Life insurance trust beneficiary information

Home » Trend » Life insurance trust beneficiary informationYour Life insurance trust beneficiary images are ready in this website. Life insurance trust beneficiary are a topic that is being searched for and liked by netizens today. You can Download the Life insurance trust beneficiary files here. Get all royalty-free images.

If you’re looking for life insurance trust beneficiary images information related to the life insurance trust beneficiary topic, you have come to the right site. Our site always gives you suggestions for downloading the highest quality video and image content, please kindly hunt and find more enlightening video content and graphics that match your interests.

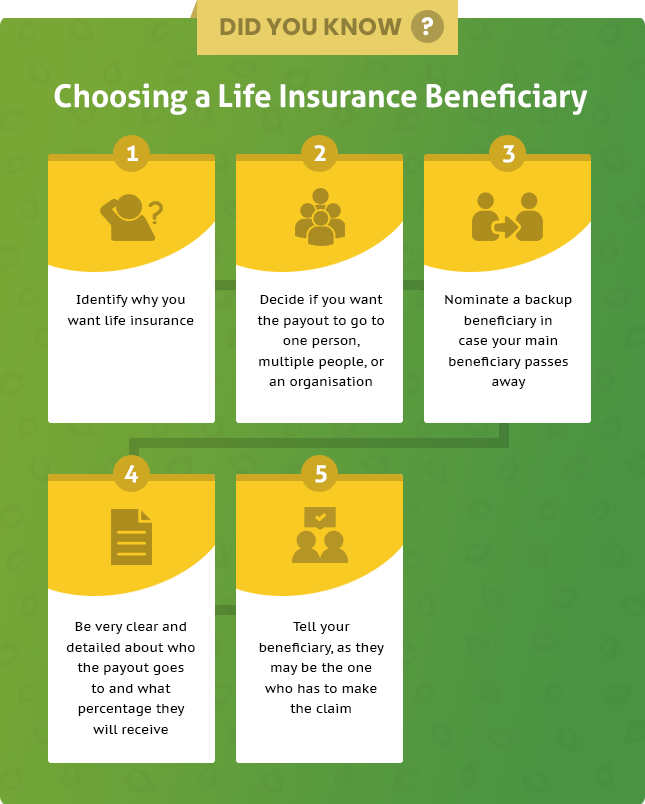

Life Insurance Trust Beneficiary. Legal instruments, like trusts, aren’t just for the ultrarich. Although naming your beneficiary is pretty straightforward, there are still plenty of questions you may. A member of your family, like children, siblings, or parents; Insurance trusts can be really beneficial on a number of fronts, especially when it comes to protecting an estate and its beneficiaries.

Do beneficiaries always supercede those named in a last From quora.com

Naming a trust as the beneficiary of a life insurance policy or annuity is a very effective way of building flexibility into one’s estate settlement planning. A life insurance beneficiary is the person you designate to inherit the proceeds from your life insurance policy after you pass away. With insurance trusts, both the owner and beneficiary of the insurance policy is the actual trust itself. The beneficiary is the person who will receive the life insurance benefit when the policy owner passes away. If you think that you may be a named beneficiary on someone’s life insurance policy and that person has passed away, you should call the claims department of the insurance company. Or, consider naming your revocable living trust as the primary beneficiary of your life insurance so that the proceeds will pass into the b trust (or bypass, credit shelter, or family trust) created for the benefit of your surviving spouse so that the proceeds will be protected from creditors, lawsuits, and a new spouse.

If the parents pass away, the.

