Loss payee vs additional insured Idea

Home » Trend » Loss payee vs additional insured IdeaYour Loss payee vs additional insured images are ready. Loss payee vs additional insured are a topic that is being searched for and liked by netizens today. You can Download the Loss payee vs additional insured files here. Download all free photos and vectors.

If you’re searching for loss payee vs additional insured pictures information related to the loss payee vs additional insured interest, you have come to the right blog. Our site frequently provides you with suggestions for seeing the maximum quality video and image content, please kindly hunt and find more informative video articles and images that match your interests.

Loss Payee Vs Additional Insured. Irmi defines a “loss payee” as: In this case, the owner might request to be named as both an additional insured and a loss payee. Difference between additional insured and loss payee. In this regard, is a lienholder and additional insured?

Loss Payee vs. Lender’s Loss Payable Endorsements A Small From mojafarma.wordpress.com

Loss Payee vs. Lender’s Loss Payable Endorsements A Small From mojafarma.wordpress.com

So what are the differences between a loss payee and an additional insured? Loss payee refers to anyone who could receive payment under the policy after an approved claim. The difference is that additional insureds receive only liability protection whereas loss payees receive only property damage coverage. A lien holder may be an additional interest or an additional insured. Difference between additional insured and loss payee. A loss payee is always paid first because they have an insurable interest in the property.

However, if the building catches fire, the additional insured would have no legal first right to the claim proceeds to pay off the loan.

The additional insured can require that not only. An additional insured is considered a loss payee and the named insured, up to the limits of their insurable interest in the property. Although both terms refer to entities that are entitled to coverage under another company’s insurance policy, the difference between the two lies in which insurance policy will respond to a loss. Then the proper term would be “loss payee”. So far we have described the difference between an named insured, additional insured, additional interest, and a loss payee; An additional insured is a loss payee as respects its insurable interest in the object subject to policy coverage.

Source: mojafarma.wordpress.com

Source: mojafarma.wordpress.com

However, if the building catches fire, the additional insured would have no legal first right to the claim proceeds to pay off the loan. A lien holder may be an additional interest or an additional insured. Loss payee only refers to the person, people, or. Additional insured so, what is the difference between a loss payee & an additional insured? Other parties involved with your property may require special protection as part of your property insurance policy, and may ask to be named as a loss payee or additional insured. the terms are similar, but have very.

Source: insureon.com

Source: insureon.com

In this case, the owner might request to be named as both an additional insured and a loss payee. Sometimes the policyholder is obligated by contract to list additional insureds, such as when leasing space in a common building. Both additional insureds and loss payees are entitled to receive insurance benefits along with the named insured. While they may seem the same, these two terms mean very different things. A loss payee and additional insured are 2 separate concepts, although you can have both listed on your insurance policy.

Source: boomtowntools.com

Source: boomtowntools.com

Loss payee — a person or entity that is entitled to all or part of the insurance proceeds in connection with the covered property in which it has an interest. An additional insured is a loss payee as respects its insurable interest in the object subject to policy coverage. Difference between additional insured and loss payee. The additional insured can require that not only. Difference between additional insured and loss payee.

Source: firearmsinsuranceagent.com

Source: firearmsinsuranceagent.com

Are additional insured and loss payee the same thing? Additional insured so, what is the difference between a loss payee & an additional insured? For example, if you take out a loan to buy a car, and then get into an accident, an insurance company will make checks out to both you and your lender. Are additional insured and loss payee the same thing? So what are the differences between a loss payee and an additional insured?

Source: advisorsmith.com

Source: advisorsmith.com

While they may seem the same, these two terms mean very different things. Difference between additional insured and loss payee. Additional insured so, what is the difference between a loss payee & an additional insured? In this case, the owner might request to be named as both an additional insured and a loss payee. Loss payee only refers to the person, people, or.

Source: mojafarma.wordpress.com

Source: mojafarma.wordpress.com

Named insured and additional insured are two important examples of insurance policy terminology. For example, if you take out a loan to buy a car, and then get into an accident, an insurance company will make checks out to both you and your lender. In this case, the owner might request to be named as both an additional insured and a loss payee. Other parties involved with your property may require special protection as part of your property insurance policy, and may ask to be named as a loss payee or additional insured. the terms are similar, but have very. It is essential to understand both payment types to recognize their main differences.

The difference is that additional insureds receive only liability protection whereas loss payees receive only property damage coverage. Loss payee refers to anyone who could receive payment under the policy after an approved claim. For example, if you take out a loan to buy a car, and then get into an accident, an insurance company will make checks out to both you and your lender. A loss payee and additional insured are 2 separate concepts, although you can have both listed on your insurance policy. Other times an additional insured may be listed to protect those additional.

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

Source: westfieldautoinsuranceclaimsdeshinpi.blogspot.com

Additional insureds receive liability protection while loss payees receive property damage coverage. Other times an additional insured may be listed to protect those additional. An additional insured is considered a loss payee and the named insured, up to the limits of their insurable interest in the property. While they may seem the same, these two terms mean very different things. An entity or person listed as an additional insured on your business policy can have the liability protection of your insurance policy extended to them.

Source: ez.insure

Source: ez.insure

For example if an auto is leased, the leasing company will usually want to be listed as an additional insured as well as a lien holder or. An additional insured can receive coverage under another company’s liability insurance. The additional insured can require that not only. Insurance requirements for property vary depending on the situation. Sometimes the policyholder is obligated by contract to list additional insureds, such as when leasing space in a common building.

