Lloyds insurance market explained Idea

Home » Trending » Lloyds insurance market explained IdeaYour Lloyds insurance market explained images are ready. Lloyds insurance market explained are a topic that is being searched for and liked by netizens now. You can Download the Lloyds insurance market explained files here. Download all free images.

If you’re searching for lloyds insurance market explained images information related to the lloyds insurance market explained interest, you have come to the right site. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

Lloyds Insurance Market Explained. The london insurance market has traditionally been seen as the world’s leading centre for insuring speciality risk. The duration between the peak and the trough and levels vary. The council of lloyds has six nominated members, six external and six working members. It provides a summary of the market milestones for the three key areas of open market, delegated authority and claims alongside the key actions that must be completed for digital adoption in 2024.

Lloyd’s is the world’s specialist insurance and reinsurance market, bringing together an outstanding concentration of underwriting expertise and talent. Understand our share dealing charges; The following definitions are intended for general guidance. It is more important, however, because of its history and impact on insurance as it is written and operates today. Glossary of insurance related terms used by lloyd�s and market participants. Unlike most of its competitors in the industry, it is not an insurance company;

Lloyd�s of london is not an insurance company.

Lloyd’s is a broker market in which strong relationships, backed by deep expertise, play a crucial part. It has held onto unusual practices and structures that are not like other providers. The original coffeehouse first opened in. Lloyd’s is the world’s specialist insurance and reinsurance market. Lloyd�s began as a coffee house in the 1600s. Lloyd’s, the world’s leading marketplace for commercial, corporate and speciality risk solutions, today released a new report to help insurers and risk managers navigate the significant overlap between geopolitical risks and climate change.

The lloyd’s marketplace is considered a market of last resort because almost any risk can be covered by some underwriters at lloyd’s. Around 80 syndicates underwrite insurance at lloyd’s, covering all classes of business. Understand our share dealing charges; Lloyd�s of london, generally known simply as lloyd�s, is an insurance and reinsurance market located in london, united kingdom. An explanation of lloyd�s slips from autoinsurancecompaniesnearme.blogspot.com.

It is more important, however, because of its history and impact on insurance as it is written and operates today. With expertise earned over centuries, lloyd’s is the foundation of the insurance industry and the future of it. Lloyd’s is the world’s specialist insurance and reinsurance market. Lloyds is the oldest insurance marketplace that has been continuously active in the world. Lloyd’s, the world’s leading marketplace for commercial, corporate and speciality risk solutions, today released a new report to help insurers and risk managers navigate the significant overlap between geopolitical risks and climate change.

Source: newyorkcityvoices.org

Source: newyorkcityvoices.org

Specialist brokers buy reliable insurance cover for their clients on competitive terms specialist underwriters put a price on each risk. Lloyd’s is a broker market in which strong relationships, backed by deep expertise, play a crucial part. Or, you could be in our market intelligence team, helping to provide analysis of the world’s insurance industry from a geographic perspective for the benefit of internal and external stakeholders, in support. Lloyd’s report highlights insurers role in easing geopolitical climate tensions. Understand our share dealing charges;

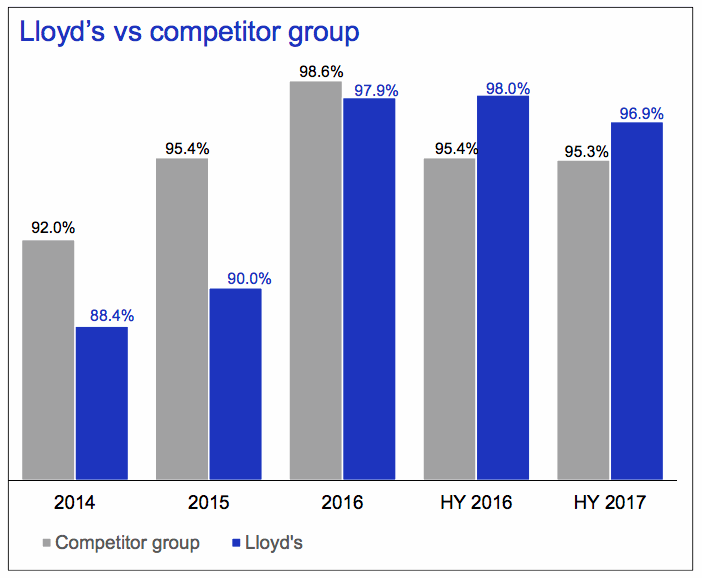

Operational improvements are fuelling the drive to enhance value and sharpen the competitive edge. The original coffeehouse first opened in. The duration between the peak and the trough and levels vary. Specifically, these include mandatory transition requirements that must be integrated and adopted into digital strategies, as well as data standards targets and other. Within the corporation you could be working within our innovation lab, testing new concepts, ideas and products with the support and active involvement of the lloyd’s market.

Source: reinsurancene.ws

Source: reinsurancene.ws

The duration between the peak and the trough and levels vary. It is not an insurance company, it’s a market regulated and overseen by lloyds corporation. Glossary of insurance related terms used by lloyd�s and market participants. Lloyd’s report highlights insurers role in easing geopolitical climate tensions. By combining risks, they aim to earn fairly consistent profits for their backers.

Specifically, these include mandatory transition requirements that must be integrated and adopted into digital strategies, as well as data standards targets and other. Lloyd’s or lloyd�s of london is an insurance marketplace located in the city of london. They do not override or qualify any definition that appears in any lloyd’s byelaw or regulation, in any contract or in any other document. The buyers are individual entities or corporate. Lloyd’s is the world’s specialist insurance and reinsurance market.

