Long term care insurance vs disability insurance Idea

Home » Trend » Long term care insurance vs disability insurance IdeaYour Long term care insurance vs disability insurance images are available in this site. Long term care insurance vs disability insurance are a topic that is being searched for and liked by netizens today. You can Get the Long term care insurance vs disability insurance files here. Find and Download all free vectors.

If you’re looking for long term care insurance vs disability insurance pictures information connected with to the long term care insurance vs disability insurance interest, you have visit the ideal blog. Our site always gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that fit your interests.

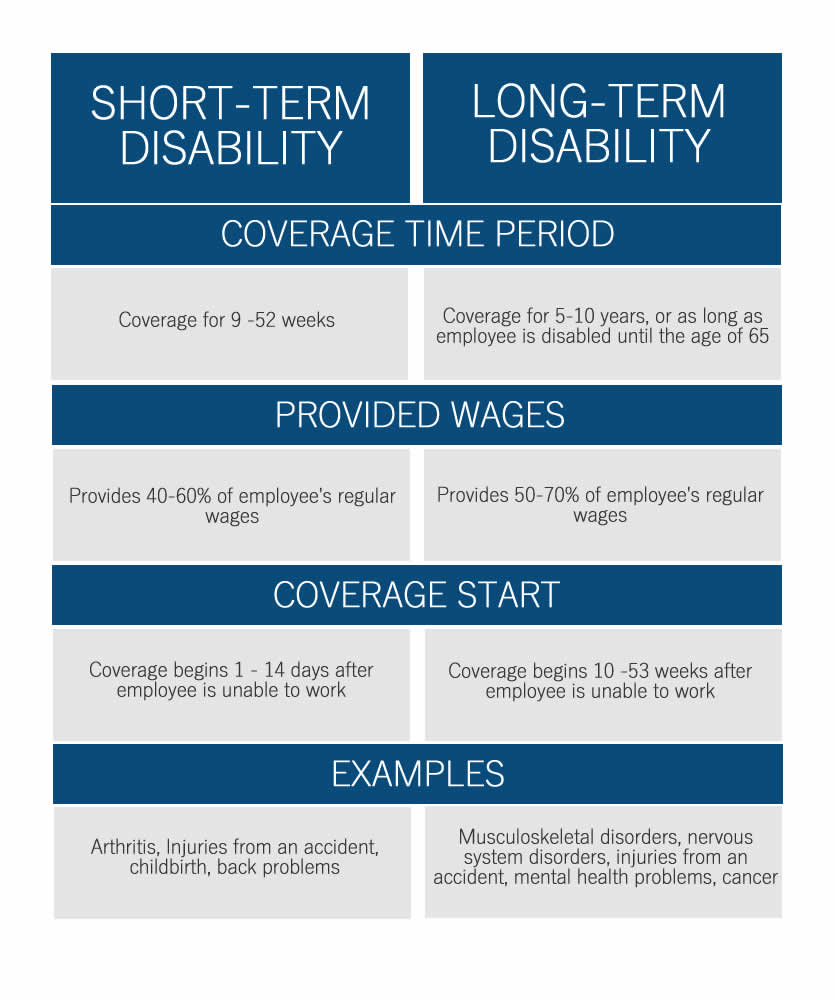

Long Term Care Insurance Vs Disability Insurance. Disability insurance replaces a portion of your income lost due to an inability to perform your job. Disability insurance protects your income in the event you can no longer work due to a disability or illness. The main difference between long term care insurance and disability insurance: Ltc is maintenance, not treatment.

Longterm Care vs. Longterm Disability… What’s the From tmait.org

Longterm Care vs. Longterm Disability… What’s the From tmait.org

Long term disability refers to an injury or illness that lasts over 26 weeks, making you unable to work and earn an income. Whereas ltd is designed to substitute a part of your income if you become unable to work, ltc aims to cover some of the costs of nursing home care, home health care, or adult daycare for beneficiaries who have difficulties taking care of. The cost of disability insurance is determined by a range of personal factors and policy choices. Tax qualified indemnity long term care compared to individual disability insurance benefit ltci you select the benefit from $1500 per month to $12,000 disability insurance the benefit is tied to your income and other coverage one may have in force. The truth is these two insurances, with very similar names, are very different. Though there are many similarities, the key difference is this:

An illness, injury, or accident can occur without warning, leaving you unable to work for a prolonged period of time.

