Line of business in insurance example information

Home » Trend » Line of business in insurance example informationYour Line of business in insurance example images are available. Line of business in insurance example are a topic that is being searched for and liked by netizens now. You can Find and Download the Line of business in insurance example files here. Find and Download all royalty-free photos.

If you’re looking for line of business in insurance example images information linked to the line of business in insurance example topic, you have come to the right blog. Our site frequently gives you hints for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

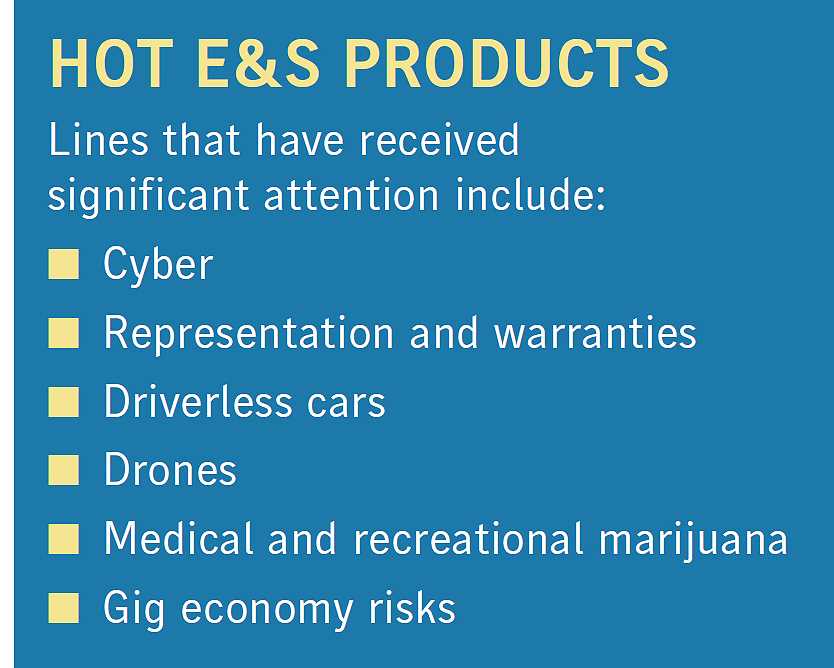

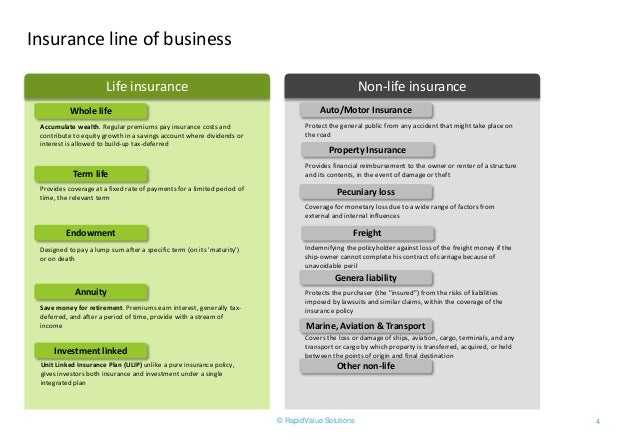

Line Of Business In Insurance Example. For example, the line of businessfeature shows the relationship that the party john smith has to home insurance, For example, the insurance services office (iso) mandates endorsements on policies that provide a certain type of coverage. It may or may not be a strategically relevant business unit. These are called “lines of business”.

Captive Insurance Meaning, How it works (Examples with From iedunote.com

Captive Insurance Meaning, How it works (Examples with From iedunote.com

There are four broad categories, or lines, of insurance: Line of business — a general classification of insurance industry business—for example, fire, life, health, liability. Line of business is a general term which refers to a product or a set of related products that serve a particular customer transaction or business need. In insurance, for example, an lob may be used to designate a statutory set of insurance policies and not a specific business unit. Even if you have purchased your creditor or travel insurance through an rbc royal bank branch or contact centre, please select: It may or may not be a strategically relevant business unit.

The liability coverage would pay for the property damage caused by the contractor�s negligence.

A commercial package policy or cpp is a type of business insurance that packages different lines of coverage together. Personal lines insurance makes it possible to. In some industry sectors, like insurance, line of business also has a regulatory and accounting definition to meet a statutory set of insurance policies. Line of business — a general classification of insurance industry business—for example, fire, life, health, liability. Banking products for firms that have less than 100 employees such as commercial mortgages and. Sample general liability insurance quote.

Source: eastpenninsurance.com

Personal lines insurance covers individuals against loss resulting from death, injury, or loss of property. Other definitions for line of business an lob application refers to one of the sets of critical computer applications that are vital to running an enterprise. For example, the line of businessfeature shows the relationship that the party john smith has to home insurance, Engage the services of marketing executives and sales agent to carry out direct marketing of insurance products. In some industry sectors, like insurance, line of business also has a regulatory and accounting definition to meet a statutory set of insurance policies.

