Manufacturing insurance cost Idea

Home » Trending » Manufacturing insurance cost IdeaYour Manufacturing insurance cost images are available in this site. Manufacturing insurance cost are a topic that is being searched for and liked by netizens today. You can Find and Download the Manufacturing insurance cost files here. Download all royalty-free photos.

If you’re looking for manufacturing insurance cost pictures information linked to the manufacturing insurance cost topic, you have pay a visit to the ideal blog. Our website frequently gives you suggestions for seeking the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and graphics that match your interests.

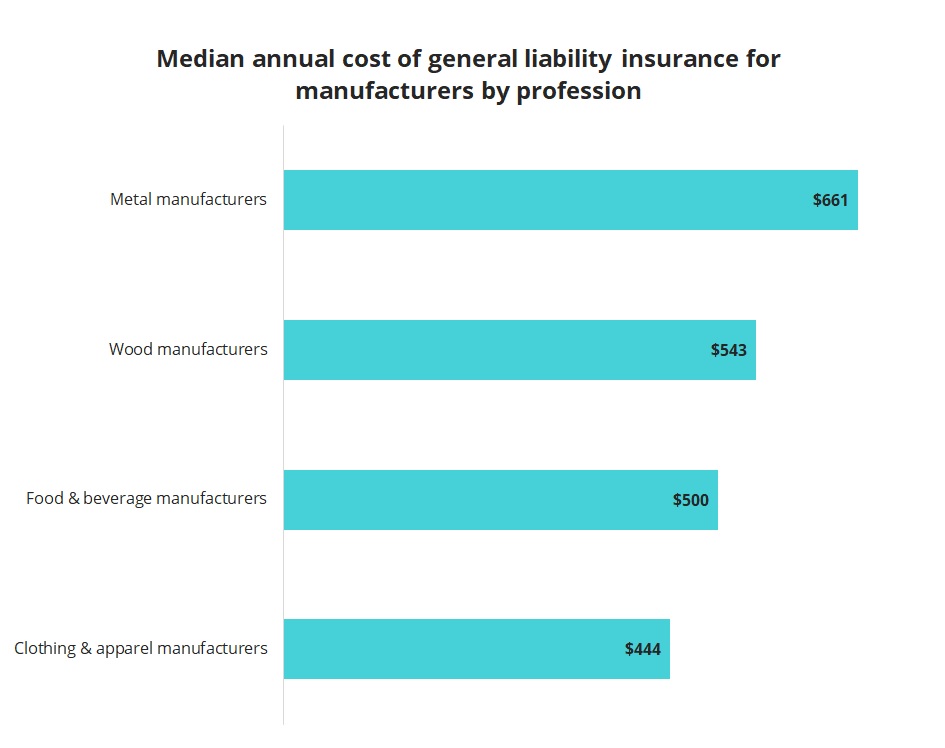

Manufacturing Insurance Cost. Your insurance cost will vary from other manufacturers because each business is exposed to different risks. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small chemical manufacturing businesses ranges from $97 to $159 per month based on location, size, revenue, claims history and more. Second, some insurance carriers will target one part of the firearms industry, such as retailers,or gunsmiths or ranges.very few have the underwriting expertise to provide full coverage for a wide range of gun and firearms businesses.this includes firearms and ammunition manufacturers, retailers, wholesalers, gunsmith operations, indoor/outdoor. The median workers’ compensation insurance premium for.

