Long tail liability insurance Idea

Home » Trend » Long tail liability insurance IdeaYour Long tail liability insurance images are ready. Long tail liability insurance are a topic that is being searched for and liked by netizens now. You can Find and Download the Long tail liability insurance files here. Download all royalty-free photos and vectors.

If you’re searching for long tail liability insurance images information related to the long tail liability insurance keyword, you have pay a visit to the right blog. Our site always provides you with hints for refferencing the maximum quality video and image content, please kindly hunt and locate more informative video content and images that fit your interests.

Long Tail Liability Insurance. Free, unlimited and instant certificates of insurance online. One where an injury or other harm takes time to become known and a claim may be separated from the circumstances that caused it by as many as 25 years or more. Nature of the long tail problem in many insurance lines (especially property insurance lines) losses are known with reasonable certainty at the end of the policy period or shortly thereafter. ( lɔŋ teɪl kleɪmz ) noun.

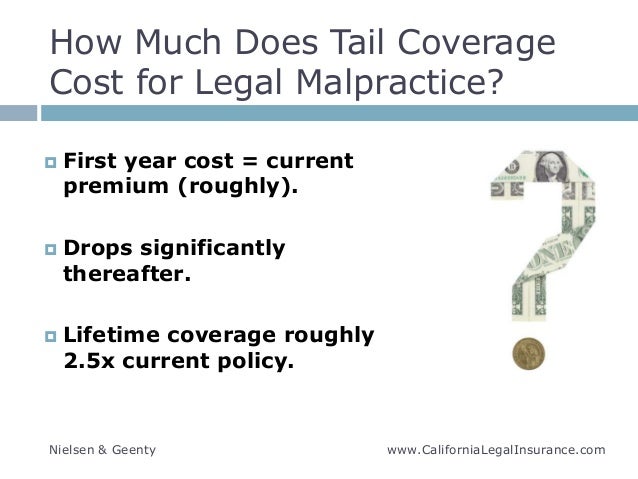

Legal Malpractice Tail Coverage Insuring Your Retirement From slideshare.net

Legal Malpractice Tail Coverage Insuring Your Retirement From slideshare.net

Exposure to coal dust, which might cause black lung. The longer your tail coverage, the longer your protection can last. Get your instant quote now! Your client sues your business in october 2021 for an incident that occurred during your policy period. One where an injury or other harm takes time to become known and a claim may be separated from the circumstances that caused it by as many as 25 years or more. Long tail liability claims are claims that involve a continuous, progressive or repeated injury over long periods of time that implicate multiple policy years.

Free, unlimited and instant certificates of insurance online.

These claims are usually associated with losses that are incurred but not reported during a policy period. Exposure to asbestos, which sometimes results in a lung disease called asbestos; Long tail liability claims are claims that involve a continuous, progressive or repeated injury over long periods of time that implicate multiple policy years. Because the damage cannot be traced to a single incident or event, it can be difficult to identify which policies are implicated, and even more difficult, how the losses will be allocated among the insurers. This definition deals with the business strategy use of the term. One where an injury or other harm takes time to become known and a claim may be separated from the circumstances that caused it by as many as 25 years or more.

Source: apcwebconcept.com

Source: apcwebconcept.com

(from a risk point of view) between the start of the exposure and the manifestation of loss or damage resulting from the exposure; Ad small business general liability insurance that�s affordable & tailored for you! These claims are usually associated with losses that are incurred but not reported during a policy period. One where an injury or other harm takes time to become known and a claim may be separated from the circumstances that caused it by as many as 25 years or more. High incurred but not reported (ibnr) claims contribute to this tail effect, since these losses are usually not settled until several years after the expiration of the policy in question.

Source: caitlin-morgan.com

Source: caitlin-morgan.com

Free, unlimited and instant certificates of insurance online. However, in the liability insurance area under the traditional occurrence policy, actual losses may not be reported or known for some years (from a risk point of view) between the start of the exposure and the manifestation of loss or damage resulting from the exposure; The longer your tail coverage, the longer your protection can last. Get your instant quote now!

