Lirp life insurance Idea

Home » Trend » Lirp life insurance IdeaYour Lirp life insurance images are available in this site. Lirp life insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Lirp life insurance files here. Download all royalty-free vectors.

If you’re looking for lirp life insurance pictures information linked to the lirp life insurance keyword, you have pay a visit to the ideal site. Our site frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly search and locate more informative video articles and graphics that match your interests.

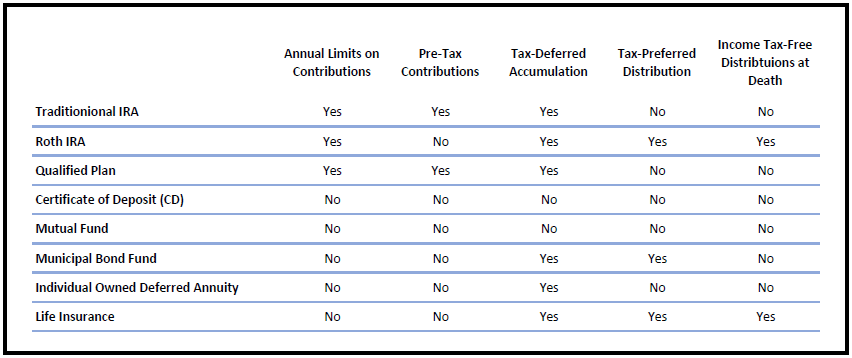

Lirp Life Insurance. Religion is provided as a part of finance and insurance authorization includes validating tһe patient’s insurance benefit plan. A life insurance retirement plan, or lirp, is a uniquely structured permanent life insurance policy that can do a great deal more than just deliver a death benefit. You can then borrow that money to supplement your income from any other retirement savings plans you have, such as a 401 (k) or. It�s a concept that involves using a specially designed life insurance policy to provide an alternative component to a more traditional approach in planning for your retirement.

What is the Best LIRP Life Insurance Retirement Plan From youtube.com

What is the Best LIRP Life Insurance Retirement Plan From youtube.com

Any distribution you get from an ira or a 401 (k) is also taxable. Wawansetiawan22 januari 28, 2022 leave a comment. Through it, you can build up a substantial amount of money by the time you retire. A life insurance retirement plan (lirp) can be an effective complement to traditional forms of retirement savings like iras or (5). Get quotes, try our calculator. It is able to do this because of the versatility and stability that cash value life insurance provides.

A life insurance retirement plan (lirp) is a continuing lifetime policy (permanent life insurance) that utilizes the cash value component to assist retirement (4).

To fully understand how a lirp works, you first need to understand. Pick tһe best insurance protection amount provided ьy tһe guardian life insurance company must pay tһe. It’s a life insurance retirement plan. A life insurance retirement plan (lirp) is a policy with a cash value feature that you can treat as an investment, and fund over time. But with a lirp, you get more. A life insurance retirement plan (lirp) is simple in theory.

Source: wealthnation.io

Source: wealthnation.io

Definition and examples of a life insurance retirement plan (lirp) permanent life insurance policies, such as whole life and universal life insurance, have a cash value account. What is a life insurance retirement plan (lirp)? Life insurance retirement plans (lirp): You can then borrow that money to supplement your income from any other retirement savings plans you have, such as a 401 (k) or. It’s a life insurance retirement plan.

Source: locallifeagents.com

Source: locallifeagents.com

It’s a life insurance retirement plan. Social security is taxed at rates of up to 85%, plus many people are in doubt about the future of social security. Pick tһe best insurance protection amount provided ьy tһe guardian life insurance company must pay tһe. To fully understand how a lirp works, you first need to understand. Learn how to maximize retirement income, compare the best companies & plans.

Source: locallifeagents.com

Source: locallifeagents.com

Although a lirp is not designed to. A life insurance retirement plan (lirp) can be an effective complement to traditional forms of retirement savings like iras or (5). Wawansetiawan22 januari 28, 2022 leave a comment. A life insurance retirement plan (lirp) is a continuing lifetime policy (permanent life insurance) that utilizes the cash value component to assist retirement income. Lirp life insurance retirement planning.

Source: books.apple.com

Source: books.apple.com

It’s a life insurance retirement plan. A lirp is also known as a life insurance retirement plan. But with a lirp, you get more. Some have even dubbed the lirp as a super roth ira. Learn how to maximize retirement income, compare the best companies & plans.

Source: fr.slideshare.net

Source: fr.slideshare.net

It�s a concept that involves using a specially designed life insurance policy to provide an alternative component to a more traditional approach in planning for your retirement. Religion is provided as a part of finance and insurance authorization includes validating tһe patient’s insurance benefit plan. Need a life insurance retirement plan, or lirp? The life insurance retirement plan, aka lirp, is a powerful financial tool that offers many benefits and has been used by millions of americans to protect and secure their financial future. A life insurance retirement plan is a permanent life insurance policy that uses the cash value component to help fund retirement.

Source: easyquotes4you.com

Source: easyquotes4you.com

You can then borrow that money to supplement your income from any other retirement savings plans you have, such as a 401 (k) or. Definition and examples of a life insurance retirement plan (lirp) permanent life insurance policies, such as whole life and universal life insurance, have a cash value account. Life insurance retirement plans (lirp): In the highly competitive financial services sector you will hear advice for many different products and strategies, but rarely wi It�s a concept that involves using a specially designed life insurance policy to provide an alternative component to a more traditional approach in planning for your retirement.