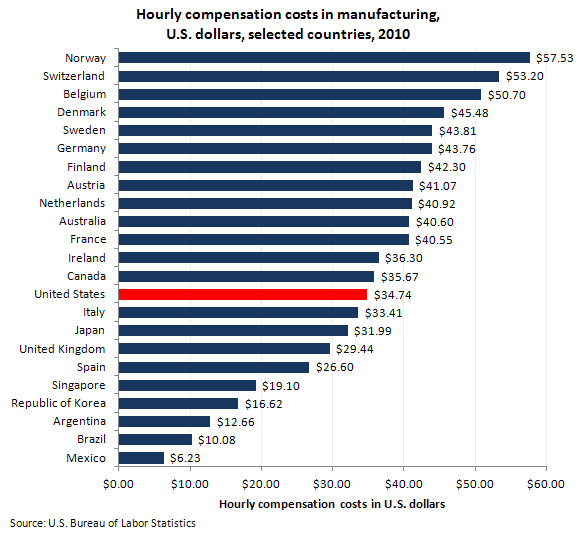

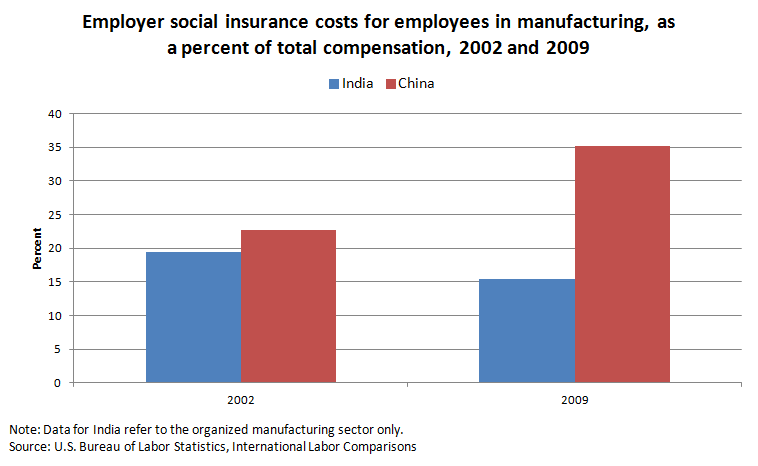

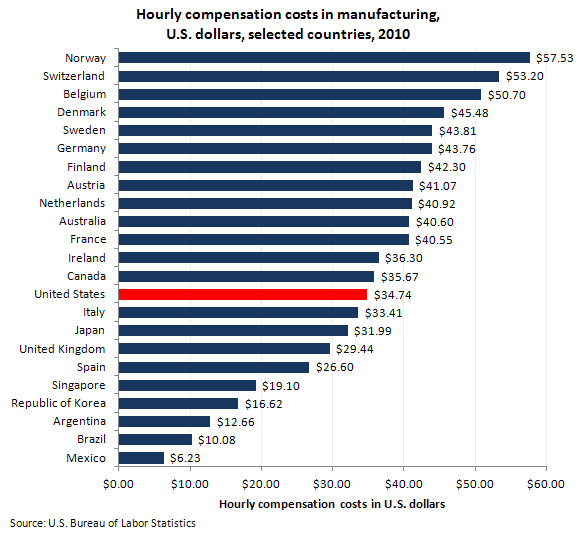

Manufacturing compensation costs in foreign countries and From bls.gov

Manufacturing compensation costs in foreign countries and From bls.gov

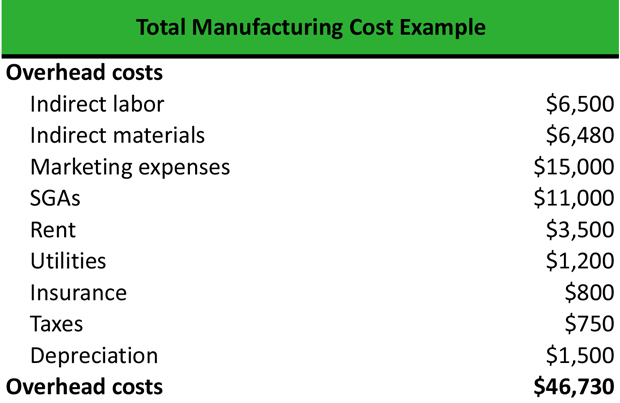

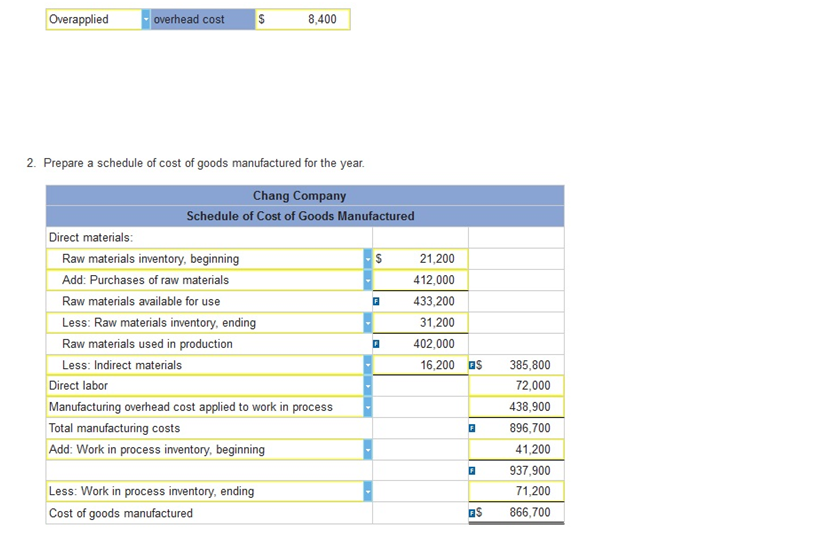

It is important to know what each element of your production process is costing you. Direct costs are generally seen to be variable costs and they are called They usually include indirect materials, indirect labor, salary of supervisor, lighting, heat and insurance cost of factory etc. Mosly, manufacturing overhead costs cannot be easily traced to individual units of finished. Along with costs such as direct material and direct labor, the cost of manufacturing overhead must be assigned to each unit produced so that. However, the insurance costs associated with the manufacturing function are included in the cost of the current period�s output.

Mosly, manufacturing overhead costs cannot be easily traced to individual units of finished.

It is important to know what each element of your production process is costing you. Get a manufacturing insurance quote today. Why do chemical manufacturers need insurance? To get manufacturing business insurance, you can work with independent agents or agents affiliated with insurance companies, like the hartford. You need to understand how to split your total manufacturing cost into its constituent parts. Workers’ compensation insurance costs for manufacturers.

Source: myaccountingcourse.com

Source: myaccountingcourse.com

