Limited payment life insurance Idea

Home » Trend » Limited payment life insurance IdeaYour Limited payment life insurance images are available in this site. Limited payment life insurance are a topic that is being searched for and liked by netizens now. You can Download the Limited payment life insurance files here. Find and Download all royalty-free photos and vectors.

If you’re looking for limited payment life insurance images information connected with to the limited payment life insurance interest, you have visit the right blog. Our site always provides you with suggestions for refferencing the maximum quality video and image content, please kindly search and locate more enlightening video articles and images that match your interests.

Limited Payment Life Insurance. Life insurance can be the foundation for a family�s financial protection. The most common options are 10 years, 15 years and 20 years. Limited pay life insurance is a type of whole life insurance policy that is structured to only owe premiums for a set number of years. A limited pay insurance policy is a type of permanent life insurance product, sometimes called whole life, in which the policyholder pays premiums over a set period of time or until a specific age.

What is Limited Pay Life Insurance 2021 > Etechbag From etechbag.com

What is Limited Pay Life Insurance 2021 > Etechbag From etechbag.com

Rather than paying premiums for as long as you live, you make payments over a predetermined period—most often, 10, 15, or 20 years or to age 65. Limited pay life insurance is a form of life insurance whose benefits last a lifetime, but whose payments last a shorter period of time. By limiting the payment load to a shorter length, term insurance with limited pay allows you to obtain a longer life coverage. The exact definition of limited pay life insurance is a bit debatable. Save money by comparing insurance quotes Limited pay life insurance is a type of whole life insurance that allows you to prepay for the entire cost of your coverage for a set number of years.

Limited premium payment plans are term life insurance plans which allow you to pay premiums for a limited tenure while your coverage continues for a longer period.

When we think of limited pay life insurance, we normally think of whole life. Life auto home health business renter disability commercial auto long term care annuity. However, unlike term life insurance, your death benefit remains in place until you pass on. Limited pay policies are (usually whole) life insurance policies that schedule premium payments over a finite period. When we think of limited pay life insurance, we normally think of whole life. A policy holder pays a premium for a predetermined number of years and holds the policy for the rest of life.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

What is limited pay life insurance? Rather than paying premiums for as long as you live, you make payments over a predetermined period—most often, 10, 15, or 20 years or to age 65. You can choose the payment period as long as you are in. However, the insurance holder gets full coverage for the entire policy term, irrespective of the premium payment term. At that point, you are no longer required to make premium payments.

Source: in.pinterest.com

Source: in.pinterest.com

The most common options are 10 years, 15 years and 20 years. With the limited pay life insurance option, you pay premiums in the first 10, 15, or 20 years of ownership, but the benefits last a lifetime. Rather than paying premiums for as long as you live, you make payments over a predetermined period—most often, 10, 15, or 20 years or to age 65. When we think of limited pay life insurance, we normally think of whole life. Limited payment life insurance has a few advantages compared to standard whole life.

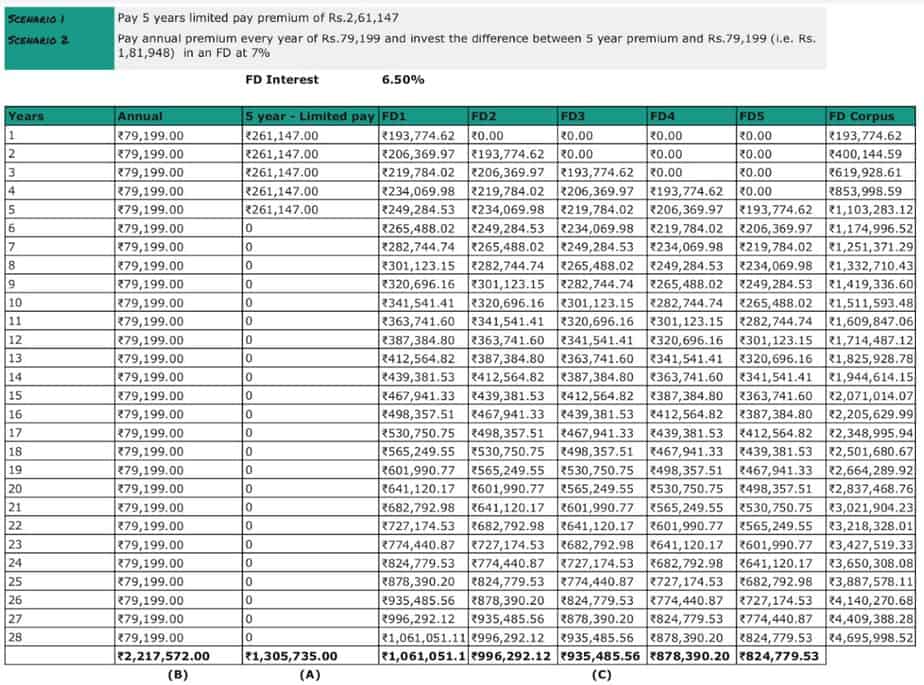

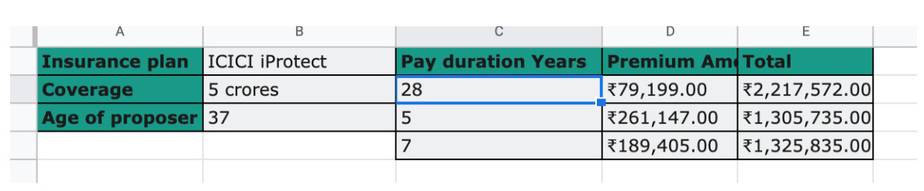

Source: freefincal.com

Source: freefincal.com

However, the insurance holder gets full coverage for the entire policy term, irrespective of the premium payment term. Limited pay life insurance is for an individual who owns a whole life insurance policy but chooses to pay for the total cost of their premiums for a limited number of years. You can choose the payment period as long as you are in. Limited pay life insurance is a type of whole life insurance that has a shorter guaranteed payment period than a traditional whole life policy. Limited pay whole life insurance is a type of permanent life insurance policy that is designed to pay all premiums on a predetermined schedule rather than annual payments for life.

