Life insurance surrender charge Idea

Home » Trending » Life insurance surrender charge IdeaYour Life insurance surrender charge images are ready. Life insurance surrender charge are a topic that is being searched for and liked by netizens now. You can Download the Life insurance surrender charge files here. Find and Download all free images.

If you’re looking for life insurance surrender charge images information connected with to the life insurance surrender charge keyword, you have come to the ideal site. Our site frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly search and locate more enlightening video content and images that fit your interests.

Life Insurance Surrender Charge. An insurance policy costs the insurance company a great deal of money to issue. However, both life insurance policies and annuity contracts often impose a fee known as a surrender charge. a surrender charge is a fee that you have to pay when you cancel your life insurance. Most life insurance contracts will explicitly tell you the policy value and the surrender value. According to the balance, “ these surrender charges will be reduced over the term of the contract and will usually be eliminated over 10 to 15 years, depending on the product being used.” while you have less of a.

What is Life Insurance Surrender Charge and How to Avoid? From seniorslifeinsurancefinder.com

What is Life Insurance Surrender Charge and How to Avoid? From seniorslifeinsurancefinder.com

These charges start higher in the first few years and then may reduce to zero over time, often over 10 years. Life insurance surrender charges are fees that the insurance company takes out of your cash value if you cancel the policy. In life insurance, surrender charges are penalties that you must pay if you terminate the policy or withdraw funds from the accrued value. A surrender charge is a fee levied on a life insurance policyholder upon cancellation of their life insurance policy. Basically, this is the fee that is designed to cover the cost of keeping the policy on the insurance company’s records. As a result the surrender charges are placed to help discourage a policy holder from cashing in a policy before those.

Agent commissions, underwriting, and a host of other administrative charges.

By surrendering, you agree to take the cash surrender value (which is assigned by your insurance provider) while also forgoing the death benefit. The surrender charge is the difference between the accumulating fund and the cash value accumulated in the insurance policy that the policy holder can access at any time, often called cash surrender value. A surrender charge is the fee imposed when a policyholder cancels their life insurance or withdraws money from the savings component before it matures. When you surrender your life insurance policy, you essentially cancel it. A surrender charge is a charge from the cash value imposed by the insurance company for surrendering the contract early or withdrawing money early. A surrender charge is also known as a “surrender fee.”.

Source: ascendantfinancial.ca

Source: ascendantfinancial.ca

Most life insurance contracts will explicitly tell you the policy value and the surrender value. Was hit with a lawsuit monday for “assessing a surrender charge on the surrender charge” on its variable annuity contracts. Surrender charge this charge is deducted from your cash value if you surrender (terminate) your policy during your surrender charge period. Check your policy to find out the fee, or ask your life insurance agent. Surrender charge schedules are difference between insurers and between the ul plans available from each insurer.

Source: wall-c.com

Source: wall-c.com

Is there a penalty for surrendering life insurance? The surrender value is the contract value net of the surrender charge. If you surrender a cash value life insurance policy, the only “penalty” is that you may have to pay a surrender fee. Life insurance surrender charges are fees that the insurance company takes out of your cash value if you cancel the policy. Be sure to check the length of your surrender charge period when evaluating a policy to buy.

Source: ascendantfinancial.ca

Source: ascendantfinancial.ca

The cash surrender value is, therefore, the amount of money that you will get after all fees and charges have been assessed, and it will be less than the policy’s actual cash value during the surrender period. It is important to remember that when investing in life insurance products, that the risk associated with surrender value and fees goes down as time goes by. Life insurance surrender charges are fees that the insurance company takes out of your cash value if you cancel the policy. What is life insurance surrender charge? An insurance policy costs the insurance company a great deal of money to issue.

Source: aws.seniormarketsales.com

Is there a penalty for surrendering life insurance? What is life insurance surrender charge? The reason behind these charges is that firms who sell these products use the funds to invest, and so it serves their bottom line if the buyers are willing to keep them longer. Basically, this is the fee that is designed to cover the cost of keeping the policy on the insurance company’s records. Cash surrender value is the sum of money an insurance company will pay you, the policyholder, in the event you voluntarily cancel your life insurance policy before its.

Source: youtube.com

Source: youtube.com

The surrender value is the contract value net of the surrender charge. This is also known as a life insurance surrender fee, but the effect is the. These charges start higher in the first few years and then may reduce to zero over time, often over 10 years. According to the balance, “ these surrender charges will be reduced over the term of the contract and will usually be eliminated over 10 to 15 years, depending on the product being used.” while you have less of a. The reason behind these charges is that firms who sell these products use the funds to invest, and so it serves their bottom line if the buyers are willing to keep them longer.