Why do chemical manufacturers need insurance? The costs are typically presented in the income statement as separate line items. How much does manufacturing insurance cost? The costs of manufacturing our products; An entity incurs these costs during the production process.

Source: desplegandofuerza.blogspot.com

Examples of costs that are included in the manufacturing overhead category are as follows: 22,000 + $15,000 + $10,000 = $47,000 total manufacturing cost General liability insurance costs for manufacturers. This overhead is applied to the units produced within a reporting period. Why do chemical manufacturers need insurance?

Source: insureon.com

Source: insureon.com

They usually include indirect materials, indirect labor, salary of supervisor, lighting, heat and insurance cost of factory etc. The term, variable cost, then primarily refers to the manufacturing costs that are reflected in the inventory accounts: These qualities can include the types of machines and equipment used, your workplace environment, your vehicles, claims history, the number of people you employ and more. To get manufacturing business insurance, you can work with independent agents or agents affiliated with insurance companies, like the hartford. Insurance can provide protection for a variety of risks within a manufacturing business.

Source: homeworklib.com

Source: homeworklib.com

General liability insurance costs for manufacturers. Depreciation on equipment used in the production process Manufacturing overhead is all indirect costs incurred during the production process. Mosly, manufacturing overhead costs cannot be easily traced to individual units of finished. Total manufacturing cost is the sum of expenses associated with all the resources spent in the process of creating your finished product.

