Loss of use coverage home insurance information

Home » Trend » Loss of use coverage home insurance informationYour Loss of use coverage home insurance images are available in this site. Loss of use coverage home insurance are a topic that is being searched for and liked by netizens today. You can Download the Loss of use coverage home insurance files here. Find and Download all free photos.

If you’re searching for loss of use coverage home insurance images information related to the loss of use coverage home insurance keyword, you have come to the right blog. Our website always gives you suggestions for refferencing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

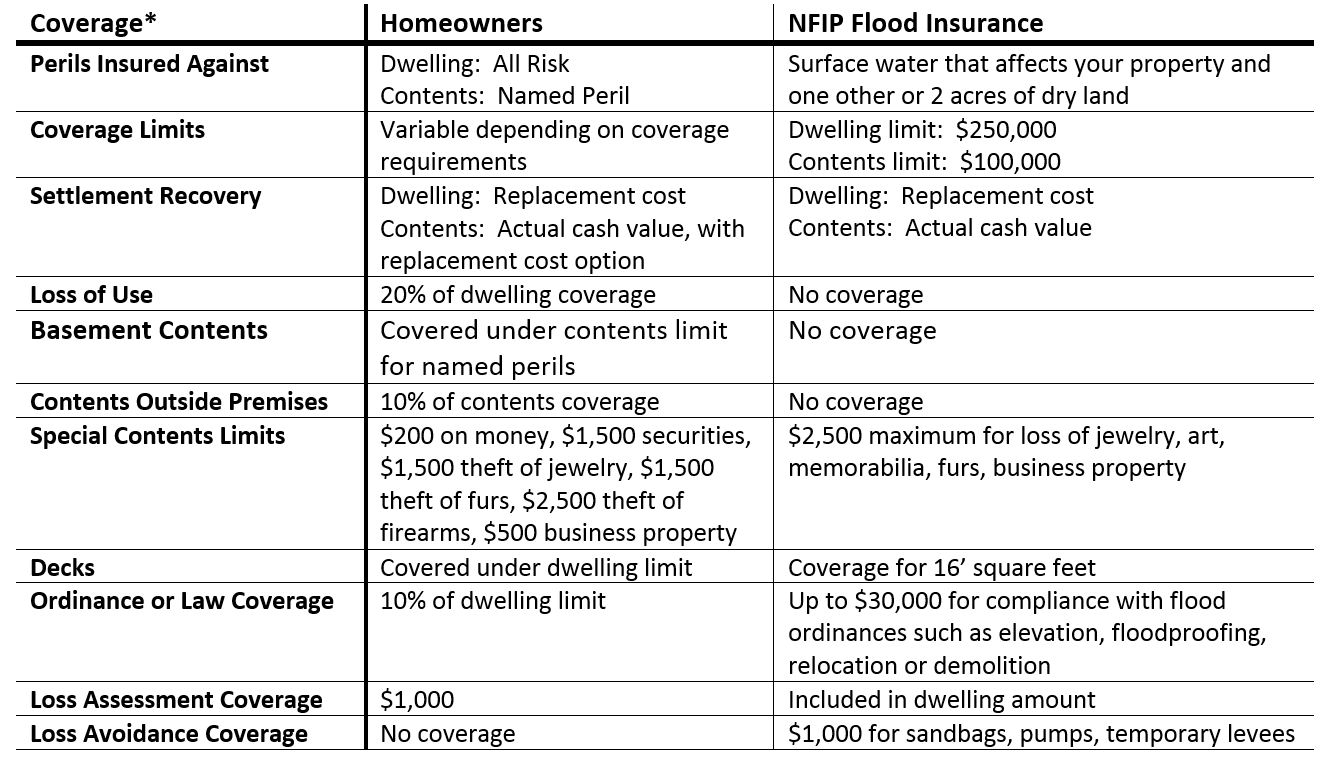

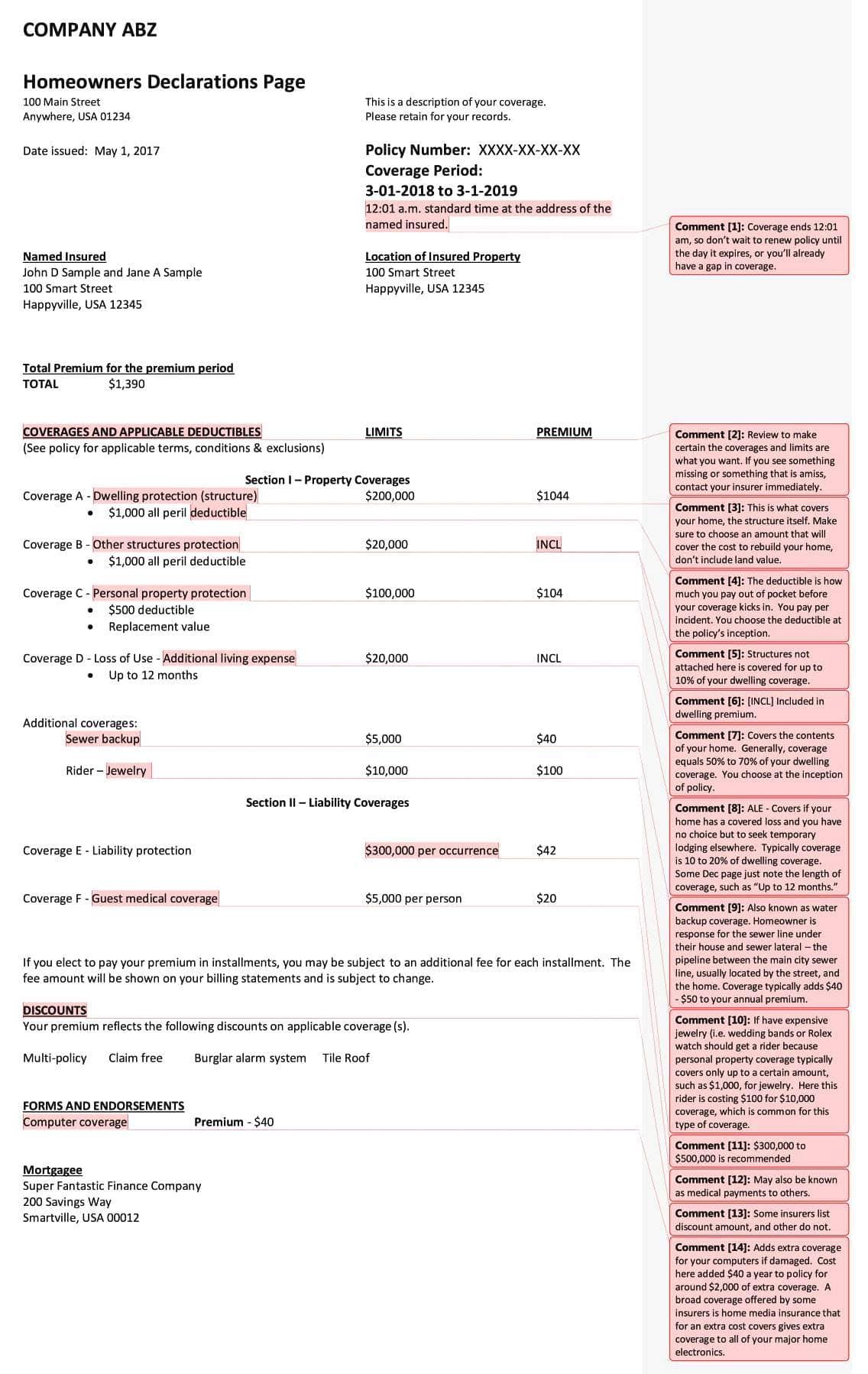

Loss Of Use Coverage Home Insurance. Loss of use coverage is included in standard homeowners insurance policies. Loss of use in home insurance is normally embedded within your home insurance policy. Loss of use coverage is a type of protection included on standard homeowners insurance policies that pays for financial loss if a home is damaged or destroyed by a covered hazard. This loss of use coverage includes things like additional living expenses, which are any extra expenses incurred by you and your family if your home is unlivable after a covered peril.

