Medical expense insurance would cover quizlet information

Home » Trending » Medical expense insurance would cover quizlet informationYour Medical expense insurance would cover quizlet images are available. Medical expense insurance would cover quizlet are a topic that is being searched for and liked by netizens now. You can Get the Medical expense insurance would cover quizlet files here. Get all royalty-free photos and vectors.

If you’re looking for medical expense insurance would cover quizlet images information linked to the medical expense insurance would cover quizlet interest, you have come to the right site. Our site always gives you hints for viewing the highest quality video and picture content, please kindly search and find more informative video articles and images that fit your interests.

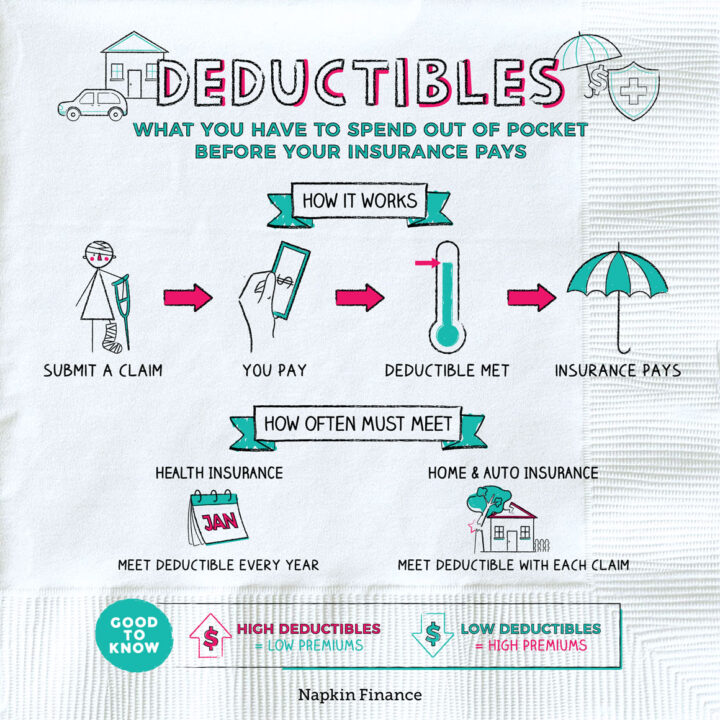

Medical Expense Insurance Would Cover Quizlet. Personal liability insurance covers anyone who lives in your home and is considered your family member. He incurs covered medical expenses of $100 in november and $400 in january. 13.1 the purpose of medical expense insurance. Coverage is provided for daily hospital room and board, miscellaneous hospital

Basic Medical Expense Insurance Quizlet Travel Insurance From galldeckvirh.blogspot.com

Basic Medical Expense Insurance Quizlet Travel Insurance From galldeckvirh.blogspot.com

If larry�s family files four claims of $400, $800, $100, and $700 in one year, how much will the insurance company pay? Medical expense insurance is a contract of reimbursement. Q has a major medical policy with a $100 deductible and 80/20 coinsurance. Get a free quote and. Click to see full answer. Comprehensive medical expense insurance covers room and board, surgical fees and hospital miscellaneous expenses up to a dollar limit.

(a basic hospital/surgical policy would most likely cover cosmetic surgery to remove a facial birthmark.) q is hospitalized for 3 days and receives a bill for $10,100.

Click to see full answer. A deductible is the amount you pay for health care services before your health insurance begins to pay. Health insurance is a product that covers your medical expenses. (a basic hospital/surgical policy would most likely cover cosmetic surgery to remove a facial birthmark.) q is hospitalized for 3 days and receives a bill for $10,100. Medical expense insurance would cover quizlet. Health insurance policy that provides broad coverage and high benefits for hospitalization, surgery, and physician services.