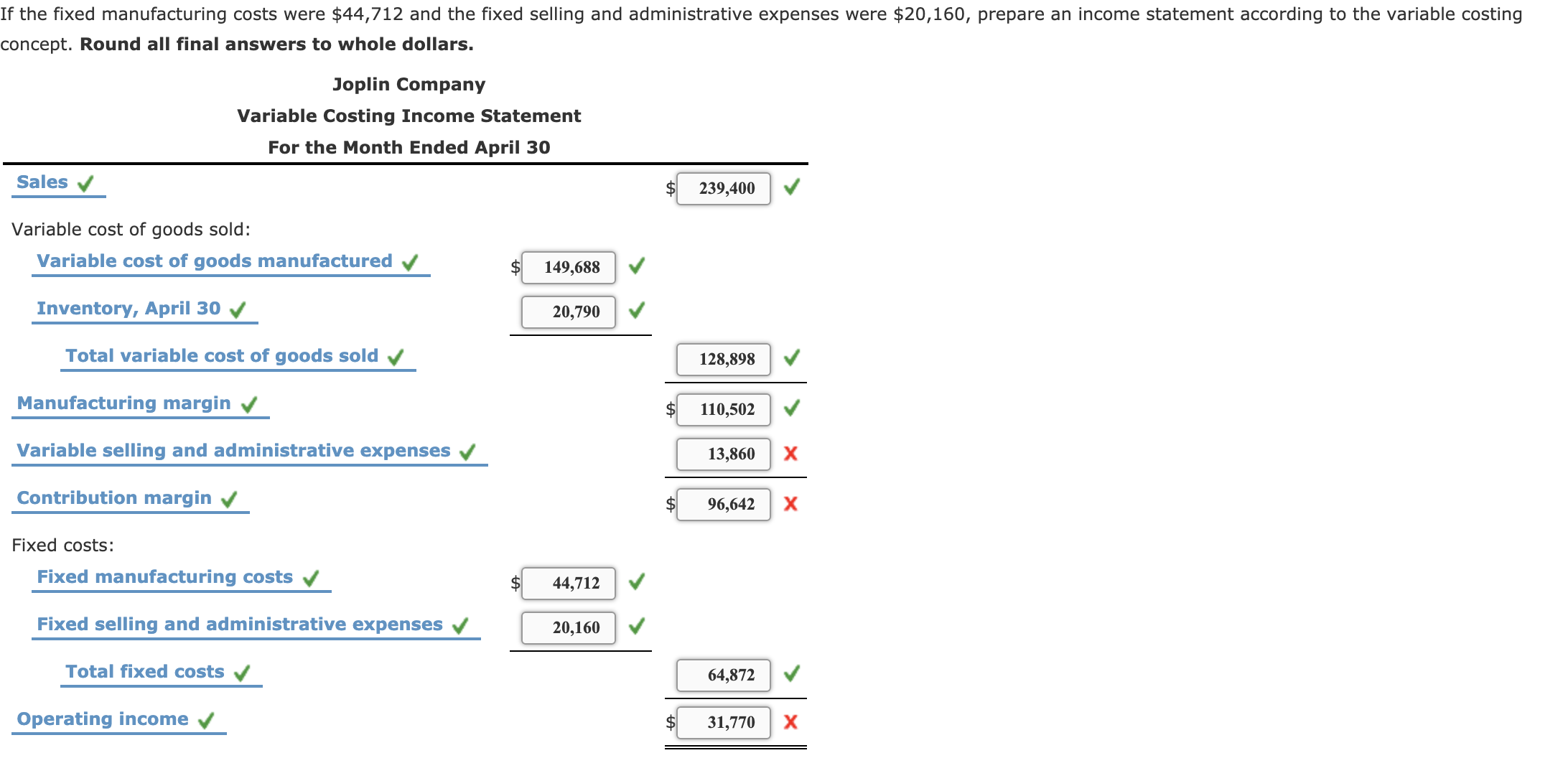

Source: chegg.com

Source: chegg.com

The term, variable expenses, refers to cost of goods sold and to other variable non manufacturing expenses such as sales people’s commissions. However, calculating and understanding it is not so obvious. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small chemical manufacturing businesses ranges from $97 to $159 per month based on location, size, revenue, claims history and more. For example, if you sell $500,000 worth of goods each year, your product liability insurance costs would be $1,250 (or 0.0025 * $500,000 ). How much does manufacturing insurance cost?

