Long term vs short term insurance Idea

Home » Trend » Long term vs short term insurance IdeaYour Long term vs short term insurance images are ready. Long term vs short term insurance are a topic that is being searched for and liked by netizens today. You can Download the Long term vs short term insurance files here. Get all royalty-free photos and vectors.

If you’re looking for long term vs short term insurance pictures information connected with to the long term vs short term insurance topic, you have visit the ideal blog. Our site frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

Long Term Vs Short Term Insurance. In fact, the estimate costs of this policy are as follows: Leverty & associates law chtd. How your premiums can stay stable over such a long time (as the span of a human life) can be attributed to the magic of actuarial science, which can make fairly accurate. Long term plans offer annually renewable coverage, so you can keep the same plan for an extended period of time, but tend to cost a bit more.

How Long Is My Job Protected Under Fmla Job Retro From jobretro.blogspot.com

How Long Is My Job Protected Under Fmla Job Retro From jobretro.blogspot.com

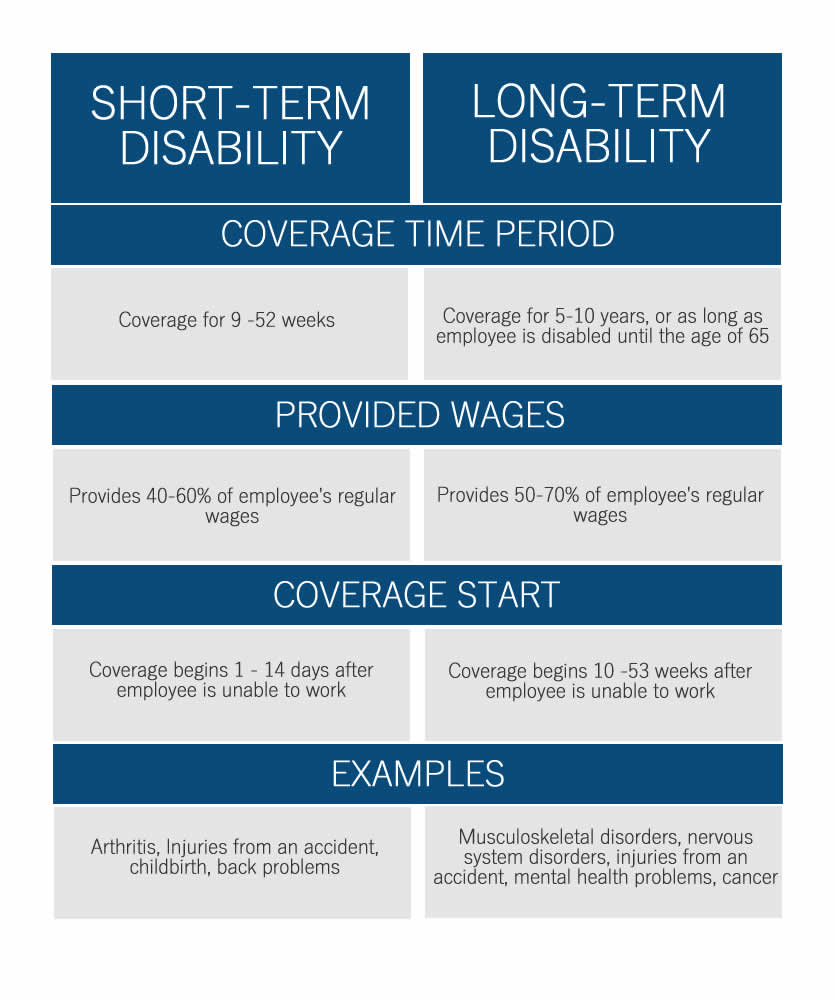

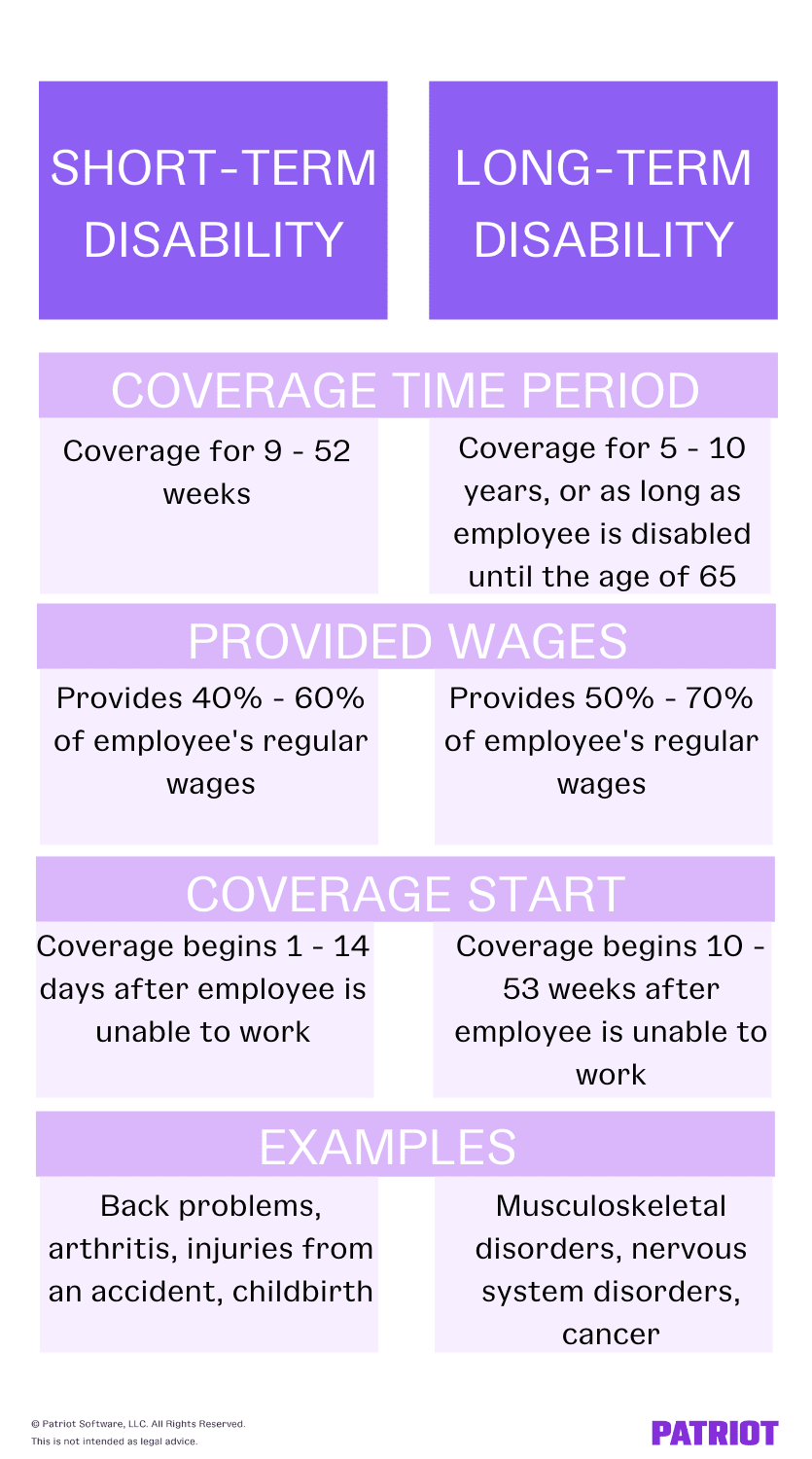

How your premiums can stay stable over such a long time (as the span of a human life) can be attributed to the magic of actuarial science, which can make fairly accurate. Looking at adding disability insurance to your employee benefits package? Policy benefits take effect immediately Substantial assistance substantial assistance refers to a. One of the primary distinctions of short term disability policy from the long term options is the length of the period it covers. Short term insurance policies tend to cover the smaller claims or something that you may be changing a lot.

How long will you need your insurance?

Remember that with any type of insurance cover, you are covering either a specific item or a specific eventuality. Leverty & associates law chtd. Short term health insurance versus long term. The longer the policy term, the more will. For periods of less than one year, a short term plan may be ideal. Let us help you weigh the pros and cons of short term and.

