Life insurance vs pension plan information

Home » Trend » Life insurance vs pension plan informationYour Life insurance vs pension plan images are ready in this website. Life insurance vs pension plan are a topic that is being searched for and liked by netizens now. You can Find and Download the Life insurance vs pension plan files here. Get all free photos.

If you’re looking for life insurance vs pension plan pictures information related to the life insurance vs pension plan topic, you have come to the ideal site. Our website always gives you suggestions for seeking the highest quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

Life Insurance Vs Pension Plan. However, it is important to remember that the insurance payout sum of this form of pension plan might be lower than with a standalone insurance plan. An example of a pension plan is the national pension scheme (nps). Another noteworthy contrast is that all contributions to provident funds are mandatory. Under without cover pension plan, no life cover is offered to the insured person.

Survivor Annuity Plan vs. Life Insurance Showdown Fed From fedretirementplanning.com

Survivor Annuity Plan vs. Life Insurance Showdown Fed From fedretirementplanning.com

Pensions grew in popularity during world war ii and became mainstays in benefit. It is written in generic terms The amount usually depends on the age of the employer and the tenure of their employment. While this is how it works across endowment pension schemes in general, the details vary across insurers. A life insurance plan offers both death benefit and maturity benefit to the life assured. Similarly, there are pension plans which create an earmarked retirement fund and promise lifelong incomes.

If you pay into a pension at work, your employer will add contributions too.

While this is how it works across endowment pension schemes in general, the details vary across insurers. Pensions can be set up to where you pay into them or the company pays into them. The life insurance and pension provider will both take these into consideration to offer a plan they feel best suits you. It’s worth shopping around for quotes to ensure you get the best deal. A pension plan is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. Investment in a pension plan from an insurance company is eligible for deduction up to a maximum of rs 1.5 lacs per financial year under section 80 ccc of the income tax act.

Source: pinterest.co.uk

Source: pinterest.co.uk

Pensions grew in popularity during world war ii and became mainstays in benefit. Another noteworthy contrast is that all contributions to provident funds are mandatory. It is written in generic terms As there is no maturity benefit offered by the policy the premium rate of the term plan is lower. Life insurance comes in many variants which constitute the different types of life insurance plans.

Source: youtube.com

Source: youtube.com

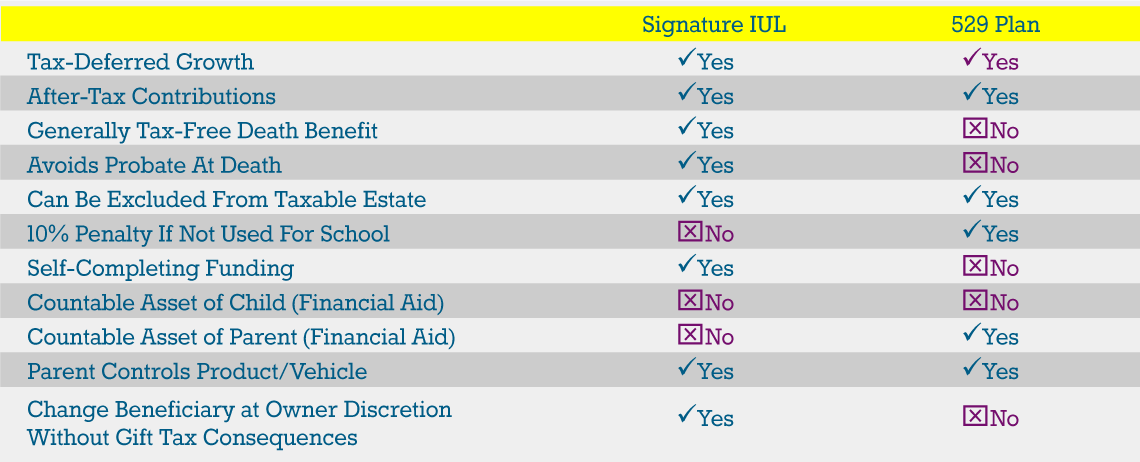

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. A life insurance plan offers both death benefit and maturity benefit to the life assured. If you pay into a pension at work, your employer will add contributions too. Indexed universal life insurance vs 401k, ira and pension plan. Pension plans a pension is provided by the company that you work for.

Source: fbsbenefits.com

Source: fbsbenefits.com

It’s worth shopping around for quotes to ensure you get the best deal. Life insurance and investment are both included in such pension plans. Pensions can be set up to where you pay into them or the company pays into them. The life insurance and pension provider will both take these into consideration to offer a plan they feel best suits you. Click here to buy this plan online.