Source: accountingswork.blogspot.com

Source: accountingswork.blogspot.com

An entity incurs these costs during the production process. Direct costs are generally seen to be variable costs and they are called Keep your manufacturing business safe with commercial insurance coverage from intact insurance, canada�s largest commercial lines insurance company. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small chemical manufacturing businesses ranges from $97 to $159 per month based on location, size, revenue, claims history and more. 22,000 + $15,000 + $10,000 = $47,000 total manufacturing cost

Source: chegg.com

Source: chegg.com

Get a manufacturing insurance quote today. How much does business insurance cost for manufacturers? The term, variable cost, then primarily refers to the manufacturing costs that are reflected in the inventory accounts: Manufacturing costs other than direct materials and direct labor are categorized as manufacturing overhead cost (also known as factory overhead costs). Keep your manufacturing business safe with commercial insurance coverage from intact insurance, canada�s largest commercial lines insurance company.

Source: chegg.com

Source: chegg.com

Why do chemical manufacturers need insurance? Manufacturing costs are the costs incurred during the production of a product. Get a manufacturing insurance quote today. Some of the most common areas of coverage for manufacturers insurance include commercial auto insurance, workers compensation, and general liability. Whatever you manufacture, let intact protect you every step of the way.

Source: homeworklib.com

Source: homeworklib.com

Second, some insurance carriers will target one part of the firearms industry, such as retailers,or gunsmiths or ranges.very few have the underwriting expertise to provide full coverage for a wide range of gun and firearms businesses.this includes firearms and ammunition manufacturers, retailers, wholesalers, gunsmith operations, indoor/outdoor. Any prepaid insurance costs are to be reported as a current asset. Keep your manufacturing business safe with commercial insurance coverage from intact insurance, canada�s largest commercial lines insurance company. Manufacturing overhead is all indirect costs incurred during the production process. How much does business insurance cost for manufacturers?

Source: bls.gov

Source: bls.gov

How much does chemical manufacturers insurance cost? An entity incurs these costs during the production process. Whatever you manufacture, let intact protect you every step of the way. Here is your manufacturing overhead formula: Manufacturing costs other than direct materials and direct labor are categorized as manufacturing overhead cost (also known as factory overhead costs).

