Life insurance underwriting information

Home » Trending » Life insurance underwriting informationYour Life insurance underwriting images are ready. Life insurance underwriting are a topic that is being searched for and liked by netizens now. You can Find and Download the Life insurance underwriting files here. Download all free photos.

If you’re searching for life insurance underwriting pictures information connected with to the life insurance underwriting interest, you have come to the right site. Our site frequently provides you with hints for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video content and images that fit your interests.

Life Insurance Underwriting. How life insurance policies are underwritten. For health insurance, they asses the risk of illness or injury. Insurance companies want to learn as much about you as possible before insuring you for hundreds of thousands of dollars. Applying for life insurance is easy but in order to determine how much your policy will truly cost, an underwriter needs to determine your likelihood of dying before the end of your policy�s term.

How Does Life Insurance Underwriting Work? Tips that Help From riskquoter.com

How Does Life Insurance Underwriting Work? Tips that Help From riskquoter.com

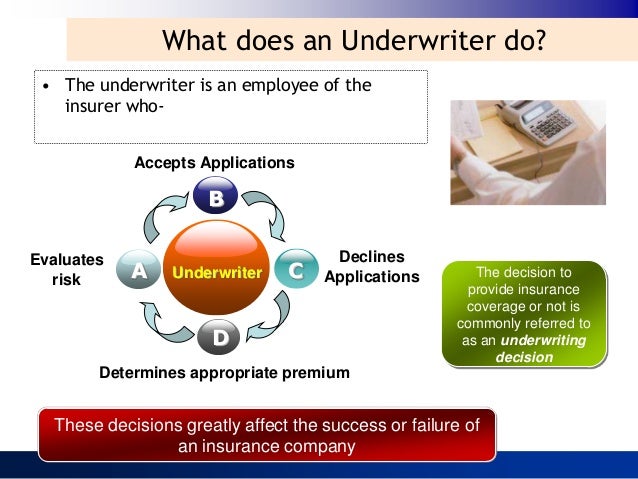

Insurance companies want to learn as much about you as possible before insuring you for hundreds of thousands of dollars. After you apply for life insurance, you go through a process called underwriting with the insurance company. Underwriting starts with an application to a life insurance policy. In essence, life insurance underwriting is the method through which insurers evaluate the risk a potential buyer poses in order to decide whether or not to approve, deny, or rate up a life insurance policy. Insurance underwriting is the name given to the process of assessing your life insurance application. Life insurance underwriting identifies factors in your life that may reduce your life expectancy and make you more risky to insure.

Underwriting is the process the insurance carrier goes through to approve your policy.

