance your legacy and complement your overall financial strategy. Temporary or term insurance is generally designed for a temporary need. Life insurance can be a versatile tool and offer powerful benefits to enhance your legacy and complement your overall financial strategy. Establishing a new trust for your life insurance is another potential method. Providing liquidity to assist the estate;

Source: slideshare.net

Source: slideshare.net

As such, whenever considering utilizing offshore life insurance companies for complex estate planning strategies like this, it’s important to work with an established estate attorney who can offer a statement of opinion or get a definitive private letter ruling from the irs. Again, this would be for an. First, it helps in creating and unlocking new wealth for the beneficiaries, in the form of the death benefit. We use a fiduciary standard in working with every client putting their needs ahead of our own. Estate planning needs differ for everyone depending.

Source: legacywealthcanada.com

Source: legacywealthcanada.com

Providing a death benefit to beneficiaries; Dependant support in the event of premature death, insurance proceeds can ensure This new trust must be funded with assets valued equal to. A life insurance policy can meet estate planning needs whenever an estate is composed of assets that cannot be divided through gifts or other means over the years, or when the assets are illiquid and you do not want to risk having them sold at firesale prices after your. Flexible estate planning strategies | allianz life flexible estate planning strategies an estate plan should have flexibility to react to changing events estate planning strategies can help minimize taxes, protect assets from creditors, avoid family strife or the mismanagement of an estate, and/or keep a business in the family.

Source: giftplanning.org

Source: giftplanning.org

Life insurance can be a versatile tool and offer powerful benefits to enhance your legacy and complement your overall financial strategy. Providing spousal income and support; Life insurance strategies for estate planning life insurance strategies for estate planning and why they matter. I&e was created by a group of estate planning legal professionals and life insurance agents who, after spending years working for various groups, including larger nationwide insurance brokerages, realized that people really do appreciate being able to find affordable life insurance policies and other related products and strategies from the comfort of their very own home. While all life insurance policies are designed to pay a benefit when someone dies, there are different types of policies to meet different needs.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

If federal estate tax planning is an issue, life insurance can be used to supply liquidity to pay the estate taxes. If federal estate tax planning is an issue, life insurance can be used to supply liquidity to pay the estate taxes. As such, whenever considering utilizing offshore life insurance companies for complex estate planning strategies like this, it’s important to work with an established estate attorney who can offer a statement of opinion or get a definitive private letter ruling from the irs. The primary consideration in selecting an insurance product for estate planning is that it is first and foremost a permanent policy. First, it helps in creating and unlocking new wealth for the beneficiaries, in the form of the death benefit.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

Dependant support in the event of premature death, insurance proceeds can ensure To provide liquidity in an estate to pay off liabilities such as taxes or mortgages. This solution has been primarily used by large estate planning to eliminate the issue of gift taxes. To do around using permanent life insurance as a financial and estate planning tool. Using insurance to keep the cottage in the family cottages are major assets, but they can cause major hardships if your estate planning falls short.

Source: topwholelife.com

Source: topwholelife.com

If you have a large amount of assets when you die, your beneficiaries. Premium financing premium financing is used in several different solutions. Providing liquidity to assist the estate; This new trust must be funded with assets valued equal to. These plans can be an important source.

Source: gatewayinv.com

Source: gatewayinv.com

Temporary or term insurance is generally designed for a temporary need. Irrevocable life insurance trusts are the most common estate tax planning technique. As such, whenever considering utilizing offshore life insurance companies for complex estate planning strategies like this, it’s important to work with an established estate attorney who can offer a statement of opinion or get a definitive private letter ruling from the irs. Estate planning needs differ for everyone depending. We educate and guide you to make confident decisions about your cash flow, insurance needs, tax savings and estate planning to reach your goals and protect your wealth, family, and lifestyle.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance strategies for estate planning by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.