Source: pinterest.com

Source: pinterest.com

In pension plans, both the employer as well as the employee regularly contribute to the pension fund which in turn, provides pension to all employers. What is the benefit of buying a life insurance policy inside a. The life insurance and pension provider will both take these into consideration to offer a plan they feel best suits you. Many life insurance agents are unaware about a defined benefit plan and its ability to hold a life insurance policy as an investment. A pension plan is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire.

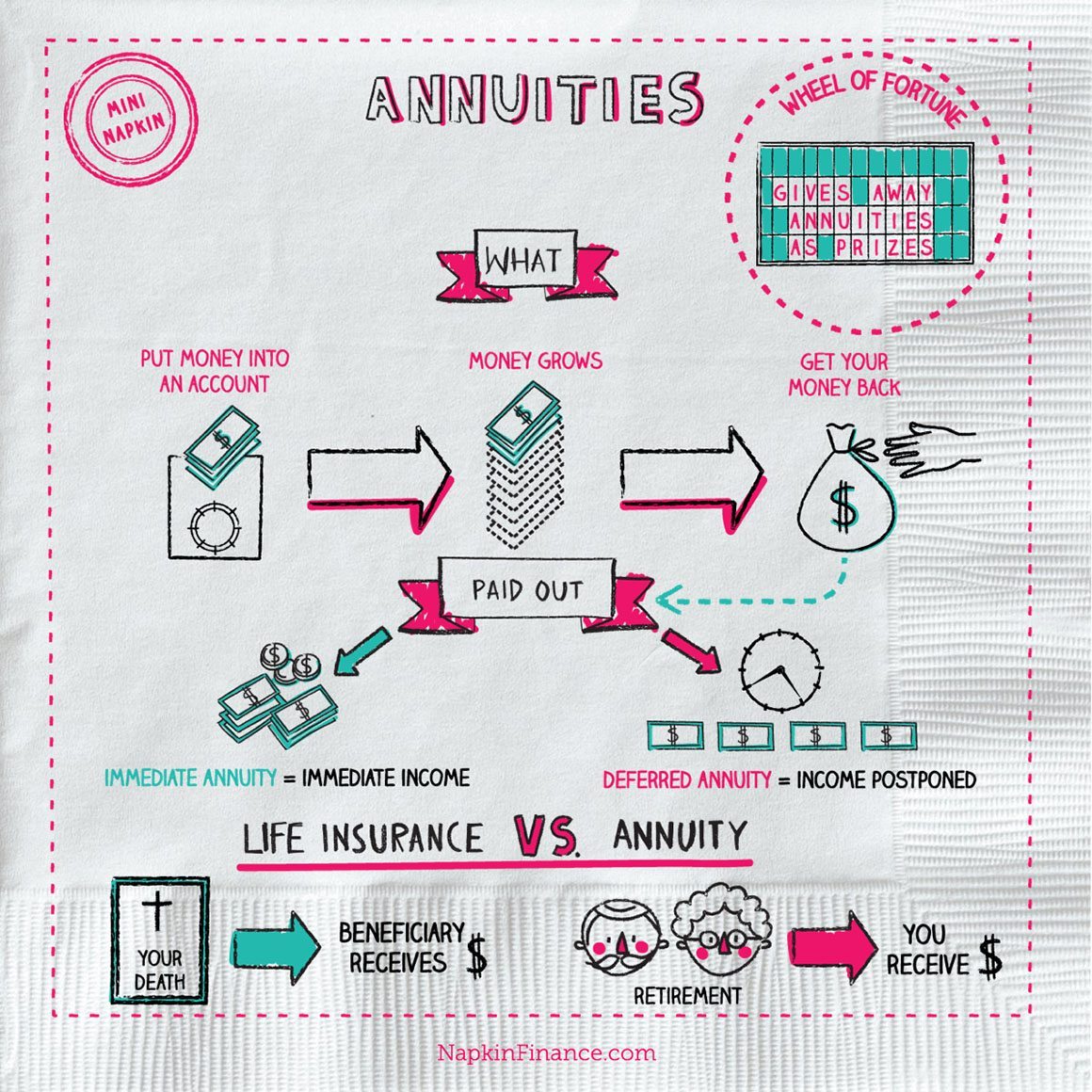

Source: napkinfinance.com

Source: napkinfinance.com

Investments in stock markets are limited. Hdfc life guaranteed pension plan. Life insurance comes in many variants which constitute the different types of life insurance plans. This life insurance policy then creates the “ survivor ” benefit, and potentially more, once he passes. An example of a pension plan is the national pension scheme (nps).

