Liquor liability insurance for wedding information

Home » Trend » Liquor liability insurance for wedding informationYour Liquor liability insurance for wedding images are ready. Liquor liability insurance for wedding are a topic that is being searched for and liked by netizens now. You can Download the Liquor liability insurance for wedding files here. Get all free photos and vectors.

If you’re looking for liquor liability insurance for wedding pictures information linked to the liquor liability insurance for wedding topic, you have visit the right blog. Our website frequently gives you suggestions for seeing the highest quality video and picture content, please kindly search and find more informative video content and graphics that match your interests.

Liquor Liability Insurance For Wedding. In addition to these coverages, you can also add a coverage for host liquor liability insurance. Host liquor liability insurance is affordable coverage that helps cover the costs of property damage and personal injury resulting from alcohol consumption. This liability insurance provides you with protection if someone is injured at your wedding or one of your guests causes property damage to the venue. Get peace of mind on your big day by taking out a wedding insurance policy.

Hosting a Party? Then You Need Liquor Liability Insurance From weeksinsurance.com

Hosting a Party? Then You Need Liquor Liability Insurance From weeksinsurance.com

Host liquor liability insurance is affordable coverage that helps cover the costs of property damage and personal injury resulting from alcohol consumption. Pal insurance is a canadian specialty broker with unique programs such as special events liability, party alcohol liability, contents in storage, wedding insurance, event cancellation, atm insurance, vlt insurance The event helper policies always include host liquor liability at no charge. In addition to these coverages, you can also add a coverage for host liquor liability insurance. Essentially, our e vent insurance for weddings covers you if damage has been inflicted upon the venue or any of your guests during your wedding day celebration. Get peace of mind on your big day by taking out a wedding insurance policy.

Optional liability and liquor liability coverage are also available to protect your interests from unfortunate.

Insureon estimates that liquor liability insurance ranges from $225 a year for retail, to $2,060 for bars. Optional liability and liquor liability coverage are also available to protect your interests from unfortunate incidents such as damage to property at the. If your venue requires a waiver of subrogation, you can add the waiver to ewed’s liability insurance with just one click! Ad cover for cancellation, rearrangement, wedding attire, transport, supplier failure & more! If your company faces a claim of bodily injury or property damage that an intoxicated person has caused after they were served liquor at your location, liquor liability can help protect you. Essentially, our e vent insurance for weddings covers you if damage has been inflicted upon the venue or any of your guests during your wedding day celebration.

Source: pinterest.com

Source: pinterest.com

The wedding couple’s wedding liability insurance should include host liquor liability whether served by others, given away or byob. Commercial insurance brokers like coverwallet or simply business make it easier for you to compare several quotes in one place. Will protect you against liquor. Most will also require a host liquor liability provision that extends coverage for. Get peace of mind on your big day by taking out a wedding insurance policy.

Source: bfsinsurance.com

Source: bfsinsurance.com

If your venue requires a waiver of subrogation, you can add the waiver to ewed’s liability insurance with just one click! Ad cover for cancellation, rearrangement, wedding attire, transport, supplier failure & more! Commercial insurance brokers like coverwallet or simply business make it easier for you to compare several quotes in one place. Get peace of mind on your big day by taking out a wedding insurance policy. The wedding couple’s wedding liability insurance should include host liquor liability whether served by others, given away or byob.

Source: javasharedhostinganmia.blogspot.com

Source: javasharedhostinganmia.blogspot.com

Temporary event liquor liability insurance is necessary if you are catering your wedding yourself or if the venue or catering company does not have liquor liability coverage. Optional liability and liquor liability coverage are also available to protect your interests from unfortunate incidents such as damage to property at the. Purchase liability insurance up to the day of the wedding about a 15% discount to bundle wedding liability and cancellation host liquor liability is included without charge wedding and event liability insurance coverage includes: Our insurance offers high limits, includes host liquor coverage and allows you to add additional insureds at no additional fee. Many weddings will reach costs well over $30,000, but you can protect the entire investment for as little as $117.50!

Source: youtube.com

Source: youtube.com

Insureon estimates that liquor liability insurance ranges from $225 a year for retail, to $2,060 for bars. Be sure to compare quotes from several companies to find the cheapest one for you. Many of these venues now require event hosts to purchase liability insurance. Ad cover for cancellation, rearrangement, wedding attire, transport, supplier failure & more! Many weddings will reach costs well over $30,000, but you can protect the entire investment for as little as $117.50!

