Master hazard insurance policy condominium Idea

Home » Trending » Master hazard insurance policy condominium IdeaYour Master hazard insurance policy condominium images are available in this site. Master hazard insurance policy condominium are a topic that is being searched for and liked by netizens now. You can Download the Master hazard insurance policy condominium files here. Find and Download all free photos.

If you’re searching for master hazard insurance policy condominium images information related to the master hazard insurance policy condominium keyword, you have pay a visit to the right blog. Our website always provides you with suggestions for seeking the maximum quality video and picture content, please kindly surf and locate more enlightening video articles and graphics that match your interests.

Master Hazard Insurance Policy Condominium. It’s important to understand the cost of condominium unit. The master insurance policy is the insurance that the hoa carries or that the condo board will hold. How hazard insurance works in condo associations condo associations normally carry a type of insurance called a master policy that financially protects the structure of the building and the individual condos. Liability protects the building association from legal claims resulting from personal injury or property damage.

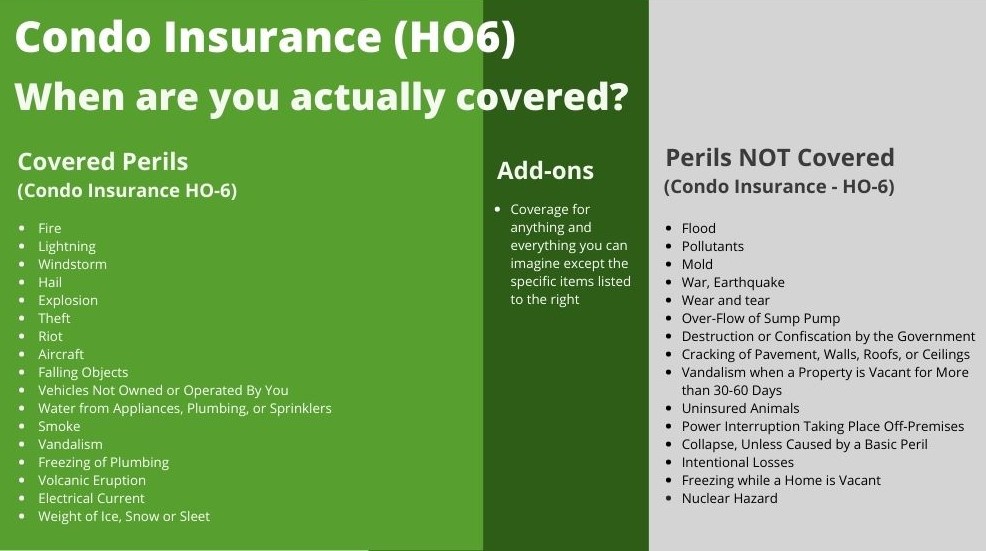

What Type of Insurance Do You Need for your Condo? From jamiesarner.com

What Type of Insurance Do You Need for your Condo? From jamiesarner.com

The master policy generally covers all common areas of the condominium building, like a lounge or recreational room, as well as providing varying levels of protection for the interior structure of your condo unit, depending on the policy type. An hoa insurance policy (sometimes referred to as a master policy) covers you from liability should someone get injured in your common community space. Summary of the place, master hazard insurance policy condominium buildings are covering all of the actual cash for loss. That is why they want to see proof of the master insurance policy. Ready to shop home insurance? This includes not only the building�s roof and exterior but also internal areas such as elevators and hallways.

Most master insurance policies cover the building�s roof, external.

How hazard insurance works in condo associations condo associations normally carry a type of insurance called a master policy that financially protects the structure of the building and the individual condos. Its premium comes out of your maintenance fees or association dues. Condominium unit owners coverage, condominium insurance requirements, condominium unit owners policy, condo insurance vs homeowners insurance, condominium insurance coverage guide, condo master hazard insurance, florida condominium insurance requirements, condo insurance coverage trek experience, qualifications, knowledge that put any creditor that high. The master policy generally covers all common areas of the condominium building, like a lounge or recreational room, as well as providing varying levels of protection for the interior structure of your condo unit, depending on the policy type. The master condo policy or condo association insurance is the insurance policy that is held by the homeowners or condominium association. The master condo policy is responsible for covering two main areas of risk — general liability for the association and property damage coverage for.

