Life insurance table ratings Idea

Home » Trend » Life insurance table ratings IdeaYour Life insurance table ratings images are available in this site. Life insurance table ratings are a topic that is being searched for and liked by netizens today. You can Download the Life insurance table ratings files here. Get all royalty-free photos.

If you’re searching for life insurance table ratings pictures information related to the life insurance table ratings topic, you have come to the ideal site. Our site frequently gives you suggestions for downloading the highest quality video and image content, please kindly hunt and locate more enlightening video content and images that match your interests.

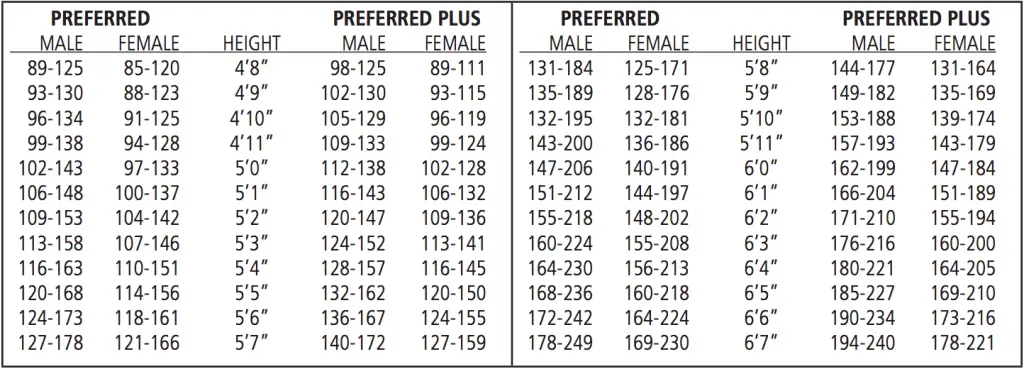

Life Insurance Table Ratings. As an example, if the standard rates were $1,000 per year, the table e or table 5 rates would be approximately $2,250. If you have been given a table rating and are unable to afford your life insurance policy, give us a call today! 50% table rating or $150 per month. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Primerica life insurance review Apr 2021 review From finder.com