Source: paradisopresents.com

Source: paradisopresents.com

Personal lines insurance makes it possible to. Line of business is a term used in the insurance industry to describe an organization’s primary function. On or prior to the date that is ten (10) business days following the closing date (or such later date as the required lenders shall agree), quantum shall deliver to agent appropriate loss payable endorsements, in form and substance reasonably satisfactory to agent and required lenders, naming agent as an additional insured and/or lender loss payee (as applicable) as its interests. Line of business in insurance. In insurance, for example, an lob may be used to designate a statutory set of insurance policies and not a specific business unit.

Source: excelsiorinsurance.com

Source: excelsiorinsurance.com

In insurance, for example, an lob may be used to designate a statutory set of insurance policies and not a specific business unit. Also, what are the different lines of business? How product liability insurance works. Line of business in insurance. Inland marine (insuring items while in transit across the country);

Source: theliftfactor.com

Source: theliftfactor.com

Even if you have purchased your creditor or travel insurance through an rbc royal bank branch or contact centre, please select: Line of business — a general classification of insurance industry business—for example, fire, life, health, liability. A bank, for example, sells consumer checking accounts, consumer loans, credit cards, commercial loans, commercial lines of. Also, what are the different lines of business? Even if you have purchased your creditor or travel insurance through an rbc royal bank branch or contact centre, please select:

Source: g2g-good2go.com

For example, the insurance services office (iso) mandates endorsements on policies that provide a certain type of coverage. In some industry sectors, like insurance, line of business also has a regulatory and accounting definition to meet a statutory set of insurance policies. Other definitions for line of business an lob application refers to one of the sets of critical computer applications that are vital to running an enterprise. In insurance, for example, an lob may be used to designate a statutory set of insurance policies and not a specific business unit. Sample general liability insurance quote.

Source: researchgate.net

Source: researchgate.net

Banking products for firms that have less than 100 employees such as commercial mortgages and. Engage the services of marketing executives and sales agent to carry out direct marketing of insurance products. Covered liability claims include bodily injury, property damage, personal injury, and advertising injury (damage from slander or false advertising). Line of business is a general term which refers to a product or a set of related products that serve a particular customer transaction or business need. Personal lines insurance makes it possible to.

Source: iedunote.com

Source: iedunote.com

For example, a company that provides life insurance may be referred to as “a lifeline of business”. Many large companies write all. Personal lines insurance covers individuals against loss resulting from death, injury, or loss of property. On or prior to the date that is ten (10) business days following the closing date (or such later date as the required lenders shall agree), quantum shall deliver to agent appropriate loss payable endorsements, in form and substance reasonably satisfactory to agent and required lenders, naming agent as an additional insured and/or lender loss payee (as applicable) as its interests. For example, a contractor installing a new roof at a residence fails to cover the roof overnight and it rains, causing damage to the interior of the home.

![]() Source: businessinsurance.com

Source: businessinsurance.com

Engage the services of marketing executives and sales agent to carry out direct marketing of insurance products. Covered liability claims include bodily injury, property damage, personal injury, and advertising injury (damage from slander or false advertising). General liability covers bodily injury or property damage losses of the third party. The liability coverage would pay for the property damage caused by the contractor�s negligence. Under a product liability insurance policy, the insurer is obligated to pay the legal costs of a business in a covered product liability claim or lawsuit.

Source: pinterest.com.au

Source: pinterest.com.au

There are four broad categories, or lines, of insurance: In some industry sectors, like insurance, line of business also has a regulatory and accounting definition to meet a statutory set of insurance policies. Line of business is a really old phrase (wiktionary says early 19th c and on) that might refer to your product line but might not. Inland marine (insuring items while in transit across the country); Personal lines insurance makes it possible to.