Source: producerpress.com

Source: producerpress.com

Long tail liability — the liability for claims that do not proceed to final settlement until a length of time beyond the policy year. For example, say you don�t renew your professional liability policy after it expired in september 2020. Ad small business general liability insurance that�s affordable & tailored for you! ( lɔŋ teɪl kleɪmz ) noun. High incurred but not reported (ibnr) claims contribute to this tail effect, since these losses are usually not settled until several years after the expiration of the policy in question.

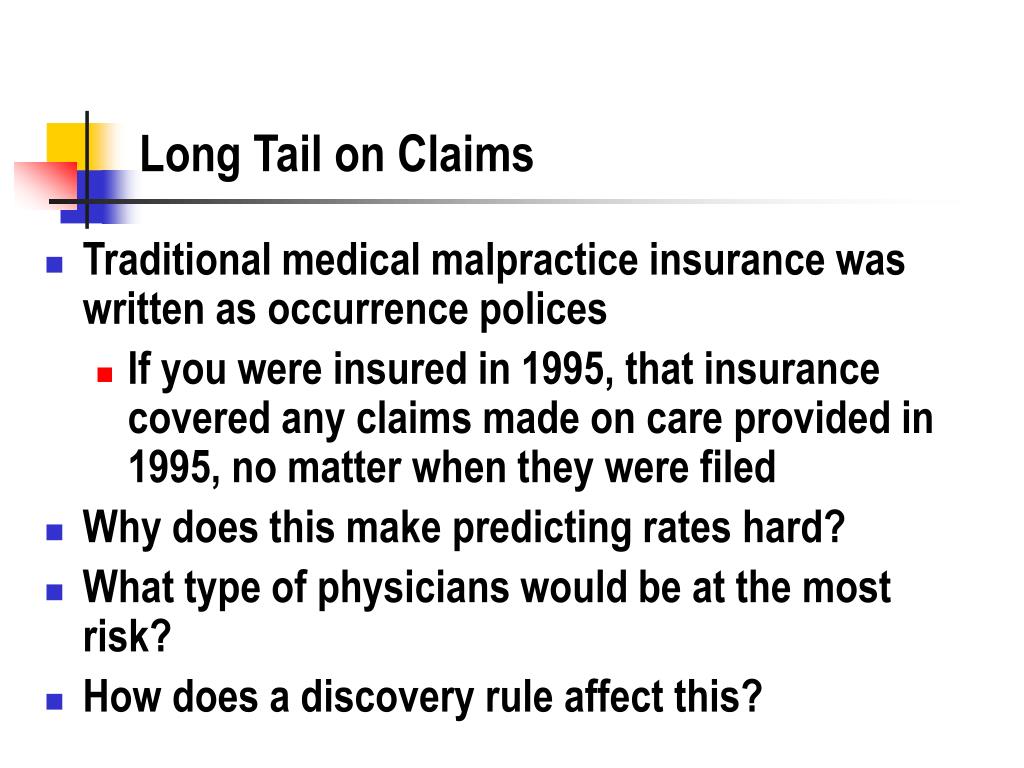

Source: slideserve.com

Source: slideserve.com

Because your policy wasn’t renewed, you add tail coverage for three years. For example, say you don�t renew your professional liability policy after it expired in september 2020. (from a risk point of view) between the start of the exposure and the manifestation of loss or damage resulting from the exposure; Ad small business general liability insurance that�s affordable & tailored for you! This delay may be caused by a long court case that must be settled first, or a lengthy investigation by the insurer.

Source: policyholderpulse.com

Source: policyholderpulse.com

Exposure to asbestos, and the storage of hazardous waste that slowly leaches into an aquifer, are paradigm examples. For example, say you don�t renew your professional liability policy after it expired in september 2020. Insurance of liability risks where notification and payment of claims are intrinsically delayed. They are liabilities for claims with long settlement periods, as. ( lɔŋ teɪl kleɪmz ) noun.