Primerica life insurance review Apr 2021 review From finder.com

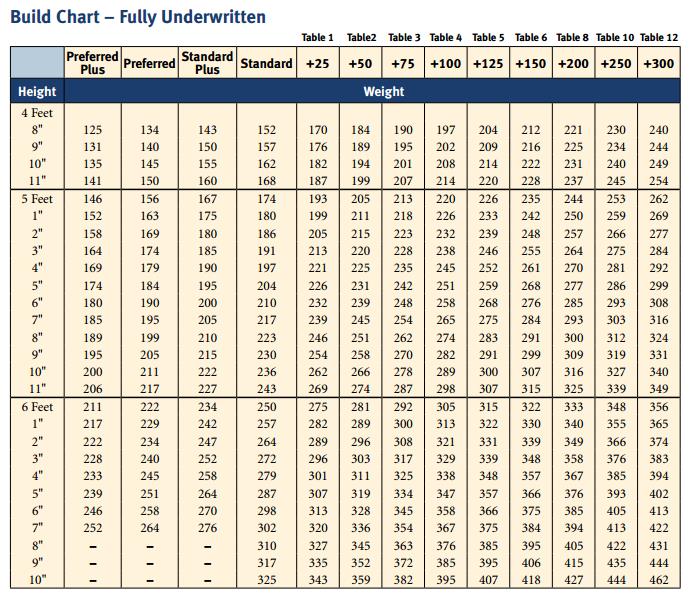

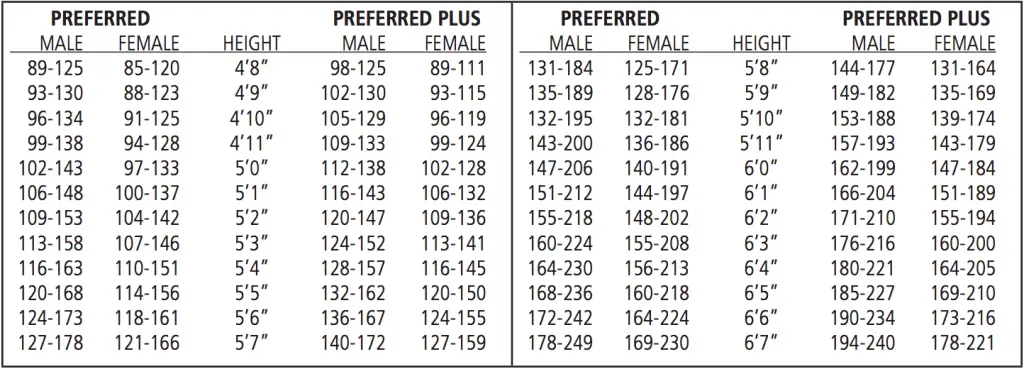

Your table rating depends on the severity of your health issue. Preferred plus, preferred & standard. 50% table rating or $150 per month. A life insurance rate class will determine how much you pay for coverage. Every life insurance company has two sets of ratings: Most life insurance companies have anywhere from 12 to 15 health class ratings.

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Depending on that rating, the applicant will pay an additional percentage if approved for a life insurance policy. While some carriers treat table ratings a little differently, for the most part, each table rating adds an extra 25% to the final cost of the policy. Each alpha letter corresponds to the number. People in preferred plus classifications get the. After this group, carriers have substandard life insurance tables for people with increased health risks. Instead of preferred or standard categories, an applicant might be given a table rating with a number or letter to designate their rating.

Source: riskquoter.com

Source: riskquoter.com

Each additional rating which you accumulate is equal to a multiplier which increases your price. Speak with an experienced advisor! When an applicant for life insurance fails to qualify for one of the standard underwriting classifications, he or she is typically subject to being table rated. (25% x 4 tables) = 100% increase. A “table b” or “table 2” life insurance rating is generally equal to the “standard” rating plus an additional 50% premium.

Source: toplifeinsurancereviews.com

Source: toplifeinsurancereviews.com

If you have been given a table rating and are unable to afford your life insurance policy, give us a call today! Lower ratings like table 1 and table a are the least costly, and higher ratings like table 8 and table g are riskier to insure, and therefore the most costly. As a rule of thumb, each table a carrier adds to a standard rating is a 25% increase in premium over the premium for a standard risk class. Such as steve’s case above, his table 4 rating resulted in doubling his premium. Applicants who are table rated will pay an extra fee on top of the standard life insurance premiums they would normally be charged.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

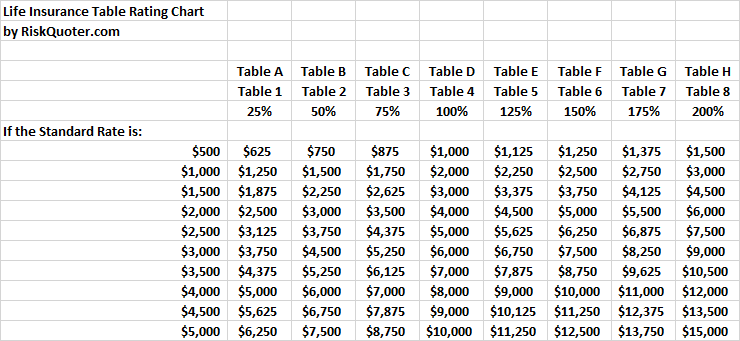

The classifications are preferred plus, preferred, standard plus, standard, and substandard. If you have been given a table rating and are unable to afford your life insurance policy, give us a call today! Depending on the carrier, they are tables a through h or 1 through 16. Life insurance table ratings chart Life insurance table ratings are used by the insurance company underwriting departments to assess the risk you present when they offer you a life insurance policy.

Source: thismybrightside.blogspot.com

Source: thismybrightside.blogspot.com

Insurers use your hobbies, health, and family history to determine your classification. See tables ratings & flat extras Lower ratings like table 1 and table a are the least costly, and higher ratings like table 8 and table g are riskier to insure, and therefore the most costly. 25% table rating or $125 per month. The first four classes are considered health ratings while the classes below those are table ratings.

