Life insurance vs roth ira Idea

Home » Trend » Life insurance vs roth ira IdeaYour Life insurance vs roth ira images are available in this site. Life insurance vs roth ira are a topic that is being searched for and liked by netizens now. You can Download the Life insurance vs roth ira files here. Find and Download all royalty-free photos.

If you’re searching for life insurance vs roth ira pictures information linked to the life insurance vs roth ira interest, you have come to the ideal site. Our site always provides you with suggestions for viewing the highest quality video and image content, please kindly search and find more informative video articles and graphics that match your interests.

Life Insurance Vs Roth Ira. Life auto home health business renter disability commercial auto long term care annuity. Jul 30, 2015 — for instance, can only be made with income that qualifies as “compensation,” which is typically earned income. The same goes for the cash value in. The difference is that the roth ira is primarily an investment vehicle, while cash value life insurance is an insurance product.

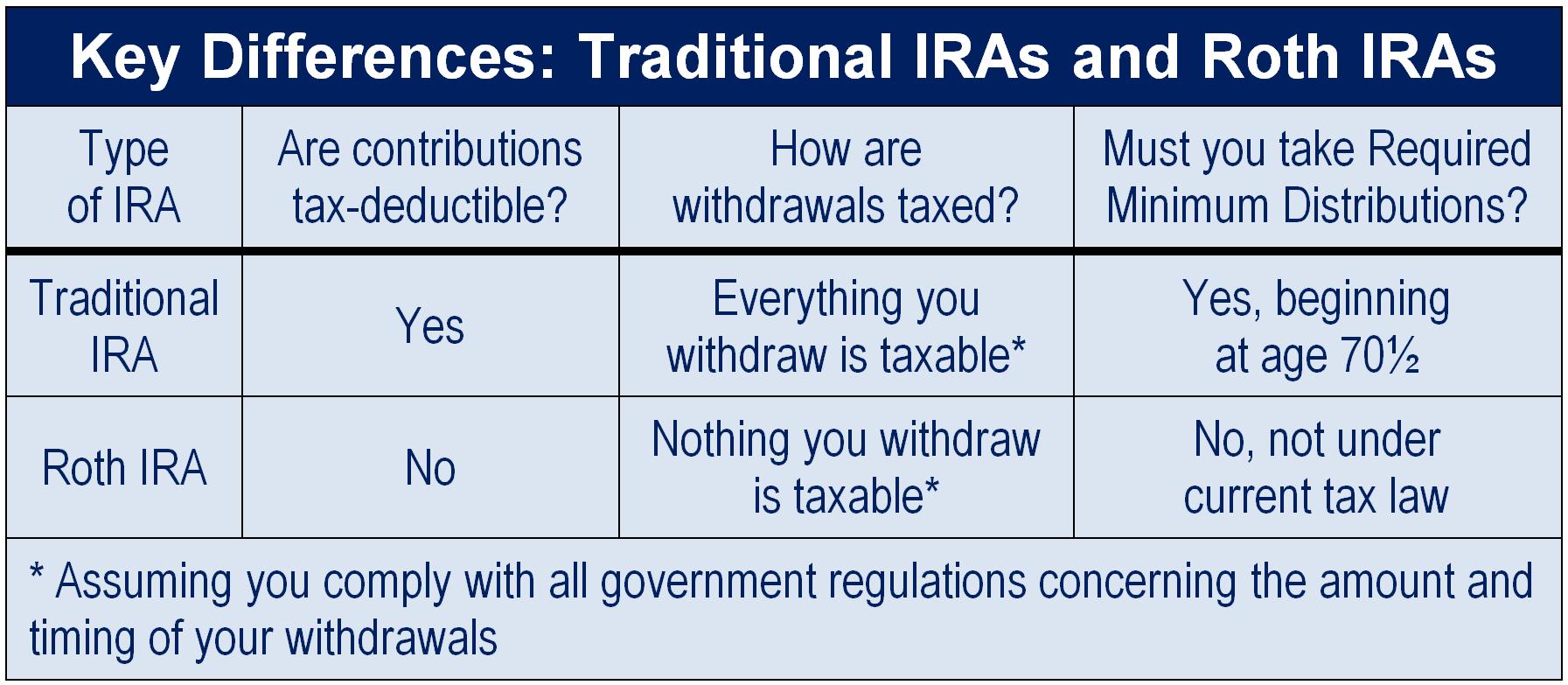

Life Insurance vs. Roth IRAs C&J Wealth AdvisorsC&J From cjwealth.com

Life Insurance vs. Roth IRAs C&J Wealth AdvisorsC&J From cjwealth.com