Your life insurance beneficiary is the designated person or enitity that will collect your policy�s death benefit when you die. If you’re married or have children, it’s important that you know what these rules are. A member of your family, like children, siblings, or parents; Naming a trust as the beneficiary of a life insurance policy or annuity is a very effective way of building flexibility into one’s estate settlement planning. A beneficiary designation naming a trust should contain the: Beneficiary considerations if you have comfortably less than $4 million in assets when you include the death benefit of your insurance policy, then estate tax will not be a consideration for you.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

A life insurance beneficiary is the person you designate to inherit the proceeds from your life insurance policy after you pass away. For those using life insurance to fund a trust, be sure you have made that clear via beneficiary designations. Naming a trust as the beneficiary of a life insurance policy or annuity is a very effective way of building flexibility into one’s estate settlement planning. Every person that owns life insurance should have the beneficiary designation reviewed in conjunction with a review of his or her revocable trust to determine whether or not a change needs to be made in light of the morey decision. This means the money does not reach your loved ones quite as fast as it would if you named an individual as.

Source: lifeinsurancecomparison.com.au

Source: lifeinsurancecomparison.com.au

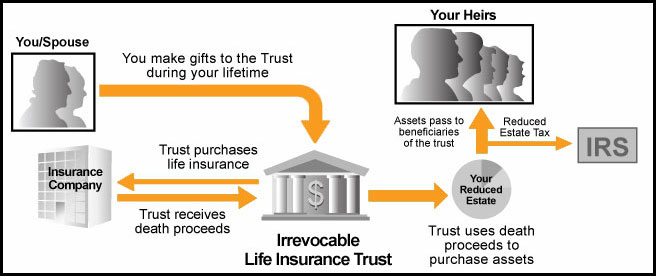

A life insurance trust is a trust designed to be the owner or beneficiary of your life insurance. A life insurance beneficiary is a person the insured chooses and designates on the policy to receive the life insurance payout after he or she passes away. Your life insurance beneficiary is the designated person or enitity that will collect your policy�s death benefit when you die. An irrevocable life insurance trust takes ownership of the life insurance policy. The most popular examples include:

Source: youtube.com

Source: youtube.com

A life insurance trust is a legal entity that holds assets that are managed and distributed by a designated trustee. This is applicable regardless of whether it is life insurance obtained through work or a private policy. Putting money or other assets in a trust lets you spell out who receives them and how they’re doled out over time. Your life insurance beneficiary is the designated person or enitity that will collect your policy�s death benefit when you die. However, in some situations, it may be better to name a trust as the beneficiary of a life insurance policy.

Source: quora.com

Although naming your beneficiary is pretty straightforward, there are still plenty of questions you may. A life insurance beneficiary is the person you designate to inherit the proceeds from your life insurance policy after you pass away. This is applicable regardless of whether it is life insurance obtained through work or a private policy. An irrevocable life insurance trust takes ownership of the life insurance policy. Pros of listing a trust as your life insurance beneficiary.