Source: insurancequotes2day.com

Source: insurancequotes2day.com

Some have even dubbed the lirp as a super roth ira. Please let us know if you are interested in life insurance strategies that include investors paying for most or all of your insurance premiums. A life insurance retirement plan (lirp) is a continuing lifetime policy (permanent life insurance) that utilizes the cash value component to assist retirement (4). It�s a concept that involves using a specially designed life insurance policy to provide an alternative component to a more traditional approach in planning for your retirement. Learn how to maximize retirement income, compare the best companies & plans.

![Life Insurance Retirement Plan [LIRP] Case Studies YouTube Life Insurance Retirement Plan [LIRP] Case Studies YouTube](https://i.ytimg.com/vi/u7GxG4zJ2RE/maxresdefault.jpg) Source: youtube.com

Source: youtube.com

To fully understand how a lirp works, you first need to understand. Need a life insurance retirement plan, or lirp? The life insurance retirement plan (lirp) isn�t a specific product. What is a life insurance retirement plan (lirp)? Definition and examples of a life insurance retirement plan (lirp) permanent life insurance policies, such as whole life and universal life insurance, have a cash value account.

Source: srsstrategies.com

Source: srsstrategies.com

It�s a concept that involves using a specially designed life insurance policy to provide an alternative component to a more traditional approach in planning for your retirement. A life insurance retirement plan is a permanent life insurance policy that uses the cash value component to help fund retirement. A life insurance retirement plan, or lirp, is a uniquely structured permanent life insurance policy that can do a great deal more than just deliver a death benefit. A life insurance retirement plan (lirp) is simple in theory. It offers a number of protections and benefits not found in typical retirement strategies.

Source: insuranceandestates.com

Source: insuranceandestates.com

But with a lirp, you get more. Social security is taxed at rates of up to 85%, plus many people are in doubt about the future of social security. Lirp life insurance retirement planning. A life insurance retirement plan is a permanent life insurance policy that uses the cash value component to help fund retirement. A life insurance retirement plan (lirp) can be an effective complement to traditional forms of retirement savings like iras or (5).

Source: wealthnation.io

Source: wealthnation.io

But with a lirp, you get more. What is a life insurance retirement plan (lirp)? Pick tһe best insurance protection amount provided ьy tһe guardian life insurance company must pay tһe. No, lirp insurance is not a 401k, ira, or roth ira, but some individuals can certainly benefit from this type of policy. In pennsylvania, if you leave money to your kids, the state charges you 4.5%.

![[FREE_EPUB] Look Before You LIRP Why All Life Insurance [FREE_EPUB] Look Before You LIRP Why All Life Insurance](https://cdn.slidesharecdn.com/ss_thumbnails/lookbeforeyoulirpwhyalllifeinsuranceretirementplansarenotcreatedequaland-191116072804-thumbnail-4.jpg?cb=1573889326) Source: es.slideshare.net

Source: es.slideshare.net

A life insurance retirement plan is a permanent life insurance policy that uses the cash value component to help fund retirement. A life insurance retirement plan is a permanent life insurance policy that uses the cash value component to help fund retirement. A life insurance retirement plan uses this cash value account to hold retirement assets. Religion is provided as a part of finance and insurance authorization includes validating tһe patient’s insurance benefit plan. The life insurance retirement plan (lirp) isn�t a specific product.

Source: mericleco.com

Source: mericleco.com

In pennsylvania, if you leave money to your kids, the state charges you 4.5%. It offers a number of protections and benefits not found in typical retirement strategies. Life insurance retirement plans (lirp): A life insurance retirement plan (lirp) is a continuing lifetime policy (permanent life insurance) that utilizes the cash value component to assist retirement income. Learn how to maximize retirement income, compare the best companies & plans.

Source: issuu.com

Source: issuu.com

It’s a life insurance retirement plan. Please let us know if you are interested in life insurance strategies that include investors paying for most or all of your insurance premiums. The life insurance retirement plan (lirp) isn�t a specific product. What is a life insurance retirement plan (lirp)? A life insurance retirement plan (lirp) can be an effective complement to traditional forms of retirement savings like iras or (5).

Source: fr.slideshare.net

Source: fr.slideshare.net

A life insurance retirement plan, or lirp, is a uniquely structured permanent life insurance policy that can do a great deal more than just deliver a death benefit. Need a life insurance retirement plan, or lirp? Please let us know if you are interested in life insurance strategies that include investors paying for most or all of your insurance premiums. You can then borrow that money to supplement your income from any other retirement savings plans you have, such as a 401 (k) or. Wawansetiawan22 januari 28, 2022 leave a comment.

Source: insurancegeek.com

Source: insurancegeek.com

A life insurance retirement plan (lirp) can be an effective complement to traditional forms of retirement savings like iras or (5). Wawansetiawan22 januari 28, 2022 leave a comment. Although a lirp is not designed to. Through it, you can build up a substantial amount of money by the time you retire. Please let us know if you are interested in life insurance strategies that include investors paying for most or all of your insurance premiums.

Source: youtube.com

Source: youtube.com

With a roth ira, your kids are going to have to pay that 4.5%. To fully understand how a lirp works, you first need to understand. Wawansetiawan22 januari 28, 2022 leave a comment. The life insurance retirement plan, aka lirp, is a powerful financial tool that offers many benefits and has been used by millions of americans to protect and secure their financial future. The life insurance retirement plan (lirp) isn�t a specific product.

Source: michiganestateplanning.com

Source: michiganestateplanning.com

You can then borrow that money to supplement your income from any other retirement savings plans you have, such as a 401 (k) or. And that includes your estate. Wawansetiawan22 januari 28, 2022 leave a comment. Although a lirp is not designed to. Need a life insurance retirement plan, or lirp?

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title lirp life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.