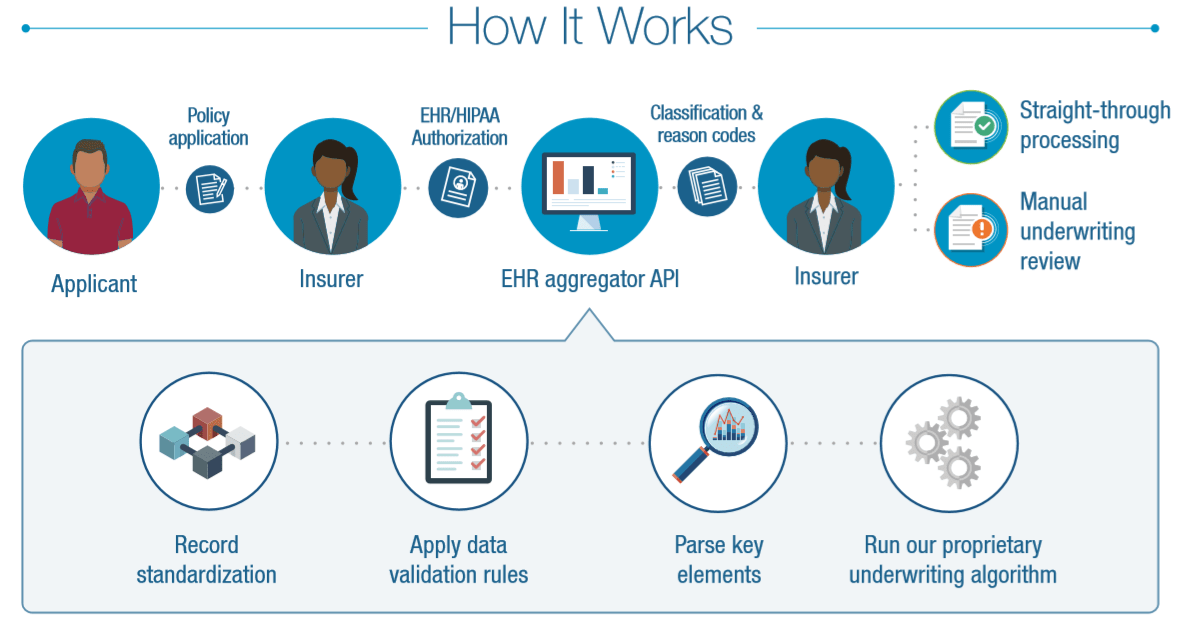

What is underwriting in life insurance? One thing that is constant for everyone who applies through fabric, however, is that the process begins with completing an online application. In the case of life insurance, it means they are betting you’ll live long enough that the company doesn’t have to pay out more than they’ve earned on your policy. For health insurance, they asses the risk of illness or injury. Each company has a list of life insurance underwriting guidelines by which the underwriter approves or denies an exam or no medical exam term life insurance application, assigns a risk classification, and sets an appropriate price. But for many insurers, legacy systems and manual work slow the process.

Source: insurance-canada.ca

Source: insurance-canada.ca

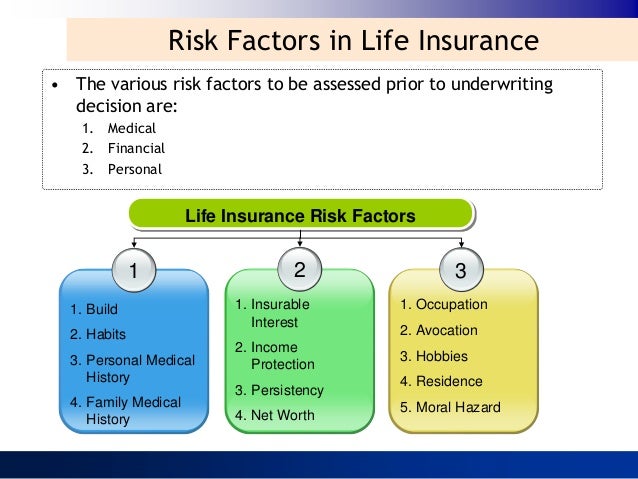

If you�re planning to buy life insurance, understand how you�ll be grouped into an underwriting class. With mortgage protection insurance, underwriters assess both the risk of death and illness/injury. A life insurer’s risk is that you may die within your policy’s active years, and they’ll have to pay out your death benefit. For health insurance, they asses the risk of illness or injury. The life insurance application process determines if an insurer can make you an offer for coverage—known as insurance underwriting—and this process varies from person to person.

Source: locallifeagents.com

Source: locallifeagents.com

Welcomewelcome life insurance underwritinglife insurance underwriting 2. Today’s life insurance customer demands a faster and more convenient quoting and buying experience. After someone applies, the insurance company with which they’ve applied puts their underwriter to work. As a rule of thumb, the healthier a person is, the less risk he/she poses, and the lower rates he/she will get. Insurance underwriting is the name given to the process of assessing your life insurance application.

Source: cbinsights.com

Source: cbinsights.com

The proposer must complete a proposal form, and the completed proposal form forms the basis of. Life insurance underwriting is a process where insurance carriers assign applicants a classification based on several factors. Eis believes streamlined underwriting innovation is a first rung in a ladder that will lead to broader life insurance transformation. Life insurance underwriting begins when an agent talks to a potential client about a quote for life insurance. Each company has a list of life insurance underwriting guidelines by which the underwriter approves or denies an exam or no medical exam term life insurance application, assigns a risk classification, and sets an appropriate price.