Red Cedar Insurance Agency From redcedaragency.com

What is loss of use coverage with home insurance and how does it work? There is a slight difference between loss of use in a homeowners policy and a renters insurance policy. This loss of use coverage includes things like additional living expenses, which are any extra expenses incurred by you and your family if your home is unlivable after a covered peril. Loss of use is typically included in most home insurance policies. Coverage for renters insurance works a little differently than home insurance. What does loss of use coverage mean in renters insurance?

It will cover additional expenses caused by the inability to use your home such as a hotel or motel stay, extra food costs, extra fuel mileage, and more.

What is loss of use insurance coverage? There is a slight difference between loss of use in a homeowners policy and a renters insurance policy. What is loss of use coverage? What does loss of use coverage mean in renters insurance? This means if your home has an insured value of $100,000, you will have a loss of use coverage of $20,000 to $30,000. What is a covered loss?

Source: redcedaragency.com

Many insurers have a loss of use coverage limit of 20% to 30% of your home’s insured value. But some top insurers like aig and chubb offer unlimited loss of use coverages. This means if your home has an insured value of $100,000, you will have a loss of use coverage of $20,000 to $30,000. Loss of use coverage (coverage d in homeowners and renters insurance) reimburses you for expenses if your home needs to be repaired. Loss of use is typically included in most home insurance policies.

Source: youtube.com

Source: youtube.com

Read more about what else may be covered under loss of use insurance and for tips on filing a. So if your home’s loss of use coverage is 30% then your loss of use benefits would be $90,000. Common covered losses include fire, theft, and vandalism. What is loss of use coverage? What is loss of use insurance coverage?

Source: pocketsense.com

Source: pocketsense.com

Loss of use coverage is included in standard homeowners insurance policies. It is also called additional living expenses (ale) coverage and coverage d. This loss of use coverage includes things like additional living expenses, which are any extra expenses incurred by you and your family if your home is unlivable after a covered peril. Loss of use coverage is insurance that helps pay for housing and living expenses when you�re unable to live in your home after a covered loss. It’s one of the six common insurance coverages you’ll find on your basic homeowners insurance policy, and one of five types on a renters insurance policy.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

We�ll detail the difference below. Loss of use is typically included in most home insurance policies. Say your home is valued by your insurance company at $300,000. Read more about what else may be covered under loss of use insurance and for tips on filing a. What does loss of use coverage mean in renters insurance?

Source: everquote.com

Source: everquote.com

A covered loss refers to the incident that caused the damage to your home, leading to it being repaired or rebuilt. Many insurers have a loss of use coverage limit of 20% to 30% of your home’s insured value. It’s one of the six common insurance coverages you’ll find on your basic homeowners insurance policy, and one of five types on a renters insurance policy. Loss of use coverage is a type of protection included on standard homeowners insurance policies that pays for financial loss if a home is damaged or destroyed by a covered hazard. What does loss of use coverage mean in renters insurance?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Loss of use coverage, also called additional living expenses (ale) refers to a situation where the home you rent is not usable for a period of time. Also known as coverage d in homeowners and renters insurance policies, loss of use can help you get back on your feet after a disaster strikes your home by reimbursing you for everyday living expenses. For example, if your total coverage limit is $200,000 and loss of use is at a 30% limit you will be covered up to $60,000. However, most companies also impose a coverage limit to these claims and it will usually depend on the total home insurance coverage. Loss of use coverage is typically anywhere between 20% to 30% of your home’s insured value and is baked into your home insurance premium.

Source: blogarama.com

Source: blogarama.com

This means if your home has an insured value of $100,000, you will have a loss of use coverage of $20,000 to $30,000. What is loss of use insurance coverage? Say your home is valued by your insurance company at $300,000. What is a covered loss? The loss of use portion of your homeowners and renters insurance (coverage d) reimburses you for the cost of additional living expenses when your home suffers a covered loss.

Source: raymondroe.com

Source: raymondroe.com

Insurance companies offer loss of use coverage for anywhere from 10% to 30% of the insured value of your home. It’s one of the six common insurance coverages you’ll find on your basic homeowners insurance policy, and one of five types on a renters insurance policy. Sometimes called additional living expenses (ale) insurance or coverage d, it can be added to your homeowners or renters insurance policy. Read more about what else may be covered under loss of use insurance and for tips on filing a. What is loss of use insurance coverage?