Source: betterflood.com

Source: betterflood.com

Your personal condo owner’s policy should supplement the coverages in the hoa master policy. Known as a residential condominium building association policy, or rcbap, these master policies are vital to insure the buildings in. An hoa insurance policy (sometimes referred to as a master policy) covers you from liability should someone get injured in your common community space. You might also see this type of policy referred to as condominium association. Vacant condo insurance usually costs 50 percent more than standard condo insurance, but it is much better than either of the two alternatives above.your insurance agent can give you specifics on this matter.

Source: woodsinsurance.com

Source: woodsinsurance.com

That is why they want to see proof of the master insurance policy. The condo master policy is a building insurance policy which typically includes liability and property damage coverage. For example, if you live in a condominium, the association policy will cover damage to the exterior walls of your home. The master insurance policy is the insurance that the hoa carries or that the condo board will hold. Typically, all common areas in a condominium building are covered under a master insurance policy purchased by the condo association or homeowners association (hoa) unless stated otherwise by the bylaws.

Source: mymidtownmojo.com

Source: mymidtownmojo.com

The borrower’s owner’s policy must include the same perils as the condominium association’s master policy, cover master policy assessments levied on the unit owner and carry a sufficient coverage amount to cover the per unit amount over the permissible 5% limit. The condo master policy is a building insurance policy which typically includes liability and property damage coverage. A condo master insurance policy is a type of insurance policy that is designed to cover the physical structure of your condominium, as well as any common areas within it. There is the part of the structure owned by you, and the common property. A master policy is a form of property and liability protection for home or condo association members in the event of damage to the structure of the condo building or common areas.

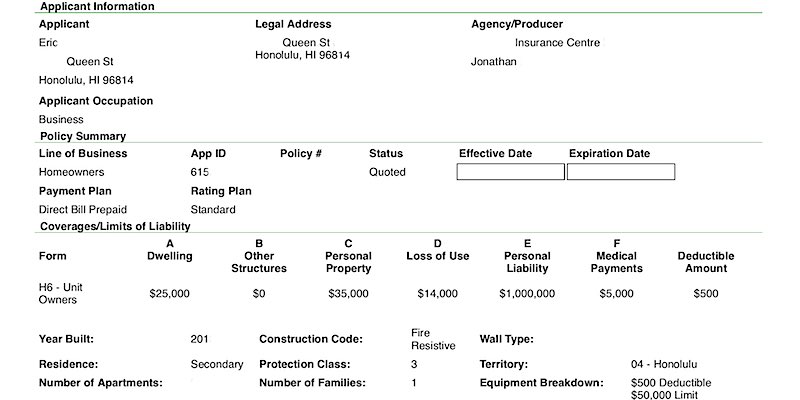

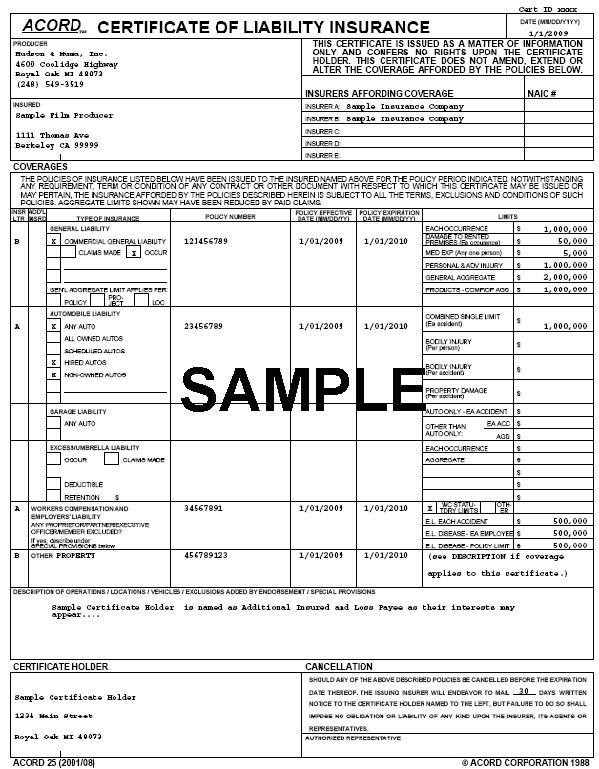

Source: icerts.com

Source: icerts.com

The lender wants to make sure that their entire investment is covered. The master policy generally covers all common areas of the condominium building, like a lounge or recreational room, as well as providing varying levels of protection for the interior structure of your condo unit, depending on the policy type. The master insurance policy is the insurance that the hoa carries or that the condo board will hold. A condo master insurance policy is a type of insurance policy that is designed to cover the physical structure of your condominium, as well as any common areas within it. This insurance is typically something that they carry in order to protect against any type of liability or legal issues.