Source: researchgate.net

Source: researchgate.net

Underwriting decisionsunderwriting decisions to accept the insurance, and ifto accept the insurance, and if so, atso, at what rate of premium,what rate of premium, to call for further informationto call for further information to postpone a decision for ato postpone a decision for a periodperiod to decline.to decline. Life insurance underwriting is the process that determines how risky you are in the eyes of your insurer. After you apply for life insurance, you go through a process called underwriting with the insurance company. The life insurance underwriting process can feel pretty personal. We have built the first coretech insurance platform that lets life insurers speed up all facets of their business.

Source: rheumatoidarthritislifeinsurance.com

Source: rheumatoidarthritislifeinsurance.com

For life insurance, underwriters assess the risk of early death. It has a direct effect on your premiums — young, healthy people typically get the best rates because their risk is lowest. The life insurance application process determines if an insurer can make you an offer for coverage—known as insurance underwriting—and this process varies from person to person. Let’s say you’re applying for life insurance on yourself. Underwriting entails the assessment of proposed life insurance and deciding whether to accept the risk and if accepting the risks, at what rate and terms.

Source: fetch.ie

Source: fetch.ie

For health insurance, they asses the risk of illness or injury. For life insurance, underwriters assess the risk of early death. With mortgage protection insurance, underwriters assess both the risk of death and illness/injury. An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. Life insurance companies use underwriters to look at the information gathered about you and then figure how much of a risk it would be to sell you life insurance.

Source: slideshare.net

Source: slideshare.net

Life insurance underwriting is the process that determines how risky you are in the eyes of your insurer. If you�re planning to buy life insurance, understand how you�ll be grouped into an underwriting class. Underwriting is a term used to describe the consideration given to a life insurance application, to determine whether a policy applied for should be issued or there are changes to be made depending on the person’s risk profile. Let’s say you’re applying for life insurance on yourself. In essence, life insurance underwriting is the method through which insurers evaluate the risk a potential buyer poses in order to decide whether or not to approve, deny, or rate up a life insurance policy.

Source: hsocal.com

Source: hsocal.com

This involves finding out key details about you and is carried out by an insurance underwriter. Underwriting is the process the insurance carrier goes through to approve your policy. Let’s say you’re applying for life insurance on yourself. How life insurance policies are underwritten. If you�re planning to buy life insurance, understand how you�ll be grouped into an underwriting class.

Source: insurancewotsutsuke.blogspot.com

Source: insurancewotsutsuke.blogspot.com

Underwriting is a term used to describe the consideration given to a life insurance application, to determine whether a policy applied for should be issued or there are changes to be made depending on the person’s risk profile. The proposer must complete a proposal form, and the completed proposal form forms the basis of. Underwriting is a term used to describe the consideration given to a life insurance application, to determine whether a policy applied for should be issued or there are changes to be made depending on the person’s risk profile. Applying for life insurance is easy but in order to determine how much your policy will truly cost, an underwriter needs to determine your likelihood of dying before the end of your policy�s term. The life insurance underwriter is the person responsible for determining that risk.

Source: instant-cyber-insurance.blogspot.com

Source: instant-cyber-insurance.blogspot.com

After someone applies, the insurance company with which they’ve applied puts their underwriter to work. Applying for life insurance is easy but in order to determine how much your policy will truly cost, an underwriter needs to determine your likelihood of dying before the end of your policy�s term. Welcomewelcome life insurance underwritinglife insurance underwriting 2. Underwriting decisionsunderwriting decisions to accept the insurance, and ifto accept the insurance, and if so, atso, at what rate of premium,what rate of premium, to call for further informationto call for further information to postpone a decision for ato postpone a decision for a periodperiod to decline.to decline. Insurance companies want to learn as much about you as possible before insuring you for hundreds of thousands of dollars.

