Maximum amount of flood insurance available under the nfip Idea

Home » Trend » Maximum amount of flood insurance available under the nfip IdeaYour Maximum amount of flood insurance available under the nfip images are available. Maximum amount of flood insurance available under the nfip are a topic that is being searched for and liked by netizens today. You can Find and Download the Maximum amount of flood insurance available under the nfip files here. Download all royalty-free photos.

If you’re looking for maximum amount of flood insurance available under the nfip images information related to the maximum amount of flood insurance available under the nfip topic, you have come to the right site. Our site always provides you with hints for viewing the highest quality video and image content, please kindly surf and find more informative video content and graphics that fit your interests.

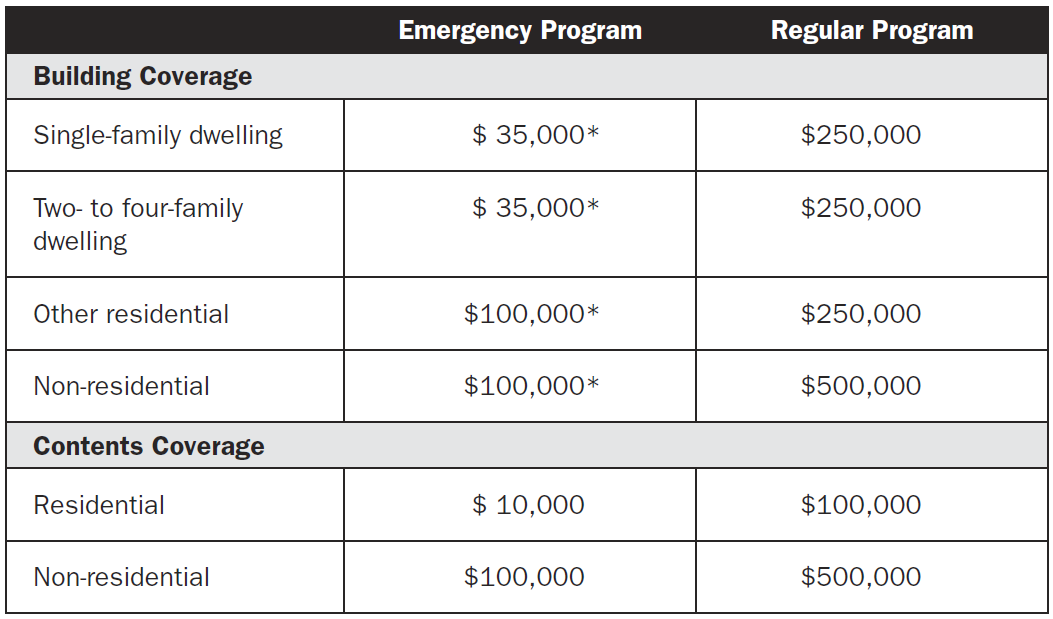

Maximum Amount Of Flood Insurance Available Under The Nfip. Flood insurance is not purchased directly through the nfip. Or o insurable value (for each nonresidential building for which insurance is required, which is $100,000, or $300,000 total) The coverage amount for the building must be at least equal to the lesser of 100% replacement cost, or the maximum coverage available under the applicable nfip program. Minimum required flood insurance coverage.

Save Money on Colorado Flood Insurance Get A Quote From From betterflood.com

Save Money on Colorado Flood Insurance Get A Quote From From betterflood.com

Flood insurance does not pay more than the policy limit. What is the maximum amount of coverage per non residential building under the nfip? The maximum amount of insurance that is available for both building and contents is $500,000 for each category. But nfip policies max out at $250,000. Your amount of flood insurance for building coverage is equal to 80 percent or more of the full replacement cost of your home, or the maximum amount of insurance available for the property under the nfip the replacement cost value is also available for. For residential structures of five or more units, the maximum is $500,000 in building coverage and $100,000 in contents coverage.

For residential structures of five or more units, the maximum is $500,000 in building coverage and $100,000 in contents coverage.

The coverage amount for the building must be at least equal to the lesser of 100% replacement cost, or the maximum coverage available under the applicable nfip program. Flood insurance does not pay more than the policy limit. It�s not a legal requirement, so not all lenders will insist that you buy excess flood insurance. The maximum amount of insurance that is available for both building and contents is $500,000 for each category. This document was prepared by the national flood insurance program (nfip) to help you understand your flood insurance policy. The coverage amount for the building must be at least equal to the lesser of 100% replacement cost, or the maximum coverage available under the applicable nfip program.