First, a shorthand description of each: Long term care insurance ( ltci) and disability insurance ( di) both help you protect your assets, but they serve different purposes. 4 rows many individuals confuse long term disability and long term care insurance. Though there are many similarities, the key difference is this: At this point, medical professionals have done all they can, and all that’s left is recuperation or living with a disability that makes you require daily assistance. Long term disability may be caused by an auto accident, fall, or other types of unforeseen misfortunes.

Source: tmait.org

Source: tmait.org

The truth is these two insurances, with very similar names, are very different. How to qualify for a claim ltci Tax qualified indemnity long term care compared to individual disability insurance benefit ltci you select the benefit from $1500 per month to $12,000 disability insurance the benefit is tied to your income and other coverage one may have in force. At this point, medical professionals have done all they can, and all that’s left is recuperation or living with a disability that makes you require daily assistance. People sometimes confuse long term care insurance and long term disability insurance (ltd).

Source: zietzlaw.com

Source: zietzlaw.com

Typically the company can offer 55% of gross income. 4 rows many individuals confuse long term disability and long term care insurance. Tax qualified indemnity long term care compared to individual disability insurance benefit ltci you select the benefit from $1500 per month to $12,000 disability insurance the benefit is tied to your income and other coverage one may have in force. Long term care insurance protects your assets from the financial burden of a long term care event. How to qualify for a claim ltci

Source: geba.com

Source: geba.com

Long term care insurance protects your assets from the financial burden of a long term care event. It has nothing to do with an inability to perform activities of daily living or the activities of one’s occupation. To conquer some of that confusion, let’s dig a little deeper into what these insurance plans are and how they may benefit you. The truth is these two insurances, with very similar names, are very different. Long term care insurance protects your assets from the financial burden of a long term care event.

Source: hshlawyers.com

Source: hshlawyers.com

Disability insurance is protection against the loss of your income when you become disabled due to an injury or illness. To conquer some of that confusion, let’s dig a little deeper into what these insurance plans are and how they may benefit you. Though there are many similarities, the key difference is this: At this point, medical professionals have done all they can, and all that’s left is recuperation or living with a disability that makes you require daily assistance. Long term care insurance ( ltci) and disability insurance ( di) both help you protect your assets, but they serve different purposes.

Source: ehealthinsurance.com

Source: ehealthinsurance.com

People sometimes confuse long term care insurance and long term disability insurance (ltd). 4 rows many individuals confuse long term disability and long term care insurance. Whereas ltd is designed to substitute a part of your income if you become unable to work, ltc aims to cover some of the costs of nursing home care, home health care, or adult daycare for beneficiaries who have difficulties taking care of. Long term care insurance protects your assets from the financial burden of a long term care event. Long term care insurance ( ltci) and disability insurance ( di) both help you protect your assets, but they serve different purposes.

Source: erisaattorneys.com

Source: erisaattorneys.com

At this point, medical professionals have done all they can, and all that’s left is recuperation or living with a disability that makes you require daily assistance. It has nothing to do with an inability to perform activities of daily living or the activities of one’s occupation. People sometimes confuse long term care insurance and long term disability insurance (ltd). Tax qualified indemnity long term care compared to individual disability insurance benefit ltci you select the benefit from $1500 per month to $12,000 disability insurance the benefit is tied to your income and other coverage one may have in force. Ltc insurance pays for assistance to come.

Source: erisaattorneys.com

Source: erisaattorneys.com

It is essentially when it is unsafe for you to be alone due to physical or cognitive impairment. It has nothing to do with an inability to perform activities of daily living or the activities of one’s occupation. It is essentially when it is unsafe for you to be alone due to physical or cognitive impairment. Long term care insurance protects your assets from the financial burden of a long term care event. To conquer some of that confusion, let’s dig a little deeper into what these insurance plans are and how they may benefit you.

Source: healthinsurancefaqs.org

Source: healthinsurancefaqs.org

Disability insurance is protection against the loss of your income when you become disabled due to an injury or illness. Long term care insurance ( ltci) and disability insurance ( di) both help you protect your assets, but they serve different purposes. First, a shorthand description of each: Activities of daily living (adls) may include bathing, dressing, toileting, transferring, continence and eating. To conquer some of that confusion, let’s dig a little deeper into what these insurance plans are and how they may benefit you.