Withdrawals the roth ira limits when you can take out some of your money. You can only take your gains out tax free from the roth ira if you are 59 1/2 or older. The same goes for the cash value in. In contrast, life insurance premiums can be paid with any type of income, (1). Life insurance vs roth ira 👪 jan 2022. They can dip into their savings at any time after.

Let’s say someone chooses to have a roth ira and a cash value life insurance policy as part of their retirement savings picture.

Withdrawals the roth ira limits when you can take out some of your money. Depending on the state, some or all of your roth ira may be protected from creditors. Withdrawals the roth ira limits when you can take out some of your money. In contrast, life insurance premiums can be paid with any type of income, (1). Compare this to someone who buys a much cheaper term life insurance policy, which has no savings feature, and invests the difference in an ira. You can only take your gains out tax free from the roth ira if you are 59 1/2 or older.

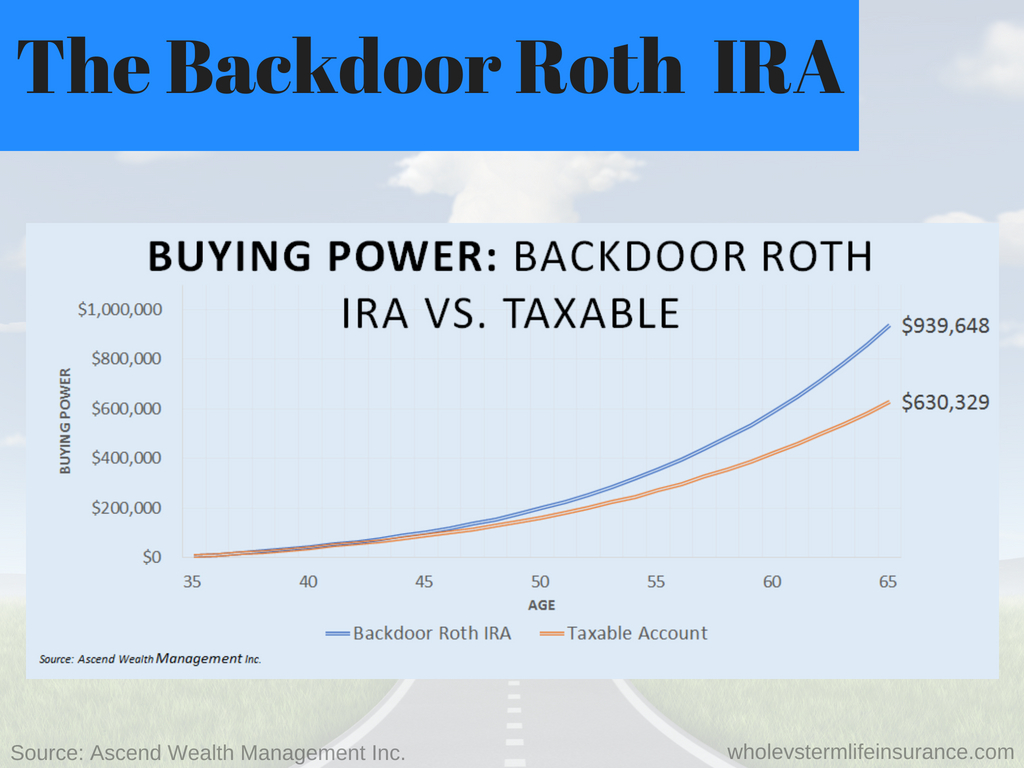

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

You can only take your gains out tax free from the roth ira if you are 59 1/2 or older. Compare this to someone who buys a much cheaper term life insurance policy, which has no savings feature, and invests the difference in an ira. Roth iras do not require payments. The key differences between them make each. For whole life insurance policies, those contributions come in the form of premium payments.