Source: oliverwherst.blogspot.com

All of the following statements about major medical benefits are true except 1) the deductible can be expressed as a fixed dollar amount 2) the benefit period begins only after a specified amount of expenses have accrued 3) benefits are generally expressed as a percentage of eligible expenses 4) benefits have no maximum limit Health insurance also covers preventive care. If larry�s family files four claims of $400, $800, $100, and $700 in one year, how much will the insurance company pay? Balance billing is only allowed when a provider is not. Disability income insurance covers loss of income resulting from accident or illness.

Source: galldeckvirh.blogspot.com

Source: galldeckvirh.blogspot.com

All of the following health care services are typically covered except for. Health insurance also covers preventive care. A deductible is the amount you pay for health care services before your health insurance begins to pay. Comprehensive major medical expense coverage. Under the carryover provision, what will the insurer pay?

Source: ramdantania.blogspot.com

Source: ramdantania.blogspot.com

The policy was issued with a $500 deductible and a limit of four deductibles per calendar year. The policy was issued with a $500 deductible and a limit of four deductibles per calendar year. * a) hospital miscellaneous expenses. Coverage is basically provided in one of two ways. All of the following statements about major medical benefits are true except 1) the deductible can be expressed as a fixed dollar amount 2) the benefit period begins only after a specified amount of expenses have accrued 3) benefits are generally expressed as a percentage of eligible expenses 4) benefits have no maximum limit

Source: galldeckvirh.blogspot.com

Source: galldeckvirh.blogspot.com

Get a free quote and. If larry�s family files four claims of $400, $800, $100, and $700 in one year, how much will the insurance company pay? He incurs covered medical expenses of $100 in november and $400 in january. Surgically removing a facial birthmark. 13.1 the purpose of medical expense insurance.

Source: galldeckvirh.blogspot.com

Source: galldeckvirh.blogspot.com

Basic medical expense insurance (often referred to as first dollar insurance) pays benefits up front without the patient having to first satisfy a deductible. A program offered by a health insurance company to manage the costs of policyholders’ chronic health conditions. Health insurance is a product that covers your medical expenses. Medical expense insurance is a contract of reimbursement. After that, you share the cost with your plan by paying coinsurance.

Source: galldeckvirh.blogspot.com

Source: galldeckvirh.blogspot.com

Medical expense insurance is designed to provide financial protection against the cost of medical care for accidents and sickness. Medical payments coverage is an optional auto insurance coverage that helps pay you or your passengers� medical expenses resulting from a car accident. All of the following health care services are typically covered except for. Terms in this set (35) major medical expense policy. Health insurance is a product that covers your medical expenses.

Source: chowtoprint.blogspot.com

Source: chowtoprint.blogspot.com

(a basic hospital/surgical policy would most likely cover cosmetic surgery to remove a facial birthmark.) q is hospitalized for 3 days and receives a bill for $10,100. Comprehensive medical expense insurance covers room and board, surgical fees and hospital miscellaneous expenses up to a dollar limit. Comprehensive major medical expense coverage. He incurs covered medical expenses of $100 in november and $400 in january. Basic medicalinsurance limits coverage to specific medical care.

Source: galldeckvirh.blogspot.com

Source: galldeckvirh.blogspot.com

A program offered by a health insurance company to manage the costs of policyholders’ chronic health conditions. Medical expense policies will typically cover which of the following? * a) hospital miscellaneous expenses. Dan has a major medical expense policy with a $200 deductible and an 80/20 coinsurance provision. Get a free quote and.

Source: mcdonaldnalack.blogspot.com

Coverage is basically provided in one of two ways. (a basic hospital/surgical policy would most likely cover cosmetic surgery to remove a facial birthmark.) q is hospitalized for 3 days and receives a bill for $10,100. A program offered by a health insurance company to manage the costs of policyholders’ chronic health conditions. Q has a major medical policy with a $100 deductible and 80/20 coinsurance. Medical expense policies will typically cover which of the following?

