Life insurance term length information

Home » Trending » Life insurance term length informationYour Life insurance term length images are available. Life insurance term length are a topic that is being searched for and liked by netizens now. You can Find and Download the Life insurance term length files here. Get all free images.

If you’re searching for life insurance term length images information related to the life insurance term length interest, you have visit the right site. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly search and locate more enlightening video articles and graphics that fit your interests.

Life Insurance Term Length. Length of term life policy Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. These are the most common length of level premium term life insurance policies offered by companies. So if you buy a term life insurance policy for 20 years, the day it becomes active it will insure you for 20 years from that date.

Life Insurance Term Length / Life Insurance Over 70 How To From viral-news-757.blogspot.com

Life Insurance Term Length / Life Insurance Over 70 How To From viral-news-757.blogspot.com

When it comes to buying term life insurance the most common lengths are 10, 15, 20, and 30 years. Term lengths typically range from 10 years to 30 years, and choosing the term that’s best for you requires balancing the cost of coverage with (7). At the end of the term period, you can either renew the policy or just allow the policy to end. Length of term life policy You’re not sure what life milestones lie ahead, so you need flexibility. A 30 year term policy is assumed to stay at the same price for 30 years.

Basic term life insurance lengths are 10, 20, or 30 years.

Term life policies are generally sold in lengths of five, 10, 15, 20, 25 or 30 years. How age affects length of term availability. There are three main questions you’ll have to ask when deciding on your policy: Term life terms usually come in fixed periods of time running 5, 10, 15, 20, 25, or 30 years depending on carrier. When it comes to buying term life insurance the most common lengths are 10, 15, 20, and 30 years. You can choose which term length (8).

Source: abiewtt.blogspot.com

Source: abiewtt.blogspot.com

The longer the policy, the higher your life insurance. Term life terms usually come in fixed periods of time running 5, 10, 15, 20, 25, or 30 years depending on carrier. There are three main questions you’ll have to ask when deciding on your policy: Here are a few things to consider when choosing the best term length for your unique situation: A “term length” indicates how long your policy lasts.

Source: blog.policyadvisor.com

Source: blog.policyadvisor.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. You’re not sure what life milestones lie ahead, so you need flexibility. Already have a 20 year $1mm policy and want a bit more as your wealth increases? How age affects length of term availability. Term life policies are generally sold in lengths of five, 10, 15, 20, 25 or 30 years.

Source: etechbag.com

Source: etechbag.com

As a general rule a ten year term life insurance policy is about the lowest term length that is mass marketed. You’re not sure what life milestones lie ahead, so you need flexibility. A “term length” indicates how long your policy lasts. How much are you qualified for? You can choose which term length (8).

Source: nophysicaltermlife.com

Source: nophysicaltermlife.com

What is a term length? There are three main questions you’ll have to ask when deciding on your policy: A term life insurance policy’s term length is how long it will last before expiring. Term lengths typically range from 10 years to 30 years, and choosing the term that’s best for you requires balancing the cost of coverage with (7). You can choose which term length (8).

Source: abramsinc.com

Source: abramsinc.com

Length of term life policy When it comes to buying term life insurance the most common lengths are 10, 15, 20, and 30 years. If you outlive your term, your beneficiaries won’t receive the proceeds. So if you buy a term life insurance policy for 20 years, the day it becomes active it will insure you for 20 years from that date. How much do you need?