Source: shortfamilyagency.com

Source: shortfamilyagency.com

Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000. Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000. Private flood insurers can provide much higher limits. Contents coverage is optional—it is not required by the lender—but it costs extra (and is limited to $100,000). In this manner, how much flood insurance is required by lender?

Source: slideserve.com

Source: slideserve.com

The amount of flood insurance coverage in a master policy is sufficient if: National flood insurance program policyholders can choose their amount of coverage. How do you calculate replacement cost of flood insurance? Flood insurance does not pay more than the policy limit. The guidance in this question and answer will apply to any loan that is made, increased, extended, or renewed after the effective date of this revised guidance.

Source: bankersonline.com

Your amount of flood insurance for building coverage is equal to 80 percent or more of the full replacement cost of your home, or the maximum amount of insurance available for the property under the nfip the replacement cost value is also available for. Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000. The amount of flood insurance coverage in a master policy is sufficient if: Under the national flood insurance program (nfip) a flood is defined as a general and temporary condition of. Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000.

Source: slideserve.com

Source: slideserve.com

$250,000, which is the coverage limit for nfip insurance however, if your home has a rebuild cost (or a mortgage) of more than $250,000, your lender may require that you buy additional coverage beyond the nfip maximum. • maximum amount of coverage available under the nfip, which is the lesser of: • maximum amount of insurance available under the nfip o maximum limit available for the type of structure is $500,000 per building (nonresidential buildings); The coverage amount for the building must be at least equal to the lesser of 100% replacement cost, or the maximum coverage available under the applicable nfip program. Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000.

Source: floodinsuranceyukeise.blogspot.com

Source: floodinsuranceyukeise.blogspot.com

The maximum amount of insurance available under the national flood insurance program (nfip), which is the lesser of the maximum limit available for the type of structure ($250,000), or the insurable value of the structure (typically the replacement cost value of your home). The act and regulation require that flood insurance coverage be obtained for the lesser of the outstanding principal balance of the loan or the maximum amount of flood insurance that is available under the nfip. In this manner, how much flood insurance is required by lender? Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000. The guidance in this question and answer will apply to any loan that is made, increased, extended, or renewed after the effective date of this revised guidance.

Source: pgpf.org

Source: pgpf.org

Private flood insurers can provide much higher limits. How do you calculate replacement cost of flood insurance? • maximum amount of insurance available under the nfip o maximum limit available for the type of structure is $500,000 per building (nonresidential buildings); As previously mentioned, an nfip policy will pay on flood claims up to $250k for damage to your home, with an additional $100,000 maximum claim for the contents of your home and other belongings. It�s not a legal requirement, so not all lenders will insist that you buy excess flood insurance.

Source: irmi.com

Source: irmi.com

This document was prepared by the national flood insurance program (nfip) to help you understand your flood insurance policy. Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000. But nfip policies max out at $250,000. (this is the lesser of the outstanding principal balance ($300,000), the maximum coverage available under the nfip ($250,000), or the insurable value ($300,000)). How do you calculate replacement cost of flood insurance?

Source: slideserve.com

Source: slideserve.com

Flood insurance coverage available limits of liability. Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000. National flood insurance program policyholders can choose their amount of coverage. The amount of flood insurance coverage in a master policy is sufficient if: • maximum amount of insurance available under the nfip o maximum limit available for the type of structure is $500,000 per building (nonresidential buildings);

Source: floodprice.com

Source: floodprice.com

The maximum amount of insurance available under the national flood insurance program (nfip), which is the lesser of the maximum limit available for the type of structure ($250,000), or the insurable value of the structure (typically the replacement cost value of your home). National flood insurance program policyholders can choose their amount of coverage. Flood insurance coverage available limits of liability. Private flood insurers can provide much higher limits. What is the maximum amount of coverage per non residential building under the nfip?

Source: betterflood.com

Source: betterflood.com

For residential structures of five or more units, the maximum is $500,000 in building coverage and $100,000 in contents coverage. The coverage amount for the building must be at least equal to the lesser of 100% replacement cost, or the maximum coverage available under the applicable nfip program. Or o insurable value (for each nonresidential building for which insurance is required, which is $100,000, or $300,000 total) • maximum amount of coverage available under the nfip, which is the lesser of: In this manner, how much flood insurance is required by lender?