Source: orangecountyestateplanninglawyer-blog.com

Source: orangecountyestateplanninglawyer-blog.com

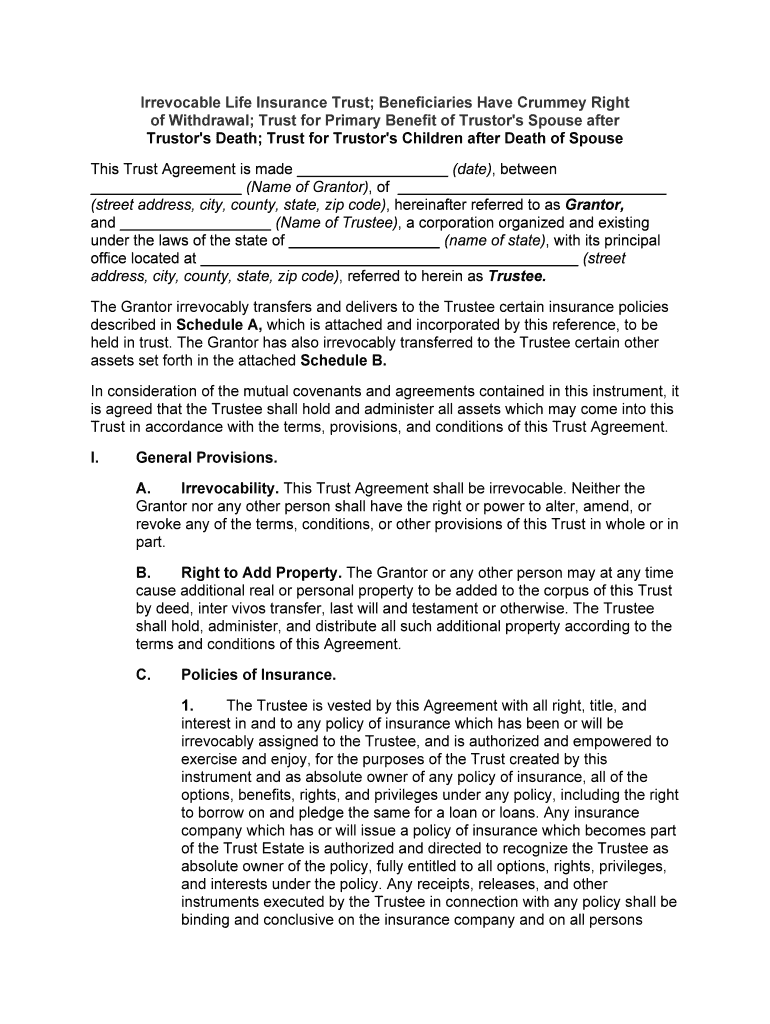

The trust’s tax identification number must be provided in the ownership section of the insurance application but is not necessary for the beneficiary designation A life insurance trust is a legal entity that holds assets that are managed and distributed by a designated trustee. The beneficiary is the person who will receive the life insurance benefit when the policy owner passes away. Under a revocable trust, you can have a lot of flexibility and control, but the death benefit value of the life insurance will be. For those using life insurance to fund a trust, be sure you have made that clear via beneficiary designations.

Source: locallifeagents.com

Source: locallifeagents.com

Legal instruments, like trusts, aren’t just for the ultrarich. For those using life insurance to fund a trust, be sure you have made that clear via beneficiary designations. A life insurance trust is a trust designed to be the owner or beneficiary of your life insurance. If you think that you may be a named beneficiary on someone’s life insurance policy and that person has passed away, you should call the claims department of the insurance company. Every person that owns life insurance should have the beneficiary designation reviewed in conjunction with a review of his or her revocable trust to determine whether or not a change needs to be made in light of the morey decision.

