Mec insurance plan information

Home » Trend » Mec insurance plan informationYour Mec insurance plan images are ready in this website. Mec insurance plan are a topic that is being searched for and liked by netizens now. You can Find and Download the Mec insurance plan files here. Download all free photos and vectors.

If you’re looking for mec insurance plan pictures information connected with to the mec insurance plan topic, you have come to the right site. Our website always provides you with suggestions for seeing the maximum quality video and image content, please kindly surf and locate more enlightening video content and images that match your interests.

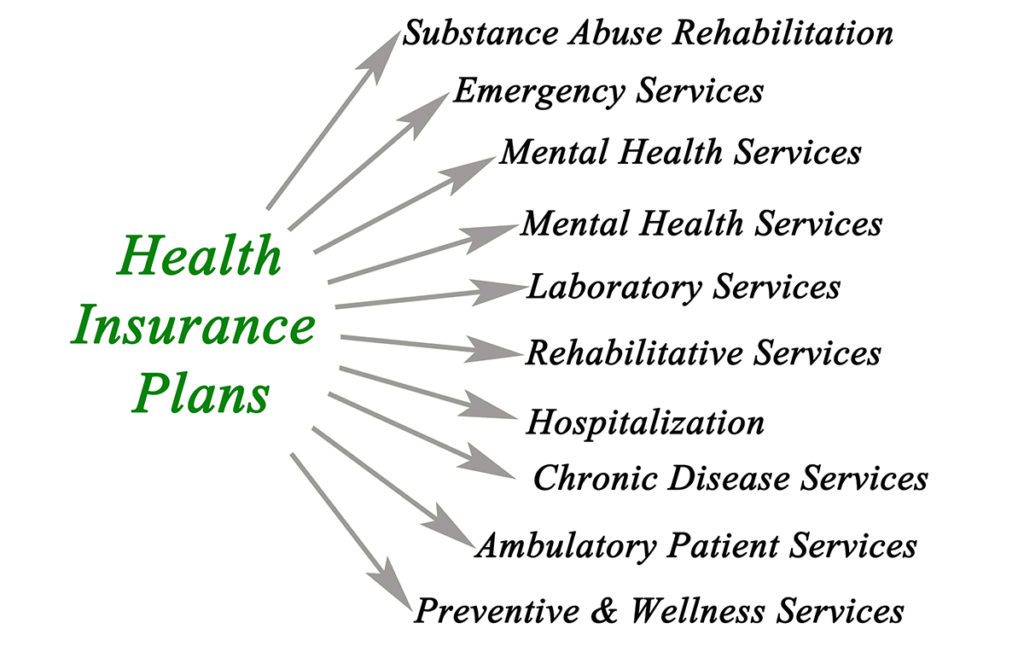

Mec Insurance Plan. Mecs ended a popular way to shelter money from taxes by borrowing from insurance policies whose cash value grew too quickly. Standard mec plans are aca compliant and include coverage for wellness, preventative services, prescription discounts, and telehealth services. The preventive minimum essential coverage plan (mec) covers the cost of federally mandated preventive services at 100% of eligible charges. Your employees will be covered for up to 64 preventive checkups,

How to Determine if You Have Minimum Essential Coverage From turbotax.intuit.com

How to Determine if You Have Minimum Essential Coverage From turbotax.intuit.com

That means protect businesses and their employees families by providing insurance plans at an affordable rate while ensuring compliance with the aca. Any “grandfathered” individual insurance plan you’ve had since march 23, 2010 or earlier. Eagle, victory liberty, star, and newmarket ontario canada 05/01/2015 31 cigna global insurance company limited Additionally, a mec plan also satisfies the individual mandate. To avoid the penalty for not having insurance for plans 2018 and earlier, you must be enrolled in a plan that qualifies as minimum essential coverage (sometimes called “qualifying health coverage”). • minimum essential coverage (mec) vs minimum value (mv):