Source: everquote.com

Source: everquote.com

Life insurance company ratings 2021 chart. Life insurance classifications reflect how risky you are to insure and determine how much you pay for coverage. 100% table rating or $200 per month. Life insurance table ratings chart The exception to the 25% rating system is prudential as we explain later.

Source: policymutual.com

Source: policymutual.com

A “table b” or “table 2” life insurance rating is generally equal to the “standard” rating plus an additional 50% premium. The actual table rating you receive will depend on the specific issue or condition you have and the company you are applying at. A “table e” or “table 5” life insurance rating is generally equal to the “standard” rating plus an additional 125% premium. A “table b” or “table 2” life insurance rating is generally equal to the “standard” rating plus an additional 50% premium. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: simplelifeinsure.com

Source: simplelifeinsure.com

Table ratings vary between insurance companies but usually range from a to p or 1 to 16 depending on whether the insurer is using a letter or number system. Life insurance table ratings are used by the insurance company underwriting departments to assess the risk you present when they offer you a life insurance policy. Here is an example of a life insurance table rating chart for term life products: Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Desk scores characterize an insureds extra threat to a.

Source: calgary-broker.blogspot.com

Source: calgary-broker.blogspot.com

If you have any medical or health issues, work in a dangerous occupation, have an adventurous lifestyle, or any combination of these factors, these all increase the risk associated. Every company and their 2021 life insurance ratings from a.m. Table ratings vary between insurance companies but usually range from a to p or 1 to 16 depending on whether the insurer is using a letter or number system. Example table ratings on life insurance policies. Most life insurance carriers have their table ratings equal to 25% of standard rates.

Source: calgary-broker.blogspot.com

Source: calgary-broker.blogspot.com

Insurers use your hobbies, health, and family history to determine your classification. 50% table rating or $150 per month. While table ratings can vary between insurers, there is some standardization. 22 rows life insurance coverage mortality tables. Such as steve’s case above, his table 4 rating resulted in doubling his premium.

Source: arninho-popper-neto.blogspot.com

If you have been given a table rating and are unable to afford your life insurance policy, give us a call today! 22 rows life insurance coverage mortality tables. Life insurance table ratings are used by the insurance company underwriting departments to assess the risk you present when they offer you a life insurance policy. People in preferred plus classifications get the. Depending on that rating, the applicant will pay an additional percentage if approved for a life insurance policy.

Source: bomadg.in

Source: bomadg.in

When an applicant for life insurance fails to qualify for one of the standard underwriting classifications, he or she is typically subject to being table rated. Insurers use your hobbies, health, and family history to determine your classification. Life insurance table ratings are used by the insurance company underwriting departments to assess the risk you present when they offer you a life insurance policy. Your life insurance table rating depends on the severity of your health issue. When an applicant for life insurance fails to qualify for one of the standard underwriting classifications, he or she is typically subject to being table rated.

Source: finder.com

Source: finder.com

Depending on the carrier, they are tables a through h or 1 through 16. If you have been given a table rating and are unable to afford your life insurance policy, give us a call today! A “table b” or “table 2” life insurance rating is generally equal to the “standard” rating plus an additional 50% premium. A “table b” or “table 2” life insurance rating is generally equal to the “standard” rating plus an additional 50% premium. The bmi limits are the same for both men and women.

Source: ratingwalls.blogspot.com

Source: ratingwalls.blogspot.com

Most life insurance companies have anywhere from 12 to 15 health class ratings. Here is an example of a life insurance table rating chart for term life products: Life insurance table ratings vary from carrier to carrier, but you can assume for simplicity’s sake of up to 10 ratings. When an applicant for life insurance fails to qualify for one of the standard underwriting classifications, he or she is typically subject to being table rated. Insurers call this further classification system table rating system.

Source: calgary-broker.blogspot.com

Source: calgary-broker.blogspot.com

Desk scores characterize an insureds extra threat to a. After this group, carriers have substandard life insurance tables for people with increased health risks. Such as steve’s case above, his table 4 rating resulted in doubling his premium. The classifications are preferred plus, preferred, standard plus, standard, and substandard. A “table e” or “table 5” life insurance rating is generally equal to the “standard” rating plus an additional 125% premium.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance table ratings by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.