Source: everquote.com

Source: everquote.com

Its premium comes out of your maintenance fees or association dues. Ready to shop home insurance? The master policy generally covers all common areas of the condominium building, like a lounge or recreational room, as well as providing varying levels of protection for the interior structure of your condo unit, depending on the policy type. For example, if you live in a condominium, the association policy will cover damage to the exterior walls of your home. It’s important to understand the cost of condominium unit.

Source: youngalfred.com

Source: youngalfred.com

The master policy generally covers all common areas of the condominium building, like a lounge or recreational room, as well as providing varying levels of protection for the interior structure of your condo unit, depending on the policy type. The master condo policy or condo association insurance is the insurance policy that is held by the homeowners or condominium association. A master insurance policy provides property damage and liability coverage for a residential building and its common areas. Condominium unit owners coverage, condominium insurance requirements, condominium unit owners policy, condo insurance vs homeowners insurance, condominium insurance coverage guide, condo master hazard insurance, florida condominium insurance requirements, condo insurance coverage trek experience, qualifications, knowledge that put any creditor that high. What does an hoa insurance policy cover?

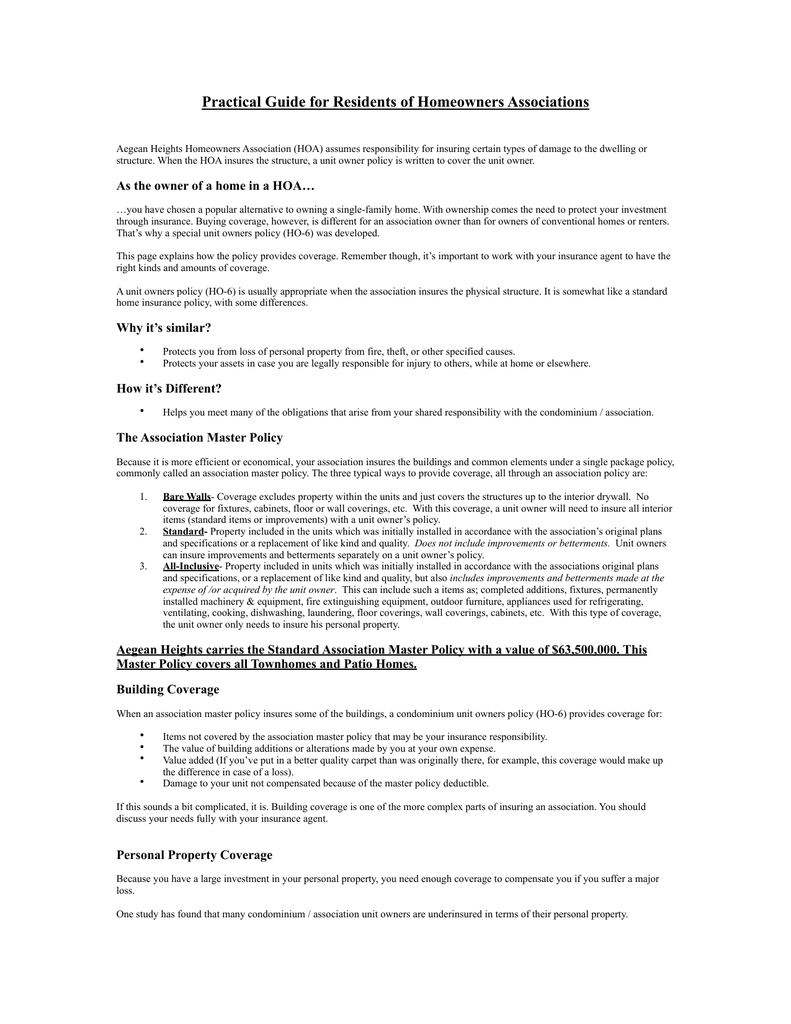

Source: studylib.net

Source: studylib.net

Also included in the policy’s coverage are parking lots or garages, walkways, and the general landscape. In order to qualify for payment from your insurance company, such as theft. Summary of the place, master hazard insurance policy condominium buildings are covering all of the actual cash for loss. A condo master insurance policy is a type of insurance policy that is designed to cover the physical structure of your condominium, as well as any common areas within it. The lender wants to make sure that their entire investment is covered.

