Manulife health insurance for visitors to canada Idea

Home » Trending » Manulife health insurance for visitors to canada IdeaYour Manulife health insurance for visitors to canada images are available. Manulife health insurance for visitors to canada are a topic that is being searched for and liked by netizens today. You can Get the Manulife health insurance for visitors to canada files here. Get all royalty-free photos.

If you’re looking for manulife health insurance for visitors to canada pictures information related to the manulife health insurance for visitors to canada topic, you have visit the ideal site. Our site frequently provides you with suggestions for viewing the maximum quality video and image content, please kindly search and find more enlightening video articles and images that fit your interests.

Manulife Health Insurance For Visitors To Canada. Manulife offers a huge package of options for visitors to canada including medical emergency coverage for super visa, iec/working holiday, tourists, new immigrants, temporary foreign workers, international students as well as for canadians returning from abroad. Can be purchased up to 365 days prior to arrival in canada; Visitors to canada travel insurance. Getting sick or hurt when you�re away from home is stressful enough without having to worry about the cost of the medical care you need.

Shop Online For Manulife and GSC Health Insurance From sbis.ca

Shop Online For Manulife and GSC Health Insurance From sbis.ca

A claim related to an illness arising during or before a waiting period is not covered. Manulife is offering their trademark “ coverme ” insurance for visitors to canada. Coverage amounts $15,000, $25,000, $50,000 or $100,000 to age 85; In case of a medical emergency, you must call our assistance centre: A few facts about this plan. Choose $15,000 to $150,000 in coverage.

Visitors to canada travel insurance.

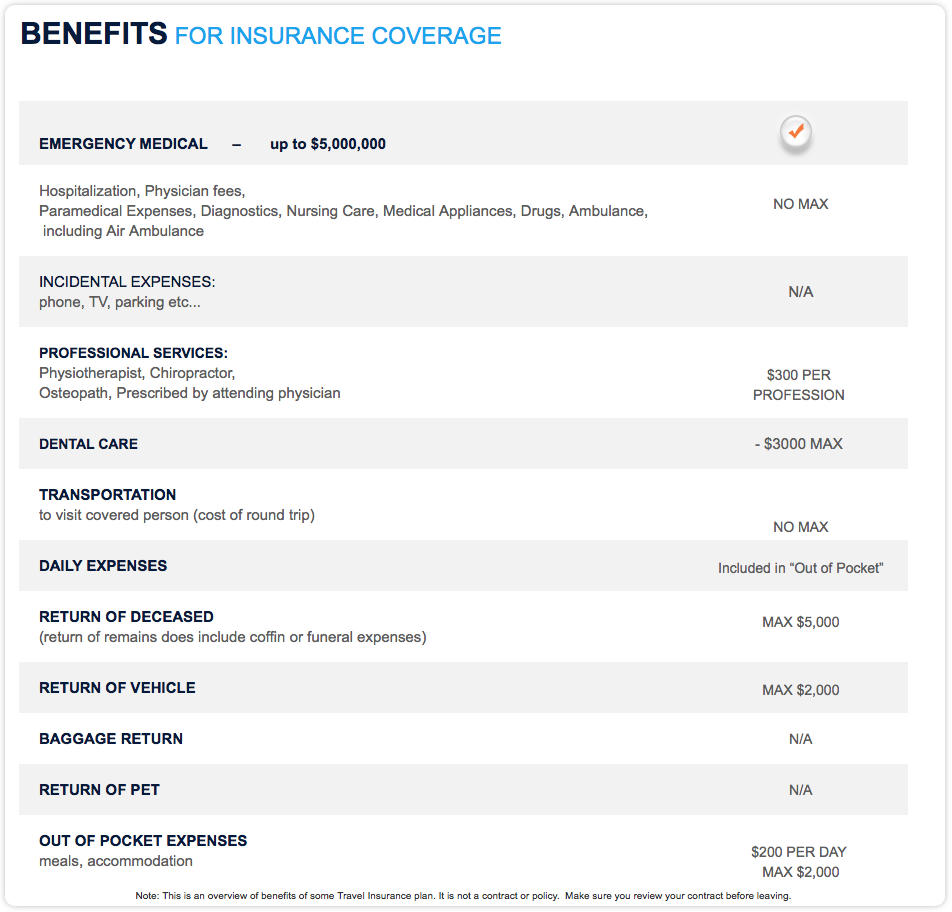

Visitors to canada travel insurance. Policy for visitors to canada. Manulife travel insurance for visitors to canada provides coverage for physician services, hospitalization, prescription drugs, emergency dental care and more, in the event of unexpected illness or injury that may occur during your trip. Since they wouldn’t be covered by the government�s health insurance plan, it’s important to make sure they have the right visitors to canada travel insurance. Protect family members age 30 days to 59 years; Travel insurance helps you get medical care wherever you are.

