Life insurance underwriting process Idea

Home » Trending » Life insurance underwriting process IdeaYour Life insurance underwriting process images are available. Life insurance underwriting process are a topic that is being searched for and liked by netizens today. You can Download the Life insurance underwriting process files here. Get all royalty-free photos.

If you’re searching for life insurance underwriting process pictures information linked to the life insurance underwriting process topic, you have pay a visit to the ideal blog. Our site frequently gives you suggestions for seeing the highest quality video and picture content, please kindly surf and locate more informative video content and images that fit your interests.

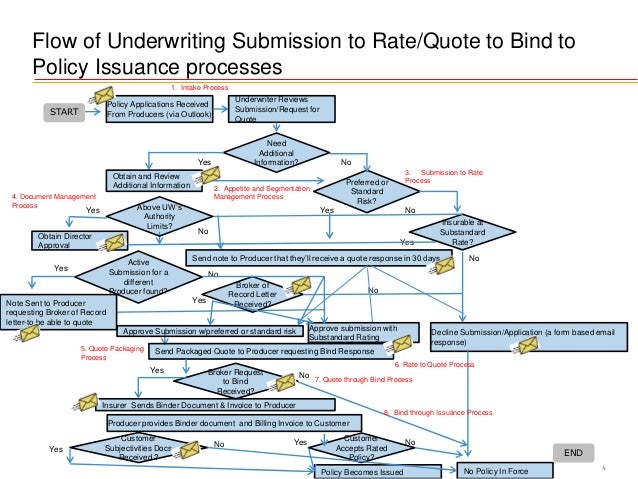

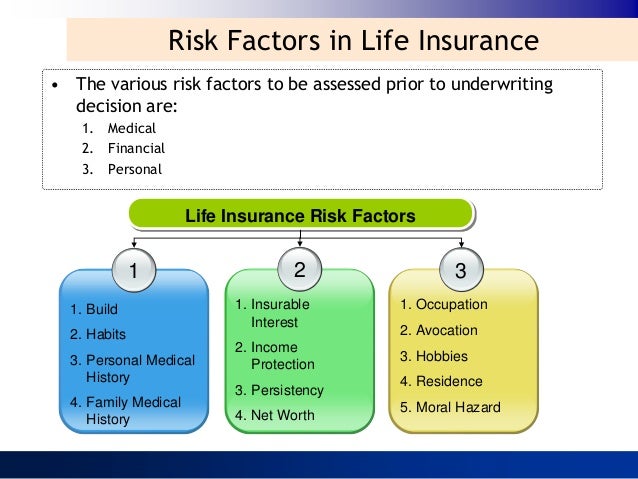

Life Insurance Underwriting Process. However, when it comes to life insurance, things take a bit longer due to the underwriting process. Simply put, your risk profile affects two things: After that, you’ll know if you’ve been approved or. Life insurers use underwriters to examine all the information collected about you and determine the level of risk it will take to sell a life insurance policy to you.

Life Insurance Underwriting Process From igniter.buzz

Life Insurance Underwriting Process From igniter.buzz

The duration of the underwriting process usually depends on the steps undertaken, as some life insurance policies don’t require specific steps. Applying for life insurance is easy but in order to determine how much your policy will truly cost, an underwriter needs to determine your likelihood of dying before the end of your policy�s term. Underwriting is the process insurance companies go through when evaluating the risk of insuring someone�s life. It’s their job to assess your personal and health information to assess the risk of selling you a life insurance policy. Let’s take a second to explain this with something everyone has likely had to deal with before: Life insurers use underwriters to examine all the information collected about you and determine the level of risk it will take to sell a life insurance policy to you.

It’s their job to assess your personal and health information to assess the risk of selling you a life insurance policy.

The process generally takes between two weeks and two months to complete. You can even do it online without even speaking to anyone. What is life insurance underwriting process? How does the life insurance underwriting process work exactly? The life insurance underwriting process is what life insurance companies use to determine risk. It is the process of assessing the life insurance application of a potential customer.