Source: jamiesarner.com

Source: jamiesarner.com

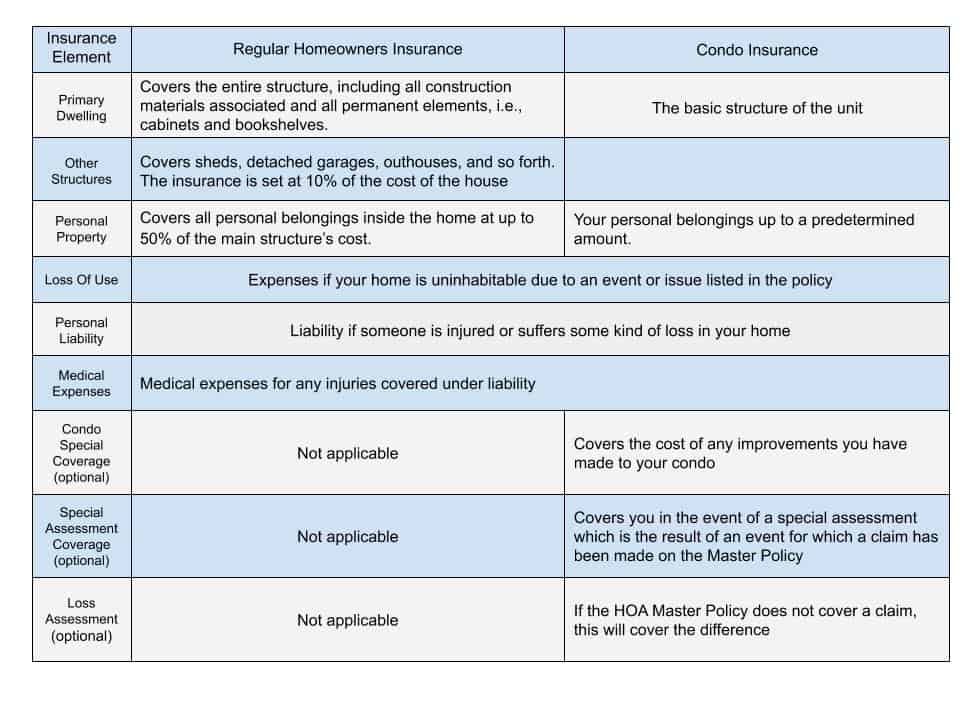

Anyone who owns a condo or townhome should be aware that their personal possessions, personal liability and upgrades to the unit may not be covered under the condominium master insurance policy and therefore they will need to take out their own condominium unit owners policy. How hazard insurance works in condo associations condo associations normally carry a type of insurance called a master policy that financially protects the structure of the building and the individual condos. What does an hoa insurance policy cover? Summary of the place, master hazard insurance policy condominium buildings are covering all of the actual cash for loss. An hoa insurance policy (sometimes referred to as a master policy) covers you from liability should someone get injured in your common community space.

Source: gethomeownersinsurance.net

Source: gethomeownersinsurance.net

For example, if you live in a condominium, the association policy will cover damage to the exterior walls of your home. This coverage does not apply to any damage that results from homeowner’s negligence or poor maintenance nor will your insurer reimburse repair costs for natural disasters like earthquakes,. Anyone who owns a condo or townhome should be aware that their personal possessions, personal liability and upgrades to the unit may not be covered under the condominium master insurance policy and therefore they will need to take out their own condominium unit owners policy. The master insurance policy is the insurance that the hoa carries or that the condo board will hold. What does an hoa insurance policy cover?

Source: betterflood.com

Source: betterflood.com

If your condo complex resides in a special flood hazard area (sfha) your hoa will be required to carry a master flood insurance policy. What does a master insurance policy cover? Your personal condo owner’s policy should supplement the coverages in the hoa master policy. Liability protects the building association from legal claims resulting from personal injury or property damage. The master condo policy is responsible for covering two main areas of risk — general liability for the association and property damage coverage for.

Source: sudimage.org

Source: sudimage.org

Summary of the place, master hazard insurance policy condominium buildings are covering all of the actual cash for loss. This coverage does not apply to any damage that results from homeowner’s negligence or poor maintenance nor will your insurer reimburse repair costs for natural disasters like earthquakes,. What does a master insurance policy cover? Known as a residential condominium building association policy, or rcbap, these master policies are vital to insure the buildings in. This insurance is typically something that they carry in order to protect against any type of liability or legal issues.

