Medical malpractice insurance pennsylvania information

Home » Trending » Medical malpractice insurance pennsylvania informationYour Medical malpractice insurance pennsylvania images are ready in this website. Medical malpractice insurance pennsylvania are a topic that is being searched for and liked by netizens today. You can Download the Medical malpractice insurance pennsylvania files here. Get all royalty-free photos and vectors.

If you’re searching for medical malpractice insurance pennsylvania images information linked to the medical malpractice insurance pennsylvania keyword, you have pay a visit to the ideal site. Our site frequently gives you suggestions for viewing the maximum quality video and picture content, please kindly surf and find more enlightening video content and graphics that match your interests.

Medical Malpractice Insurance Pennsylvania. 26808 hallmark specialty ins co. Medical malpractice 2014 market share report created date: Public citizen’s congress watch v “medical malpractice in pennsylvania” • 5.3 percent of doctors nationally are responsible for 56 percent of medical That means that if a doctor of hospital conducts more than half of its business in pennsylvania, it is mandated to participate in mcare.

Pennsylvania Medical Malpractice Insurance Free No From galaghermalpractice.com

Pennsylvania Medical Malpractice Insurance Free No From galaghermalpractice.com

Medical malpractice requirements in pennsylvania. Public citizen’s congress watch v “medical malpractice in pennsylvania” • 5.3 percent of doctors nationally are responsible for 56 percent of medical The mcare fund routinely plays the role of informal. Foremost, applicable state medical malpractice laws in pennsylvania give the individual given the individual claimant and former patient up to two (2) years to file a medical negligence tort claim, and instances of delayed discovery, pennsylvania adheres to a discovery of harm rule as well, allowing the injured patients exemptions to the statutes of limitation period in the event that an. The required pennsylvania medical malpractice insurance limits for physicians and surgeons must maintain are $1,000,000 per claim and $3,000,000 as an annual aggregate. Approved to offer medical malpractice insurance in pennsylvania, according to the state insurance department’s, illustrating the temporary nature of the “hard” market that drove some insurers to drastically raise rates or discontinue writing policies.

At the mcare fund, it is our responsibility to serve citizens of the commonwealth of pennsylvania in three key ways:

The primary (private) policy insures the first $500,000 of any claim, and the mcare fund will cover excess losses of up to another $500,000. It protects such professionals against potential negligence claims made by their patients and/or employers. Most hospitals require a physician carry malpractice insurance prior to granting admitting privileges. Next year, pennsylvania doctors will pay less for medical malpractice insurance purchased through mcare, but part of the lower cost is a result of overpayments in years past. We take a different approach to medical malpractice insurance, professional liability insurance for a home health care agency, home care workers comp, and more, offering quick. Clapper insurance agency provides medical malpractice insurance for stoneboro and all of pennsylvania.

Source: gallaghermalpractice.com

Source: gallaghermalpractice.com

That means that if a doctor of hospital conducts more than half of its business in pennsylvania, it is mandated to participate in mcare. Public citizen’s congress watch v “medical malpractice in pennsylvania” • 5.3 percent of doctors nationally are responsible for 56 percent of medical That means that if a doctor of hospital conducts more than half of its business in pennsylvania, it is mandated to participate in mcare. There were 2 crisis points where rates were unaffordable and coverage was extremely limited which prompted lawmakers to initiate reforms. The mcare fund routinely plays the role of informal.

Source: galaghermalpractice.com

Source: galaghermalpractice.com

The mcare fund routinely plays the role of informal. Foremost, applicable state medical malpractice laws in pennsylvania give the individual given the individual claimant and former patient up to two (2) years to file a medical negligence tort claim, and instances of delayed discovery, pennsylvania adheres to a discovery of harm rule as well, allowing the injured patients exemptions to the statutes of limitation period in the event that an. The mcare fund mandates proof of coverage, and if evidence of insurance is not received, it has the obligation to report the health care provider to the appropriate licensing board for license suspension or revocation. Medical malpractice insurance in pennsylvania is available from admitted insurers, surplus lines insurers, risk retention groups, and the pennsylvania professional liability joint underwriting association (jua). Pennsylvania malpractice insurance covers bodily injury or property damage as.