Source: diarioiwuk.blogspot.com

Source: diarioiwuk.blogspot.com

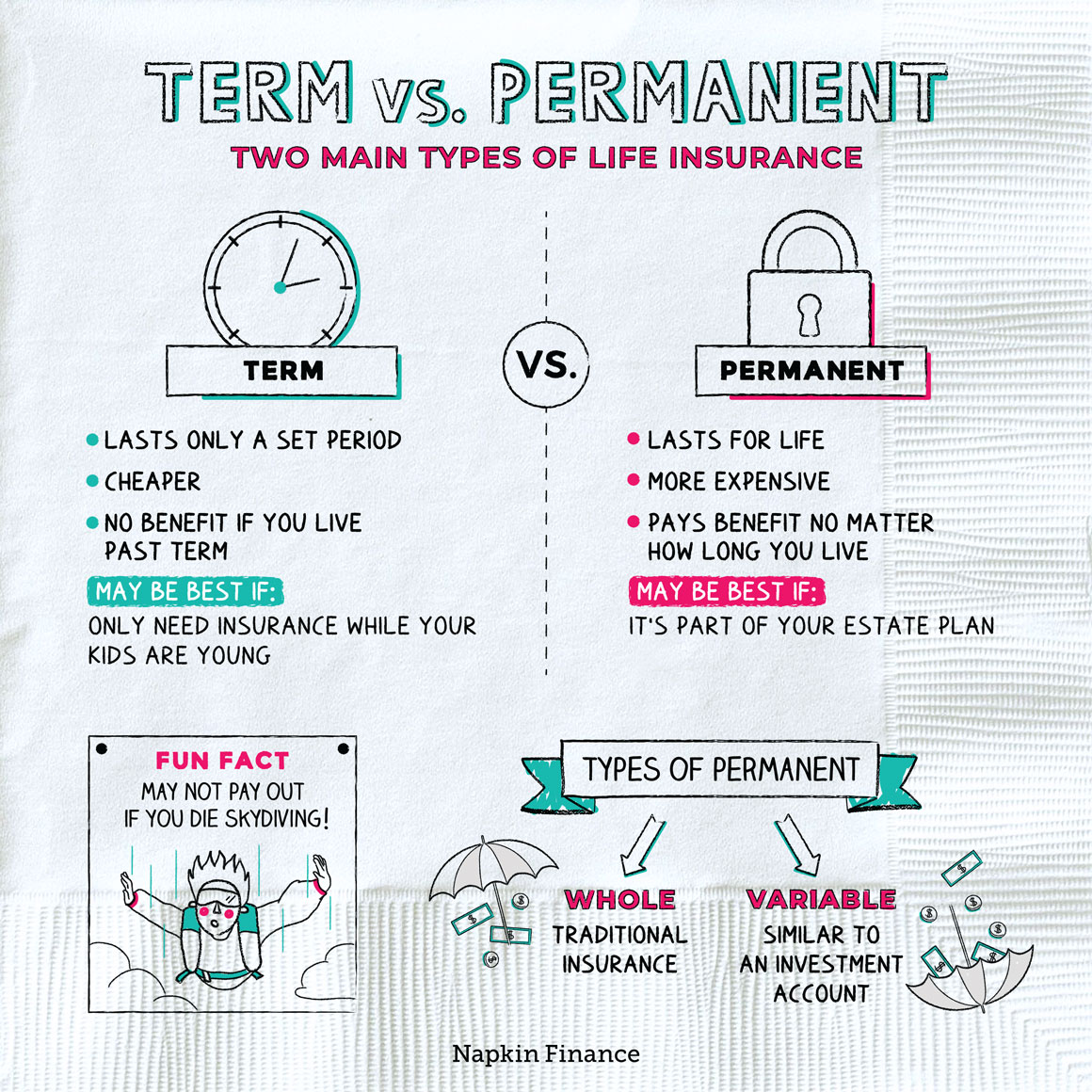

One of the reasons that term life insurance is so much less expensive than whole life insurance is that the carrier is only at risk for a period of time. Most term life plans run from 10 to 30 years. Term length in life insurance means the number of years that the policy will stay in effect at the same premium. The ten year is a great top layer of life insurance policies for many. There are three main questions you’ll have to ask when deciding on your policy:

Source: themoneysavvyblog.com

Source: themoneysavvyblog.com

The average number of term life insurance lengths offered by most providers is three consisting of: Term life policies are generally sold in lengths of five, 10, 15, 20, 25 or 30 years. Length of term life policy A 30 year term policy is assumed to stay at the same price for 30 years. The ten year is a great top layer of life insurance policies for many.

Source: frasesdeumaluaneteapaxionada.blogspot.com

Source: frasesdeumaluaneteapaxionada.blogspot.com

The older you are the shorter the term available for coverage. How much can you afford? If your insurance policy runs out before you have finished paying off your mortgage, you are at risk of leaving your loved ones with significant mortgage debt after your death. Most term life plans run from 10 to 30 years. The best term length for mortgage life insurance.