Source: wrsinsurancesolutions.com

Source: wrsinsurancesolutions.com

There are some short term policies that offer coverage up to one year, although those are rare. For short term disability insurance policies, the coverage would usually go from three to six months. One of the primary distinctions of short term disability policy from the long term options is the length of the period it covers. While long term health insurance has a tenure of 2 to 3 years, short term health insurance is for a period of up to 12 months. For periods of less than one year, a short term plan may be ideal.

Source: roylawgroup.com

Source: roylawgroup.com

Let us help you weigh the pros and cons of short term and. As you will be paying into a short term insurance policy for a lesser amount of time it is likely that the ‘benefits’ from the policy are far lower than what a long term policy would be able to provide you with. In fact, the estimate costs of this policy are as follows: When selecting between a long term and short term health insurance plan, it’s vital to ask yourself two general questions: Short term policies generally cover just the first few months you’re unable to work.

Source: jobretro.blogspot.com

Source: jobretro.blogspot.com

Despite the way it sounds, long term and short term insurance policies are not always about the length of time. California, hawaii, new jersey, new york, rhode island, and puerto rico require. Leverty & associates law chtd. One of the primary distinctions of short term disability policy from the long term options is the length of the period it covers. Despite the way it sounds, long term and short term insurance policies are not always about the length of time.

Source: view.barnumfg.com

Source: view.barnumfg.com

One of the primary distinctions of short term disability policy from the long term options is the length of the period it covers. Remember that with any type of insurance cover, you are covering either a specific item or a specific eventuality. California, hawaii, new jersey, new york, rhode island, and puerto rico require. Long term plans offer annually renewable coverage, so you can keep the same plan for an extended period of time, but tend to cost a bit more. The cost of a short term care policy is more affordable than long term care insurance.

Source: slideshare.net

Source: slideshare.net

Looking at adding disability insurance to your employee benefits package? The longer the policy term, the more will. Despite the way it sounds, long term and short term insurance policies are not always about the length of time. There are some short term policies that offer coverage up to one year, although those are rare. Short term insurance policies tend to cover the smaller claims or something that you may be changing a lot.

Source: fbsbenefits.com

Source: fbsbenefits.com

Leverty & associates law chtd. When selecting between a long term and short term health insurance plan, it’s vital to ask yourself two general questions: Short term insurance policies tend to cover the smaller claims or something that you may be changing a lot. Let us help you weigh the pros and cons of short term and. While long term health insurance has a tenure of 2 to 3 years, short term health insurance is for a period of up to 12 months.

Source: symboinsurance.com

Source: symboinsurance.com

Short term health insurance versus long term. In fact, the estimate costs of this policy are as follows: Another major difference is in their premium costs. For periods of less than one year, a short term plan may be ideal. Short term policies generally cover just the first few months you’re unable to work.

Source: view.barnumfg.com

Source: view.barnumfg.com

For periods of less than one year, a short term plan may be ideal. The cost of a short term care policy is more affordable than long term care insurance. Short term care insurance cost is actually the biggest selling point of this insurance product. For short term disability insurance policies, the coverage would usually go from three to six months. Let us help you weigh the pros and cons of short term and.

Source: towhomimayconcern.info

Source: towhomimayconcern.info

Remember that with any type of insurance cover, you are covering either a specific item or a specific eventuality. The longer the policy term, the more will. Another major difference is in their premium costs. To help you evaluate both ends of the spectrum, this article describes the benefits, length of coverage, and purpose of both short term and long term health insurance choices. How long will you need your insurance?

Source: sdtplanning.com

6 rows a long term health insurance plan offers coverage for more time as compared to a short term. As you will be paying into a short term insurance policy for a lesser amount of time it is likely that the ‘benefits’ from the policy are far lower than what a long term policy would be able to provide you with. With short term insurance you are covering possessions for the short term. The cost of a short term care policy is more affordable than long term care insurance. There are some short term policies that offer coverage up to one year, although those are rare.