Source: ocnj.us

Source: ocnj.us

Most homeowners who need flood insurance buy it from the federal government’s national flood insurance program. The replacement cost of the improvements; $250,000, which is the coverage limit for nfip insurance however, if your home has a rebuild cost (or a mortgage) of more than $250,000, your lender may require that you buy additional coverage beyond the nfip maximum. Minimum required flood insurance coverage. For residential structures of five or more units, the maximum is $500,000 in building coverage and $100,000 in contents coverage.

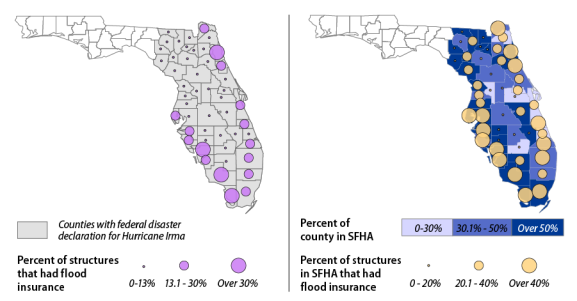

Source: everycrsreport.com

Source: everycrsreport.com

If your lender wants you to have insurance coverage beyond that, you have to purchase at least some of your flood insurance in the private sector. The guidance in this question and answer will apply to any loan that is made, increased, extended, or renewed after the effective date of this revised guidance. The maximum amount of coverage available under the nfip for the type of improvements, or; • maximum amount of insurance available under the nfip o maximum limit available for the type of structure is $500,000 per building (nonresidential buildings); It�s not a legal requirement, so not all lenders will insist that you buy excess flood insurance.

Source: everycrsreport.com

Source: everycrsreport.com

What is the maximum amount of coverage per non residential building under the nfip? Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000. The maximum amount of insurance that is available for both building and contents is $500,000 for each category. Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000. $250,000, which is the coverage limit for nfip insurance however, if your home has a rebuild cost (or a mortgage) of more than $250,000, your lender may require that you buy additional coverage beyond the nfip maximum.

Source: miniter.com

Source: miniter.com

• maximum amount of coverage available under the nfip, which is the lesser of: Flood insurance does not pay more than the policy limit. Five or more families, classified as “other residential buildings” by the national flood insurance program (nfip), has been increased from $250,000 per building to $500,000. It�s not a legal requirement, so not all lenders will insist that you buy excess flood insurance. The coverage amount for the building must be at least equal to the lesser of 100% replacement cost, or the maximum coverage available under the applicable nfip program.

Source: dlnreng.hawaii.gov

Source: dlnreng.hawaii.gov

Flood insurance does not pay more than the policy limit. Private flood insurers can provide much higher limits. The maximum amount of coverage available under the nfip for the type of improvements, or; Most homeowners who need flood insurance buy it from the federal government’s national flood insurance program. Minimum required flood insurance coverage.

Source: flash.org

Source: flash.org

If your lender wants you to have insurance coverage beyond that, you have to purchase at least some of your flood insurance in the private sector. For residential structures of five or more units, the maximum is $500,000 in building coverage and $100,000 in contents coverage. The maximum amount of coverage available under the nfip for the type of improvements, or; The replacement cost of the improvements; Flood insurance does not pay more than the policy limit.

Source: eduardoevelise.blogspot.com

Source: eduardoevelise.blogspot.com

The maximum amount of coverage available under the nfip for the type of improvements, or; • maximum amount of coverage available under the nfip, which is the lesser of: Flood insurance is not purchased directly through the nfip. This document was prepared by the national flood insurance program (nfip) to help you understand your flood insurance policy. It�s not a legal requirement, so not all lenders will insist that you buy excess flood insurance.

Source: researchgate.net

Source: researchgate.net

As previously mentioned, an nfip policy will pay on flood claims up to $250k for damage to your home, with an additional $100,000 maximum claim for the contents of your home and other belongings. Flood insurance does not pay more than the policy limit. The coverage amount for the building must be at least equal to the lesser of 100% replacement cost, or the maximum coverage available under the applicable nfip program. Contents coverage is optional—it is not required by the lender—but it costs extra (and is limited to $100,000). The maximum insurance amount allowed by law for an nfip policy is $250,000 for the structure.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title maximum amount of flood insurance available under the nfip by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.