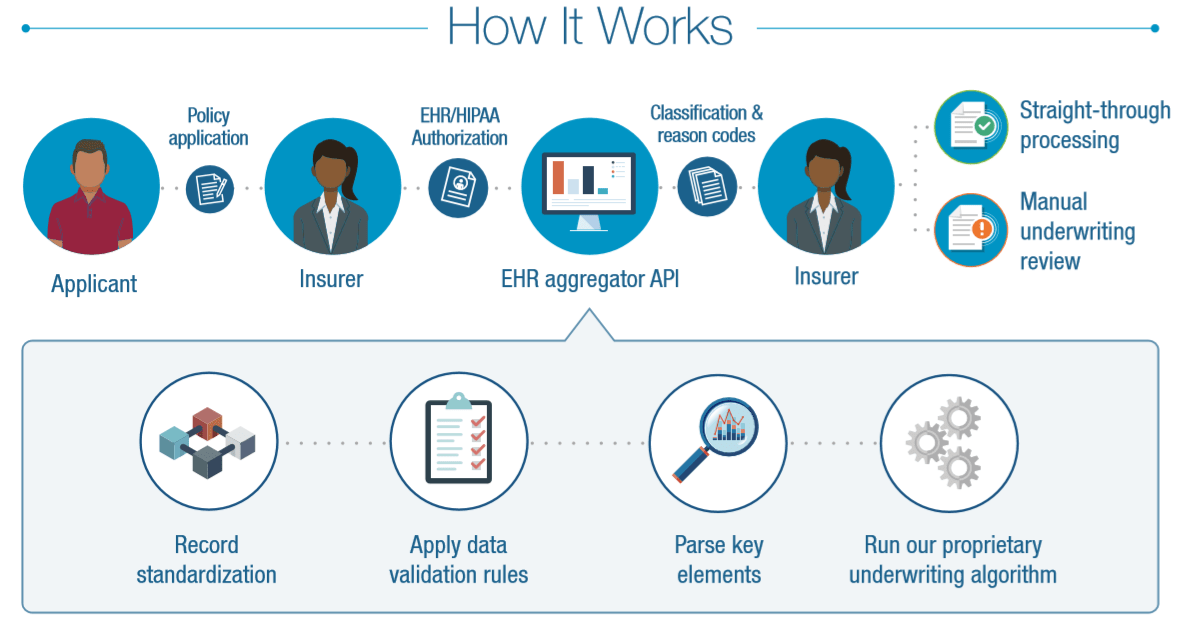

Source: cbinsights.com

Source: cbinsights.com

In essence, life insurance underwriting is the method through which insurers evaluate the risk a potential buyer poses in order to decide whether or not to approve, deny, or rate up a life insurance policy. The process generally takes between two weeks and two months to complete. It is the process of assessing the life insurance application of a potential customer. In essence, life insurance underwriting is the method through which insurers evaluate the risk a potential buyer poses in order to decide whether or not to approve, deny, or rate up a life insurance policy. This process can take even longer if an underwriter orders an aps, to see if there are any health matters or proverbial red flags that may be an issue of.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

Insurers take a risk when they sell a life insurance policy. Underwriting is the process the insurance carrier goes through to approve your policy. The process generally takes between two weeks and two months to complete. With so many companies and plans available, it can be difficult to figure out the right plan for your needs. Life insurance underwriting begins when an agent talks to a potential client about a quote for life insurance.

Source: igniter.buzz

Source: igniter.buzz

Applying and being approved for car insurance. Life insurance underwriting begins when an agent talks to a potential client about a quote for life insurance. What is life insurance underwriting process? The insurance companies codify a set of procedures which must be followed before accepting any new business. Underwriting in life insurance is the process of a company analyzing and determining the risk an applicant poses in order to determine acceptability and pricing for a policy.

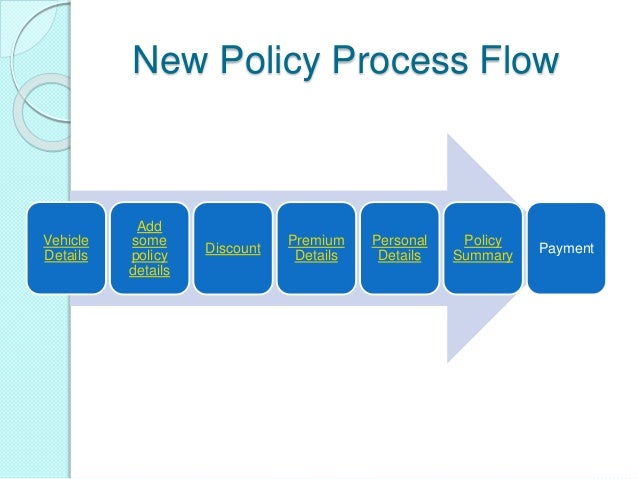

Source: slideteam.net

Source: slideteam.net

Underwriting is the process insurance companies go through when evaluating the risk of insuring someone�s life. Insurers have underwriters who try to know as much about you, your finances, dependents, health, habits, etc. Life insurers use underwriters to examine all the information collected about you and determine the level of risk it will take to sell a life insurance policy to you. It’s their job to assess your personal and health information to assess the risk of selling you a life insurance policy. Underwriting is the process a life insurance company goes through to determine the risk involved in insuring your life.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

Underwriting is the process the insurance carrier goes through to approve your policy. What is life insurance underwriting. Life insurance underwriting is the process of evaluating your application for a life insurance policy. Life insurers use underwriters to examine all the information collected about you and determine the level of risk it will take to sell a life insurance policy to you. Life insurance underwriting is the process of accepting the proposal of the customer based on the guidelines formulated by the insurance company.