Source: massageliabilityinsurancegroup.com

Source: massageliabilityinsurancegroup.com

Free, unlimited and instant certificates of insurance online. Ad small business general liability insurance that�s affordable & tailored for you! A few common examples of long tail claims include (1) environmental claims involving pollution events that occur over many years (2) occupational disease such as asbestos claims and (3. Exposure to asbestos, which sometimes results in a lung disease called asbestos; Exposure to coal dust, which might cause black lung.

Source: slideserve.com

Source: slideserve.com

Get your instant quote now! Exposure to asbestos, and the storage of hazardous waste that slowly leaches into an aquifer, are paradigm examples. Because your policy wasn’t renewed, you add tail coverage for three years. However, in the liability insurance area under the traditional occurrence policy, actual losses may not be reported or known for some years Because the damage cannot be traced to a single incident or event, it can be difficult to identify which policies are implicated, and even more difficult, how the losses will be allocated among the insurers.

Source: gccapitalideas.com

Source: gccapitalideas.com

The longer your tail coverage, the longer your protection can last. Types of insurance in which claims may be made long after the end of the insured period. Long tail liability claims are claims that involve a continuous, progressive or repeated injury over long periods of time that implicate multiple policy years. Your client sues your business in october 2021 for an incident that occurred during your policy period. These claims are usually associated with losses that are incurred but not reported during a policy period.

Source: professionalinforme.blogspot.com

Source: professionalinforme.blogspot.com

( lɔŋ teɪl kleɪmz ) noun. High incurred but not reported (ibnr) claims contribute to this tail effect, since these losses are usually not settled until several years after the expiration of the policy in question. Nature of the long tail problem in many insurance lines (especially property insurance lines) losses are known with reasonable certainty at the end of the policy period or shortly thereafter. Your client sues your business in october 2021 for an incident that occurred during your policy period. This delay may be caused by a long court case that must be settled first, or a lengthy investigation by the insurer.

Source: investopedia.com

Source: investopedia.com

For example, say you don�t renew your professional liability policy after it expired in september 2020. Types of insurance in which claims may be made long after the end of the insured period. However, in the liability insurance area under the traditional occurrence policy, actual losses may not be reported or known for some years Exposure to asbestos, and the storage of hazardous waste that slowly leaches into an aquifer, are paradigm examples. Exposure to coal dust, which might cause black lung.

Source: slideshare.net

Source: slideshare.net

For example, say you don�t renew your professional liability policy after it expired in september 2020. ( lɔŋ teɪl kleɪmz ) noun. This includes most casualty lines such as general liability, d&o, and workers’ compensation ”. A few common examples of long tail claims include (1) environmental claims involving pollution events that occur over many years (2) occupational disease such as asbestos claims and (3. Exposure to coal dust, which might cause black lung.

Source: slideserve.com

Source: slideserve.com

(from a liability point of view) between the act/behaviour that created the liability and the recognition of the liability; One where an injury or other harm takes time to become known and a claim may be separated from the circumstances that caused it by as many as 25 years or more. They are liabilities for claims with long settlement periods, as. However, in the liability insurance area under the traditional occurrence policy, actual losses may not be reported or known for some years This definition deals with the business strategy use of the term.

Source: nichesmakeriches.com

Source: nichesmakeriches.com

A few common examples of long tail claims include (1) environmental claims involving pollution events that occur over many years (2) occupational disease such as asbestos claims and (3. These claims are usually associated with losses that are incurred but not reported during a policy period. Long tail liability claims are claims that involve a continuous, progressive or repeated injury over long periods of time that implicate multiple policy years. Insurance of liability risks where notification and payment of claims are intrinsically delayed. Get your instant quote now!

Source: carriermanagement.com

Source: carriermanagement.com

Long tail liability — the liability for claims that do not proceed to final settlement until a length of time beyond the policy year. (from a risk point of view) between the start of the exposure and the manifestation of loss or damage resulting from the exposure; Because your policy wasn’t renewed, you add tail coverage for three years. One where an injury or other harm takes time to become known and a claim may be separated from the circumstances that caused it by as many as 25 years or more. They are liabilities for claims with long settlement periods, as.