Source: ez.insure

Source: ez.insure

Are additional insured and loss payee the same thing? Difference between additional insured and loss payee. In this regard, is a lienholder and additional insured? So what are the differences between a loss payee and an additional insured? The difference is that additional insureds receive only liability protection whereas loss payees receive only property damage coverage.

Source: lenderkurokuta.blogspot.com

Source: lenderkurokuta.blogspot.com

Additional insureds receive liability protection while loss payees receive property damage coverage. In general terms, loss payees have first rights on claim payments for property losses.instead, additional insureds share in the maned insured’s liability coverage. Are additional insured and loss payee the same thing? A loss payee is always paid first because they have an insurable interest in the property. A loss payee and additional insured are 2 separate concepts, although you can have both listed on your insurance policy.

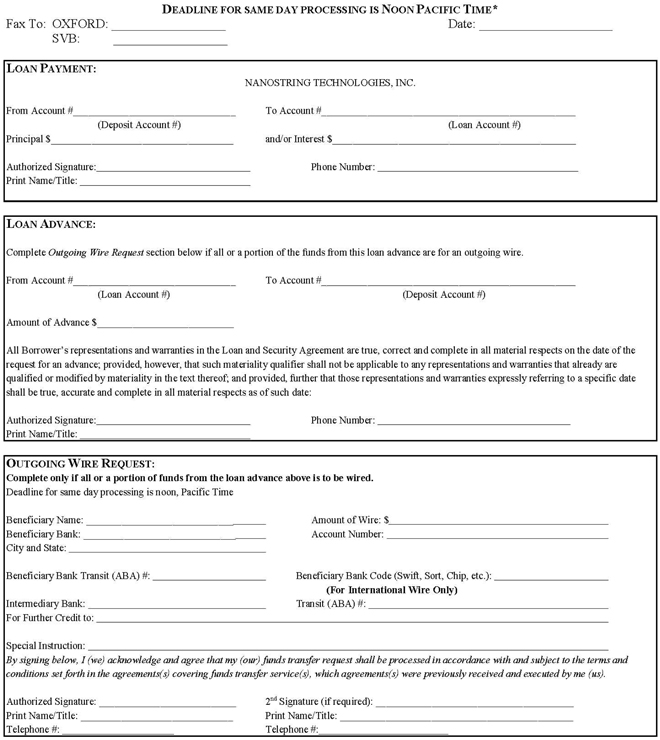

Source: sec.gov

Source: sec.gov

An additional insured is an entity that is added to an insured’s policy and receives the. In this case, the owner might request to be named as both an additional insured and a loss payee. Loss payee refers to anyone who could receive payment under the policy after an approved claim. However, if the building catches fire, the additional insured would have no legal first right to the claim proceeds to pay off the loan. In general terms, loss payees have first rights on claim payments for property losses.

Source: fundera.com

Source: fundera.com

Are additional insured and loss payee the same thing? Other parties involved with your property may require special protection as part of your property insurance policy, and may ask to be named as a loss payee or additional insured. the terms are similar, but have very. Loss payee — a person or entity that is entitled to all or part of the insurance proceeds in connection with the covered property in which it has an interest. However, if the building catches fire, the additional insured would have no legal first right to the claim proceeds to pay off the loan. In this case, the owner might request to be named as both an additional insured and a loss payee.

Even without being specified as a loss payee, it is understood that the additional insured has this status if an object of its insurable interest is damaged or destroyed. The most obvious difference between additional insureds and loss payees is in the insurance benefits that they receive. Other times an additional insured may be listed to protect those additional. Then the proper term would be “loss payee”. Additional insureds receive liability protection while loss payees receive property damage coverage.

Loss payee — a person or entity that is entitled to all or part of the insurance proceeds in connection with the covered property in which it has an interest. Often those asking to be named as loss payees have leased some type of equipment to the. A loss payee and additional insured are 2 separate concepts, although you can have both listed on your insurance policy. Insurance requirements for property vary depending on the situation. A lien holder may be an additional interest or an additional insured.

Source: school-site5.net

Source: school-site5.net

A loss payable endorsement will give the loss payee a share of the. An additional insured is a loss payee as respects its insurable interest in the object subject to policy coverage. An entity or person listed as an additional insured on your business policy can have the liability protection of your insurance policy extended to them. However, listing someone as an additional insured does not mean they. However, if the building catches fire, the additional insured would have no legal first right to the claim proceeds to pay off the loan.

Source: lenderkurokuta.blogspot.com

Source: lenderkurokuta.blogspot.com

This protects the lender from potential losses or unpaid loans. Additional insured so, what is the difference between a loss payee & an additional insured? In this case, the owner might request to be named as both an additional insured and a loss payee. A loss payee is always paid first because they have an insurable interest in the property. Other parties involved with your property may require special protection as part of your property insurance policy, and may ask to be named as a loss payee or additional insured. the terms are similar, but have very.

Source: fundera.com

Source: fundera.com

The difference is that additional insureds receive only liability protection whereas loss payees receive only property damage coverage. A lien holder may be an additional interest or an additional insured. In this case, the owner might request to be named as both an additional insured and a loss payee. However, if the building catches fire, the additional insured would have no legal first right to the claim proceeds to pay off the loan. Additional insureds receive liability protection while loss payees receive property damage coverage.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title loss payee vs additional insured by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.