Source: freefincal.com

Source: freefincal.com

What is the advantage of limited payment life insurance? However, the insurance holder gets full coverage for the entire policy term, irrespective of the premium payment term. Limited pay life insurance is a life insurance contract between you (the owner/insured) and the carrier (the insurer), for the benefit of the beneficiary, that requires you to pay into the policy for a set period of time. There are several types of limited pay life insurance policies all with differing guaranteed premium payment periods. Limited pay life insurance is for an individual who owns a whole life insurance policy but chooses to pay for the total cost of their premiums for a limited number of years.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

You may select limited pay life insurance if you have a whole life policy but want to pay for the full cost of your premiums for a certain period instead of over a lifetime. At that point, you are no longer required to make premium payments. As you can imagine, the more extended period you choose, the lower your monthly payment. Limited pay life insurance 👪 jan 2022. Life insurance can be the foundation for a family�s financial protection.

Source: freefincal.com

Source: freefincal.com

Limited pay whole life insurance is a type of permanent life insurance policy that is designed to pay all premiums on a predetermined schedule rather than annual payments for life. The most common options are 10 years, 15 years and 20 years. Rather than paying premiums forever, you choose a set amount of coverage and pay it off within a specific period. With the limited pay life insurance option, you pay premiums in the first 10, 15, or 20 years of ownership, but the benefits last a lifetime. Limited pay life insurance is a type of whole life insurance that has a shorter guaranteed payment period than a traditional whole life policy.

Source: youtube.com

Source: youtube.com

Limited pay life insurance 👪 jan 2022. What is limited pay life insurance? When the premium period ends, the policy is paid up. A limited pay insurance policy is a type of permanent life insurance product, sometimes called whole life, in which the policyholder pays premiums over a set period of time or until a specific age. What is the advantage of limited payment life insurance?

Source: seedly.sg

A limited pay insurance policy is a type of permanent life insurance product, sometimes called whole life, in which the policyholder pays premiums over a set period of time or until a specific age. What is limited pay life insurance? By limiting the payment load to a shorter length, term insurance with limited pay allows you to obtain a longer life coverage. For example, a twenty payment limited life insurance policy would literally be paid. The exact definition of limited pay life insurance is a bit debatable.

Source: structuredwealthstrategies.com

Source: structuredwealthstrategies.com

However, the insurance holder gets full coverage for the entire policy term, irrespective of the premium payment term. What is limited pay life insurance? Here are a few of the plan�s advantages. However, unlike term life insurance, your death benefit remains in place until you pass on. Therefore we share with you our definition of it:

Source: epayon.app

Source: epayon.app

As you can imagine, the more extended period you choose, the lower your monthly payment. What is limited pay life insurance? The most common options are 10 years, 15 years and 20 years. Limited pay life insurance 👪 jan 2022. Therefore we share with you our definition of it:

Source: lifeinvestmentinsurance.com

Source: lifeinvestmentinsurance.com

With the limited pay life insurance option, you pay premiums in the first 10, 15, or 20 years of ownership, but the benefits last a lifetime. As you can imagine, the more extended period you choose, the lower your monthly payment. Save money by comparing insurance quotes Limited pay life insurance is for an individual who owns a whole life insurance policy but chooses to pay for the total cost of their premiums for a limited number of years. What is limited pay life insurance ?

![Limited Pay Whole Life Insurance Source: insuranceandestates.com

Like any major purchase, the decision to make smaller payments over a longer period vs. When we think of limited pay life insurance, we normally think of whole life. There are several types of limited pay life insurance policies all with differing guaranteed premium payment periods. What is limited pay life insurance? The exact definition of limited pay life insurance is a bit debatable.

![Limited Pay Whole Life Insurance [Advantages vs Disadvantages] Limited Pay Whole Life Insurance [Advantages vs Disadvantages]](https://insurancebrokersusa.com/wp-content/uploads/2021/01/limited-pay-life-insurance-1536x1024.jpg) Source: insurancebrokersusa.com

Source: insurancebrokersusa.com

At that point, you are no longer required to make premium payments. You may select limited pay life insurance if you have a whole life policy but want to pay for the full cost of your premiums for a certain period instead of over a lifetime. You can choose the payment period as long as you are in. With limited pay whole life, you can receive life insurance coverage that lasts a lifetime without paying for a lifetime. Limited pay life insurance 👪 jan 2022.

Source: etechbag.com

Source: etechbag.com

What is limited pay life insurance? There are several types of limited pay life insurance policies all with differing guaranteed premium payment periods. With the limited pay life insurance option, you pay premiums in the first 10, 15, or 20 years of ownership, but the benefits last a lifetime. With a limited pay whole life insurance policy, you’re required to pay a premium for a predetermined number of years or until you reach a specific age. Limited pay life insurance is a life insurance contract between you (the owner/insured) and the carrier (the insurer), for the benefit of the beneficiary, that requires you to pay into the policy for a set period of time.

Source: wholevstermlifeinsurance.com

Source: wholevstermlifeinsurance.com

Limited pay life insurance is a form of life insurance whose benefits last a lifetime, but whose payments last a shorter period of time. What is limited pay life insurance ? That payment period of time can be one of several choices listed below. State farm life insurance company (not licensed in ma, ny or wi) or state farm life and accident assurance company (licensed in ny and wi) offer whole life policies that not only help your family. For a longer policy term and life coverage, you get a shorter premium payment period.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title limited payment life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.