Source: pinterest.com

Source: pinterest.com

Sometimes life insurance is better for clients than a roth conversion. The same goes for the cash value in. Life insurance policies and roth ira’s may both be important financial planning tools that should be in your financial portfolio, but they are two very different types of financial vehicles that serve entirely different purposes. For whole life insurance policies, those contributions come in the form of premium payments. Jul 30, 2015 — for instance, can only be made with income that qualifies as “compensation,” which is typically earned income.

Source: pinterest.com

Source: pinterest.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Life insurance policies and roth ira’s may both be important financial planning tools that should be in your financial portfolio, but they are two very different types of financial vehicles that serve entirely different purposes. Roth ira contributions, for instance, can only be made with income that qualifies as “compensation,” which is typically earned income. Life auto home health business renter disability commercial auto long term care annuity. Roth iras and life insurance — some important differences roth iras come with more limits for contributions than life insurance does for premium payments.

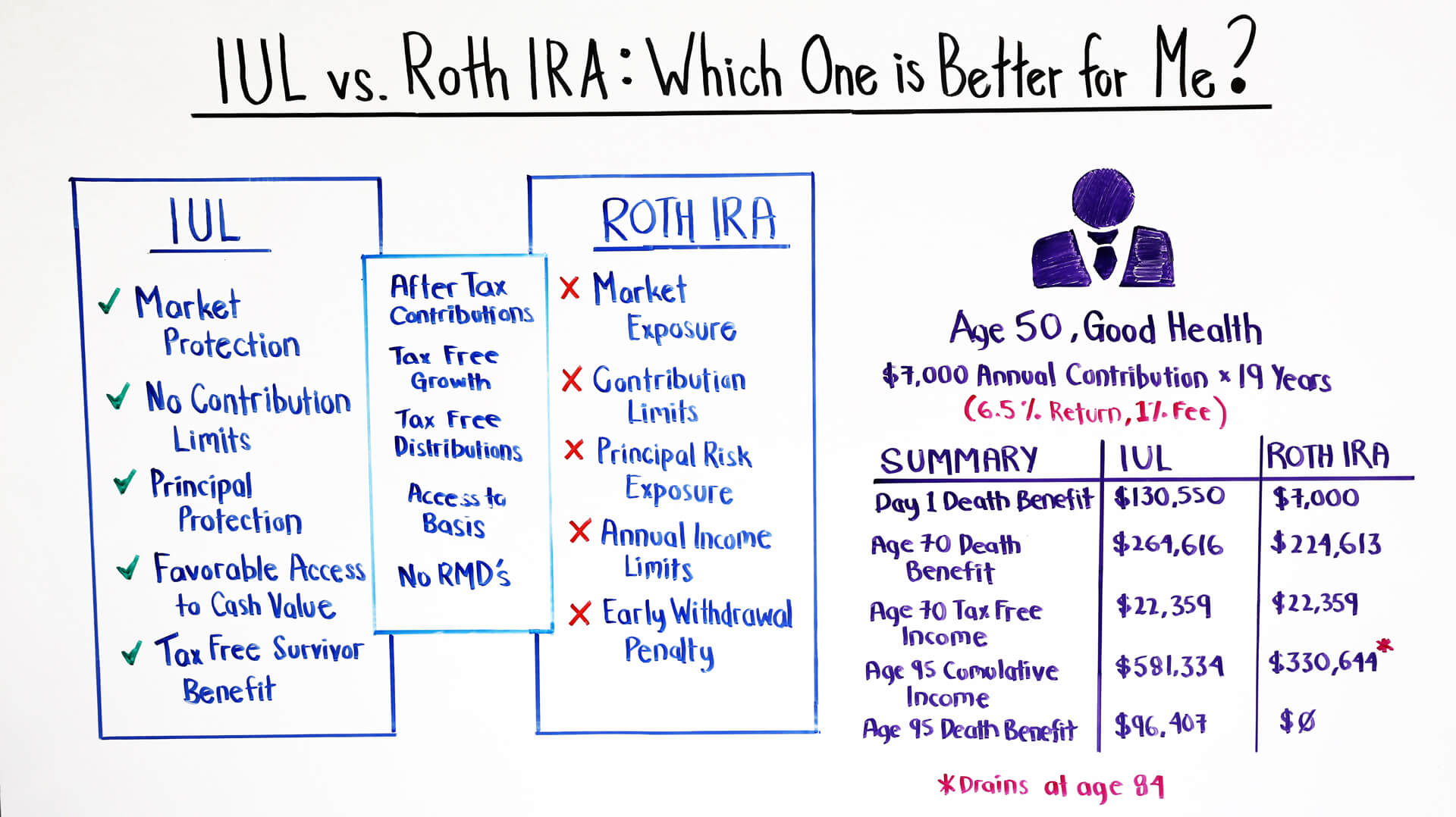

Source: lifepro.com

Source: lifepro.com

Life insurance policies and roth ira’s may both be important financial planning tools that should be in your financial portfolio, but they are two very different types of financial vehicles that serve entirely different purposes. In contrast, life insurance premiums can be paid with any type of income, including interest, dividends and social security, all of which are not considered compensation. The key differences between them make each. Roth iras and whole life insurance may be treated very differently when it comes to asset protection and estate planning issues. No, a roth ira is not the same as life insurance.

Roth iras and life insurance — some important differences roth iras come with more limits for contributions than life insurance does for premium payments. In contrast, life insurance premiums can be paid with any type of income, including interest, dividends and social security, all of which are not considered compensation. You can only take your gains out tax free from the roth ira if you are 59 1/2 or older. The difference is that the roth ira is primarily an investment vehicle, while cash value life insurance is an insurance product. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: napkinfinance.com

Source: napkinfinance.com

