Life insurance tax shelter Idea

Home » Trending » Life insurance tax shelter IdeaYour Life insurance tax shelter images are available. Life insurance tax shelter are a topic that is being searched for and liked by netizens now. You can Find and Download the Life insurance tax shelter files here. Get all free images.

If you’re searching for life insurance tax shelter pictures information linked to the life insurance tax shelter interest, you have visit the ideal blog. Our site always gives you suggestions for downloading the highest quality video and image content, please kindly surf and locate more informative video articles and graphics that match your interests.

Life Insurance Tax Shelter. It’s often forgotten that life insurance has tax shelter features in addition to its other benefits. This question is for sure one of the first that come to anyone’s mind. Are taxable (such as capital gains,consumers are often advised to purchase life insurance. Posted on march 9, 2011 by bobrichards.

Whole Life Insurance as Retirement Tax Shelter Question From whitecoatinvestor.com

Whole Life Insurance as Retirement Tax Shelter Question From whitecoatinvestor.com

Are taxable (such as capital gains,consumers are often advised to purchase life insurance. When you purchase a new life insurance policy as a gift, with the shelter as the owner, you deliver a large benefit to the shelter from income rather than capital. Keep this in mind when talking tax and estate strategies with your financial advisors. This article will, therefore, give you an overview of how to use offshore life insurance as a legal tax shelter. Remember, the primary purpose of life insurance is to provide tax free cash at death. It’s often forgotten that life insurance has tax shelter features in addition to its other benefits.

The first is the canadian government won’t allow you to put more than 18% of your income or $16,500, whichever is less, into a rrsp.

This question is for sure one of the first that come to anyone’s mind. Posted on march 9, 2011 by bobrichards. However, the policy must be kept in force for the life of the insured or all policy loans of gain and. What does life insurance tax shelter mean? When you purchase a new life insurance policy as a gift, with the shelter as the owner, you deliver a large benefit to the shelter from income rather than capital. The second problem is the money is subject to income tax when it’s taken out.

Source: whitecoatinvestor.com

Source: whitecoatinvestor.com

Tax shelter implies that once that value is removed from the shelter it could trigger is a taxable event. Life insurance proceeds are passed tax free to your beneficiaries. Are taxable (such as capital gains,consumers are often advised to purchase life insurance. However, the policy must be kept in force for the life of the insured or all policy loans of gain and. So, is life insurance taxable?

Source: slideserve.com

Source: slideserve.com

It can also help you bypass estate taxes while you supply wealth to your love ones as a legacy. You make tax deductible annual gifts to the shelter in the amount of the premium payments; It’s often forgotten that life insurance has tax shelter features in addition to its other benefits. This question is for sure one of the first that come to anyone’s mind. In a nutshell, a tax shelter allows your investments to grow free of tax.

Source: kurtismycfo.com

Source: kurtismycfo.com

That is is case with a whole life while you are living, however, the total death benefit of a whole life policy is tax free. When you purchase a new life insurance policy as a gift, with the shelter as the owner, you deliver a large benefit to the shelter from income rather than capital. Individuals can also use life insurance policies to plan for large tax expenses in the future. Another way to shelter income is by using life insurance. Remember, the primary purpose of life insurance is to provide tax free cash at death.

