Loss of rent insurance Idea

Home » Trending » Loss of rent insurance IdeaYour Loss of rent insurance images are available. Loss of rent insurance are a topic that is being searched for and liked by netizens today. You can Download the Loss of rent insurance files here. Get all royalty-free photos.

If you’re searching for loss of rent insurance images information related to the loss of rent insurance topic, you have pay a visit to the ideal blog. Our site always gives you hints for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that fit your interests.

Loss Of Rent Insurance. Steady insurance agency llc or steady insurance agency llc�s brokers maintain excess and surplus lines broker licenses in every state where landlord rent default policies are bound and issued. As the name suggests, loss of rent insurance is a form of cover that safeguards landlords and letting agents against a loss of rent income. Only with, fire consequential loss insurance, full protection is obtained. Similarly, only certain expenses are covered under loss of use.

If I’m A Landlord, Will My Home Insurance Cover Loss Of Rent? From quoteme.ie

If I’m A Landlord, Will My Home Insurance Cover Loss Of Rent? From quoteme.ie

Loss of rent protection is intended to apply when a unit suffers damage which is covered under the strata insurance, and is then unable / unfit to be occupied for its intended purpose. Loss of use insurance is temporary and only certain types of loss are covered. What is loss of rental income insurance? We can help settle your claims for loss of rent. The loss of rent being the actual amount by which the rent during the indemnity period falls short of the rent which but for the damage would have been received by the insured ii. Similarly, only certain expenses are covered under loss of use.

Loss of use insurance is temporary and only certain types of loss are covered.