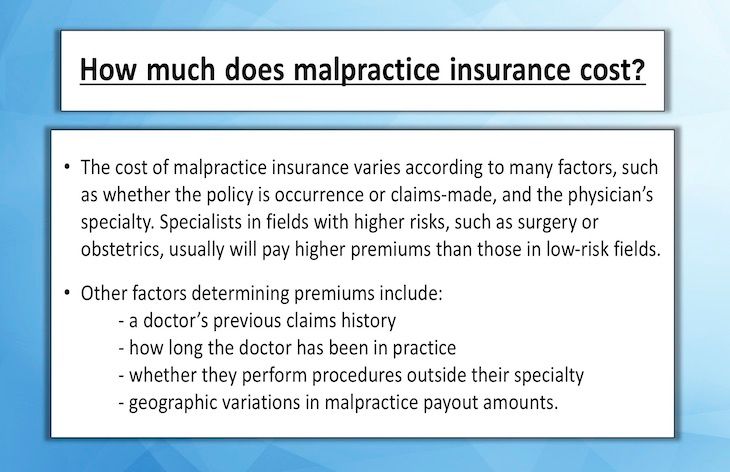

Source: medicaleconomics.com

Source: medicaleconomics.com

One where an injury or other harm takes time to become known and a claim may be separated from the circumstances that caused it by as many as 25 years or more. Exposure to asbestos, and the storage of hazardous waste that slowly leaches into an aquifer, are paradigm examples. Exposure to coal dust, which might cause black lung. They are liabilities for claims with long settlement periods, as. One where an injury or other harm takes time to become known and a claim may be separated from the circumstances that caused it by as many as 25 years or more.

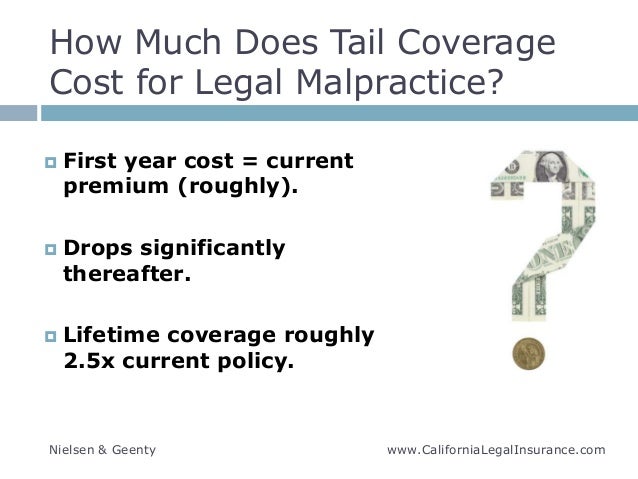

Source: slideshare.net

Source: slideshare.net

Nature of the long tail problem in many insurance lines (especially property insurance lines) losses are known with reasonable certainty at the end of the policy period or shortly thereafter. These claims are usually associated with losses that are incurred but not reported during a policy period. A few common examples of long tail claims include (1) environmental claims involving pollution events that occur over many years (2) occupational disease such as asbestos claims and (3. This definition deals with the business strategy use of the term. Exposure to asbestos, which sometimes results in a lung disease called asbestos;

Source: slideserve.com

Source: slideserve.com

This includes most casualty lines such as general liability, d&o, and workers’ compensation ”. The longer your tail coverage, the longer your protection can last. For example, say you don�t renew your professional liability policy after it expired in september 2020. This delay may be caused by a long court case that must be settled first, or a lengthy investigation by the insurer. Nature of the long tail problem in many insurance lines (especially property insurance lines) losses are known with reasonable certainty at the end of the policy period or shortly thereafter.

Source: vimeo.com

Source: vimeo.com

Your client sues your business in october 2021 for an incident that occurred during your policy period. Exposure to coal dust, which might cause black lung. High incurred but not reported (ibnr) claims contribute to this tail effect, since these losses are usually not settled until several years after the expiration of the policy in question. ( lɔŋ teɪl kleɪmz ) noun. Free, unlimited and instant certificates of insurance online.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title long tail liability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.