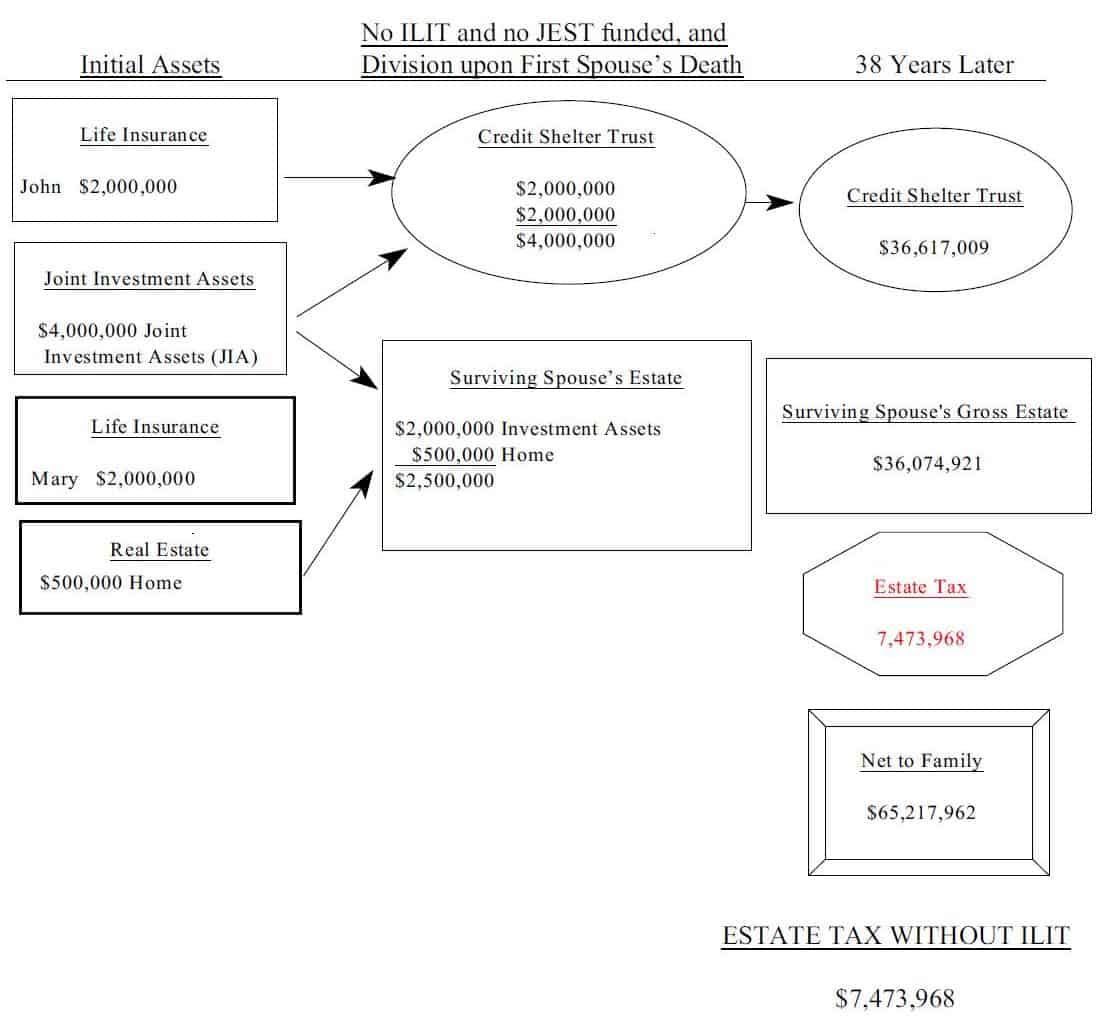

Source: gassmanlaw.com

Source: gassmanlaw.com

Both offer a death benefit to a designated beneficiary upon the death of the. It can also help you bypass estate taxes while you supply wealth to your love ones as a legacy. The first is the canadian government won’t allow you to put more than 18% of your income or $16,500, whichever is less, into a rrsp. Remember, the primary purpose of life insurance is to provide tax free cash at death. Life insurance tax shelter for dummies the secret to life insurance tax shelter.

Source: wholesalerg6cablecl78919.blogspot.com

Source: wholesalerg6cablecl78919.blogspot.com

You make tax deductible annual gifts to the shelter in the amount of the premium payments; We will, in turn, pay the premiums to the insurer. As a tax shelter, life insurance can save on income taxes for you or your beneficiaries. The exemption was gradually lifted to. The greater your insurance requirements, the greater the limit.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

When you purchase a new life insurance policy as a gift, with the shelter as the owner, you deliver a large benefit to the shelter from income rather than capital. As a tax shelter, life insurance can save on income taxes for you or your beneficiaries. A tax shelter is a place to legally store assets so that current or future tax liabilities are minimized. This question is for sure one of the first that come to anyone’s mind. The first is the canadian government won’t allow you to put more than 18% of your income or $16,500, whichever is less, into a rrsp.

Source: forbes.com

Source: forbes.com

It can also help you bypass estate taxes while you supply wealth to your love ones as a legacy. The life insurance tax shelter is used by many individuals when engaging in financial planning. However, the policy must be kept in force for the life of the insured or all policy loans of gain and. The first is the canadian government won’t allow you to put more than 18% of your income or $16,500, whichever is less, into a rrsp. As a tax shelter, life insurance can save on income taxes for you or your beneficiaries.