Source: gallaghermalpractice.com

Source: gallaghermalpractice.com

Medical malpractice 2014 market share report created date: 2019 medical malpractice insurance companies in pennsylvania page 1 of 4. Pennsylvania malpractice insurance covers bodily injury or property damage as. One of those efforts to reduce medical malpractice insurance premiums is a pennsylvania law that was passed in 2002. The mcare fund mandates proof of coverage, and if evidence of insurance is not received, it has the obligation to report the health care provider to the appropriate licensing board for license suspension or revocation.

Source: advancedprofessional.com

Source: advancedprofessional.com

In today’s challenging healthcare marketplace, medical malpractice insurance is a necessity. Direct premiums rank naic # company name domicile written 46 15865 ncmic ins co ia 2,493,475 47. Clapper insurance agency provides medical malpractice insurance for stoneboro and all of pennsylvania. Client first brokers dedicated to educating medical professionals about insurance and placing their needs before our own interests 2019 medical malpractice insurance companies in pennsylvania page 1 of 4.

Source: cmfgroup.com

Source: cmfgroup.com

Medical malpractice requirements in pennsylvania. The mcare fund mandates proof of coverage, and if evidence of insurance is not received, it has the obligation to report the health care provider to the appropriate licensing board for license suspension or revocation. The primary (private) policy insures the first $500,000 of any claim, and the mcare fund will cover excess losses of up to another $500,000. Medical malpractice insurance in pennsylvania is available from admitted insurers, surplus lines insurers, risk retention groups, and the pennsylvania professional liability joint underwriting association (jua). Clapper insurance agency provides medical malpractice insurance for stoneboro and all of pennsylvania.

Source: gallaghermalpractice.com

Source: gallaghermalpractice.com

At the mcare fund, it is our responsibility to serve citizens of the commonwealth of pennsylvania in three key ways: At the mcare fund, it is our responsibility to serve citizens of the commonwealth of pennsylvania in three key ways: Next year, pennsylvania doctors will pay less for medical malpractice insurance purchased through mcare, but part of the lower cost is a result of overpayments in years past. Clapper insurance agency provides medical malpractice insurance for stoneboro and all of pennsylvania. Approved to offer medical malpractice insurance in pennsylvania, according to the state insurance department’s, illustrating the temporary nature of the “hard” market that drove some insurers to drastically raise rates or discontinue writing policies.

Source: gallaghermalpractice.com

Source: gallaghermalpractice.com

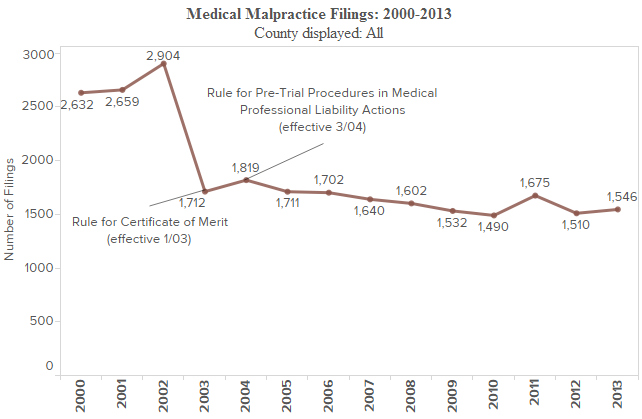

Clapper insurance agency provides medical malpractice insurance for stoneboro and all of pennsylvania. In 2012, for example, there were 1,508 filings within the state, which represented a decrease of 44.8 percent since the year 2000. Ad compare medical coverage online in minutes. We take a different approach to medical malpractice insurance, professional liability insurance for a home health care agency, home care workers comp, and more, offering quick. Clapper insurance agency provides medical malpractice insurance for stoneboro and all of pennsylvania.