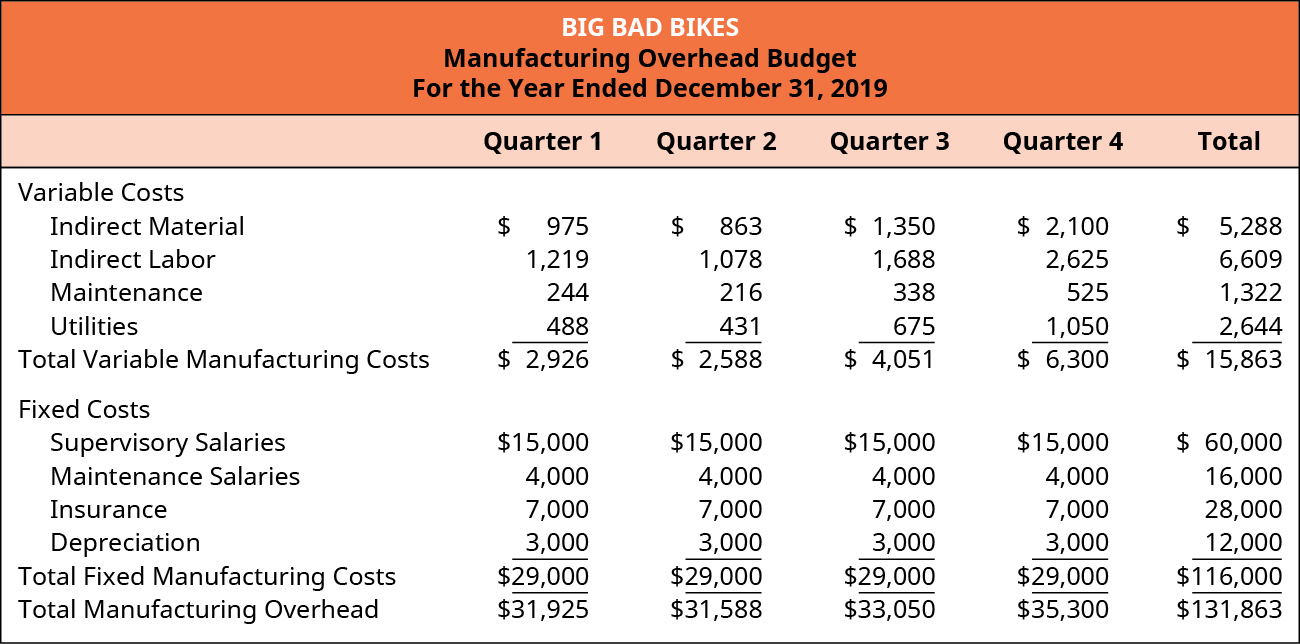

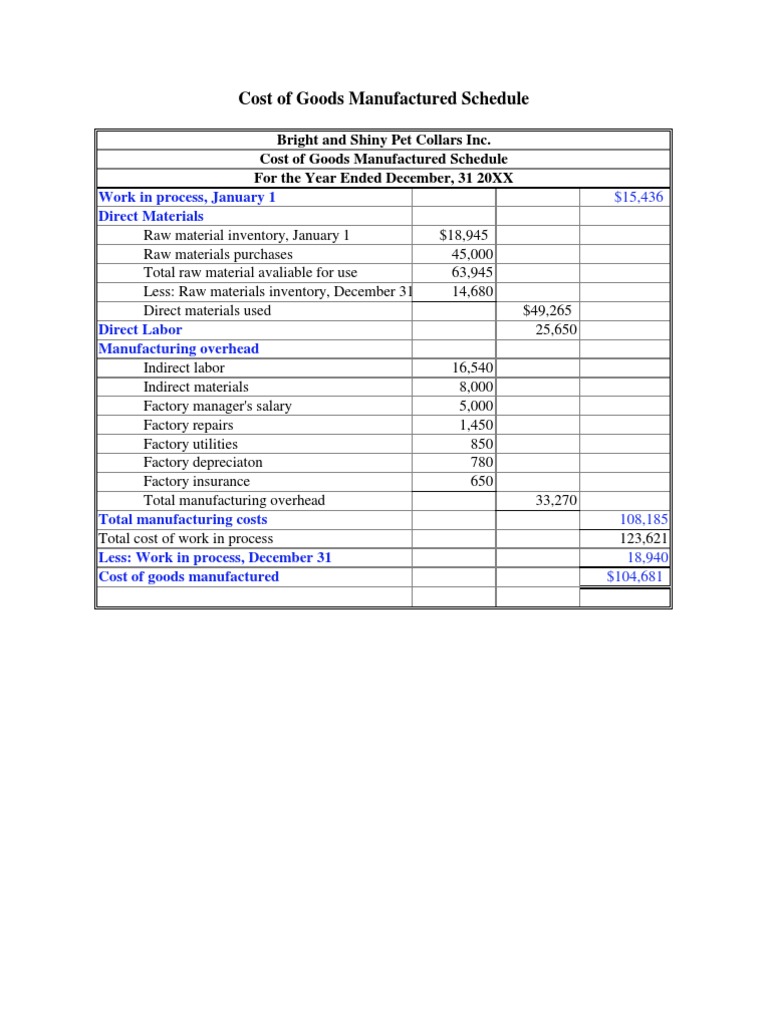

Source: opentextbc.ca

Source: opentextbc.ca

Second, some insurance carriers will target one part of the firearms industry, such as retailers,or gunsmiths or ranges.very few have the underwriting expertise to provide full coverage for a wide range of gun and firearms businesses.this includes firearms and ammunition manufacturers, retailers, wholesalers, gunsmith operations, indoor/outdoor. 22,000 + $15,000 + $10,000 = $47,000 total manufacturing cost Manufacturing costs other than direct materials and direct labor are categorized as manufacturing overhead cost (also known as factory overhead costs). If we had $15,000 in labor costs related to production (excluding general admin costs) and another $10,000 in manufacturing overhead (such as taxes, insurance and equipment depreciation), we would have the following: The median workers’ compensation insurance premium for.