Source: riskquoter.com

Source: riskquoter.com

The life insurance underwriting process helps insurers calculate risk to ensure your life cover is tailored to you. Life insurance underwriting is the process of evaluating your application for a life insurance policy. What is life insurance underwriting process? Underwriting is the process insurance companies go through when evaluating the risk of insuring someone�s life. The insurance companies codify a set of procedures which must be followed before accepting any new business.

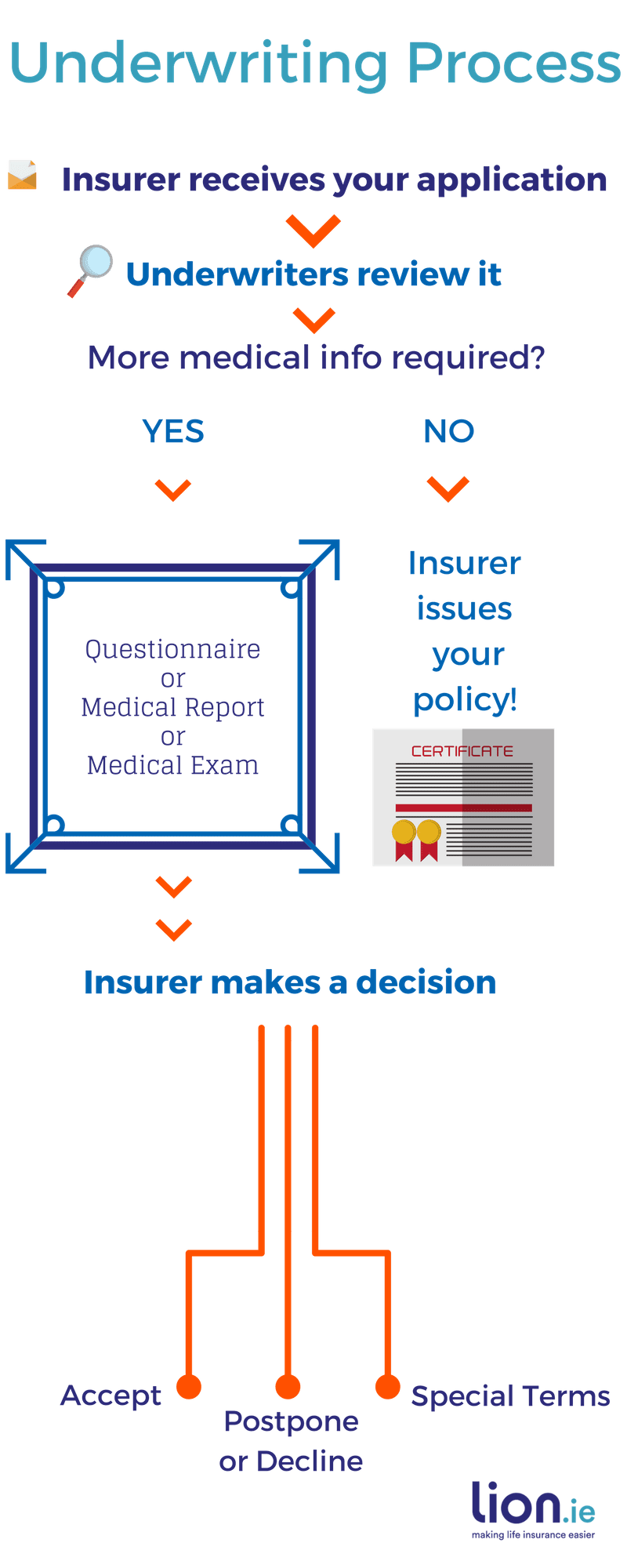

Source: lion.ie

Source: lion.ie

What is life insurance underwriting process? If you’re new to life insurance, it can seem a bit overwhelming at first. In essence, life insurance underwriting is the method through which insurers evaluate the risk a potential buyer poses in order to decide whether or not to approve, deny, or rate up a life insurance policy. Simply put, your risk profile affects two things: Insurers have underwriters who try to know as much about you, your finances, dependents, health, habits, etc.