Source: bestweddinganniversary.blogspot.com

Source: bestweddinganniversary.blogspot.com

This added alcohol insurance for weddings will cover you in case of an accident resulting from the serving. Ad cover for cancellation, rearrangement, wedding attire, transport, supplier failure & more! Get peace of mind on your big day by taking out a wedding insurance policy. According to the knot’s 2016 wedding study, the national average cost of a wedding is $35,329. Commercial insurance brokers like coverwallet or simply business make it easier for you to compare several quotes in one place.

Source: matrixinsurance.net.au

Source: matrixinsurance.net.au

Wedding insurance helps cover that down payment on your future memories. This added alcohol insurance for weddings will cover you in case of an accident resulting from the serving. Such “incidents” might include bodily injury or property damage caused by an intoxicated guest who was served liquor at a wedding. Essentially, our e vent insurance for weddings covers you if damage has been inflicted upon the venue or any of your guests during your wedding day celebration. Our wedding and event liability insurance includes naming your venue as an additional insured and host liquor liability, all for no additional cost.

Source: weeksinsurance.com

Source: weeksinsurance.com

Be sure to compare quotes from several companies to find the cheapest one for you. This liability insurance provides you with protection if someone is injured at your wedding or one of your guests causes property damage to the venue. It offers you protection in the case of an unfortunate incident from an event you host including an option to add liquor liability insurance. Host liquor liability insurance is affordable coverage that helps cover the costs of property damage and personal injury resulting from alcohol consumption. Get a quote for liquor liability coverage from the hartford.

Source: encharter.com

Source: encharter.com

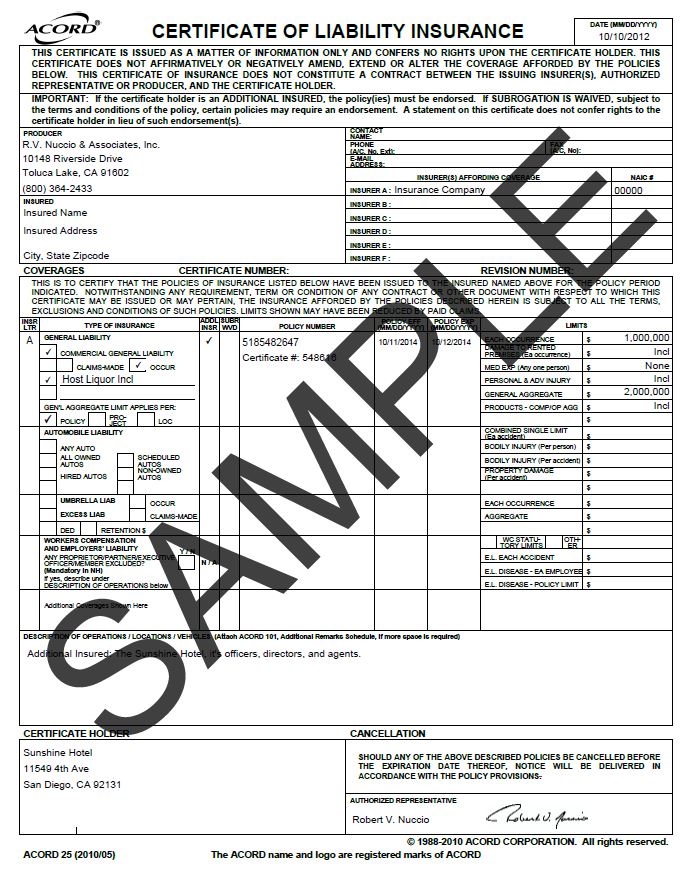

By accepting liquor liability coverage on your policy, your agent can provide the venue of your choice, with a certificate of insurance showing them listed on the policy and protecting your event for not only the wedding itself but also from the. Host liquor liability insurance is affordable coverage that helps cover the costs of property damage and personal injury resulting from alcohol consumption. Our wedding and event liability insurance includes naming your venue as an additional insured and host liquor liability, all for no additional cost. Liquor liability insurance helps protect businesses that sell, serve or distribute alcohol. Many of these venues now require event hosts to purchase liability insurance.

Source: habermaninsurance.com

Source: habermaninsurance.com

Many of these venues now require event hosts to purchase liability insurance. Policies can be purchased up to the day before your event and. Such “incidents” might include bodily injury or property damage caused by an intoxicated guest who was served liquor at a wedding. Our wedding and event liability insurance includes naming your venue as an additional insured and host liquor liability, all for no additional cost. Will protect you against liquor.