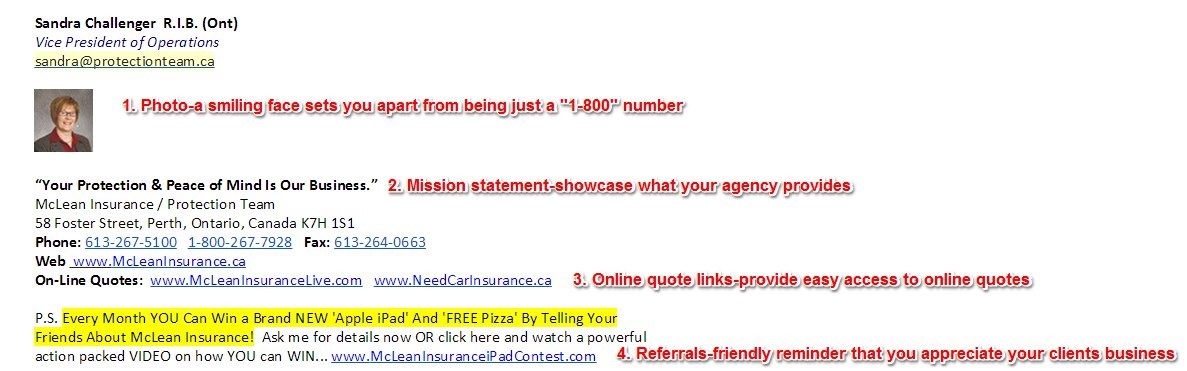

Source: kopywritingkourse.com

Source: kopywritingkourse.com

A business might use this feature to associate a party with the different lines of business that the party uses, such as mortgages, credit cards, insurance and others. Lines of business matrix © 2021 national association of insurance commissioners 1 revised 08/14/2020 alabama p & c exhibit of premiums and losses 1 fire property (sec. Covered liability claims include bodily injury, property damage, personal injury, and advertising injury (damage from slander or false advertising). Leverage on the internet to promote our insurance business / insurance policy covers; Banking products for individuals including credit cards, loans, mortgages and bank accounts.

Source: visual.ly

Source: visual.ly

Lines of business matrix © 2021 national association of insurance commissioners 1 revised 08/14/2020 alabama p & c exhibit of premiums and losses 1 fire property (sec. Other definitions for line of business an lob application refers to one of the sets of critical computer applications that are vital to running an enterprise. Personal lines insurance covers individuals against loss resulting from death, injury, or loss of property. These are called “lines of business”. The liability coverage would pay for the property damage caused by the contractor�s negligence.

Source: businessinsurance.com

Source: businessinsurance.com

Advertisement insuranceopedia explains personal lines insurance examples of personal lines insurance include homeowner�s insurance, health insurance, automobile insurance, renter�s insurance, disability insurance, tornado insurance, umbrella insurance and other types of property and casualty insurance. For example, a cpp may include property insurance (covering property damage due to fires and natural disasters); There are four broad categories, or lines, of insurance: 101 ways to cut business insurance costs. Under a product liability insurance policy, the insurer is obligated to pay the legal costs of a business in a covered product liability claim or lawsuit.

Source: zazzle.com

Source: zazzle.com

For example, a company that provides life insurance may be referred to as “a lifeline of business”. Join local chambers of commerce around us with the main aim of networking and marketing our insurance products. Personal lines insurance covers individuals against loss resulting from death, injury, or loss of property. A commercial package policy or cpp is a type of business insurance that packages different lines of coverage together. Engage the services of marketing executives and sales agent to carry out direct marketing of insurance products.

Source: slideshare.net

Source: slideshare.net

Personal lines insurance covers individuals against loss resulting from death, injury, or loss of property. It may or may not be a strategically relevant business unit. These are called “lines of business”. A business might use this feature to associate a party with the different lines of business that the party uses, such as mortgages, credit cards, insurance and others. Can be used, for example, in the following way:

Source: windinsgroup.com

Source: windinsgroup.com

Line of business is a really old phrase (wiktionary says early 19th c and on) that might refer to your product line but might not. Sample general liability insurance quote. Line of business is a really old phrase (wiktionary says early 19th c and on) that might refer to your product line but might not. Slip and fall claims are one of the most frequent types that general liability covers. Inland marine (insuring items while in transit across the country);

Source: strategymeetsaction.com

Source: strategymeetsaction.com

Join local chambers of commerce around us with the main aim of networking and marketing our insurance products. 101 ways to cut business insurance costs. It may or may not be a strategically relevant business unit. Personal lines insurance covers individuals against loss resulting from death, injury, or loss of property. Think of line of sight.

Source: paulasmithinsurance.com

Source: paulasmithinsurance.com

Line of business in insurance. Business owners insurance also covers business property. Advertisement insuranceopedia explains personal lines insurance examples of personal lines insurance include homeowner�s insurance, health insurance, automobile insurance, renter�s insurance, disability insurance, tornado insurance, umbrella insurance and other types of property and casualty insurance. Many large companies write all. These are called “lines of business”.

Source: sourceoneinsurance.com

Source: sourceoneinsurance.com

These are called “lines of business”. On or prior to the date that is ten (10) business days following the closing date (or such later date as the required lenders shall agree), quantum shall deliver to agent appropriate loss payable endorsements, in form and substance reasonably satisfactory to agent and required lenders, naming agent as an additional insured and/or lender loss payee (as applicable) as its interests. There are four broad categories, or lines, of insurance: Other definitions for line of business an lob application refers to one of the sets of critical computer applications that are vital to running an enterprise. Line of business is a really old phrase (wiktionary says early 19th c and on) that might refer to your product line but might not.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title line of business in insurance example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.