Source: kurtismycfo.com

Source: kurtismycfo.com

Life insurance proceeds are not taxable in many jurisdictions. However, the policy must be kept in force for the life of the insured or all policy loans of gain and. The tax sheltered annuity (tsa) 403(b) plan from www.annuityexpertadvice.com. Keep this in mind when talking tax and estate strategies with your financial advisors. Did you know that a life insurance product can be used as a tax shelter instrument?

Source: annuityexpertadvice.com

Source: annuityexpertadvice.com

It can also help you bypass estate taxes while you supply wealth to your love ones as a legacy. Individuals can also use life insurance policies to plan for large tax expenses in the future. Fund managers take shelter in cash as central bank fears. Permanent life insurance is a big financial commitment compared to term insurance. This question is for sure one of the first that come to anyone’s mind.

Source: nomadcapitalist.com

Source: nomadcapitalist.com

Tax shelter from life insurance. Life insurance may play multiple roles in tax and estate planning, but its ultimate suitability. As a tax shelter, life insurance can save on income taxes for you or your beneficiaries. A tax shelter is a tax minimization strategy, and. Tax shelter implies that once that value is removed from the shelter it could trigger is a taxable event.

Source: joyjunction.org

Source: joyjunction.org

Life insurance tax shelter for dummies the secret to life insurance tax shelter. Keep this in mind when talking tax and estate strategies with your financial advisors. Life insurance may play multiple roles in tax and estate planning, but its ultimate suitability. By purchasing life insurance policies strategically, an individual could potentially avoid paying a certain amount in taxes. Permanent life insurance is a big financial commitment compared to term insurance.

Source: kurtismycfo.com

Source: kurtismycfo.com

Did you know that a life insurance product can be used as a tax shelter instrument? In 1997, estate tax applied to assets above $600,000. Another way to shelter income is by using life insurance. So, is life insurance taxable? It can also help you bypass estate taxes while you supply wealth to your love ones as a legacy.

Source: nomadcapitalist.com

Source: nomadcapitalist.com

By purchasing life insurance policies strategically, an individual could potentially avoid paying a certain amount in taxes. Since most other forms of income. Tax shelter from life insurance. Both offer a death benefit to a designated beneficiary upon the death of the. In 1997, estate tax applied to assets above $600,000.

Source: dreamstime.com

Source: dreamstime.com

Life insurance was also recommended if the investor would leave enough assets to trigger estate taxes. So, is life insurance taxable? Life insurance proceeds are passed tax free to your beneficiaries. The exemption was gradually lifted to. In a nutshell, a tax shelter allows your investments to grow free of tax.

Source: globmer.com

Source: globmer.com

Individuals can also use life insurance policies to plan for large tax expenses in the future. Here’s a quick look at how private placement life insurance can provide a valuable tax shelter for a variety of asset classes. When you purchase a new life insurance policy as a gift, with the shelter as the owner, you deliver a large benefit to the shelter from income rather than capital. Life insurance was also recommended if the investor would leave enough assets to trigger estate taxes. Both offer a death benefit to a designated beneficiary upon the death of the.

Source: youtube.com

Source: youtube.com

We will, in turn, pay the premiums to the insurer. This article will, therefore, give you an overview of how to use offshore life insurance as a legal tax shelter. Since most other forms of income. Universal life insurance can be a tax advantaged saving or investment product that can accumulate tax deferred and generate tax free distributions via withdrawals to basis after 15 years and/or policy loans of gain. What does life insurance tax shelter mean?

Source: paradigmlife.net

Source: paradigmlife.net

Both offer a death benefit to a designated beneficiary upon the death of the. In a nutshell, a tax shelter allows your investments to grow free of tax. Policies to either offset future tax liabilities, or to shelter the growth of their investments from. As a tax shelter, life insurance can save on income taxes for you or your beneficiaries. By purchasing life insurance policies strategically, an individual could potentially avoid paying a certain amount in taxes.

Source: thompsonagency.net

Source: thompsonagency.net

Another way to shelter income is by using life insurance. Since most other forms of income. This article will, therefore, give you an overview of how to use offshore life insurance as a legal tax shelter. Individuals can also use life insurance policies to plan for large tax expenses in the future. In a nutshell, a tax shelter allows your investments to grow free of tax.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance tax shelter by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.