Source: youtube.com

Source: youtube.com

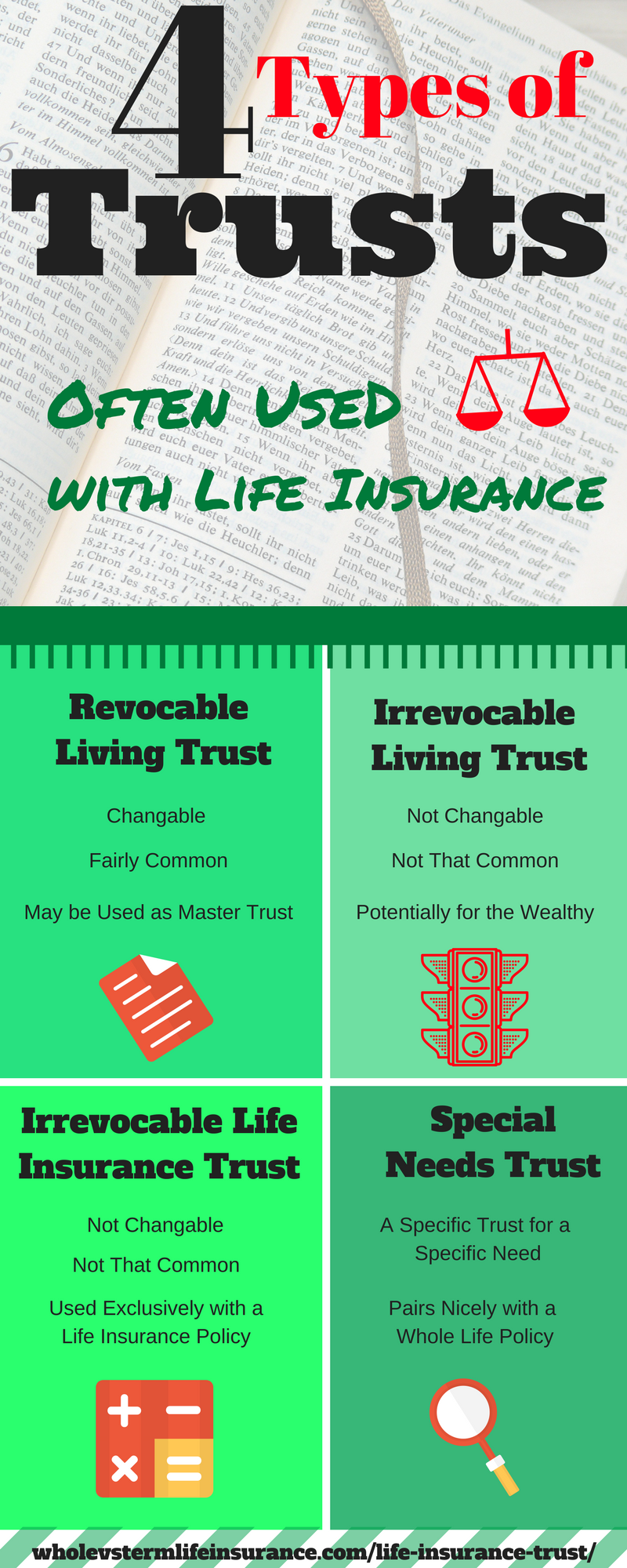

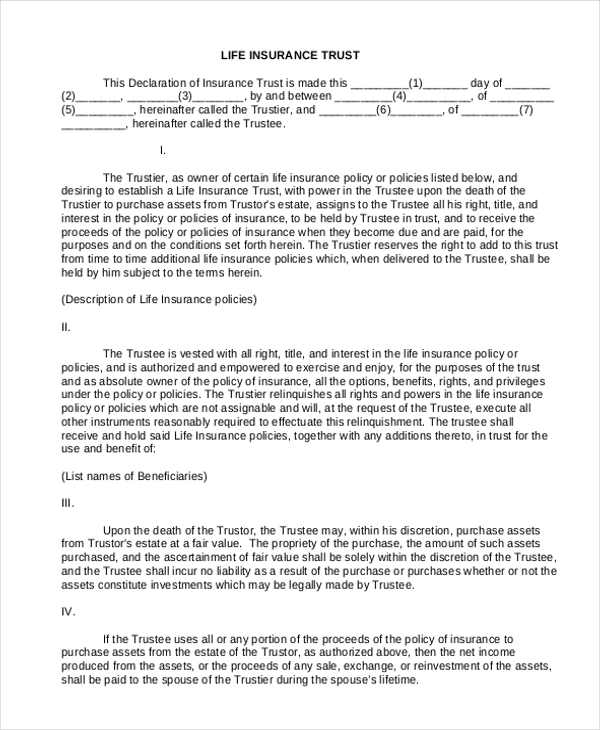

A life insurance trust is a trust designed to be the owner or beneficiary of your life insurance. A life insurance trust is a legal entity that holds assets that are managed and distributed by a designated trustee. 1) irrevocable trust or 2) revocable trust. What is a life insurance trust? There are two types of trusts that are used to hold life insurance:

Source: enprocesodenacer.blogspot.com

Source: enprocesodenacer.blogspot.com

Can anyone be your life insurance beneficiary? A life insurance beneficiary rule is a rule put in place either by the life insurance company or the insurance commissioner of the state you live in. The trust’s tax identification number must be provided in the ownership section of the insurance application but is not necessary for the beneficiary designation Whether to list your trust as a beneficiary of your life. There are two types of trusts that are used to hold life insurance:

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

A life insurance beneficiary is the person you designate to inherit the proceeds from your life insurance policy after you pass away. Beneficiaries may be legal entities, organizations or individuals with a substantial interest in the policy’s proceeds. For those using life insurance to fund a trust, be sure you have made that clear via beneficiary designations. Although naming your beneficiary is pretty straightforward, there are still plenty of questions you may. An insurance trust is a type of irrevocable trust where the trust assets consist of a life insurance policy.

