Living benefits insurance information

Home » Trending » Living benefits insurance informationYour Living benefits insurance images are ready in this website. Living benefits insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Living benefits insurance files here. Download all free photos and vectors.

If you’re looking for living benefits insurance images information connected with to the living benefits insurance topic, you have visit the right site. Our website always gives you hints for refferencing the highest quality video and image content, please kindly hunt and find more informative video content and images that fit your interests.

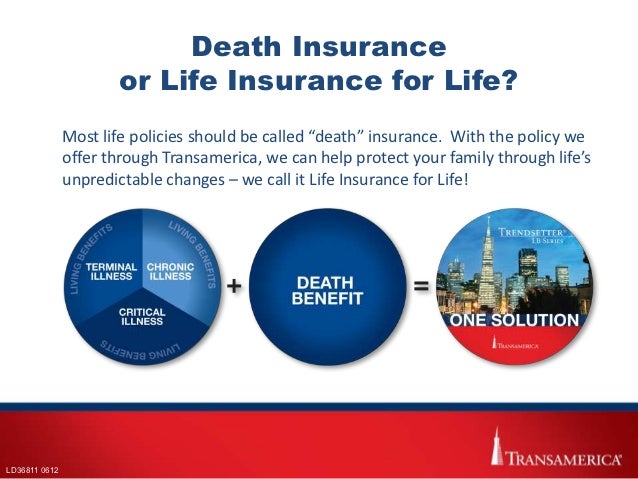

Living Benefits Insurance. It allows you to access funds while youre still living under certain conditions. Garcia life insurance with living benefits life insurance you don�t have to die to use. What are living benefits in life insurance? Read on to see our list of the best life insurance companies that provide living benefits.

What is life insurance with living benefits? Your life insurance with living benefits policy riders include living benefits which allow you to access part of your death benefits while still alive. With life insurance with living benefits, you have the power to accelerate your death benefit while you�re still living if you suffer a heart attack, cancer diagnosis, stroke, or any other critical, chronic, or terminal illness. Living benefits are also known as accelerated death benefits. Living benefits are offered before you die, and death benefits are offered. What does living benefits of life insurance mean?

* purchase life insurance with living benefits.

While not a true cash benefit, it nonetheless is a valuable option to have since there’s a three in 10 chance you’ll face a disability that keeps you out of work for 90 days or longer at some point during your working career. What is cash value in life. This benefit can be purchased as a rider with term or permanent insurance. These plans can be tailored to work in tandem with employee benefit plans or recognize the fact that you own and operate a business or work independently. * purchase life insurance with living benefits. The living benefits rider allows you to pay your daily living expenses, and medical expenses, while also allowing you to look after your family after your death.

Source: nextgen-life-insurance.com

Source: nextgen-life-insurance.com

And living benefits are the subject of this article. A life insurance rider is an optional piece of coverage or. The living benefits rider allows you to pay your daily living expenses, and medical expenses, while also allowing you to look after your family after your death. Living benefits life insurance is the new, evolved kind of life insurance. Well, you get the picture.

Source: youtube.com

Source: youtube.com

Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime. While not a true cash benefit, it nonetheless is a valuable option to have since there’s a three in 10 chance you’ll face a disability that keeps you out of work for 90 days or longer at some point during your working career. And living benefits are the subject of this article. This could happen in 2 scenarios: The insured does not have to die to use the policy.

Source: insurerelaxinfo.blogspot.com

Source: insurerelaxinfo.blogspot.com

Most people assume that this financial support only happens after death, but some policies provide living benefits. Getting life insurance with living benefits is not complicated, usually you just need a solid company and they will offer it as part of the policy. Life insurance is intended to provide financial support for the beneficiaries of someone who passes away. Permanent life insurance policies from state farm life insurance company and state farm life and accident assurance company (residents of ny and wi only) offer financial protection in the event of your death. Affordable life insurance quotes online | fidelity life

Simply put, the living benefits of life insurance is the option for the insured to use his or her life insurance policy while still alive. What are living benefits in life insurance? Life insurance with living benefits can help to ensure your loved ones are covered financially, so that your family can focus on what matters most — spending time together. Because the benefit is unrestricted, you can use the financial help for any reason once you qualify. Garcia life insurance with living benefits life insurance you don�t have to die to use.

Source: wsdba.org

Source: wsdba.org

Well, you get the picture. Living benefit plans are insurance policies that provide financial benefits to survivors who face issues due to aging, illness, accidents and dependency. Permanent life insurance policies from state farm life insurance company and state farm life and accident assurance company (residents of ny and wi only) offer financial protection in the event of your death. Life insurance with living benefits can help to ensure your loved ones are covered financially, so that your family can focus on what matters most — spending time together. There are two kinds of living benefits insurance:

Source: pacificinsurancegroup.com

Source: pacificinsurancegroup.com

The best life insurance companies with living benefits are affordable, offer a wide variety of options, and come with high customer satisfaction ratings. These plans can be tailored to work in tandem with employee benefit plans or recognize the fact that you own and operate a business or work independently. Life insurance benefits you can use in your lifetime. This affordable insurance solution gives you complete peace of mind so you can breathe easier. It allows you to access funds while youre still living under certain conditions.