Source: cpp.ca

Source: cpp.ca

A 30 year term policy is assumed to stay at the same price for 30 years. The older you are the shorter the term available for coverage. Term lengths typically range from 10 years to 30 years, and choosing the term that’s best for you requires balancing the cost of coverage with (7). There are three main questions you’ll have to ask when deciding on your policy: How much can you afford?

Source: trustlife.ca

Source: trustlife.ca

When it comes to buying term life insurance the most common lengths are 10, 15, 20, and 30 years. Term length in life insurance means the number of years that the policy will stay in effect at the same premium. Term life insurance is coverage for a fixed term, depending on the plan this term can be for 10 years, 20 years, 25 years, or for any other period that is defined in the policy. Factors to consider when deciding on term length for life insurance: Term life policies are generally sold in lengths of five, 10, 15, 20, 25 or 30 years.

The ten year is a great top layer of life insurance policies for many. A “term length” indicates how long your policy lasts. If you die during the term, your beneficiaries will receive a death benefit. Your age will have an impact on your options for term insurance. However, some companies may also offer term lengths of 5, 15, or 25 years or options for longer terms over 30 years.

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

How age affects length of term availability. You’re not sure what life milestones lie ahead, so you need flexibility. You can choose which term length (8). Term life insurance offers protection for a set period of time, such as 10, 15, 20, 25 or 30 years. The average number of term life insurance lengths offered by most providers is three consisting of:

Source: nophysicaltermlife.com

Source: nophysicaltermlife.com

Here are a few things to consider when choosing the best term length for your unique situation: How much are you qualified for? If your insurance policy runs out before you have finished paying off your mortgage, you are at risk of leaving your loved ones with significant mortgage debt after your death. Term lengths typically range from 10 years to 30 years, and choosing the term that’s best for you requires balancing the cost of coverage with (7). Your age will have an impact on your options for term insurance.

Source: nonmedlifeinsurance.com

Source: nonmedlifeinsurance.com

A “term length” indicates how long your policy lasts. One of the reasons that term life insurance is so much less expensive than whole life insurance is that the carrier is only at risk for a period of time. 40 years (some companies) most companies also offer increasing premium term life insurance policies which last (as long as you make premium payments) until age 85, 90, 95, 100 or even older. How much can you afford? Term lengths typically range from 10 years to 30 years, and choosing the term that’s best for you requires balancing the cost of coverage with (7).

Source: everquote.com

Source: everquote.com

Term life insurance is coverage for a fixed term, depending on the plan this term can be for 10 years, 20 years, 25 years, or for any other period that is defined in the policy. A term life insurance policy’s term length is how long it will last before expiring. How age affects length of term availability. Term life insurance is coverage for a fixed term, depending on the plan this term can be for 10 years, 20 years, 25 years, or for any other period that is defined in the policy. A 30 year term policy is assumed to stay at the same price for 30 years.

If you die during your term, your beneficiaries will get the death benefit. You’re not sure what life milestones lie ahead, so you need flexibility. If you die during your term, your beneficiaries will get the death benefit. If your insurance policy runs out before you have finished paying off your mortgage, you are at risk of leaving your loved ones with significant mortgage debt after your death. Term life policies are generally sold in lengths of five, 10, 15, 20, 25 or 30 years.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

The ten year is a great top layer of life insurance policies for many. The best term length for mortgage life insurance. Basic term life insurance lengths are 10, 20, or 30 years. You pay a monthly premium in exchange for coverage, and coverage lasts for the number of years in your term. The average number of term life insurance lengths offered by most providers is three consisting of:

![No B.S. Guide To 20Year Term Life Insurance [Rates Revealed] No B.S. Guide To 20Year Term Life Insurance [Rates Revealed]](https://buylifeinsuranceforburial.com/wp-content/uploads/2018/08/Copy-of-Infografic63-Top-3-Term-LI-Programs.png) Source: buylifeinsuranceforburial.com

Source: buylifeinsuranceforburial.com

Term life policies are generally sold in lengths of five, 10, 15, 20, 25 or 30 years. Your age will have an impact on your options for term insurance. Term length in life insurance means the number of years that the policy will stay in effect at the same premium. If you die during the term, your beneficiaries will receive a death benefit. A “term length” indicates how long your policy lasts.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance term length by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.