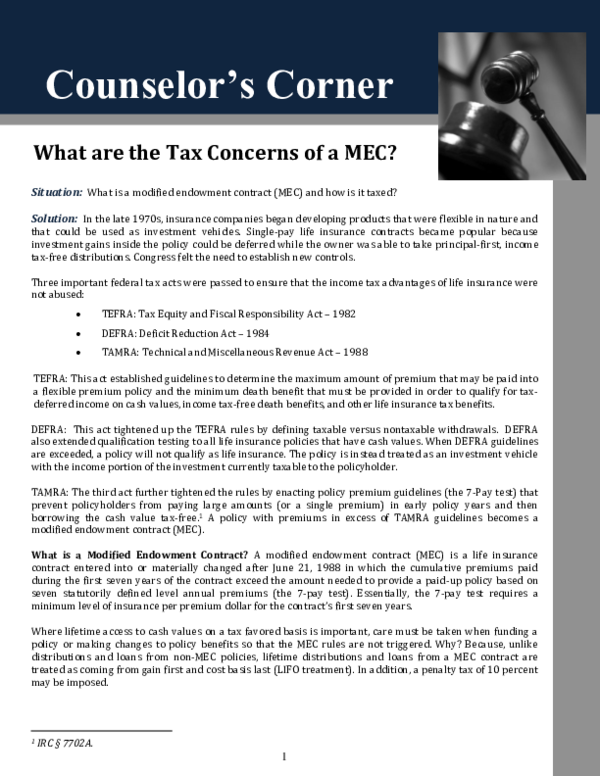

A modified endowment contract (mec) is a tax qualification of a life insurance policy whose funding exceeds federal tax law limits.

Pick the right one for your group from 2 plan options: • minimum essential coverage (mec) vs minimum value (mv): A modified endowment contract (commonly referred to as a mec) is a tax qualification of a life insurance policy that has been funded with more money than allowed under federal tax laws. Thus, the employer avoids the $2,000 per employee tax penalty. 08/01/2018 30 aetna life insurance company (canadian branch) group health insurance plans; To determine which services will be covered, check out the list that was approved by the u.s.

![]() Source: hallmarkvoluntarybenefits.com

Source: hallmarkvoluntarybenefits.com

Pick the right one for your group from 2 plan options: Coverage is affordable and flexible. To encourage enrollment in the mec plan, and minimize exposure to the tackhammer penalty maxon is offering the additional services outside of the plan: Pick the right one for your group from 2 plan options: Individual health plans bought outside the health insurance marketplace, if they meet the standards for qualified health plans.

Source: robertedgaragent.com

Source: robertedgaragent.com

Your employees will be covered for up to 64 preventive checkups, A modified endowment contract (commonly referred to as a mec) is a tax qualification of a life insurance policy that has been funded with more money than allowed under federal tax laws. So, we tailored plans just for you. The taxation structure and irs policy classification change. It is a strategy that is compiled of a one of a mec plan, composite rated indemnity plans, and major medical plans.

![Life Insurance MEC [3 Things You MUST Know] YouTube Life Insurance MEC [3 Things You MUST Know] YouTube](https://i.ytimg.com/vi/5UYYNREpuRc/maxresdefault.jpg) Source: youtube.com

Source: youtube.com

The affordable care act (aca) requires all employers offer and individuals to maintain coverage that. To avoid the penalty for not having insurance for plans 2018 and earlier, you must be enrolled in a plan that qualifies as minimum essential coverage (sometimes called “qualifying health coverage”). Provides benefits for most commonly utilized services. Additionally, a mec plan also satisfies the individual mandate. While all life insurance policies can.

Source: thehealthsharelady.com

While all life insurance policies can. High value mec plans that encompass all the value of a mec plan but provides sick benefits as well. We partner with “best in class” insurance carriers and other industry vendors to provide one consolidated benefit package to clients. Examples of plans that qualify include: A person is not barred from ptc due to an employer offer of coverage unless

Source: hr-ps.com

Source: hr-ps.com

For a complete list of the essential health benefits, visit www.healthcare.gov. Your employees will be covered for up to 64 preventive checkups, Examples of plans that qualify include: A modified endowment contract (mec) is a tax qualification of a life insurance policy whose funding exceeds federal tax law limits. We understand that many americans are tired of overpaying for medical insurance and also want an aca compliant plans.

Source: insurancequotes2day.com

Source: insurancequotes2day.com

It is a strategy that is compiled of a one of a mec plan, composite rated indemnity plans, and major medical plans. The mec plan covers 100% of the cost of certain preventive health services when delivered by a network provider, such as: A modified endowment contract (mec) is a tax qualification of a life insurance policy whose funding exceeds federal tax law limits. A modified endowment contract (commonly referred to as a mec) is a tax qualification of a life insurance policy that has been funded with more money than allowed under federal tax laws. High value mec plans that encompass all the value of a mec plan but provides sick benefits as well.

Source: clips-hardcore.blogspot.com

Source: clips-hardcore.blogspot.com

For a complete list of the essential health benefits, visit www.healthcare.gov. We help protect instead of penalize businesses. A life insurance policy that becomes a mec is no longer considered life insurance by the irs, but instead, it is considered a modified endowment contract. So, we tailored plans just for you. The preventive minimum essential coverage plan (mec) covers the cost of federally mandated preventive services at 100% of eligible charges.

Source: schwartzinsgrp.com

Source: schwartzinsgrp.com

We help protect instead of penalize businesses. Mecs ended a popular way to shelter money from taxes by borrowing from insurance policies whose cash value grew too quickly. Minimum essential coverage (mec) any insurance plan that meets the affordable care act requirement for having health coverage. The mec plan covers 100% of the cost of certain preventive health services when delivered by a network provider, such as: A life insurance policy that becomes a mec is no longer considered life insurance by the irs, but instead, it is considered a modified endowment contract.