Source: universallifeinsurancecheck.com

Source: universallifeinsurancecheck.com

For the latter, it typically decreases as time elapses. The surrender charge is the difference between the accumulating fund and the cash value accumulated in the insurance policy that the policy holder can access at any time, often called cash surrender value. Life insurance surrender charges are fees that the insurance company takes out of your cash value if you cancel the policy. The fee is used to cover the costs of keeping the insurance policy on the insurance provider’s books. In a whole life or universal life policy there are surrender charges.

Source: ascendantfinancial.ca

Source: ascendantfinancial.ca

Life insurance surrender charges are fees that the insurance company takes out of your cash value if you cancel the policy. When you surrender your life insurance policy, you essentially cancel it. However, both life insurance policies and annuity contracts often impose a fee known as a surrender charge. a surrender charge is a fee that you have to pay when you cancel your life insurance. Surrender charge schedules are difference between insurers and between the ul plans available from each insurer. What is a surrender charge?

Source: seniorslifeinsurancefinder.com

Source: seniorslifeinsurancefinder.com

In life insurance, surrender charges are penalties that you must pay if you terminate the policy or withdraw funds from the accrued value. Most life insurance contracts will explicitly tell you the policy value and the surrender value. Surrender charge this charge is deducted from your cash value if you surrender (terminate) your policy during your surrender charge period. What is a life insurance surrender charge? Life insurance surrender charges are fees that the insurance company takes out of your cash value if you cancel the policy.

Source: blog.massmutual.com

Source: blog.massmutual.com

Essentially, when you cancel a permanent life insurance policy or withdraw the cash value, there’s a surrender charge or fee. Surrendering is common for whole life insurance policies, which accrue cash value over time. Cash surrender value is the sum of money an insurance company will pay you, the policyholder, in the event you voluntarily cancel your life insurance policy before its. The cash surrender value is what you would receive upon cancelling your policy or making a withdrawal after the surrender charges. The surrender charge is supposed to.

Source: lifeandhealthinsurancestudyguidepdfse.blogspot.com

The surrender charge is the difference between the accumulating fund and the cash value accumulated in the insurance policy that the policy holder can access at any time, often called cash surrender value. This process is the same for both permanent life insurance (such as whole life and universal life) and term life insurance. Be sure to check the length of your surrender charge period when evaluating a policy to buy. A surrender charge is a fee levied on a life insurance policyholder upon cancellation of their life insurance policy. Life insurance surrender charges are fees that the insurance company takes out of your cash value if you cancel the policy.

Source: myannuitystore.com

Source: myannuitystore.com

Surrender charge this charge is deducted from your cash value if you surrender (terminate) your policy during your surrender charge period. The surrender value is the contract value net of the surrender charge. What is a life insurance surrender charge? However, both life insurance policies and annuity contracts often impose a fee known as a surrender charge. a surrender charge is a fee that you have to pay when you cancel your life insurance. A surrender charge is a charge from the cash value imposed by the insurance company for surrendering the contract early or withdrawing money early.