You can only take your gains out tax free from the roth ira if you are 59 1/2 or older. Roth iras and whole life insurance may be treated very differently when it comes to asset protection and estate planning issues. In contrast, life insurance premiums can be paid with any type of income, including interest, dividends and social security, all of which are not considered compensation. The roth ira is more restrictive than variable life insurance when it comes to withdrawals. No, a roth ira is not the same as life insurance.

Source: barberfinancialgroup.com

Source: barberfinancialgroup.com

Compare this to someone who buys a much cheaper term life insurance policy, which has no savings feature, and invests the difference in an ira. Roth iras and whole life insurance may be treated very differently when it comes to asset protection and estate planning issues. Roth iras do not require payments. Roth ira contributions, for instance, can only be made with income that qualifies as “compensation,” which is typically earned income. The roth ira is more restrictive than variable life insurance when it comes to withdrawals.

Source: melsretirementblog.com

Source: melsretirementblog.com

For whole life insurance policies, those contributions come in the form of premium payments. If you are on a mission to start planning for your family’s financial future, it is very. Life insurance vs roth ira. In contrast, life insurance premiums can be paid with any type of income, (1). Roth iras and life insurance — some important differences roth iras come with more limits for contributions than life insurance does for premium payments.

Source: paytaxeslater.com

Source: paytaxeslater.com

If you are on a mission to start planning for your family’s financial future, it is very. Let’s say someone chooses to have a roth ira and a cash value life insurance policy as part of their retirement savings picture. You can only take your gains out tax free from the roth ira if you are 59 1/2 or older. Jul 30, 2015 — for instance, can only be made with income that qualifies as “compensation,” which is typically earned income. If you are on a mission to start planning for your family’s financial future, it is very.

Source: pinterest.com

Source: pinterest.com

No, a roth ira is not the same as life insurance. Jul 30, 2015 — for instance, can only be made with income that qualifies as “compensation,” which is typically earned income. Depending on the state, some or all of your roth ira may be protected from creditors. You can only take your gains out tax free from the roth ira if you are 59 1/2 or older. Roth ira contributions, for instance, can only be made with income that qualifies as “compensation,” which is typically earned income.