Source: harborlifesettlements.com

Source: harborlifesettlements.com

To encourage enrollment in the mec plan, and minimize exposure to the tackhammer penalty maxon is offering the additional services outside of the plan: We now offer mec plans. Optional coverage for cobra, vision, and telemedicine services; Mec, which is the coverage that an individual must maintain to meet the individual responsibility requirement, should not be confused with minimum value (mv), a measure of a plan’s comprehensiveness. So, we tailored plans just for you.

Source: smbhealthsolutions.com

Source: smbhealthsolutions.com

High value mec plans that encompass all the value of a mec plan but provides sick benefits as well. Provides benefits for most commonly utilized services. Additionally, a mec plan also satisfies the individual mandate. For a complete list of the essential health benefits, visit www.healthcare.gov. While all life insurance policies can.

Source: optionsplusplan.com

Source: optionsplusplan.com

To avoid the penalty for not having insurance, you must be enrolled in a plan that qualifies as minimum essential coverage (sometimes called “qualifying health coverage”). The preventive minimum essential coverage plan (mec) covers the cost of federally mandated preventive services at 100% of eligible charges. Bma specializes in minimum essential coverage plan options to include minimum value plan, which help employers be compliant with all current affordable care act (aca) requirements under the employer shared responsibility provisions (esrp). A life insurance policy that becomes a mec is no longer considered life insurance by the irs, but instead, it is considered a modified endowment contract. Minimum essential coverage (mec) any insurance plan that meets the affordable care act (aca) requirement for having health coverage.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

That means protect businesses and their employees families by providing insurance plans at an affordable rate while ensuring compliance with the aca. Provides benefits for most commonly utilized services. Coverage is affordable and flexible. Our mymec basic plan empowers your employees to take care of their health while helping you control costs. A person is not barred from ptc due to an employer offer of coverage unless

Source: youtube.com

Source: youtube.com

Manage the plan and process all claims for benefits. Additionally, a mec plan also satisfies the individual mandate. Minimum essential coverage (mec) any insurance plan that meets the affordable care act (aca) requirement for having health coverage. Any health plan bought through the health insurance marketplace. Our mymec basic plan empowers your employees to take care of their health while helping you control costs.

Source: slideshare.net

Source: slideshare.net

This level of mec coverage includes: Additionally, a mec plan also satisfies the individual mandate. That means protect businesses and their employees families by providing insurance plans at an affordable rate while ensuring compliance with the aca. 08/01/2018 30 aetna life insurance company (canadian branch) group health insurance plans; A person is not barred from ptc due to an employer offer of coverage unless

Source: turbotax.intuit.com

Source: turbotax.intuit.com

To encourage enrollment in the mec plan, and minimize exposure to the tackhammer penalty maxon is offering the additional services outside of the plan: Bma specializes in minimum essential coverage plan options to include minimum value plan, which help employers be compliant with all current affordable care act (aca) requirements under the employer shared responsibility provisions (esrp). The affordable care act (aca) requires all employers offer and individuals to maintain coverage that. Historically, these kinds of bare bones coverage plans have been offered by restaurant chains, hotels, retailers and other lower. A modified endowment contract (mec) is a cash value life insurance policy that gets stripped of many tax benefits.

Source: keepwalkingtheworld.blogspot.com

Preventive services are paid at 100% when you use network providers. While all life insurance policies can. A modified endowment contract (mec) is a tax qualification of a life insurance policy whose funding exceeds federal tax law limits. To avoid the penalty for not having insurance for plans 2018 and earlier, you must be enrolled in a plan that qualifies as minimum essential coverage (sometimes called “qualifying health coverage”). A person is not barred from ptc due to an employer offer of coverage unless

Source: tetrapui.blogspot.com

Source: tetrapui.blogspot.com

Additionally, a mec plan also satisfies the individual mandate. For our preventative services there is a 0 copay and is covered at 100%. Elan essential and advantage plans: Historically, these kinds of bare bones coverage plans have been offered by restaurant chains, hotels, retailers and other lower. The affordable care act (aca) requires all employers offer and individuals to maintain coverage that.

Source: abouthealthinsurance.com

Source: abouthealthinsurance.com

A modified endowment contract (mec) is a tax qualification of a life insurance policy whose funding exceeds federal tax law limits. Thus, the employer avoids the $2,000 per employee tax penalty. Examples of plans that qualify include: Optional coverage for cobra, vision, and telemedicine services; Manage the plan and process all claims for benefits.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site convienient, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title mec insurance plan by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.