![Life Insurance Underwriting Assistant Tool [Free] LIHD Life Insurance Underwriting Assistant Tool [Free] LIHD](https://mlgaewotv2bs.i.optimole.com/Hk9998E.cKqR~25f5c/w:auto/h:auto/q:90/https://lifeinsurancehelpdesk.com/wp-content/uploads/2020/05/c9da9655-4207-49cc-bcab-cae9bfb1549b.png) Source: lifeinsurancehelpdesk.com

Source: lifeinsurancehelpdesk.com

An agent will know how to help this potential client long before the client submits a signed application to the insurance company. Let’s say you’re applying for life insurance on yourself. After someone applies, the insurance company with which they’ve applied puts their underwriter to work. A life insurer’s risk is that you may die within your policy’s active years, and they’ll have to pay out your death benefit. Life insurance underwriting is the process that determines how risky you are in the eyes of your insurer.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

But for many insurers, legacy systems and manual work slow the process. In the case of life insurance, it means they are betting you’ll live long enough that the company doesn’t have to pay out more than they’ve earned on your policy. Insurance companies use the underwriting process for various types of insurance. Underwriting is a term used to describe the consideration given to a life insurance application, to determine whether a policy applied for should be issued or there are changes to be made depending on the person’s risk profile. So, most life insurance companies insist on a medical exam , as well as reviewing your medical history and current lifestyle.

Source: fotografiabelohorizonte.blogspot.com

Source: fotografiabelohorizonte.blogspot.com

After someone applies, the insurance company with which they’ve applied puts their underwriter to work. One thing that is constant for everyone who applies through fabric, however, is that the process begins with completing an online application. Let’s say you’re applying for life insurance on yourself. But for many insurers, legacy systems and manual work slow the process. So, most life insurance companies insist on a medical exam , as well as reviewing your medical history and current lifestyle.

Source: riskquoter.com

Source: riskquoter.com

In the case of life insurance, it means they are betting you’ll live long enough that the company doesn’t have to pay out more than they’ve earned on your policy. Today’s life insurance customer demands a faster and more convenient quoting and buying experience. Each company has a list of life insurance underwriting guidelines by which the underwriter approves or denies an exam or no medical exam term life insurance application, assigns a risk classification, and sets an appropriate price. But for many insurers, legacy systems and manual work slow the process. Life insurance underwriting is a process where insurance carriers assign applicants a classification based on several factors.

Source: youtube.com

Source: youtube.com

Life insurance underwriting is the process that determines how risky you are in the eyes of your insurer. The proposer must complete a proposal form, and the completed proposal form forms the basis of. How life insurance policies are underwritten. Insurance underwriting is the name given to the process of assessing your life insurance application. It has a direct effect on your premiums — young, healthy people typically get the best rates because their risk is lowest.

Source: fotografiabelohorizonte.blogspot.com

Source: fotografiabelohorizonte.blogspot.com

The life insurance application process determines if an insurer can make you an offer for coverage—known as insurance underwriting—and this process varies from person to person. Life insurance underwriting is a process where insurance carriers assign applicants a classification based on several factors. In the case of life insurance, it means they are betting you’ll live long enough that the company doesn’t have to pay out more than they’ve earned on your policy. Today’s life insurance customer demands a faster and more convenient quoting and buying experience. After you apply for life insurance, you go through a process called underwriting with the insurance company.

Source: everquote.com

Source: everquote.com

What is underwriting in life insurance? So, most life insurance companies insist on a medical exam , as well as reviewing your medical history and current lifestyle. An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. Insurance companies make their profits by betting on risk. If you�re planning to buy life insurance, understand how you�ll be grouped into an underwriting class.

Source: youtube.com

Source: youtube.com

We have built the first coretech insurance platform that lets life insurers speed up all facets of their business. An underwriter works on behalf of the life insurance company to evaluate your application details, health information, and lifestyle to give you an insurance classification based on risk, which determines your premium. But for many insurers, legacy systems and manual work slow the process. After someone applies, the insurance company with which they’ve applied puts their underwriter to work. For health insurance, they asses the risk of illness or injury.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance underwriting by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.