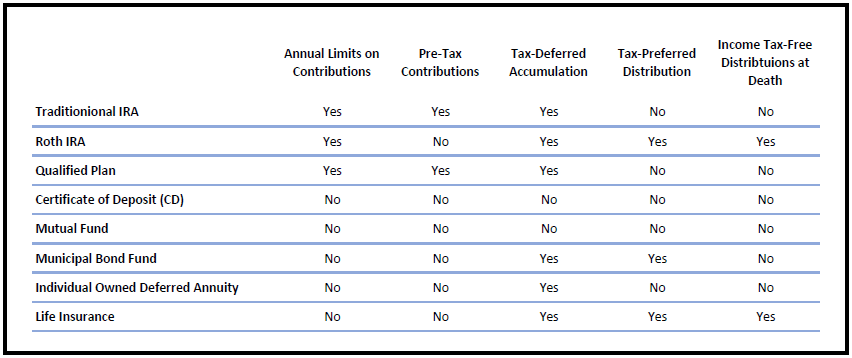

Source: mericleco.com

Source: mericleco.com

Many life insurance agents are unaware about a defined benefit plan and its ability to hold a life insurance policy as an investment. If you are not an employee of a company that offers pensions, you will not be able to obtain one on your own. What is the benefit of buying a life insurance policy inside a. Pension plans a pension is provided by the company that you work for. Similarly, there are pension plans which create an earmarked retirement fund and promise lifelong incomes.