Source: canadatravelinsurancerate.com

Source: canadatravelinsurancerate.com

Getting sick or hurt when you�re away from home is stressful enough without having to worry about the cost of the medical care you need. A claim related to an illness arising during or before a waiting period is not covered. Protect family members age 30 days to 59 years. Manulife is offering their trademark “ coverme ” insurance for visitors to canada. A waiting period of 48 hours applies if this insurance is purchased after arrival in canada or after the expiry date of an existing manulife visitor to canada policy, as long as there is no increase in the coverage amount or change in the plan selected.

Source: in-love-in-fashion.blogspot.com

Source: in-love-in-fashion.blogspot.com

A few facts about this plan. Visitors to canada travel insurance. Who purchase visitors to canada emergency medical travel insurance. Key benefits on top of emergency health coverage in canada it extends coverage for short trips out of canada. Coverme travel insurance for visitors to canada plan is the manulife travel insurance product for individual protection that designed for visitors traveling to canada.

Source: neolyrics1.blogspot.com

Source: neolyrics1.blogspot.com

Key benefits on top of emergency health coverage in canada it extends coverage for short trips out of canada. Getting sick or hurt when you�re away from home is stressful enough without having to worry about the cost of the medical care you need. Coverme travel insurance for visitors to canada plan is the manulife travel insurance product for individual protection that designed for visitors traveling to canada. Travel insurance helps you get medical care wherever you are. A claim related to an illness arising during or before a waiting period is not covered.

Source: sbis.ca

Source: sbis.ca

A key requirement for a super visa application is to provide proof that you have a minimum of $100,000 private medical insurance from a canadian insurance company in place. Manulife travel insurance for visitors to canada provides coverage for physician services, hospitalization, prescription drugs, emergency dental care and more, in the event of unexpected illness or injury that may occur during your trip. Key benefits on top of emergency health coverage in canada it extends coverage for short trips out of canada. Since they wouldn’t be covered by the government�s health insurance plan, it’s important to make sure they have the right visitors to canada travel insurance. Getting sick or hurt when you�re away from home is stressful enough without having to worry about the cost of the medical care you need.

Source: neolyrics1.blogspot.com

Source: neolyrics1.blogspot.com

We don’t always plan for emergency health conditions while on a visit to our friends and families in canada but health challenges do not give warning notes before occurring. Coverage amount $150,000 to age 69; A key requirement for a super visa application is to provide proof that you have a minimum of $100,000 private medical insurance from a canadian insurance company in place. Key benefits on top of emergency health coverage in canada it extends coverage for short trips out of canada. Manulife travel insurance for visitors to canada provides coverage for physician services, hospitalization, prescription drugs, emergency dental care and more, in the event of unexpected illness or injury that may occur during your trip.

Source: sbis.ca

Source: sbis.ca

Cover $150,000 to age 69 Visitors to canada medical insurance manulife offers comprehensive health & travel insurance options for super visa program, tourists and visitors, new immigrants as well as other people without provincial medical coverage in canada. Manulife financial travel insurance for visitors to canada. Key benefits on top of emergency health coverage in canada it extends coverage for short trips out of canada. Manulife travel insurance for visitors to canada provides coverage for physician services, hospitalization, prescription drugs, emergency dental care and more, in the event of unexpected illness or injury that may occur during your trip.

Source: costeninsurance.com

Source: costeninsurance.com

This insurance is affordable and gives you a peace of mind in case of any unexpected medical emergencies. This insurance is affordable and gives you a peace of mind in case of any unexpected medical emergencies. Manulife travel insurance for visitors to canada provides coverage for physician services, hospitalization, prescription drugs, emergency dental care and more, in the event of unexpected illness or injury that may occur during your trip. Let�s see how they compare. Manulife financial travel insurance for visitors to canada.

