Mechanical breakdown insurance for used cars Idea

Home » Trend » Mechanical breakdown insurance for used cars IdeaYour Mechanical breakdown insurance for used cars images are available in this site. Mechanical breakdown insurance for used cars are a topic that is being searched for and liked by netizens now. You can Find and Download the Mechanical breakdown insurance for used cars files here. Find and Download all free photos and vectors.

If you’re looking for mechanical breakdown insurance for used cars images information linked to the mechanical breakdown insurance for used cars topic, you have come to the ideal site. Our site frequently gives you hints for downloading the highest quality video and picture content, please kindly search and find more enlightening video content and graphics that fit your interests.

Mechanical Breakdown Insurance For Used Cars. While the insurance holds little value for consumers, it’s likely to be a tidy little earner for car dealers and insurers. If you car is used, you probably do not qualify for mechanical breakdown insurance. Unless you can offer mechanical breakdown insurance from autoprotect. Prospective buyers feel more comfortable buying a vehicle that has mechanical breakdown coverage, because it is a good indicator that the owner has already fixed common issues they would otherwise worry about.

Your Guide To Mechanical Breakdown Insurance For Used Cars From motor1.com

Your Guide To Mechanical Breakdown Insurance For Used Cars From motor1.com

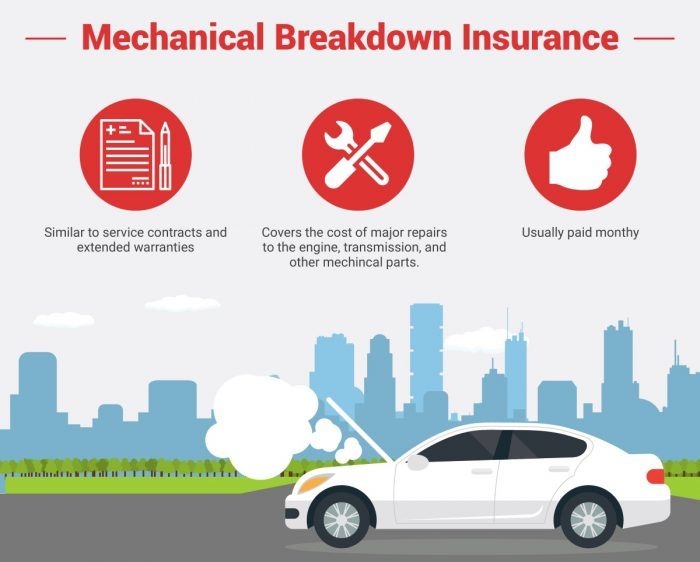

What is actually mechanical breakdown insurance? Our autolife mechanical breakdown insurance policies also cover costs associated with breakdowns, such as towing and rental car coverage. While the coverage seems reasonable in principle, many experts question its value. That is because mbi is relatively uncommon and not generally available for used cars. Accordingly, you don’t want to pay a hefty deductible fee to move forward with the repairs. Mechanical breakdown insurance (mbi) is an insurance policy that covers your car’s major parts and systems.

This makes it a bit more like an extended warranty than a true mechanical breakdown insurance policy.

Mechanical breakdown insurance is heavily promoted. While it may seem similar to extended warranties, it is cheaper to afford and offers more coverage. Also more of an extended warranty than true mechanical breakdown insurance, mercury’s policies cover both new and used cars. Mechanical breakdown insurance for used cars must be bought while your car is still under the manufacturer’s warranty. If you car is used, you probably do not qualify for mechanical breakdown insurance. Prospective buyers feel more comfortable buying a vehicle that has mechanical breakdown coverage, because it is a good indicator that the owner has already fixed common issues they would otherwise worry about.

Source: insurify.com

Source: insurify.com

Mechanical breakdown insurance is offered by a few insurance providers, but most companies offer a slightly different product known as an extended car warranty (also called a vehicle service. Prospective buyers feel more comfortable buying a vehicle that has mechanical breakdown coverage, because it is a good indicator that the owner has already fixed common issues they would otherwise worry about. Mechanical breakdown insurance (mbi) is an optional part of car insurance meant to cover trips to the mechanic not caused by an accident. Your insurance company might suggest you add mechanical breakdown insurance (mbi) to your policy. Mechanical breakdown insurance for used cars can act as a valuable safety net, ensuring that if the vehicle you purchase turns out to be unreliable, you won’t be stuck paying for repair after repair to keep it running.