Source: pecintanoah.blogspot.com

Source: pecintanoah.blogspot.com

Dan has a major medical expense policy with a $200 deductible and an 80/20 coinsurance provision. Q has a major medical policy with a $100 deductible and 80/20 coinsurance. A program offered by a health insurance company to manage the costs of policyholders’ chronic health conditions. Comprehensive major medical expense coverage. Coverage is provided for daily hospital room and board, miscellaneous hospital

Source: oregonmedicalgroup.art

The policy was issued with a $500 deductible and a limit of four deductibles per calendar year. A comprehensive major medical health insurance policy contains an eligible expenses provision which identifies the types of health care services that are covered. Under the carryover provision, what will the insurer pay? Health insurance policy that provides broad coverage and high benefits for hospitalization, surgery, and physician services. Comprehensive medical expense insurance covers room and board, surgical fees and hospital miscellaneous expenses up to a dollar limit.

Source: lisabearile.blogspot.com

Source: lisabearile.blogspot.com

Personal liability insurance covers anyone who lives in your home and is considered your family member. Two claims were paid in september 2013, each incurring medical expenses in excess of the deductible. Her health policy most likely contains a. If your plan�s deductible is $1,500, you�ll pay 100 percent of eligible health care expenses until the bills total $1,500. What is medical expense insurance?

Source: galldeckvirh.blogspot.com

Source: galldeckvirh.blogspot.com

Balance billing is only allowed when a provider is not. * a) hospital miscellaneous expenses. He incurs covered medical expenses of $100 in november and $400 in january. All of the following health care services are typically covered except for. Health insurance policy that provides broad coverage and high benefits for hospitalization, surgery, and physician services.

![]() Source: galldeckvirh.blogspot.com

Source: galldeckvirh.blogspot.com

Health insurance is a product that covers your medical expenses. Two claims were paid in september 2013, each incurring medical expenses in excess of the deductible. A hospital/surgical expense policy was purchased for a family of four in march of 2013. He incurs covered medical expenses of $100 in november and $400 in january. Basic medicalinsurance limits coverage to specific medical care.

Source: galldeckvirh.blogspot.com

Source: galldeckvirh.blogspot.com

What is medical expense insurance? Her health policy most likely contains a. Normally members would pay their deductible for the services provided, and the insurance company would reimburse the medical service provider for the balance of the amount due. Disability income insurance covers loss of income resulting from accident or illness. Health insurance policy that provides broad coverage and high benefits for hospitalization, surgery, and physician services.

Source: x-k-a-i-b-i-n-x.blogspot.com

Source: x-k-a-i-b-i-n-x.blogspot.com

Comprehensive medical expense insurance covers room and board, surgical fees and hospital miscellaneous expenses up to a dollar limit. The policy was issued with a $500 deductible and a limit of four deductibles per calendar year. A program offered by a health insurance company to manage the costs of policyholders’ chronic health conditions. Health insurance also covers preventive care. Under the carryover provision, what will the insurer pay?

Source: janettesprid1939.blogspot.com

Source: janettesprid1939.blogspot.com

All of the following statements about major medical benefits are true except 1) the deductible can be expressed as a fixed dollar amount 2) the benefit period begins only after a specified amount of expenses have accrued 3) benefits are generally expressed as a percentage of eligible expenses 4) benefits have no maximum limit Like auto insurance covers your car if you get into an accident, health insurance covers you if you get sick or injured. Balance billing is only allowed when a provider is not. Disability income insurance covers loss of income resulting from accident or illness. Two claims were paid in september 2013, each incurring medical expenses in excess of the deductible.

Source: galldeckvirh.blogspot.com

Source: galldeckvirh.blogspot.com

Medical expense insurance would cover quizlet. Medical expense insurance would cover quizlet. Health insurance policy that provides broad coverage and high benefits for hospitalization, surgery, and physician services. What is medical expense insurance? Get a free quote and.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title medical expense insurance would cover quizlet by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.