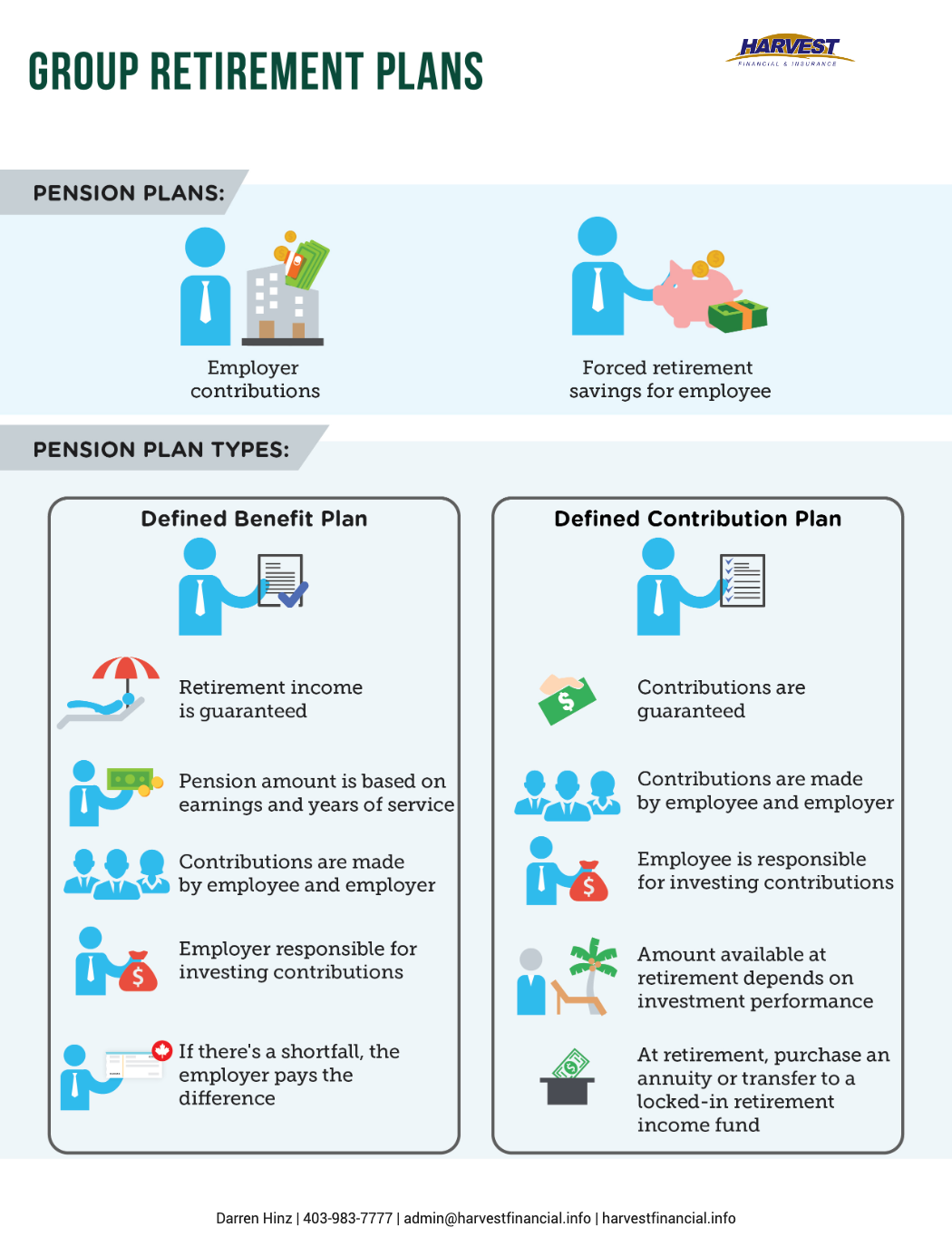

Source: harvest-financial.ca

Source: harvest-financial.ca

Life insurance and investment are both included in such pension plans. Under without cover pension plan, no life cover is offered to the insured person. Many life insurance agents are unaware about a defined benefit plan and its ability to hold a life insurance policy as an investment. In pension plans, both the employer as well as the employee regularly contribute to the pension fund which in turn, provides pension to all employers. If you pay into a pension at work, your employer will add contributions too.

Source: youtube.com

Source: youtube.com

A life insurance retirement plan is a permanent life insurance policy that uses the cash value component to help fund retirement. The objective is to offer stable returns, as opposed to high returns marked by volatility. In the regular insurance scene policyholders, get back the full corpus as it stands on maturity. The amount usually depends on the age of the employer and the tenure of their employment. Currently, deferred pension schemes come with the option of life cover, whereas immediate annuity plans do not offer the option of life cover.

Source: youtube.com

Source: youtube.com

In pension plans, both the employer as well as the employee regularly contribute to the pension fund which in turn, provides pension to all employers. Indexed universal life insurance vs 401k, ira and pension plan. Pension plans a pension is provided by the company that you work for. A pension fund�s benefits are more akin to that of an annuity, while a provident fund�s benefits offer far greater investment freedom. This life insurance policy then creates the “ survivor ” benefit, and potentially more, once he passes.

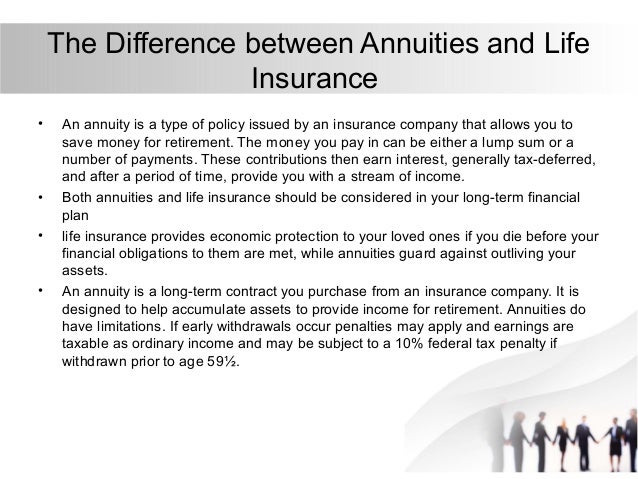

Source: slideshare.net

Source: slideshare.net

In pension plans, both the employer as well as the employee regularly contribute to the pension fund which in turn, provides pension to all employers. The objective is to offer stable returns, as opposed to high returns marked by volatility. Indexed universal life insurance vs 401k, ira and pension plan. A brief discussion on the similarities and differences in delivering a pension benefit through insurance or a pension fund (or other occupational vehicle) further to earlier discussion in iaa committees, this paper considers in high level terms similarities and differences between life insurance and pensions. An example of a pension plan is the national pension scheme (nps).

Source: fedretirementplanning.com

Source: fedretirementplanning.com

In the event of unfortunate death of the insured person, the nominee will get the corpus (till the date of the death). Life insurance and investment are both included in such pension plans. A pension fund�s benefits are more akin to that of an annuity, while a provident fund�s benefits offer far greater investment freedom. Another noteworthy contrast is that all contributions to provident funds are mandatory. Government employees are eligible for nps.

Source: youtube.com

Source: youtube.com

This however does not happen with pension plans where you can withdraw up to only one third of the maturity amounts. An example of a pension plan is the national pension scheme (nps). The objective is to offer stable returns, as opposed to high returns marked by volatility. Currently, deferred pension schemes come with the option of life cover, whereas immediate annuity plans do not offer the option of life cover. How does the pension plan vary from regular life insurance?