Source: youtube.com

Source: youtube.com

Life insurance vs roth ira 👪 jan 2022. Life auto home health business renter disability commercial auto long term care annuity. Depending on the state, some or all of your roth ira may be protected from creditors. While they share tax benefits, (17). Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: pinterest.com

Source: pinterest.com

No, a roth ira is not the same as life insurance. You can only take your gains out tax free from the roth ira if you are 59 1/2 or older. Depending on the state, some or all of your roth ira may be protected from creditors. Roth iras give you many investment options and generally pay a higher rate of interest than an lirp based on a whole life insurance policy. Compare this to someone who buys a much cheaper term life insurance policy, which has no savings feature, and invests the difference in an ira.

Source: pinterest.com

Source: pinterest.com

Life insurance vs roth ira 👪 jan 2022. Sometimes life insurance is better for clients than a roth conversion. Roth iras and whole life insurance may be treated very differently when it comes to asset protection and estate planning issues. For whole life insurance policies, those contributions come in the form of premium payments. You can only take your gains out tax free from the roth ira if you are 59 1/2 or older.

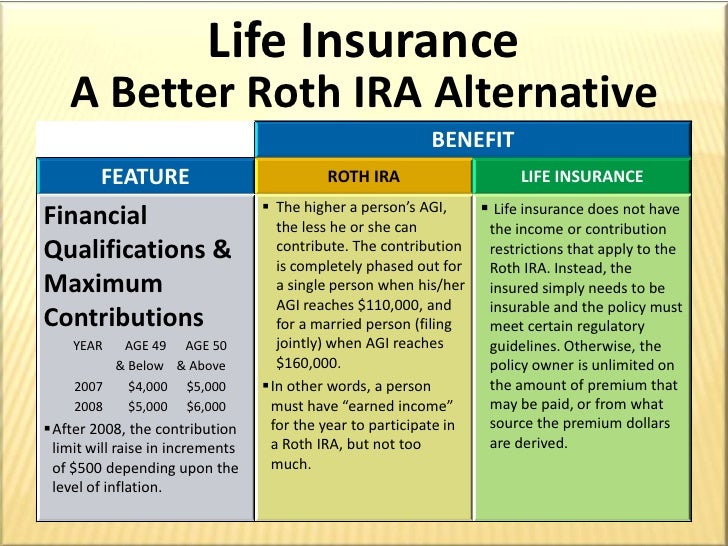

Source: authorstream.com

Source: authorstream.com

Life insurance vs roth ira 👪 jan 2022. You may earn a higher rate of interest by using variable life or some forms of universal life for an lirp. Roth iras do not require payments. In contrast, life insurance premiums can be paid with any type of income, (1). You can only take your gains out tax free from the roth ira if you are 59 1/2 or older.

Source: cjwealth.com

Source: cjwealth.com

In contrast, life insurance premiums can be paid with any type of income, (1). Jul 30, 2015 — for instance, can only be made with income that qualifies as “compensation,” which is typically earned income. The same goes for the cash value in. Life insurance vs roth ira. Roth iras give you many investment options and generally pay a higher rate of interest than an lirp based on a whole life insurance policy.

Source: slideshare.net

Source: slideshare.net

Roth iras and life insurance — some important differences roth iras come with more limits for contributions than life insurance does for premium payments. Roth iras and whole life insurance may be treated very differently when it comes to asset protection and estate planning issues. The key differences between them make each. In contrast, life insurance premiums can be paid with any type of income, including interest, dividends and social security, all of which are not considered compensation. Life insurance vs roth ira.

Source: bankonyourself.com

Source: bankonyourself.com

Life insurance policies and roth ira’s may both be important financial planning tools that should be in your financial portfolio, but they are two very different types of financial vehicles that serve entirely different purposes. The key differences between them make each. Depending on the state, some or all of your roth ira may be protected from creditors. They can dip into their savings at any time after. Roth iras and life insurance — some important differences roth iras come with more limits for contributions than life insurance does for premium payments.

Source: wealthmanagement.com

Source: wealthmanagement.com

Withdrawals the roth ira limits when you can take out some of your money. In contrast, life insurance premiums can be paid with any type of income, including interest, dividends and social security, all of which are not considered compensation. Life auto home health business renter disability commercial auto long term care annuity. You can only take your gains out tax free from the roth ira if you are 59 1/2 or older. The roth ira is more restrictive than variable life insurance when it comes to withdrawals.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title life insurance vs roth ira by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.