Source: noclutter.cloud

Source: noclutter.cloud

Lloyd’s, the world’s leading marketplace for commercial, corporate and speciality risk solutions, today released a new report to help insurers and risk managers navigate the significant overlap between geopolitical risks and climate change. For over 330 years, people, businesses and communities have relied on the lloyd’s market to protect what matters most and we are proud to continue that service today. It developed out of an informal meeting of ship owners, merchants and sailors in edward lloyd�s coffeehouse. It provides a summary of the market milestones for the three key areas of open market, delegated authority and claims alongside the key actions that must be completed for digital adoption in 2024. Rather, it is a marketplace where insurance buyers and sellers come together.

Source: robertharding.com

Glossary of insurance related terms used by lloyd�s and market participants. Rather, it is a marketplace where insurance buyers and sellers come together. Lloyd’s is a broker market in which strong relationships, backed by deep expertise, play a crucial part. The original coffeehouse first opened in. Lloyd’s, the world’s leading marketplace for commercial, corporate and speciality risk solutions, today released a new report to help insurers and risk managers navigate the significant overlap between geopolitical risks and climate change.

Source: noclutter.cloud

Source: noclutter.cloud

Lloyd’s, the world’s leading marketplace for commercial, corporate and speciality risk solutions, today released a new report to help insurers and risk managers navigate the significant overlap between geopolitical risks and climate change. By combining risks, they aim to earn fairly consistent profits for their backers. It is important to understand the lloyd’s market to understand how insurance works. Understand our share dealing charges; Lloyd�s of london, generally known simply as lloyd�s, is an insurance and reinsurance market located in london, united kingdom.

Source: issuu.com

Source: issuu.com

By combining risks, they aim to earn fairly consistent profits for their backers. Market is underpinned by its unparalleled concentration of experience and specialist expertise. With expertise earned over centuries, lloyd’s is the foundation of the insurance industry and the future of it. The lloyd’s marketplace is one of the world’s largest insurance companies and can be split up into 6 subsections of industries that they target. Much of this business involves face to face negotiations between brokers and underwriters.

Source: reinsurancene.ws

Source: reinsurancene.ws

With expertise earned over centuries, lloyd’s is the foundation of the insurance industry and the future of it. It is more important, however, because of its history and impact on insurance as it is written and operates today. The original coffeehouse first opened in. Market is underpinned by its unparalleled concentration of experience and specialist expertise. Rather, it is a marketplace where insurance buyers and sellers come together.

Lloyds is the oldest insurance marketplace that has been continuously active in the world. Operational improvements are fuelling the drive to enhance value and sharpen the competitive edge. The london insurance market has traditionally been seen as the world’s leading centre for insuring speciality risk. Lloyd’s, the world’s leading marketplace for commercial, corporate and speciality risk solutions, today released a new report to help insurers and risk managers navigate the significant overlap between geopolitical risks and climate change. Lloyd’s report highlights insurers role in easing geopolitical climate tensions.

Source: garotadeparis45.blogspot.com

Source: garotadeparis45.blogspot.com

The original coffeehouse first opened in. With expertise earned over centuries, lloyd’s is the foundation of the insurance industry and the future of it. It developed out of an informal meeting of ship owners, merchants and sailors in edward lloyd�s coffeehouse. Rather, lloyd�s is a corporate body governed by the lloyd�s act 1871 and subsequent acts of parliament. Glossary of insurance related terms used by lloyd�s and market participants.

Source: noclutter.cloud

Source: noclutter.cloud

The following definitions are intended for general guidance. It is important to understand the lloyd’s market to understand how insurance works. At 31 december 2020, there were 350 brokers at lloyd’s. They do not override or qualify any definition that appears in any lloyd’s byelaw or regulation, in any contract or in any other document. Within the corporation you could be working within our innovation lab, testing new concepts, ideas and products with the support and active involvement of the lloyd’s market.

Source: scotsman.com

Source: scotsman.com

The london insurance market has traditionally been seen as the world’s leading centre for insuring speciality risk. Lloyd�s began as a coffee house in the 1600s. Brokers facilitate the risk transfer process between policyholders and underwriters. Around 80 syndicates underwrite insurance at lloyd’s, covering all classes of business. Here’s a full list of cover we offer including additional help and guidance.

Source: noclutter.cloud

Source: noclutter.cloud

Unlike most of its competitors in the industry, it is not an insurance company; The buyers are individual entities or corporate. Brokers facilitate the risk transfer process between policyholders and underwriters. Here’s a full list of cover we offer including additional help and guidance. Lloyds of london is one of the world’s oldest and most popular insurance markets headquartered in london.

As of 2018, the breakdown of their business by region is per the following: The buyers are individual entities or corporate. An explanation of lloyd�s slips from autoinsurancecompaniesnearme.blogspot.com. Operational improvements are fuelling the drive to enhance value and sharpen the competitive edge. The lloyd’s marketplace is considered a market of last resort because almost any risk can be covered by some underwriters at lloyd’s.

Source: leadersedge.com

Source: leadersedge.com

Lloyd�s began as a coffee house in the 1600s. It developed out of an informal meeting of ship owners, merchants and sailors in edward lloyd�s coffeehouse. Much of this business involves face to face negotiations between brokers and underwriters. Unlike most of its competitors in the industry, it is not an insurance company; Lloyd’s is the world’s specialist insurance and reinsurance market, bringing together an outstanding concentration of underwriting expertise and talent.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title lloyds insurance market explained by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.