Source: definitoin.blogspot.com

Source: definitoin.blogspot.com

To conquer some of that confusion, let’s dig a little deeper into what these insurance plans are and how they may benefit you. The main difference between long term care insurance and disability insurance: Disability insurance protects your income in the event you can no longer work due to a disability or illness. Long term disability refers to an injury or illness that lasts over 26 weeks, making you unable to work and earn an income. The truth is these two insurances, with very similar names, are very different.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Activities of daily living (adls) may include bathing, dressing, toileting, transferring, continence and eating. 4 rows many individuals confuse long term disability and long term care insurance. The cost of disability insurance is determined by a range of personal factors and policy choices. Long term disability insurance replaces a portion of the income you’ll lose if you’re unable to work because of an injury or illness. Ltc insurance pays for assistance to come.

![]() Source: ltcconsumer.com

Source: ltcconsumer.com

It is essentially when it is unsafe for you to be alone due to physical or cognitive impairment. First, a shorthand description of each: Disability insurance is protection against the loss of your income when you become disabled due to an injury or illness. Long term disability may be caused by an auto accident, fall, or other types of unforeseen misfortunes. Though there are many similarities, the key difference is this:

Source: insuranceclaim-attorney.com

Source: insuranceclaim-attorney.com

Disability insurance is protection against the loss of your income when you become disabled due to an injury or illness. There are several similarities but there are also key differences: It’s about the need for assistance — when you can’t perform normal activities of life and you need help to function. 4 rows many individuals confuse long term disability and long term care insurance. Ltc is maintenance, not treatment.

Source: pinterest.com

Source: pinterest.com

Though there are many similarities, the key difference is this: Disability insurance replaces a portion of your income lost due to an inability to perform your job. How to qualify for a claim ltci Ltc insurance pays for assistance to come. It is essentially when it is unsafe for you to be alone due to physical or cognitive impairment.

Source: pinterest.com

Source: pinterest.com

Activities of daily living (adls) may include bathing, dressing, toileting, transferring, continence and eating. An illness, injury, or accident can occur without warning, leaving you unable to work for a prolonged period of time. Long term disability insurance replaces a portion of the income you’ll lose if you’re unable to work because of an injury or illness. Ltc insurance pays for assistance to come. Disability insurance protects your income in the event you can no longer work due to a disability or illness.

Source: insurancemining.blogspot.com

Source: insurancemining.blogspot.com

Disability insurance replaces a portion of your income lost due to an inability to perform your job. Whereas ltd is designed to substitute a part of your income if you become unable to work, ltc aims to cover some of the costs of nursing home care, home health care, or adult daycare for beneficiaries who have difficulties taking care of. To conquer some of that confusion, let’s dig a little deeper into what these insurance plans are and how they may benefit you. First, a shorthand description of each: Long term disability refers to an injury or illness that lasts over 26 weeks, making you unable to work and earn an income.

Source: semplesolutionsllc.com

Source: semplesolutionsllc.com

People sometimes confuse long term care insurance and long term disability insurance (ltd). It’s about the need for assistance — when you can’t perform normal activities of life and you need help to function. The main difference between long term care insurance and disability insurance: The qualifying disability may be job or task specific (unable to perform your particular job) or general (unable to. Disability insurance protects your income in the event you can no longer work due to a disability or illness.

Source: hollowaybenefitconcepts.com

Source: hollowaybenefitconcepts.com

Long term disability may be caused by an auto accident, fall, or other types of unforeseen misfortunes. Disability insurance is protection against the loss of your income when you become disabled due to an injury or illness. The truth is these two insurances, with very similar names, are very different. Long term care insurance protects your assets from the financial burden of a long term care event. Disability insurance replaces a portion of your income lost due to an inability to perform your job.

Source: geba.com

Source: geba.com

First, a shorthand description of each: First, a shorthand description of each: Ltc is maintenance, not treatment. The main difference between long term care insurance and disability insurance: Long term care insurance ( ltci) and disability insurance ( di) both help you protect your assets, but they serve different purposes.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title long term care insurance vs disability insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.