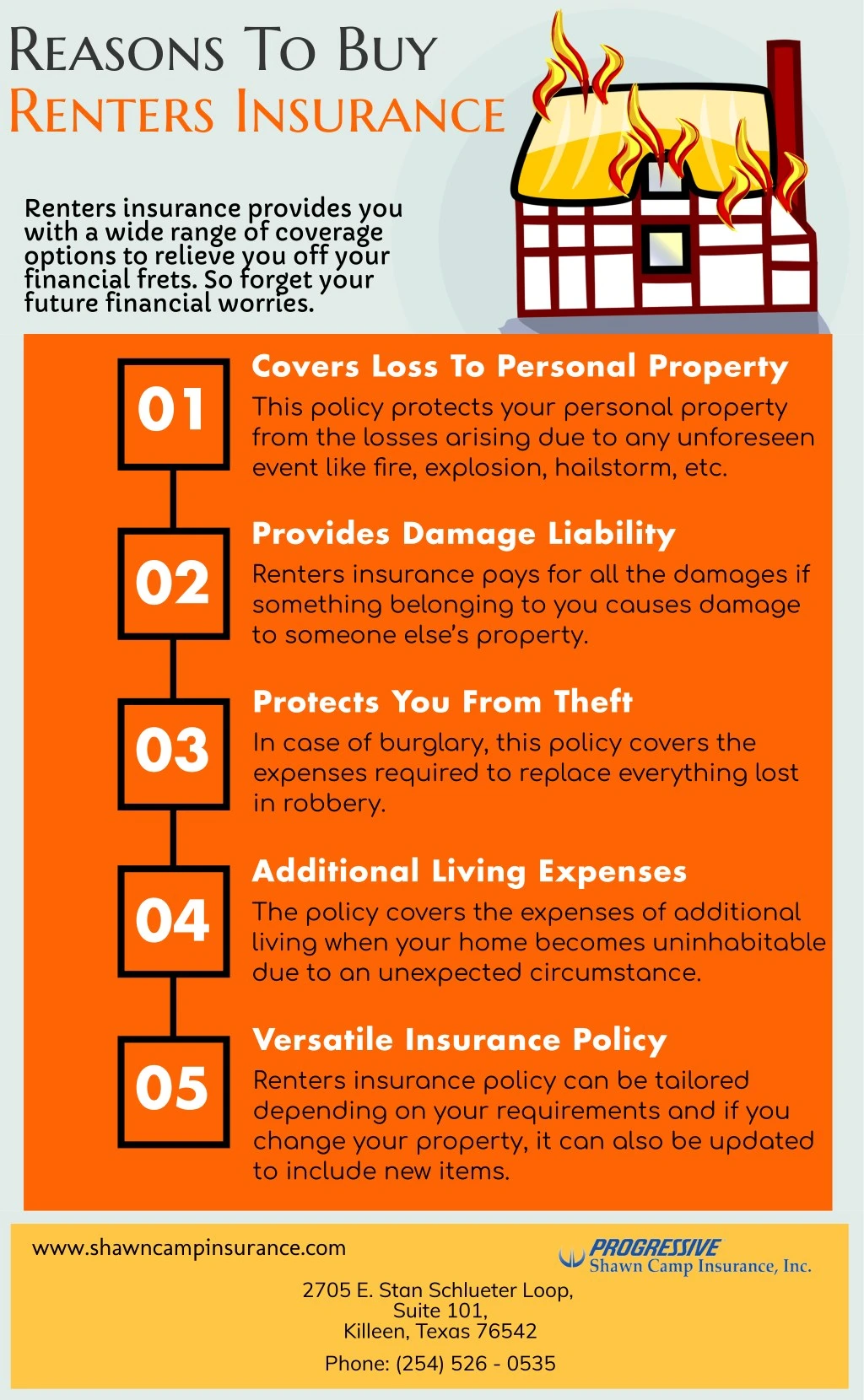

Loss of rent insurance covers the money you would lose, as a landlord, if your property becomes uninhabitable due to an insured event (e.g. A property owner’s or landlord’s policy which includes loss of rent insurance will cover you if your property is damaged by an insured event, such as vandalism, fire, flood, or another natural disaster. Duration of cover (e.g., 6 or 12 months) cover limits (e.g., £2,500 a month) there are usually limitation on a loss of rental income insurance policy. What to look out for. For example, your existing landlord insurance will cover you if someone accidentally puts their foot through your ceiling. As the name suggests, loss of rent insurance is a form of cover that safeguards landlords and letting agents against a loss of rent income.

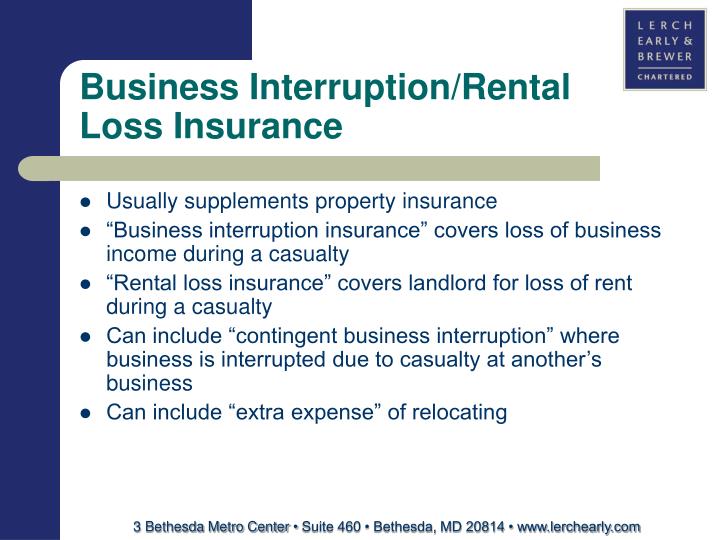

Source: slideshare.net

Source: slideshare.net

Loss of use insurance is temporary and only certain types of loss are covered. Rent loss insurance is used whenever some casualty event causes damage to the property, and that damage makes it so that the tenant can no longer stay at the property. To understand the coverage, under fire material damage policy and lop policy, consider the following diagram. What is loss of rent insurance? What will loss of rent insurance cover?

Source: simplelandlordsinsurance.com

Source: simplelandlordsinsurance.com

Loss of rent insurance covers the money you would lose, as a landlord, if your property becomes uninhabitable due to an insured event (e.g. What is loss of rent insurance? Rent guarantee insurance is a supplemental insurance option that can fill the gap. To understand the coverage, under fire material damage policy and lop policy, consider the following diagram. Loss of rent insurance covers rental payment losses when damage makes your rental unit uninhabitable.