Source: calgary-broker.blogspot.com

Source: calgary-broker.blogspot.com

The duration of the underwriting process usually depends on the steps undertaken, as some life insurance policies don’t require specific steps. With so many companies and plans available, it can be difficult to figure out the right plan for your needs. The life insurance underwriting process helps outline details about your life, including personal, financial and health information. Underwriting is the process a life insurance company goes through to determine the risk involved in insuring your life. You can even do it online without even speaking to anyone.

Source: insurancewotsutsuke.blogspot.com

Source: insurancewotsutsuke.blogspot.com

This process can take even longer if an underwriter orders an aps, to see if there are any health matters or proverbial red flags that may be an issue of. The insurance underwriting process involves evaluating the risks you present when applying for insurance to establish the corresponding premium amount. A fully underwritten life insurance policy can take an average of four to six weeks to receive approval. Life insurance underwriting begins when an agent talks to a potential client about a quote for life insurance. The underwriting process determines whether one can get coverage and at what price it can be approved.

Source: igniter.buzz

Source: igniter.buzz

Medical insurance requires underwriting, but is it necessary for life insurance? The duration of the underwriting process usually depends on the steps undertaken, as some life insurance policies don’t require specific steps. The insurance underwriting process involves evaluating the risks you present when applying for insurance to establish the corresponding premium amount. An underwriter needs to step in and determine how much you’ll need to pay for the coverage […] A fully underwritten life insurance policy can take an average of four to six weeks to receive approval.

Source: insurance-canada.ca

Source: insurance-canada.ca

The process generally takes between two weeks and two months to complete. How does the life insurance underwriting process work exactly? The insurance companies codify a set of procedures which must be followed before accepting any new business. Below, we’ll walk through all the steps to expect during underwriting. The process generally takes between two weeks and two months to complete.

Source: insurance.siswapelajar.com

Source: insurance.siswapelajar.com

An agent will know how to help this potential client long before the client submits a signed application to the insurance company. Your life insurance company will collect this information to determine if your application should be approved and. Below, we’ll walk through all the steps to expect during underwriting. When a new proposal comes to the insurance company its underwriting department scrutinizes the proposal whether. Insurers take a risk when they sell a life insurance policy.

Source: abiteofculture.com

Source: abiteofculture.com

Life insurance underwriting is part of your life insurance application process. Simply put, your risk profile affects two things: Underwriting is the process insurance companies go through when evaluating the risk of insuring someone�s life. Applying for a life insurance policy is easy, especially when applied for online, it may take only a few minutes. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: locallifeagents.com

Source: locallifeagents.com

The underwriting process in life insurance helps the insurance company in risk selection while issuing a policy to the prospective assured. Underwriting is the process insurance companies go through when evaluating the risk of insuring someone�s life. The underwriting process is a crucial step in the life insurance application that involves a series of steps. What is life insurance underwriting process? Underwriting is the process the insurance carrier goes through to approve your policy.

Source: motorinsurancewandogi.blogspot.com

Source: motorinsurancewandogi.blogspot.com

Purchasing insurance in south africa today has never been easier. Let’s take a second to explain this with something everyone has likely had to deal with before: After that, you’ll know if you’ve been approved or. The duration of the underwriting process usually depends on the steps undertaken, as some life insurance policies don’t require specific steps. This process allows the insurer to price life insurance premiums correctly or outright deny your coverage altogether.

Source: insurancewotsutsuke.blogspot.com

Source: insurancewotsutsuke.blogspot.com

Insurers have underwriters who try to know as much about you, your finances, dependents, health, habits, etc. Purchasing insurance in south africa today has never been easier. A fully underwritten life insurance policy can take an average of four to six weeks to receive approval. This process involves finding out important details about you, and this is done by an insurance underwriter. Life insurance companies rely on insurance underwriters to determine the risk they face in selling you a policy.

Source: bbc-morning-news-update21.blogspot.com

Source: bbc-morning-news-update21.blogspot.com

Applying and being approved for car insurance. What is life insurance underwriting. Life insurance underwriting is the process of evaluating your application for a life insurance policy. The duration of the underwriting process usually depends on the steps undertaken, as some life insurance policies don’t require specific steps. What is life insurance underwriting?

Source: insurancewotsutsuke.blogspot.com

Source: insurancewotsutsuke.blogspot.com

An underwriter needs to step in and determine how much you’ll need to pay for the coverage […] With so many companies and plans available, it can be difficult to figure out the right plan for your needs. Underwriting in life insurance is the process of a company analyzing and determining the risk an applicant poses in order to determine acceptability and pricing for a policy. Life insurers use underwriters to examine all the information collected about you and determine the level of risk it will take to sell a life insurance policy to you. Once you have given your basic details and provided necessary information, your insurance application is then sent for the underwriting process.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title life insurance underwriting process by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.