Medical insurance relief 2014 information

Home » Trend » Medical insurance relief 2014 informationYour Medical insurance relief 2014 images are ready. Medical insurance relief 2014 are a topic that is being searched for and liked by netizens today. You can Download the Medical insurance relief 2014 files here. Get all free photos.

If you’re looking for medical insurance relief 2014 pictures information connected with to the medical insurance relief 2014 keyword, you have pay a visit to the ideal blog. Our site always provides you with hints for refferencing the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

Medical Insurance Relief 2014. People without coverage may pay a shared responsibility payment. There is a requirement to have health insurance coverage starting jan. To fill out a health coverage exemption application, you’ll need to download it onto your computer first. For example in 2014, the fine for being uninsured will be $95 for each adult and $47.50 for each child, or one percent of your income whichever is higher.

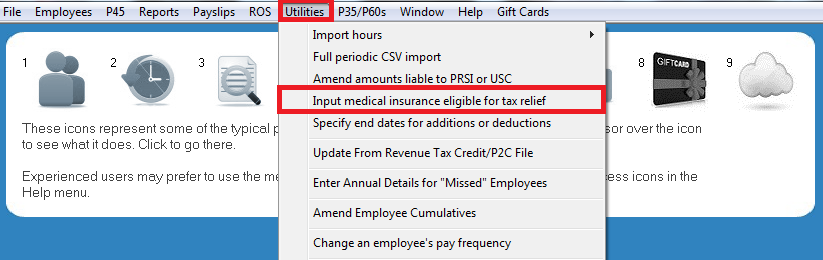

Sage Payroll Enter medical insurance eligible for tax From youtube.com

Sage Payroll Enter medical insurance eligible for tax From youtube.com

Prior to the budget 2014 announcement those who had private medical insurance had 20% tax deducted from their full gross premium by their private medical insurers on behalf of the revenue commissioner. The penalty is generally the larger of a flat dollar amount per individual or a percentage of your income, whichever is greater. Download health coverage exemption forms. Ongoing analysis of the health safety net trust fund: By , on april 20th, 2014. Consistent with guidance released by the secretary of hhs on october, 28, 2013, the proposed regulations provide that an individual who enrolls in a plan through an exchange during the open enrollment period for coverage for 2014 may claim a hardship exemption for months in 2014 prior to the effective date of the individual’s coverage without obtaining a hardship.

When it comes to insurance policies, these are the claimable tax reliefs offered for malaysia personal income tax:

There is a requirement to have health insurance coverage starting jan. Trs stands for tax relief at source. If you pay medical insurance directly to an approved insurer, tax relief is available. Starting in 2014, every person needs to have health insurance or make a payment on his or her federal income tax return. To claim a hardship exemption, you must fill out a paper application and mail it to the marketplace. You can get examples of how tax relief is applied where medical insurance premiums are paid directly by employers on revenue�s website.

Source: pinterest.com

Source: pinterest.com

May have to pay a penalty if they don’t have sufficient health insurance under the affordable care act. Qualifying medical insurance policies can be for: For details and forms, follow the links below. Identify the correct form for you. If you have minimum essential coverage through your employer or that you’ve purchased on your own or through your state’s marketplace , you likely don’t need to worry about this penalty.

Source: tra-professional.ie

Source: tra-professional.ie

You will need to return, to revenue, the value of the medical insurance relief. Prior to the budget 2014 announcement those who had private medical insurance had 20% tax deducted from their full gross premium by their private medical insurers on behalf of the revenue commissioner. Prior to 16 october 2013, tax relief was available on the full gross premium paid. In 2015 that fine increases to $325 per adult and $162.50 per child per or 2 percent of your income, whichever is greater. · up to rm7,000 for life insurance public servants.

Source: youtube.com

Source: youtube.com

Trs stands for tax relief at source. People without coverage may pay a shared responsibility payment. To fill out a health coverage exemption application, you’ll need to download it onto your computer first. The affordable care act is designed to ensure everyone has health insurance and imposes tax penalties on those who don’t. You must add this gross value, as notional pay, to your employee’s pay to deduct:

Source: blog.myrickcpa.com

Source: blog.myrickcpa.com

Ongoing analysis of the health safety net trust fund: The regulation reiterated what was stated in the september 21, 2010 guidance and added a Qualifying medical insurance policies can be for: The affordable care act is designed to ensure everyone has health insurance and imposes tax penalties on those who don’t. If someone on the tax return purchased coverage in the marketplace and qualifies for a premium tax credit, complete form 8962.

Source: ispot.tv

Source: ispot.tv

How to claim a health insurance exemption. How to claim a health insurance exemption. First things first, if you pay for private health insurance you�re entitled to benefit from tax relief at a rate of 20 per cent on the cost of the premium. To claim a hardship exemption, you must fill out a paper application and mail it to the marketplace. But the law recognizes there are legitimate reasons people may be exempt from this rule.

Such charges are made through their bursar account. In fact, an estimated 20 million americans may qualify to waive the tax. The fine is due when you file your 2014 taxes. For details and forms, follow the links below. How to claim a health insurance exemption.

Source: ispot.tv

Source: ispot.tv

Download health coverage exemption forms. · up to rm7,000 for life insurance public servants. In 2015 that fine increases to $325 per adult and $162.50 per child per or 2 percent of your income, whichever is greater. 2014 hardship exemptions and forms. Finance act 2015 amended tax relief for medical insurance premiums for young adults from 1 may 2015 on foot of changes introduced under the health insurance (amendment) act 2014.

Source: youtube.com

Source: youtube.com

This limit applies to the premium paid towards health insurance purchased for you, your spouse, and your dependent children. How to claim a health insurance exemption. The instructions list 19 categories of exemptions from the requirement for health insurance coverage. This limit applies to the premium paid towards health insurance purchased for you, your spouse, and your dependent children. You will need to return, to revenue, the value of the medical insurance relief.