Source: bls.gov

Source: bls.gov

The median workers’ compensation insurance premium for. Along with costs such as direct material and direct labor, the cost of manufacturing overhead must be assigned to each unit produced so that. To get manufacturing business insurance, you can work with independent agents or agents affiliated with insurance companies, like the hartford. Some of the most common areas of coverage for manufacturers insurance include commercial auto insurance, workers compensation, and general liability. Examples of costs that are included in the manufacturing overhead category are as follows:

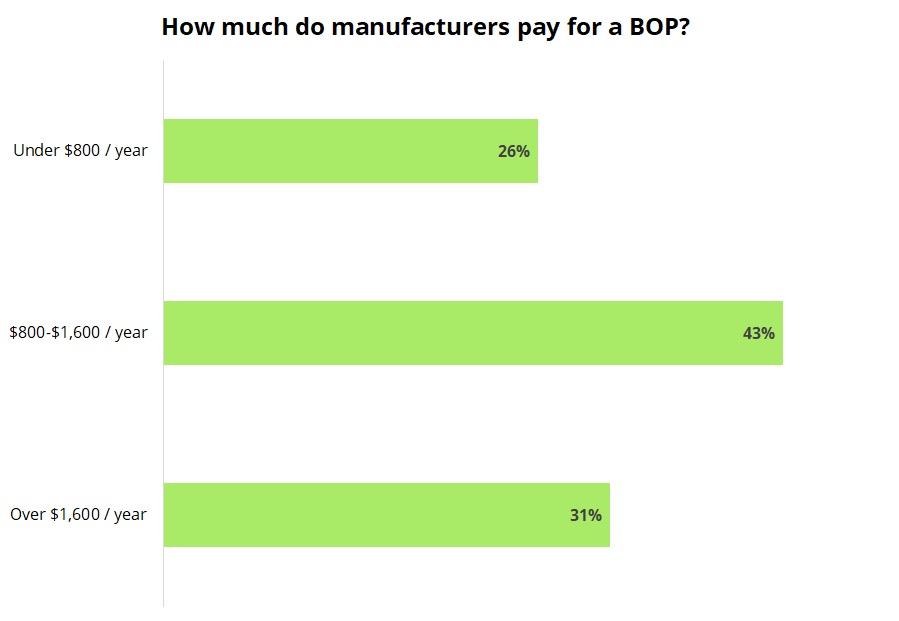

Source: insureon.com

Source: insureon.com

Examples of costs that are included in the manufacturing overhead category are as follows: Here is your manufacturing overhead formula: The costs of manufacturing our products; They usually include indirect materials, indirect labor, salary of supervisor, lighting, heat and insurance cost of factory etc. The average price of a standard $1,000,000/$2,000,000 general liability insurance policy for small chemical manufacturing businesses ranges from $97 to $159 per month based on location, size, revenue, claims history and more.

Source: chegg.com

Source: chegg.com

Workers’ compensation insurance costs for manufacturers. Let�s say a company had to pay $10,000 per quarter in rent, $6,000 per quarter in insurance, $1,000 per quarter in machine maintenance, and $12,000 per quarter in salary for a supervisor and a quality control professional. Manufacturing costs other than direct materials and direct labor are categorized as manufacturing overhead cost (also known as factory overhead costs). Mosly, manufacturing overhead costs cannot be easily traced to individual units of finished. Workers’ compensation insurance costs for manufacturers.