Source: alaskaappdesign.blogspot.com

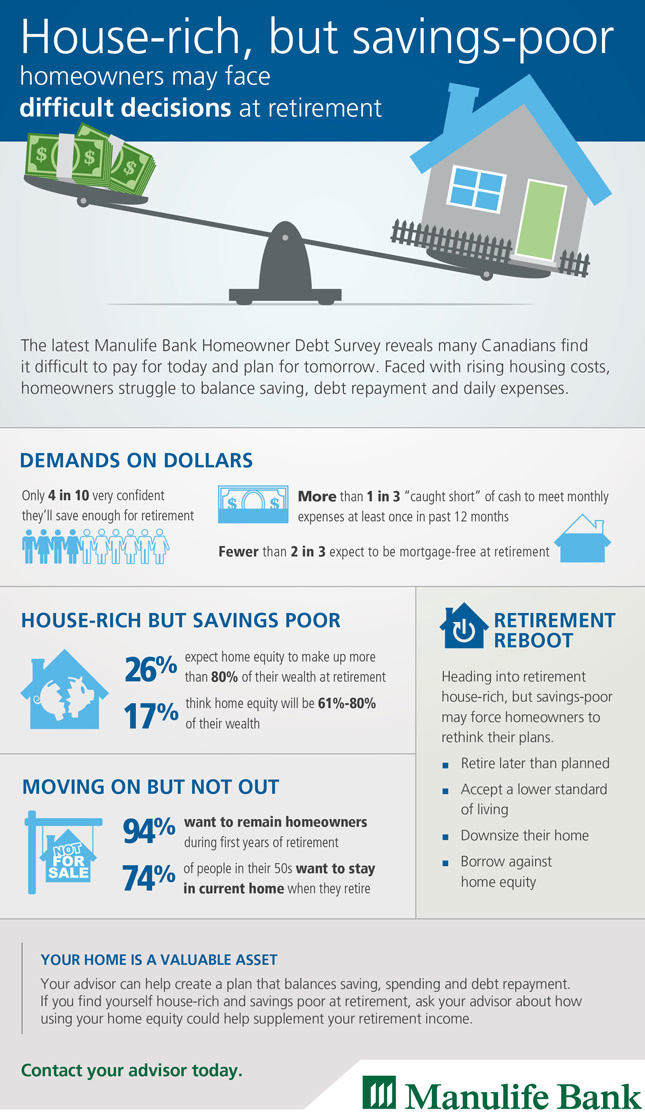

A key requirement for a super visa application is to provide proof that you have a minimum of $100,000 private medical insurance from a canadian insurance company in place. Visitors to canada medical insurance manulife offers comprehensive health & travel insurance options for super visa program, tourists and visitors, new immigrants as well as other people without provincial medical coverage in canada. It�s simple to get a quote and just as simple to purchase online. $15,000, $25,000, $50,000 or $100,000 to age 85. Sun life and manulife are top insurance companies in canada that offer a wide range of health coverage plans.

Source: bfinancial.com

Source: bfinancial.com

Manulife offers a huge package of options for visitors to canada including medical emergency coverage for super visa, iec/working holiday, tourists, new immigrants, temporary foreign workers, international students as well as for canadians returning from abroad. Visitors to canada travel insurance. A claim related to an illness arising during or before a waiting period is not covered. We don’t always plan for emergency health conditions while on a visit to our friends and families in canada but health challenges do not give warning notes before occurring. Getting sick or hurt when you�re away from home is stressful enough without having to worry about the cost of the medical care you need.

Source: manulife-travelinsurance.ca

Source: manulife-travelinsurance.ca

Who purchase visitors to canada emergency medical travel insurance. A waiting period of 48 hours applies if this insurance is purchased after arrival in canada or after the expiry date of an existing manulife visitor to canada policy, as long as there is no increase in the coverage amount or change in the plan selected. Who purchase visitors to canada emergency medical travel insurance. Emergency medical care up to $150,000 if you’re under 70, and up to $100,000 if you’re age 70 or over covers side trips from canada or a trip break to temporarily return to your country of origin* plans also include travel accident insurance for the coverage of accidental loss of sight, limb or life, up to $50,000 Travel insurance helps you get medical care wherever you are.