Source: housenotebook.com

Source: housenotebook.com

Loss of use coverage (coverage d in homeowners and renters insurance) reimburses you for expenses if your home needs to be repaired. Common covered losses include fire, theft, and vandalism. It is also called additional living expenses (ale) coverage and coverage d. However, most companies also impose a coverage limit to these claims and it will usually depend on the total home insurance coverage. Coverage for renters insurance works a little differently than home insurance.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

What is loss of use coverage? Loss of use coverage can help reimburse you for hotel, restaurant and other living expenses […] We�ll detail the difference below. What is loss of use coverage with home insurance and how does it work? Common covered losses include fire, theft, and vandalism.

Source: claimsmate.com

Source: claimsmate.com

For example, if your total coverage limit is $200,000 and loss of use is at a 30% limit you will be covered up to $60,000. What does loss of use coverage mean in renters insurance? Coverage for renters insurance works a little differently than home insurance. This means if your home has an insured value of $100,000, you will have a loss of use coverage of $20,000 to $30,000. Common covered losses include fire, theft, and vandalism.

Source: loanscalc.org

Source: loanscalc.org

Say your home is valued by your insurance company at $300,000. It covers the additional living expenses that occur when a home becomes unlivable due to an emergency, and you move out while it gets repaired. Coverage for renters insurance works a little differently than home insurance. Loss of use is typically included in most home insurance policies. Loss of use coverage assists homeowners and renters who move out of their homes due to a covered loss.

Source: insuranceschoices.blogspot.com

Source: insuranceschoices.blogspot.com

In short, if your home is uninhabitable due to a covered peril or prohibited use, loss of use coverage protects you from the extra costs of living elsewhere. What is loss of use insurance coverage? What is a covered loss? Many insurers have a loss of use coverage limit of 20% to 30% of your home’s insured value. Common covered losses include fire, theft, and vandalism.

Source: bridgeportbenedumfestival.com

Source: bridgeportbenedumfestival.com

It covers the additional living expenses that occur when a home becomes unlivable due to an emergency, and you move out while it gets repaired. What is loss of use insurance coverage? But some top insurers like aig and chubb offer unlimited loss of use coverages. A typical home insurance policy includes loss of use coverage with a limit of 20% to 30% of your home’s insured value. In short, if your home is uninhabitable due to a covered peril or prohibited use, loss of use coverage protects you from the extra costs of living elsewhere.

Source: fbfs.com

Source: fbfs.com

In short, if your home is uninhabitable due to a covered peril or prohibited use, loss of use coverage protects you from the extra costs of living elsewhere. Read more about what else may be covered under loss of use insurance and for tips on filing a. There is a slight difference between loss of use in a homeowners policy and a renters insurance policy. But some top insurers like aig and chubb offer unlimited loss of use coverages. What is loss of use coverage with home insurance and how does it work?

Source: thankgoodnessforinsurance.org

Source: thankgoodnessforinsurance.org

What is loss of use coverage with home insurance and how does it work? What does loss of use coverage mean in renters insurance? It is also called additional living expenses (ale) coverage and coverage d. It covers the additional living expenses that occur when a home becomes unlivable due to an emergency, and you move out while it gets repaired. Loss of use coverage assists homeowners and renters who move out of their homes due to a covered loss.

Source: progressive.com

Source: progressive.com

Loss of use coverage (coverage d in homeowners and renters insurance) reimburses you for expenses if your home needs to be repaired. Loss of use is typically included in most home insurance policies. The loss of use coverage limit for home insurance is usually between 20% to 30% of your home’s insured value or your dwelling amount. This loss of use coverage includes things like additional living expenses, which are any extra expenses incurred by you and your family if your home is unlivable after a covered peril. However, most companies also impose a coverage limit to these claims and it will usually depend on the total home insurance coverage.

Source: finance.zacks.com

Source: finance.zacks.com

Say your home is valued by your insurance company at $300,000. Many insurers have a loss of use coverage limit of 20% to 30% of your home’s insured value. Say your home is valued by your insurance company at $300,000. Loss of use home insurance helps you pay for temporary living expenses when damage to your home and its contents prevents you from living there. Insurance companies offer loss of use coverage for anywhere from 10% to 30% of the insured value of your home.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site helpful, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title loss of use coverage home insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.