Source: healthplansny.com

Source: healthplansny.com

But the law recognizes there are legitimate reasons people may be exempt from this rule. Under section 80d, you are allowed to claim a tax deduction of up to rs 25,000 per financial year on medical insurance premiums. Consistent with guidance released by the secretary of hhs on october, 28, 2013, the proposed regulations provide that an individual who enrolls in a plan through an exchange during the open enrollment period for coverage for 2014 may claim a hardship exemption for months in 2014 prior to the effective date of the individual’s coverage without obtaining a hardship. By , on april 20th, 2014. For details and forms, follow the links below.

Source: ibanding.my

Source: ibanding.my

The fine is due when you file your 2014 taxes. This limit applies to the premium paid towards health insurance purchased for you, your spouse, and your dependent children. In addition to the exemptions above, you may qualify for a “hardship” exemption. A child is someone under 21 years of age that a child premium has been paid for. For example in 2014, the fine for being uninsured will be $95 for each adult and $47.50 for each child, or one percent of your income whichever is higher.

Source: youtube.com

Source: youtube.com

You will need to return, to revenue, the value of the medical insurance relief. If someone on the tax return purchased coverage in the marketplace and qualifies for a premium tax credit, complete form 8962. The affordable care act is designed to ensure everyone has health insurance and imposes tax penalties on those who don’t. If you pay medical insurance directly to an approved insurer, tax relief is available. In 2015 that fine increases to $325 per adult and $162.50 per child per or 2 percent of your income, whichever is greater.

Source: insurance-relief.com

Source: insurance-relief.com

If someone on the tax return purchased coverage in the marketplace and qualifies for a premium tax credit, complete form 8962. Ongoing analysis of the health safety net trust fund: The affordable care act calls for individuals to have qualifying health insurance coverage for each month of the year, have an exemption, or make a shared responsibility payment when filing his or her federal income tax return. Limit on the tax relief granted A child is someone under 21 years of age that a child premium has been paid for.

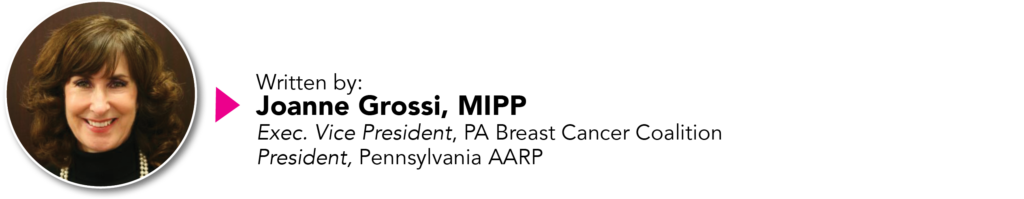

Source: pabreastcancer.org

Source: pabreastcancer.org

If you have minimum essential coverage through your employer or that you’ve purchased on your own or through your state’s marketplace , you likely don’t need to worry about this penalty. How health insurance costs are charged: The penalty is generally the larger of a flat dollar amount per individual or a percentage of your income, whichever is greater. Health and dental insurance combined. If someone on the tax return purchased coverage in the marketplace and qualifies for a premium tax credit, complete form 8962.

Source: thesaurus.ie

Source: thesaurus.ie

The penalty is generally the larger of a flat dollar amount per individual or a percentage of your income, whichever is greater. Qualifying for a health insurance coverage exemption. This is called the “shared responsibility payment.” The relief is given as a discount on the cost of the policy, regardless of who the policy is for. For example in 2014, the fine for being uninsured will be $95 for each adult and $47.50 for each child, or one percent of your income whichever is higher.

Source: harmonicsfinancial.ie

Source: harmonicsfinancial.ie

A child is someone under 21 years of age that a child premium has been paid for. Ongoing analysis of the health safety net trust fund: Qualifying medical insurance policies can be for: If you pay medical insurance directly to an approved insurer, tax relief is available. To claim a hardship exemption, you must fill out a paper application and mail it to the marketplace.

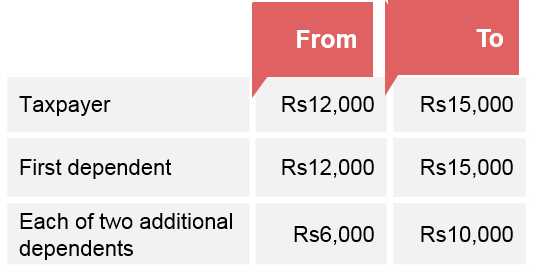

Source: pwc.com

Source: pwc.com

How health insurance costs are charged: This is called the “shared responsibility payment.” Starting in 2014, every person needs to have health insurance or make a payment on his or her federal income tax return. The relief is given at the rate of 20% of the cost, up to a maximum of €1,000 per adult and €500 per child. When it comes to insurance policies, these are the claimable tax reliefs offered for malaysia personal income tax:

Source: oliverjean-alittlelovefromyou.blogspot.com

However, you don�t have to claim this relief from revenue in order to benefit. Such charges are made through their bursar account. Health and dental insurance combined. People without coverage may pay a shared responsibility payment. For example in 2014, the fine for being uninsured will be $95 for each adult and $47.50 for each child, or one percent of your income whichever is higher.

Source: bajet.com.my

Source: bajet.com.my

The affordable care act calls for individuals to have qualifying health insurance coverage for each month of the year, have an exemption, or make a shared responsibility payment when filing his or her federal income tax return. This page is intentionally left blank. Qualifying for a health insurance coverage exemption. 2014 hardship exemptions and forms. How health insurance costs are charged:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title medical insurance relief 2014 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.