Source: theldsgroup.com

Source: theldsgroup.com

Mechanical breakdown insurance for used cars can act as a valuable safety net, ensuring that if the vehicle you purchase turns out to be unreliable, you won’t be stuck paying for repair after repair to keep it running. Mechanical breakdown insurance (mbi) is a special type of car insurance that covers car repair costs due to mechanical failures in your vehicle, not accidents or natural disasters. Mechanical breakdown insurance is heavily promoted. The insurance agent will probably explain that mbi can help repair your car if it breaks down. Mechanical breakdown insurance is an optional type of insurance that provides coverage for the major systems in your car, like the engine and transmission, which are not covered by standard car insurance policies.

Source: hwpinsurance.com

Source: hwpinsurance.com

The insurance agent will probably explain that mbi can help repair your car if it breaks down. It is sometimes referred to as car repair. The amount of the claim limit applicable to a vehicle is shown on the registration certificate which forms a part of the policy document. Generally, if a used car has more than 15,000 miles on it, it will not qualify for mechanical breakdown insurance coverage, and many insurers refuse to offer mbi on used vehicles altogether. Furthermore, used car mechanical breakdown insurance covers the failure of major components that puts a vehicle to work, such as the engine, gears, and transmission.

Source: motor1.com

Source: motor1.com

That is because mbi is relatively uncommon and not generally available for used cars. Accordingly, you don’t want to pay a hefty deductible fee to move forward with the repairs. Furthermore, used car mechanical breakdown insurance covers the failure of major components that puts a vehicle to work, such as the engine, gears, and transmission. Once you�ve purchased mbi, you can renew it for up to seven years or 100,000 miles (whichever comes first). Mechanical repair insurance with roadside assistance.

Source: sudimage.org

Source: sudimage.org

After purchasing a new or used car, you’ll need to insure it to stay compliant with state insurance laws. After purchasing a new or used car, you’ll need to insure it to stay compliant with state insurance laws. Mechanical breakdown insurance for used cars can act as a valuable safety net, ensuring that if the vehicle you purchase turns out to be unreliable, you won’t be stuck paying for repair after repair to keep it running. It can help pay for repairs to. Having olive’s mechanical breakdown insurance coverage on your vehicle shows buyers that your car, truck, or suv has been well maintained.

Source: motor1.com

Source: motor1.com

While it may seem similar to extended warranties, it is cheaper to afford and offers more coverage. Mechanical breakdown insurance is an optional type of insurance that provides coverage for the major systems in your car, like the engine and transmission, which are not covered by standard car insurance policies. Accordingly, you don’t want to pay a hefty deductible fee to move forward with the repairs. Specific coverage terms can vary by provider, so check your policy for a full list of exclusions. Also more of an extended warranty than true mechanical breakdown insurance, mercury’s policies cover both new and used cars.

Source: automoblog.net

Source: automoblog.net

It is sometimes referred to as car repair. Of nearly 4000 consumer members in our car reliability survey who bought a vehicle from a dealer, 68% recalled being offered a policy. These factory warranties typically last. It can help pay for repairs to. The insurance agent will probably explain that mbi can help repair your car if it breaks down.

Source: autoguide.com

Source: autoguide.com

Mechanical breakdown insurance is an optional type of insurance that provides coverage for the major systems in your car, like the engine and transmission, which are not covered by standard car insurance policies. Generally, if a used car has more than 15,000 miles on it, it will not qualify for mechanical breakdown insurance coverage, and many insurers refuse to offer mbi on used vehicles altogether. Specific coverage terms can vary by provider, so check your policy for a full list of exclusions. Your insurance company might suggest you add mechanical breakdown insurance (mbi) to your policy. Mechanical breakdown insurance for used cars must be bought while your car is still under the manufacturer’s warranty.

Source: carchex.com

Source: carchex.com

That is because mbi is relatively uncommon and not generally available for used cars. Mechanical repair insurance with roadside assistance. It is sometimes referred to as car repair. Mbi is available for new or leased cars that are less than 15 months old and with less than 15,000 miles. Generally, if a used car has more than 15,000 miles on it, it will not qualify for mechanical breakdown insurance coverage, and many insurers refuse to offer mbi on used vehicles altogether.

Source: drivesmartwarranty.com

Source: drivesmartwarranty.com

While your used vehicle might not qualify for mbi, you. What is actually mechanical breakdown insurance? If you car is used, you probably do not qualify for mechanical breakdown insurance. And when you consider that modern vehicles contain over 700 components, any of which might fail over time, the impact on your customer’s pocket could be painful. Mechanical breakdown insurance (mbi) is an insurance policy that covers your car’s major parts and systems.