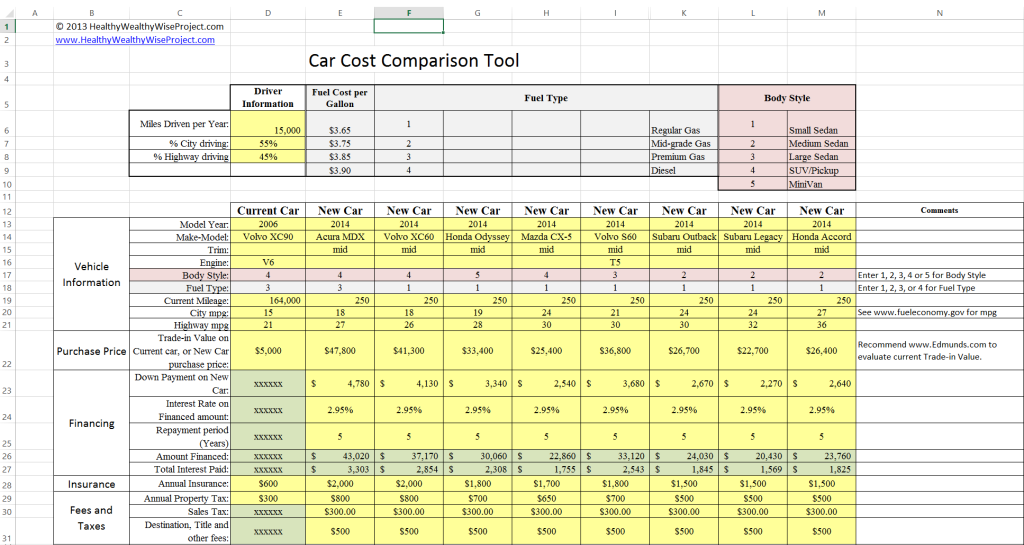

Source: healthywealthywiseproject.com

Source: healthywealthywiseproject.com

How much does chemical manufacturers insurance cost? Your rate ultimately depends on the unique qualities of your business. These qualities can include the types of machines and equipment used, your workplace environment, your vehicles, claims history, the number of people you employ and more. If we had $15,000 in labor costs related to production (excluding general admin costs) and another $10,000 in manufacturing overhead (such as taxes, insurance and equipment depreciation), we would have the following: These are the costs other than product costs that are charged to, debited to, or written off to the income statement each period.

Source: bartleby.com

Source: bartleby.com

As a student of management accounting, you should understand,. The idea behind having insurance is to protect the business from things like lawsuits, loss of personal and. Manufacturing costs are the costs incurred during the production of a product. Let�s say a company had to pay $10,000 per quarter in rent, $6,000 per quarter in insurance, $1,000 per quarter in machine maintenance, and $12,000 per quarter in salary for a supervisor and a quality control professional. Materials, work in process, and finished goods.

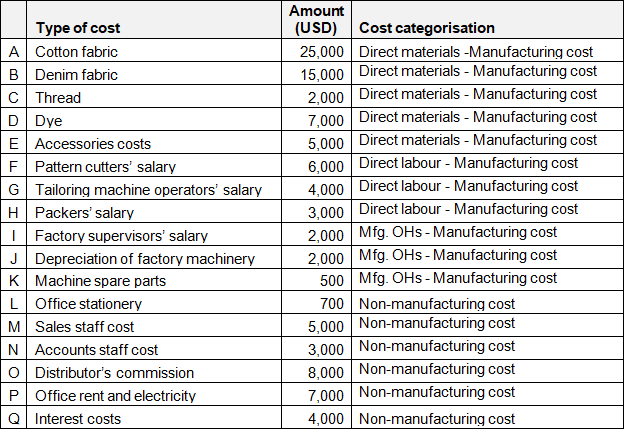

Source: termscompared.com

Source: termscompared.com

These costs include the costs of direct material, direct labor, and manufacturing overhead. Mosly, manufacturing overhead costs cannot be easily traced to individual units of finished. Let�s say a company had to pay $10,000 per quarter in rent, $6,000 per quarter in insurance, $1,000 per quarter in machine maintenance, and $12,000 per quarter in salary for a supervisor and a quality control professional. Second, some insurance carriers will target one part of the firearms industry, such as retailers,or gunsmiths or ranges.very few have the underwriting expertise to provide full coverage for a wide range of gun and firearms businesses.this includes firearms and ammunition manufacturers, retailers, wholesalers, gunsmith operations, indoor/outdoor. Manufacturers pay a median premium of less than $45 per month, or.

Insurance can provide protection for a variety of risks within a manufacturing business. How much does business insurance cost for manufacturers? The costs of manufacturing our products; A manufacturer will report on its income statement the insurance expense incurred for its selling, general and administrative functions. These costs include the costs of direct material, direct labor, and manufacturing overhead.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title manufacturing insurance cost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.