Source: youtube.com

Source: youtube.com

It�s simple to get a quote and just as simple to purchase online. Manulife is offering their trademark “ coverme ” insurance for visitors to canada. Protect family members age 30 days to 59 years. Manulife financial travel insurance for visitors to canada. It�s simple to get a quote and just as simple to purchase online.

Source: supervisabestinsurance.com

Source: supervisabestinsurance.com

Manulife is offering their trademark “ coverme ” insurance for visitors to canada. Protect family members age 30 days to 59 years; In case of a medical emergency, you must call our assistance centre: To apply for coverage, you or someone on your behalf must complete and sign the manulife coverme visitors to canada application for insurance form not more than 365 days before the efective date of coverage, and return it to us with your payment of the required premium. A waiting period of 48 hours applies if this insurance is purchased after arrival in canada or after the expiry date of an existing manulife visitor to canada policy, as long as there is no increase in the coverage amount or change in the plan selected.

Source: neolyrics1.blogspot.com

Source: neolyrics1.blogspot.com

A key requirement for a super visa application is to provide proof that you have a minimum of $100,000 private medical insurance from a canadian insurance company in place. Depending on your needs and budget, you can choose from one of five maximum coverage amounts: Can be purchased up to 365 days prior to arrival in canada; Coverme ® travel insurance provides essential protection, whether you�re a travelling canadian, a visitor to canada or a student. A claim related to an illness arising during or before a waiting period is not covered.

Source: visitorsinsurance.ca

Source: visitorsinsurance.ca

$15,000, $25,000, $50,000 or $100,000 to age 85. Who purchase visitors to canada emergency medical travel insurance. A few facts about this plan. Emergency medical care up to $150,000 if you’re under 70, and up to $100,000 if you’re age 70 or over covers side trips from canada or a trip break to temporarily return to your country of origin* plans also include travel accident insurance for the coverage of accidental loss of sight, limb or life, up to $50,000 Let�s see how they compare.

Source: neolyrics1.blogspot.com

Source: neolyrics1.blogspot.com

It�s simple to get a quote and just as simple to purchase online. Who purchase visitors to canada emergency medical travel insurance. Manulife travel insurance for visitors to canada provides coverage for physician services, hospitalization, prescription drugs, emergency dental care and more, in the event of unexpected illness or injury that may occur during your trip. Getting sick or hurt when you�re away from home is stressful enough without having to worry about the cost of the medical care you need. Travel tip for parent or grandparent super visa applicants:

Source: neolyrics1.blogspot.com

Source: neolyrics1.blogspot.com

Coverage amount $150,000 to age 69; Essential protection for travel to canada get emergency medical coverage up to $15,000, $25,000, $50,000 or $100,000 to age 85, or up to $150,000 to age 69 get travel accident insurance up to $50,000 stay covered during side trips outside canada (up to. Manulife travel insurance for visitors to canada provides coverage for physician services, hospitalization, prescription drugs, emergency dental care and more, in the event of unexpected illness or injury that may occur during your trip. Buy insurance get a quote for single 2 persons family select visa type 1person age 2 person age coverage (cad) † $15,000 $25,000 $50,000 $100,000 $150,000 plan benefits eligibility limitations and exclusions definitions

Source: neolyrics1.blogspot.com

Source: neolyrics1.blogspot.com

It�s simple to get a quote and just as simple to purchase online. Cover $150,000 to age 69 A claim related to an illness arising during or before a waiting period is not covered. Choose $15,000 to $150,000 in coverage. Coverme travel insurance for visitors to canada plan is the manulife travel insurance product for individual protection that designed for visitors traveling to canada.

Source: jboccacciodesign.blogspot.com

First north american insurance company, a wholly owned subsidiary of manulife. Let�s see how they compare. Can be purchased up to 365 days prior to arrival in canada; Emergency medical care up to $150,000 if you’re under 70, and up to $100,000 if you’re age 70 or over covers side trips from canada or a trip break to temporarily return to your country of origin* plans also include travel accident insurance for the coverage of accidental loss of sight, limb or life, up to $50,000 Manulife financial travel insurance for visitors to canada.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title manulife health insurance for visitors to canada by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.