Source: coverwallet.com

Source: coverwallet.com

Pal insurance is a canadian specialty broker with unique programs such as special events liability, party alcohol liability, contents in storage, wedding insurance, event cancellation, atm insurance, vlt insurance Be sure to compare quotes from several companies to find the cheapest one for you. If you are planning a wedding, duliban insurance can help you navigate your liquor liability coverage options and select a policy that is right for your event. Up to $5 million in liability coverage. Temporary event liquor liability insurance is necessary if you are catering your wedding yourself or if the venue or catering company does not have liquor liability coverage.

Source: hmic.com

Source: hmic.com

Eventsured’s policy is designed to meet your venue’s requirements. By accepting liquor liability coverage on your policy, your agent can provide the venue of your choice, with a certificate of insurance showing them listed on the policy and protecting your event for not only the wedding itself but also from the. Ad cover for cancellation, rearrangement, wedding attire, transport, supplier failure & more! Many of these venues now require event hosts to purchase liability insurance. If your venue requires a waiver of subrogation, you can add the waiver to ewed’s liability insurance with just one click!

Our wedding and event liability insurance includes naming your venue as an additional insured and host liquor liability, all for no additional cost. This added alcohol insurance for weddings will cover you in case of an accident resulting from the serving. Get a quote for liquor liability coverage from the hartford. Optional liability and liquor liability coverage are also available to protect your interests from unfortunate. Wedding insurance helps cover that down payment on your future memories.

Source: pinterest.com

Source: pinterest.com

This liability insurance provides you with protection if someone is injured at your wedding or one of your guests causes property damage to the venue. Covers liability at the venue for property damage or injuries to guests that you may be held responsible for. This added alcohol insurance for weddings will cover you in case of an accident resulting from the serving. Most will also require a host liquor liability provision that extends coverage for. Liquor liability insurance and host liquor liability coverage.

Source: theeventplanner.com

Source: theeventplanner.com

It’s no secret that weddings come with a high price tag and a million details to plan. Liability insurance is an optional coverage and can be added as an endorsement on to your private event insurance policy. Covers liability at the venue for property damage or injuries to guests that you may be held responsible for. If you are planning a wedding, duliban insurance can help you navigate your liquor liability coverage options and select a policy that is right for your event. Policies can be purchased up to the day before your event and.

Source: slideshare.net

Source: slideshare.net

If your company faces a claim of bodily injury or property damage that an intoxicated person has caused after they were served liquor at your location, liquor liability can help protect you. It offers you protection in the case of an unfortunate incident from an event you host including an option to add liquor liability insurance. Covers liability at the venue for property damage or injuries to guests that you may be held responsible for. Pal insurance is a canadian specialty broker with unique programs such as special events liability, party alcohol liability, contents in storage, wedding insurance, event cancellation, atm insurance, vlt insurance Ad cover for cancellation, rearrangement, wedding attire, transport, supplier failure & more!

Source: arizonaweddinginsurance.com

Source: arizonaweddinginsurance.com

Purchase liability insurance up to the day of the wedding about a 15% discount to bundle wedding liability and cancellation host liquor liability is included without charge wedding and event liability insurance coverage includes: By accepting liquor liability coverage on your policy, your agent can provide the venue of your choice, with a certificate of insurance showing them listed on the policy and protecting your event for not only the wedding itself but also from the. Wedding insurance helps cover that down payment on your future memories. Host liquor liability would make sense for a venue such as the montclair wedding. In addition to these coverages, you can also add a coverage for host liquor liability insurance.

Source: americanspecialtyexpress.com

Source: americanspecialtyexpress.com

Wedding insurance helps cover that down payment on your future memories. Liquor liability insurance and host liquor liability coverage. Get peace of mind on your big day by taking out a wedding insurance policy. If your company faces a claim of bodily injury or property damage that an intoxicated person has caused after they were served liquor at your location, liquor liability can help protect you. If your venue requires a waiver of subrogation, you can add the waiver to ewed’s liability insurance with just one click!

Source: wedsafe.com

Source: wedsafe.com

In addition to these coverages, you can also add a coverage for host liquor liability insurance. Policies can be purchased up to the day before your event and. Liquor liability insurance helps protect businesses that sell, serve or distribute alcohol. Host liquor liability would make sense for a venue such as the montclair wedding. Optional liability and liquor liability coverage are also available to protect your interests from unfortunate incidents such as damage to property at the.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title liquor liability insurance for wedding by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.