Source: mericleco.com

Source: mericleco.com

A member of your family, like children, siblings, or parents; Or, consider naming your revocable living trust as the primary beneficiary of your life insurance so that the proceeds will pass into the b trust (or bypass, credit shelter, or family trust) created for the benefit of your surviving spouse so that the proceeds will be protected from creditors, lawsuits, and a new spouse. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. If you’re married or have children, it’s important that you know what these rules are. The beneficiary is the person who will receive the life insurance benefit when the policy owner passes away.

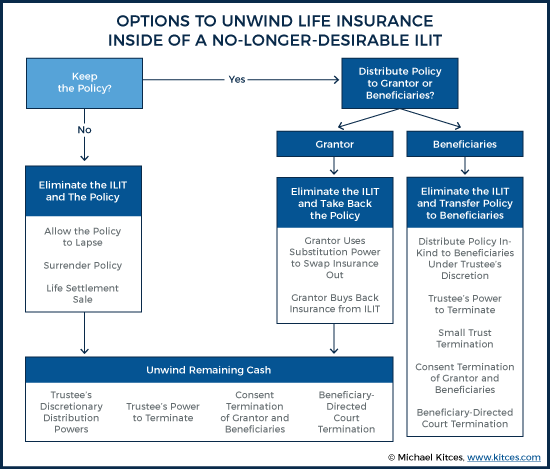

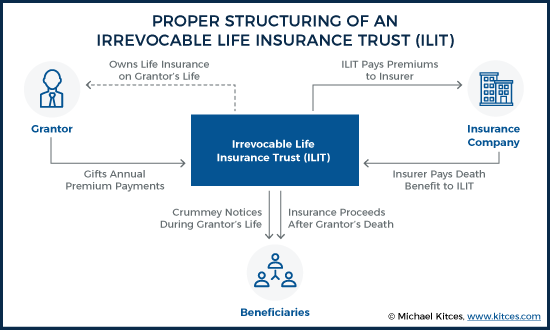

Source: kitces.com

Source: kitces.com

This is applicable regardless of whether it is life insurance obtained through work or a private policy. When you list a trust as your life insurance beneficiary, you’re able to maneuver around probate, estate tax (depending on your unique financial situation — make sure you’re consulting a cpa), and you’re able to control how your wealth is used, or when it’s given to your kids. Consider a life insurance trust beneficiary as a potential solution. The beneficiary is the person who will receive the life insurance benefit when the policy owner passes away. In most cases, it makes better sense to name your beneficiaries individually on life insurance policies versus naming a.