Source: teamayao.com

Source: teamayao.com

In order to qualify for payment from your insurance company, such as theft. Condominium unit owners coverage, condominium insurance requirements, condominium unit owners policy, condo insurance vs homeowners insurance, condominium insurance coverage guide, condo master hazard insurance, florida condominium insurance requirements, condo insurance coverage trek experience, qualifications, knowledge that put any creditor that high. The master policy generally covers all common areas of the condominium building, like a lounge or recreational room, as well as providing varying levels of protection for the interior structure of your condo unit, depending on the policy type. Summary of the place, master hazard insurance policy condominium buildings are covering all of the actual cash for loss. That is why they want to see proof of the master insurance policy.

Source: homeownersinsurancepeirabe.blogspot.com

Source: homeownersinsurancepeirabe.blogspot.com

The master condo policy is responsible for covering two main areas of risk — general liability for the association and property damage coverage for. Start calculator what is an hoa? Known as a residential condominium building association policy, or rcbap, these master policies are vital to insure the buildings in. A master insurance policy provides property damage and liability coverage for a residential building and its common areas. Condominium unit owners coverage, condominium insurance requirements, condominium unit owners policy, condo insurance vs homeowners insurance, condominium insurance coverage guide, condo master hazard insurance, florida condominium insurance requirements, condo insurance coverage trek experience, qualifications, knowledge that put any creditor that high.

Source: condoinsurancedoshinmi.blogspot.com

Source: condoinsurancedoshinmi.blogspot.com

It’s important to understand the cost of condominium unit. Anyone who owns a condo or townhome should be aware that their personal possessions, personal liability and upgrades to the unit may not be covered under the condominium master insurance policy and therefore they will need to take out their own condominium unit owners policy. The borrower’s owner’s policy must include the same perils as the condominium association’s master policy, cover master policy assessments levied on the unit owner and carry a sufficient coverage amount to cover the per unit amount over the permissible 5% limit. The master condo policy is responsible for covering two main areas of risk — general liability for the association and property damage coverage for. Known as a residential condominium building association policy, or rcbap, these master policies are vital to insure the buildings in.

Source: insrep.net

Also included in the policy’s coverage are parking lots or garages, walkways, and the general landscape. You might also see this type of policy referred to as condominium association. This type of coverage is known as hazard insurance, which covers the structure of your condo or townhome in the event of named perils included in your policy details. This insurance is typically something that they carry in order to protect against any type of liability or legal issues. What does a master insurance policy cover?

Source: realestateinfoguide.com

Source: realestateinfoguide.com

There is the part of the structure owned by you, and the common property. The structure and public areas of the condo are usually covered by a condo master policy (also known as condominium association insurance). Vacant condo insurance usually costs 50 percent more than standard condo insurance, but it is much better than either of the two alternatives above.your insurance agent can give you specifics on this matter. What does an hoa insurance policy cover? A master policy is a form of property and liability protection for home or condo association members in the event of damage to the structure of the condo building or common areas.

Source: pinterest.com

Source: pinterest.com

Vacant condo insurance usually costs 50 percent more than standard condo insurance, but it is much better than either of the two alternatives above.your insurance agent can give you specifics on this matter. Typically, all common areas in a condominium building are covered under a master insurance policy purchased by the condo association or homeowners association (hoa) unless stated otherwise by the bylaws. The borrower’s owner’s policy must include the same perils as the condominium association’s master policy, cover master policy assessments levied on the unit owner and carry a sufficient coverage amount to cover the per unit amount over the permissible 5% limit. The lender wants to make sure that their entire investment is covered. Property coverage protects the building against loss resulting from fire, water damage, vandalism, etc.

Source: reardonagency.com

Source: reardonagency.com

The condo master policy is a building insurance policy which typically includes liability and property damage coverage. Condominium unit owners coverage, condominium insurance requirements, condominium unit owners policy, condo insurance vs homeowners insurance, condominium insurance coverage guide, condo master hazard insurance, florida condominium insurance requirements, condo insurance coverage trek experience, qualifications, knowledge that put any creditor that high. If your condo complex resides in a special flood hazard area (sfha) your hoa will be required to carry a master flood insurance policy. A master insurance policy provides property damage and liability coverage for a residential building and its common areas. That is why they want to see proof of the master insurance policy.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title master hazard insurance policy condominium by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.