Source: quickquote.com

Source: quickquote.com

Permanent life insurance policies from state farm life insurance company and state farm life and accident assurance company (residents of ny and wi only) offer financial protection in the event of your death. A life insurance rider is an optional piece of coverage or. These plans can be tailored to work in tandem with employee benefit plans or recognize the fact that you own and operate a business or work independently. This benefit can be purchased as a rider with term or permanent insurance. While not a true cash benefit, it nonetheless is a valuable option to have since there’s a three in 10 chance you’ll face a disability that keeps you out of work for 90 days or longer at some point during your working career.

Source: coachkimmyelp.com

Source: coachkimmyelp.com

This is considered a living benefit of life insurance because, in contrast to a death benefit that pays out when you pass away, you can use the money while you’re still alive. Because the benefit is unrestricted, you can use the financial help for any reason once you qualify. This could happen in 2 scenarios: Well, you get the picture. What does living benefits of life insurance mean?

Source: locallifeagents.com

Source: locallifeagents.com

There is no reason to wait for life insurance coverage for you and your family. And living benefits are the subject of this article. What is cash value in life. What is life insurance with living benefits? These plans can be tailored to work in tandem with employee benefit plans or recognize the fact that you own and operate a business or work independently.

Source: youtube.com

Source: youtube.com

This is considered a living benefit of life insurance because, in contrast to a death benefit that pays out when you pass away, you can use the money while you’re still alive. Life insurance allows you, the policy owner, to build cash value through your life insurance policy that accumulates over your lifetime. This affordable insurance solution gives you complete peace of mind so you can breathe easier. Affordable life insurance quotes online | fidelity life What is life insurance with living benefits?

Source: calgary-broker.blogspot.com

Source: calgary-broker.blogspot.com

While not a true cash benefit, it nonetheless is a valuable option to have since there’s a three in 10 chance you’ll face a disability that keeps you out of work for 90 days or longer at some point during your working career. * purchase a policy that builds up cash value. What is life insurance with living benefits? They are riders attached to a life. Affordable life insurance quotes online | fidelity life

Source: tigagency.com

Source: tigagency.com

While not a true cash benefit, it nonetheless is a valuable option to have since there’s a three in 10 chance you’ll face a disability that keeps you out of work for 90 days or longer at some point during your working career. You can click here or on any of the above buttons to get a quick life insurance quote and get covered. Life insurance with living benefits can help to ensure your loved ones are covered financially, so that your family can focus on what matters most — spending time together. Life insurance benefits you can use in your lifetime. It allows you to access funds while youre still living under certain conditions.

Source: susyzinn.com

Source: susyzinn.com

Life insurance with living benefits can help to ensure your loved ones are covered financially, so that your family can focus on what matters most — spending time together. Living benefits are offered before you die, and death benefits are offered. This is considered a living benefit of life insurance because, in contrast to a death benefit that pays out when you pass away, you can use the money while you’re still alive. * purchase a policy that builds up cash value. Because the benefit is unrestricted, you can use the financial help for any reason once you qualify.

Source: slideteam.net

Source: slideteam.net

The insured does not have to die to use the policy. The best life insurance companies with living benefits are affordable, offer a wide variety of options, and come with high customer satisfaction ratings. Yes, life insurance can offer the advantages of both death benefits and living benefits. What are living benefits in life insurance? Your life insurance with living benefits policy riders include living benefits which allow you to access part of your death benefits while still alive.

Source: youtube.com

Source: youtube.com

Getting life insurance with living benefits is not complicated, usually you just need a solid company and they will offer it as part of the policy. Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless you also have a need for life insurance. Living benefits are also known as accelerated death benefits. Your life insurance with living benefits policy riders include living benefits which allow you to access part of your death benefits while still alive. To better understand how living benefits work, it helps to understand what a rider is.

Source: slideshare.net

Source: slideshare.net

What are living benefits in life insurance? These plans can be tailored to work in tandem with employee benefit plans or recognize the fact that you own and operate a business or work independently. Living benefits may be provided by optional accelerated benefits riders. Living benefits life insurance is the new, evolved kind of life insurance. It allows you to access funds while youre still living under certain conditions.

Source: youtube.com

Source: youtube.com

While not a true cash benefit, it nonetheless is a valuable option to have since there’s a three in 10 chance you’ll face a disability that keeps you out of work for 90 days or longer at some point during your working career. While not a true cash benefit, it nonetheless is a valuable option to have since there’s a three in 10 chance you’ll face a disability that keeps you out of work for 90 days or longer at some point during your working career. Because the benefit is unrestricted, you can use the financial help for any reason once you qualify. What is cash value in life. This benefit can be purchased as a rider with term or permanent insurance.

Source: pinterest.com

Source: pinterest.com

While not a true cash benefit, it nonetheless is a valuable option to have since there’s a three in 10 chance you’ll face a disability that keeps you out of work for 90 days or longer at some point during your working career. A living benefit is equal to the basic life insurance amount, plus any extra benefit for persons under age 45, that would be in effect nine months after the date of the office of federal employees� group life insurance (ofegli) receives a completed claim for living benefits form. Riders are supplemental benefits that can be added to a life insurance policy and are not suitable unless you also have a need for life insurance. Permanent life insurance policies from state farm life insurance company and state farm life and accident assurance company (residents of ny and wi only) offer financial protection in the event of your death. The best life insurance companies with living benefits are affordable, offer a wide variety of options, and come with high customer satisfaction ratings.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title living benefits insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.