Source: carriehightower.net

Source: carriehightower.net

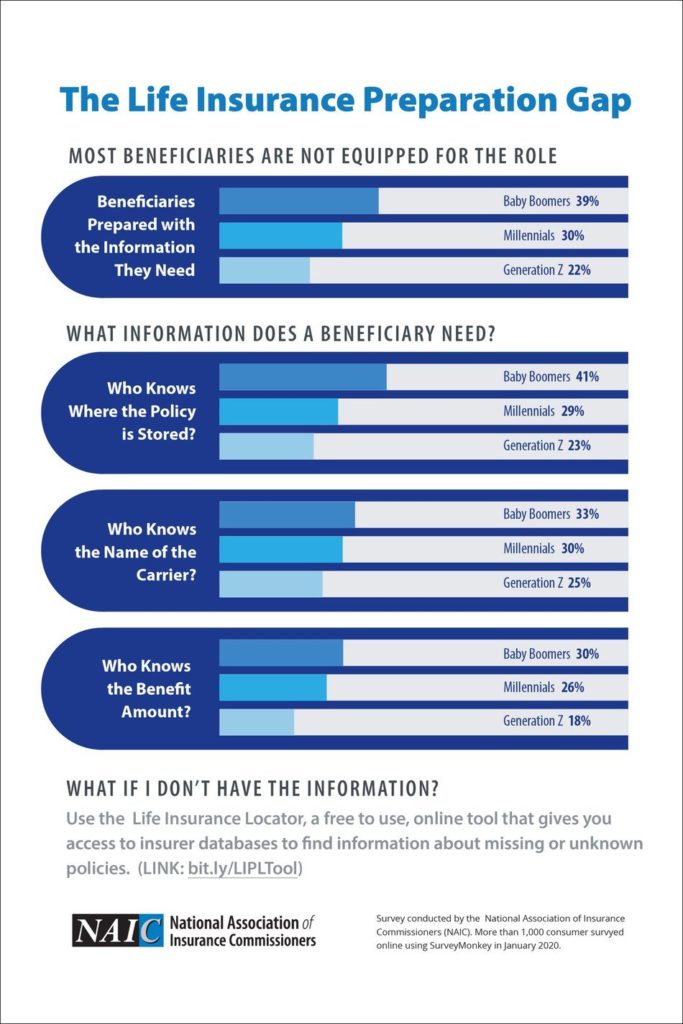

If you think that you may be a named beneficiary on someone’s life insurance policy and that person has passed away, you should call the claims department of the insurance company. When the insured person dies, the trustee administers the trust on behalf of the beneficiary or beneficiaries, who could be minors. Pros of listing a trust as your life insurance beneficiary. What is a life insurance trust? The insurance company pays the death benefit to the trust and the trust dictates the.

Source: sellmyforms.com

Source: sellmyforms.com

Beneficiaries may be legal entities, organizations or individuals with a substantial interest in the policy’s proceeds. Naming a trust as the beneficiary of a life insurance policy or annuity is a very effective way of building flexibility into one’s estate settlement planning. There are two types of trusts that are used to hold life insurance: A life insurance beneficiary is the person you designate to inherit the proceeds from your life insurance policy after you pass away. Whether to make your revocable living trust the beneficiary of your life insurance policy depends on your personal situation and what your goals are.

Source: signnow.com

Source: signnow.com

Naming a trust as the beneficiary of a life insurance policy or annuity is a very effective way of building flexibility into one’s estate settlement planning. There are two types of trusts that are used to hold life insurance: A beneficiary can be one or multiple people or even an organization. This is applicable regardless of whether it is life insurance obtained through work or a private policy. Full name of the trust;

Source: bettersinsurance.com

Source: bettersinsurance.com

For those using life insurance to fund a trust, be sure you have made that clear via beneficiary designations. Although naming your beneficiary is pretty straightforward, there are still plenty of questions you may. Insurance trusts can be really beneficial on a number of fronts, especially when it comes to protecting an estate and its beneficiaries. A life insurance trust is a trust designed to be the owner or beneficiary of your life insurance. There are two types of trusts that are used to hold life insurance:

Source: everplans.com

Source: everplans.com

The most popular examples include: Whether to list your trust as a beneficiary of your life. Pros of listing a trust as your life insurance beneficiary. For those using life insurance to fund a trust, be sure you have made that clear via beneficiary designations. By far the biggest disadvantage to naming a trust as life insurance beneficiary is that rusts needs to be administered, which takes time.

Source: kitces.com

Source: kitces.com

A life insurance trust is a trust designed to be the owner or beneficiary of your life insurance. If you’re single and don’t have children, you are free to name anyone that you want as your beneficiary. These individuals are entitled to life insurance proceeds through a contract you and the life insurance agency arrange. 1) irrevocable trust or 2) revocable trust. Can anyone be your life insurance beneficiary?

Source: sampleforms.com

Source: sampleforms.com

Life insurance is a protective policy that serves to financially support those you’re closest to. By far the biggest disadvantage to naming a trust as life insurance beneficiary is that rusts needs to be administered which takes time. Date the trust was executed including month, day and year. Again, if you choose to pursue this strategy, then one or both of the trusts should be the beneficiary of the life insurance policy. Life insurance is a protective policy that serves to financially support those you’re closest to.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance trust beneficiary by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.