Source: jdarringross.com

Source: jdarringross.com

Loss of use insurance covers the living expenses you incur if your rental home becomes uninhabitable. Loss of rent insurance would cover lost rental income during this period. We can help settle your claims for loss of rent. What will loss of rent insurance cover? © 2022 nationwide mutual insurance company.

Source: propertyinsurancecentre.co.uk

Source: propertyinsurancecentre.co.uk

Rent guarantee insurance is a supplemental insurance option that can fill the gap. Consequential loss insurance (loss of profit insurance) is concerned with the loss of earning power consequent upon the capital loss. Only with, fire consequential loss insurance, full protection is obtained. The first is the loss of rental income caused by property damage. If you have a loss of rent coverage under your landlord insurance, you could qualify for compensation for loss of rental income of the fair rental.

Source: youtube.com

Source: youtube.com

Rental income insurance is a type of coverage within a landlord insurance policy that can be applied to either a residential or commercial property. The loss of rent being the actual amount by which the rent during the indemnity period falls short of the rent which but for the damage would have been received by the insured ii. This type of insurance coverage generally has an end date, meaning it is only a temporary solution. It can help replace lost rent income if the property is temporarily uninhabitable after a claim. Loss of rent insurance is coverage that will pay out if you lose rental income.

Source: slideshare.net

Source: slideshare.net

Steady insurance agency llc or steady insurance agency llc�s brokers maintain excess and surplus lines broker licenses in every state where landlord rent default policies are bound and issued. Rental income insurance is a type of coverage within a landlord insurance policy that can be applied to either a residential or commercial property. Loss of use insurance is temporary and only certain types of loss are covered. Loss of rent insurance covers rental payment losses when damage makes your rental unit uninhabitable. We can help settle your claims for loss of rent.

Source: briscobusinessinsurance.co.uk

Source: briscobusinessinsurance.co.uk

Consequential loss insurance (loss of profit insurance) is concerned with the loss of earning power consequent upon the capital loss. For starters, there will be a limit on the monthly payout. Loss of rent protection is intended to apply when a unit suffers damage which is covered under the strata insurance, and is then unable / unfit to be occupied for its intended purpose. Similarly, only certain expenses are covered under loss of use. If you are a landlord and are unable to rent your property due to damage caused by fire, water, weather events, or other unforeseen circumstances.

Source: youngalfred.com

Source: youngalfred.com

If you are a landlord and are unable to rent your property due to damage caused by fire, water, weather events, or other unforeseen circumstances. In most cases landlords are not contractually obliged to provide alternative accommodation. Before buying loss of rent cover, check: Consequential loss insurance (loss of profit insurance) is concerned with the loss of earning power consequent upon the capital loss. A property owner’s or landlord’s policy which includes loss of rent insurance will cover you if your property is damaged by an insured event, such as vandalism, fire, flood, or another natural disaster.

We can help settle your claims for loss of rent. If you’re subletting out a room in your rented home, you can even get reimbursed for the loss of your rental income if a covered peril forces your tenant to move out. Consequential loss insurance (loss of profit insurance) is concerned with the loss of earning power consequent upon the capital loss. The loss of rent being the actual amount by which the rent during the indemnity period falls short of the rent which but for the damage would have been received by the insured ii. © 2022 nationwide mutual insurance company.

Source: lincolninsuranceagency.com

Source: lincolninsuranceagency.com

Loss of rent caused by denial of access at another premises within the vicinity of the insured property & loss or damage caused by an insured peril happening at the premises of a managing agent resulting in the reduction of rent at the insured premises. In these circumstances, if your property becomes uninhabitable as a result of an insured event like fire or flood, loss of rent insurance will cover the income you’ve lost as a result of your tenants no longer paying rent. The court held that it had therefore suffered a financial loss of rents. For starters, there will be a limit on the monthly payout. The loss of rent being the actual amount by which the rent during the indemnity period falls short of the rent which but for the damage would have been received by the insured ii.

Source: allstate.com

Source: allstate.com

A fire or flood) and your tenants are forced to move out. If your roof is damaged during a storm forcing your tenant to move out, loss of rent will cover your rental income. Because of a title defect, the insured had to pay its mortgage and other expenses but could not rent the building. Before buying loss of rent cover, check: As the name suggests, loss of rent insurance is a form of cover that safeguards landlords and letting agents against a loss of rent income.