Source: cpsinsurance.com

Source: cpsinsurance.com

Long term plans offer annually renewable coverage, so you can keep the same plan for an extended period of time, but tend to cost a bit more. While long term health insurance has a tenure of 2 to 3 years, short term health insurance is for a period of up to 12 months. While long term health insurance provides comprehensive coverage, short term health insurance covers major expenses against medical emergencies for a shorter duration. The primary distinction between short and long term disability insurance is the coverage period. Long term plans offer annually renewable coverage, so you can keep the same plan for an extended period of time, but tend to cost a bit more.

Source: progressiveli.org

Source: progressiveli.org

How your premiums can stay stable over such a long time (as the span of a human life) can be attributed to the magic of actuarial science, which can make fairly accurate. Another major difference is in their premium costs. Looking at adding disability insurance to your employee benefits package? Short term health insurance versus long term. Short term policies generally cover just the first few months you’re unable to work.

Source: patriotsoftware.com

Source: patriotsoftware.com

Short term care insurance cost is actually the biggest selling point of this insurance product. Remember that with any type of insurance cover, you are covering either a specific item or a specific eventuality. While long term health insurance has a tenure of 2 to 3 years, short term health insurance is for a period of up to 12 months. Another major difference is in their premium costs. Substantial assistance substantial assistance refers to a.

Source: parkerlawfirm.com

Short term insurance policies tend to cover the smaller claims or something that you may be changing a lot. Also, these plans are not renewable. To help you evaluate both ends of the spectrum, this article describes the benefits, length of coverage, and purpose of both short term and long term health insurance choices. When selecting between a long term and short term health insurance plan, it’s vital to ask yourself two general questions: Another major difference is in their premium costs.

Source: semplesolutionsllc.com

Source: semplesolutionsllc.com

Also, these plans are not renewable. With short term insurance you are covering possessions for the short term. Short term insurance policies tend to cover the smaller claims or something that you may be changing a lot. Long term plans offer annually renewable coverage, so you can keep the same plan for an extended period of time, but tend to cost a bit more. One of the primary distinctions of short term disability policy from the long term options is the length of the period it covers.

Source: insuranceclaim-attorney.com

Source: insuranceclaim-attorney.com

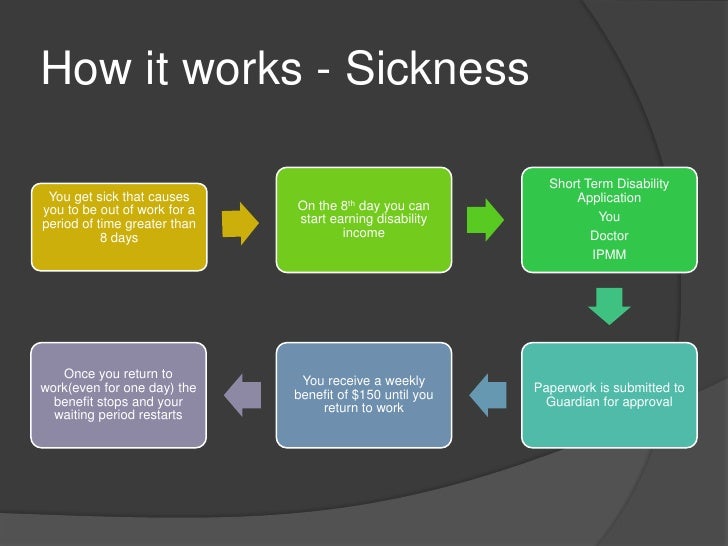

The longer the policy term, the more will. While short term disability insurance begins paying benefits within a couple weeks following a qualifying illness or injury, long term disability insurance requires a longer waiting period, called an “elimination period”, before a policyholder begins receiving benefits. With short term insurance you are covering possessions for the short term. Looking at adding disability insurance to your employee benefits package? For periods of less than one year, a short term plan may be ideal.

Source: hollowaybenefitconcepts.com

Source: hollowaybenefitconcepts.com

6 rows a long term health insurance plan offers coverage for more time as compared to a short term. Also, these plans are not renewable. The primary distinction between short and long term disability insurance is the coverage period. Looking at adding disability insurance to your employee benefits package? The longer the policy term, the more will.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title long term vs short term insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.