Source: dallastribunenews.blogspot.com

Source: dallastribunenews.blogspot.com

Investments in stock markets are limited. How does the pension plan vary from regular life insurance? Similarly, there are pension plans which create an earmarked retirement fund and promise lifelong incomes. Government employees are eligible for nps. Nps vs pension plans from insurance companies:

Source: pinterest.com

Source: pinterest.com

Investments in stock markets are limited. A pension plan is a type of retirement plan where employers promise to pay a defined benefit to employees for life after they retire. Life insurance comes in many variants which constitute the different types of life insurance plans. Nps vs pension plans from insurance companies: The objective is to offer stable returns, as opposed to high returns marked by volatility.

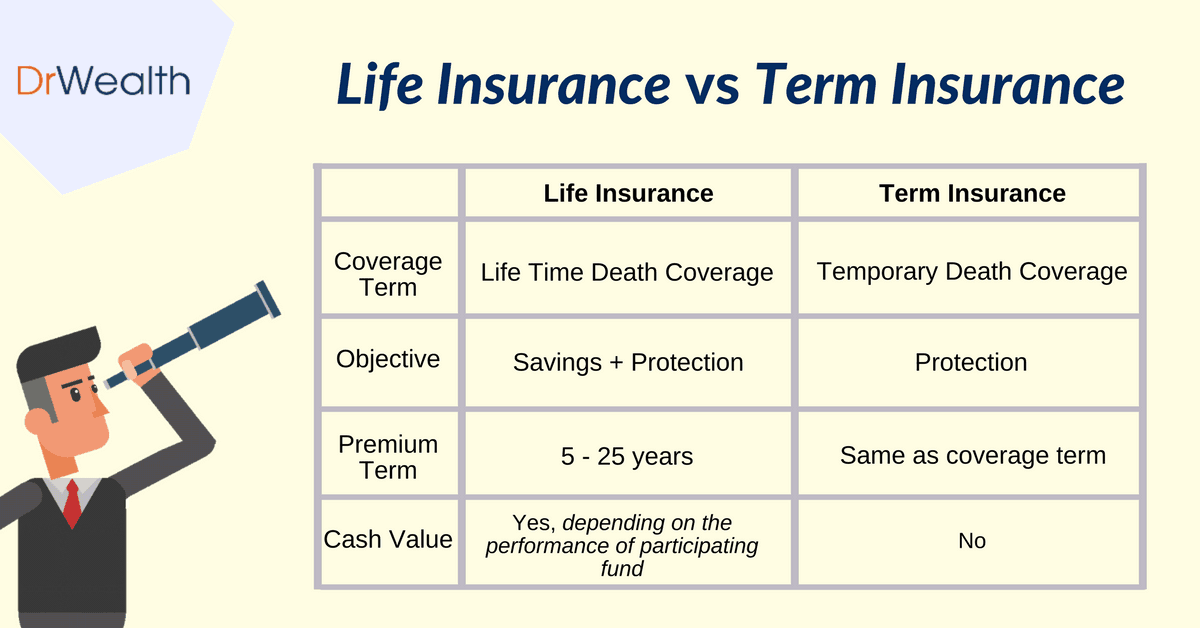

Source: drwealth.com

Source: drwealth.com

While this is how it works across endowment pension schemes in general, the details vary across insurers. The amount usually depends on the age of the employer and the tenure of their employment. Pensions grew in popularity during world war ii and became mainstays in benefit. Lirps mimic the tax benefits of a roth ira, meaning you don’t pay taxes on any withdrawals after. Many life insurance agents are unaware about a defined benefit plan and its ability to hold a life insurance policy as an investment.

Source: dallastribunenews.blogspot.com

Source: dallastribunenews.blogspot.com

In summation, a pension plan is where a retiree chooses the maximum benefit from his pension, where a portion of it is earmarked for a life insurance policy. This however does not happen with pension plans where you can withdraw up to only one third of the maturity amounts. However, it is important to remember that the insurance payout sum of this form of pension plan might be lower than with a standalone insurance plan. While this is how it works across endowment pension schemes in general, the details vary across insurers. Indexed universal life insurance vs 401k, ira and pension plan.

Source: annuity.org

Source: annuity.org

Another noteworthy contrast is that all contributions to provident funds are mandatory. The amount usually depends on the age of the employer and the tenure of their employment. Thus, life insurance plans find a place in every aspect of your life and give you financial security. The life insurance and pension provider will both take these into consideration to offer a plan they feel best suits you. Nps vs pension plans from insurance companies:

Source: trustedchoice.com

Source: trustedchoice.com

If you are not an employee of a company that offers pensions, you will not be able to obtain one on your own. The life insurance and pension provider will both take these into consideration to offer a plan they feel best suits you. In the event of unfortunate death of the insured person, the nominee will get the corpus (till the date of the death). Pensions grew in popularity during world war ii and became mainstays in benefit. Under without cover pension plan, no life cover is offered to the insured person.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance vs pension plan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.