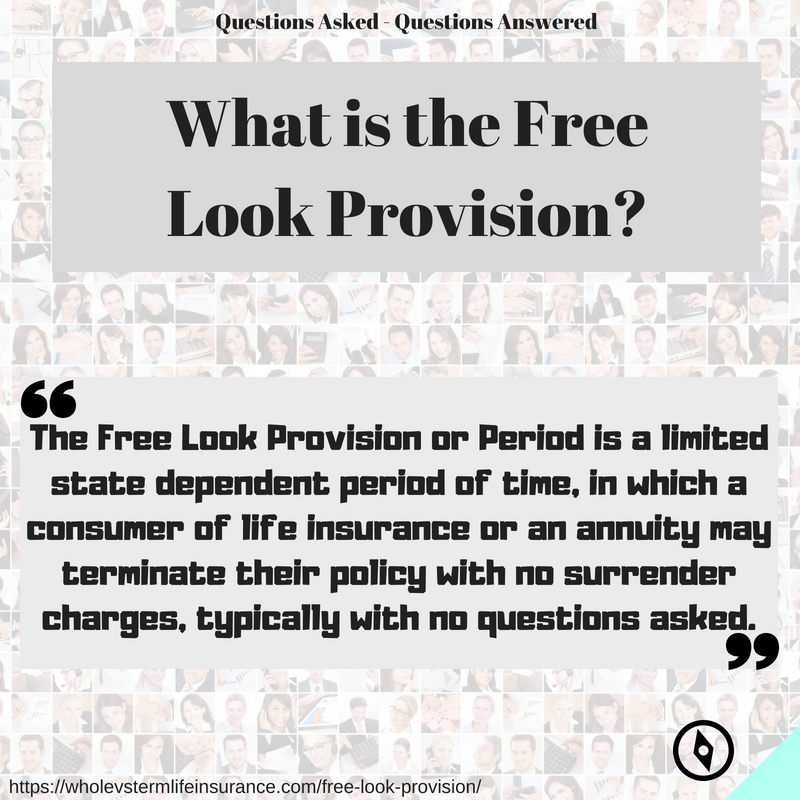

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

A surrender charge is the fee imposed when a policyholder cancels their life insurance or withdraws money from the savings component before it matures. Basically, this is the fee that is designed to cover the cost of keeping the policy on the insurance company’s records. Surrender charge schedules are difference between insurers and between the ul plans available from each insurer. You can avoid having to pay a surrender charge, or the period where surrender fees can be charged will elapse over time. According to the balance, “ these surrender charges will be reduced over the term of the contract and will usually be eliminated over 10 to 15 years, depending on the product being used.” while you have less of a.

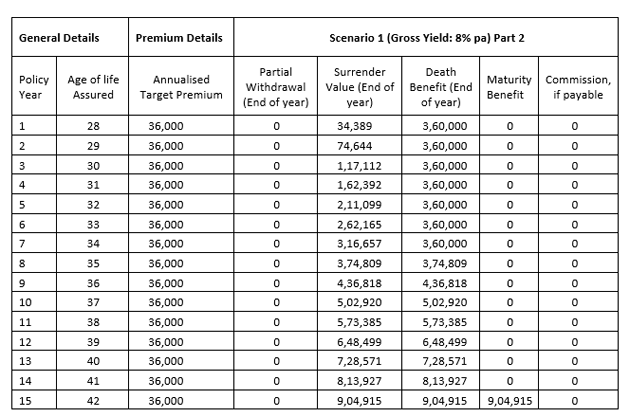

Source: economictimes.indiatimes.com

Source: economictimes.indiatimes.com

Basically, this is the fee that is designed to cover the cost of keeping the policy on the insurance company’s records. Life insurance surrender charges are fees that the insurance company takes out of your cash value if you cancel the policy. Basically, this is the fee that is designed to cover the cost of keeping the policy on the insurance company’s records. The life insurance company will deduct the surrender fee when it sends you the money. A surrender charge is a fee levied on a life insurance policyholder upon cancellation of their life insurance policy.

Source: finance.zacks.com

Source: finance.zacks.com

What is a surrender charge? In a whole life or universal life policy there are surrender charges. Life insurance surrender charges are fees that the insurance company takes out of your cash value if you cancel the policy. What is a surrender charge? The life insurance company will deduct the surrender fee when it sends you the money.

Source: thebalance.com

Source: thebalance.com

According to the balance, “ these surrender charges will be reduced over the term of the contract and will usually be eliminated over 10 to 15 years, depending on the product being used.” while you have less of a. What is a surrender charge? In life insurance, surrender charges are penalties that you must pay if you terminate the policy or withdraw funds from the accrued value. A surrender charge is a fee levied on a life insurance policyholder upon cancellation of their life insurance policy. Was hit with a lawsuit monday for “assessing a surrender charge on the surrender charge” on its variable annuity contracts.

Source: fool.com

Source: fool.com

Surrender charge this charge is deducted from your cash value if you surrender (terminate) your policy during your surrender charge period. Surrender charges are fees imposed on investments, annuities, and life insurance policies. Essentially, when you cancel a permanent life insurance policy or withdraw the cash value, there’s a surrender charge or fee. You can avoid having to pay a surrender charge, or the period where surrender fees can be charged will elapse over time. It is important to remember that when investing in life insurance products, that the risk associated with surrender value and fees goes down as time goes by.

Source: securenow.in

Source: securenow.in

The surrender charge is supposed to. However, both life insurance policies and annuity contracts often impose a fee known as a surrender charge. a surrender charge is a fee that you have to pay when you cancel your life insurance. If you surrender a cash value life insurance policy, the only “penalty” is that you may have to pay a surrender fee. The surrender charge is the difference between the accumulating fund and the cash value accumulated in the insurance policy that the policy holder can access at any time, often called cash surrender value. Life insurance companies pay their agents a large commission when the policy is first sold.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance surrender charge by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.