Source: blog.aisinsurance.com

Source: blog.aisinsurance.com

Unless you can offer mechanical breakdown insurance from autoprotect. What is actually mechanical breakdown insurance? While your used vehicle might not qualify for mbi, you. Mechanical breakdown insurance (mbi) is an insurance policy that covers your car’s major parts and systems. Mechanical breakdown insurance (mbi) is an optional part of car insurance meant to cover trips to the mechanic not caused by an accident.

Source: purvesinsurance.com

Source: purvesinsurance.com

Mechanical breakdown insurance is an optional type of insurance that provides coverage for the major systems in your car, like the engine and transmission, which are not covered by standard car insurance policies. Accordingly, you don’t want to pay a hefty deductible fee to move forward with the repairs. You can purchase various levels of vehicle repair cover for a certain number of kilometres or months. While the insurance holds little value for consumers, it’s likely to be a tidy little earner for car dealers and insurers. Mechanical breakdown insurance (mbi) is similar to an extended warranty but provides more coverage.

Source: endurancewarranty.com

Source: endurancewarranty.com

It can help pay for repairs to. While your used vehicle might not qualify for mbi, you. Yes, you can get mbi for a used car, although it is quite difficult unless the car is only lightly used. At this point, the only major car insurance provider that offers mbi is geico, but it only offers the insurance to leased or new cars that are less than 15 months old and with fewer than 15,000. Mechanical breakdown insurance for used cars must be bought while your car is still under the manufacturer’s warranty.

Source: autolife.co.nz

Source: autolife.co.nz

It is sometimes referred to as car repair. While the insurance holds little value for consumers, it’s likely to be a tidy little earner for car dealers and insurers. While it may seem similar to extended warranties, it is cheaper to afford and offers more coverage. Mechanical breakdown insurance (mbi) is a type of insurance policy that covers the repairs or replacements of certain vehicle parts after they break down. Having olive’s mechanical breakdown insurance coverage on your vehicle shows buyers that your car, truck, or suv has been well maintained.

Source: americanautoshield.com

Source: americanautoshield.com

Also more of an extended warranty than true mechanical breakdown insurance, mercury’s policies cover both new and used cars. While the insurance holds little value for consumers, it’s likely to be a tidy little earner for car dealers and insurers. Mechanical breakdown insurance (mbi) is a type of insurance policy that covers the repairs or replacements of certain vehicle parts after they break down. Mechanical breakdown insurance is an optional type of insurance that provides coverage for the major systems in your car, like the engine and transmission, which are not covered by standard car insurance policies. Mbi is available for new or leased cars that are less than 15 months old and with less than 15,000 miles.

Source: inscenter.com

Source: inscenter.com

Our car warranties are designed to help with the cost of repairs, including labour, vat and replacement parts. What is actually mechanical breakdown insurance? The amount of the claim limit applicable to a vehicle is shown on the registration certificate which forms a part of the policy document. It is sometimes referred to as car repair. Generally, if a used car has more than 15,000 miles on it, it will not qualify for mechanical breakdown insurance coverage, and many insurers refuse to offer mbi on used vehicles altogether.

Source: autoguide.com

Source: autoguide.com

Yes, you can get mbi for a used car, although it is quite difficult unless the car is only lightly used. Accordingly, you don’t want to pay a hefty deductible fee to move forward with the repairs. Mechanical breakdown insurance is offered by a few insurance providers, but most companies offer a slightly different product known as an extended car warranty (also called a vehicle service. While the insurance holds little value for consumers, it’s likely to be a tidy little earner for car dealers and insurers. Our car warranties are designed to help with the cost of repairs, including labour, vat and replacement parts.

Source: moneycrashers.com

Source: moneycrashers.com

Of nearly 4000 consumer members in our car reliability survey who bought a vehicle from a dealer, 68% recalled being offered a policy. While it may seem similar to extended warranties, it is cheaper to afford and offers more coverage. Furthermore, used car mechanical breakdown insurance covers the failure of major components that puts a vehicle to work, such as the engine, gears, and transmission. At this point, the only major car insurance provider that offers mbi is geico, but it only offers the insurance to leased or new cars that are less than 15 months old and with fewer than 15,000. Mechanical breakdown insurance for used cars can act as a valuable safety net, ensuring that if the vehicle you purchase turns out to be unreliable, you won’t be stuck paying for repair after repair to keep it running.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title mechanical breakdown insurance for used cars by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.