Source: quoteme.ie

Source: quoteme.ie

Loss of rent insurance covers the money you would lose, as a landlord, if your property becomes uninhabitable due to an insured event (e.g. Loss of rent insurance would cover lost rental income during this period. To begin the loss of rent claims process, we’ll collect your lease agreements and expense reports to calculate all non. Damages must occur because of a covered peril to qualify for loss of rent coverage. Loss of rent protection is intended to apply when a unit suffers damage which is covered under the strata insurance, and is then unable / unfit to be occupied for its intended purpose.

Source: slideserve.com

Source: slideserve.com

Rent loss insurance is used whenever some casualty event causes damage to the property, and that damage makes it so that the tenant can no longer stay at the property. Rent loss insurance replaces the income lost due to damage beyond your control. This insurance is bought by the tenant and pays the monthly rent for a set period of. An opportunity cost is a financial loss If you’re subletting out a room in your rented home, you can even get reimbursed for the loss of your rental income if a covered peril forces your tenant to move out.

Source: upkeepmedia.com

Source: upkeepmedia.com

We can help settle your claims for loss of rent. Consequential loss insurance (loss of profit insurance) is concerned with the loss of earning power consequent upon the capital loss. However, if your tenants skip town or simply refuse to pay rent, rent loss won�t reimburse you. If you are a landlord and are unable to rent your property due to damage caused by fire, water, weather events, or other unforeseen circumstances. (1971) 21 cal.app.3d 222, 228, a title insurance policy covered loss of rents due to a defect in title.

Source: jdarringross.com

Source: jdarringross.com

Nationwide, the nationwide n and eagle are service marks of nationwide mutual insurance company. The first is a rent loss policy that is often included with landlord insurance or can be added on to a landlord insurance package very easily. Understand rent loss insurance rent loss insurance is available from most major property insurance companies. Loss of rent protection is intended to apply when a unit suffers damage which is covered under the strata insurance, and is then unable / unfit to be occupied for its intended purpose. This insurance is bought by the tenant and pays the monthly rent for a set period of.

Source: redrockmanagementlv.com

Source: redrockmanagementlv.com

This insurance is bought by the tenant and pays the monthly rent for a set period of. Loss of rent insurance is coverage that will pay out if you lose rental income. Loss of use insurance covers the living expenses you incur if your rental home becomes uninhabitable. The loss of rent being the actual amount by which the rent during the indemnity period falls short of the rent which but for the damage would have been received by the insured ii. Loss of rent insurance is cover designed for landlords so that if something happens to a property and your insured for it, you’ll not only get the problem fixed on your insurance, but you’ll also get your rent paid if tenants can’t live there while the problem is being fixed.

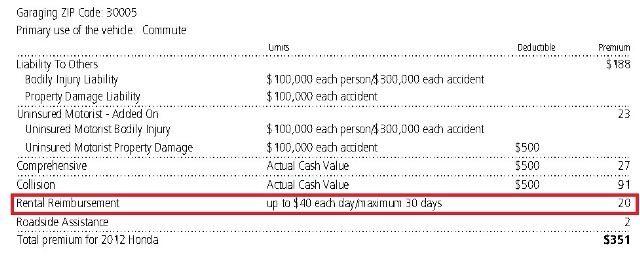

Source: diminishedvalueofgeorgia.com

Source: diminishedvalueofgeorgia.com

This type of insurance coverage generally has an end date, meaning it is only a temporary solution. Loss of use insurance is temporary and only certain types of loss are covered. What is loss of rental income insurance? Loss of rent insurance enables you to. What is loss of rent insurance?

Source: eskimales.blogspot.com

Source: eskimales.blogspot.com

If you’re subletting out a room in your rented home, you can even get reimbursed for the loss of your rental income if a covered peril forces your tenant to move out. To begin the loss of rent claims process, we’ll collect your lease agreements and expense reports to calculate all non. To understand the coverage, under fire material damage policy and lop policy, consider the following diagram. This cover is automatically included in most strata insurance policies, and is designed to protect the interests of the owner of the property, whether they are owner occupiers or landlords. Loss of rent insurance would cover lost rental income during this period.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title loss of rent insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.