Source: yurconic.com

Source: yurconic.com

Direct premiums rank naic # company name domicile written 46 15865 ncmic ins co ia 2,493,475 47. Clapper insurance agency provides medical malpractice insurance for stoneboro and all of pennsylvania. One of those efforts to reduce medical malpractice insurance premiums is a pennsylvania law that was passed in 2002. Medical malpractice requirements in pennsylvania. The law made it more difficult for medical malpractice plaintiffs to arrange for the removal of their lawsuits to a jurisdiction known to have generous juries.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Pennsylvania state law requires health care providers who provide 50 percent or more of their medical care within the state to maintain medical malpractice insurance coverage. 2019 medical malpractice insurance companies in pennsylvania page 1 of 4. Direct premiums rank naic # company name domicile written 46 15865 ncmic ins co ia 2,493,475 47. Since april of 2002, the pennsylvania department of insurance has licensed or approved 57 new entities to offer medical malpractice insurance coverage to hospitals and. 26808 hallmark specialty ins co.

Source: centralpachamber.com

Source: centralpachamber.com

Pennsylvania malpractice insurance covers bodily injury or property damage as. The law made it more difficult for medical malpractice plaintiffs to arrange for the removal of their lawsuits to a jurisdiction known to have generous juries. Pennsylvania malpractice insurance covers bodily injury or property damage as. Malpractice insurance to pennsylvania’s health care providers is about $683 million a year. Pennsylvania has the mcare act, which requires all practicing doctors to carry medical malpractice insurance.

Source: medpli.com

Source: medpli.com

Medical malpractice insurance in pennsylvania is available from admitted insurers, surplus lines insurers, risk retention groups, and the pennsylvania professional liability joint underwriting association (jua). Client first brokers dedicated to educating medical professionals about insurance and placing their needs before our own interests In 2012, for example, there were 1,508 filings within the state, which represented a decrease of 44.8 percent since the year 2000. The primary (private) policy insures the first $500,000 of any claim, and the mcare fund will cover excess losses of up to another $500,000. Medical malpractice requirements in pennsylvania.

Source: medpli.com

Source: medpli.com

Malpractice insurance to pennsylvania’s health care providers is about $683 million a year. Public citizen’s congress watch v “medical malpractice in pennsylvania” • 5.3 percent of doctors nationally are responsible for 56 percent of medical Malpractice insurance to pennsylvania’s health care providers is about $683 million a year. Like many states pennsylvania’s medical malpractice insurance market has had its ups and downs. Pennsylvania state law requires health care providers who provide 50 percent or more of their medical care within the state to maintain medical malpractice insurance coverage.

Source: gallaghermalpractice.com

Source: gallaghermalpractice.com

Medical malpractice insurance in pennsylvania the number of medical malpractice cases in the state of pennsylvania has been declining quickly in recent years. Pennsylvania malpractice insurance covers bodily injury or property damage as. We can help guide you to better results and a higher set of expectations with our value added services. Ad compare medical coverage online in minutes. Most hospitals require a physician carry malpractice insurance prior to granting admitting privileges.

Source: nhstexas.com

Source: nhstexas.com

26808 hallmark specialty ins co. We understand your struggle to deliver quality health care and avoid medical malpractice claims. In 2012, for example, there were 1,508 filings within the state, which represented a decrease of 44.8 percent since the year 2000. Malpractice insurance to pennsylvania’s health care providers is about $683 million a year. In today’s challenging healthcare marketplace, medical malpractice insurance is a necessity.

Source: mutualbenefitgroup.com

Source: mutualbenefitgroup.com

Direct premiums rank naic # company name domicile written 46 15865 ncmic ins co ia 2,493,475 47. We understand your struggle to deliver quality health care and avoid medical malpractice claims. Medical malpractice requirements in pennsylvania. 26808 hallmark specialty ins co. Client first brokers dedicated to educating medical professionals about insurance and placing their needs before our own interests

Source: centerjd.org

Source: centerjd.org

Laser focused on medical malpractice insurance, it’s all we do ; 2019 medical malpractice insurance companies in pennsylvania page 1 of 4. One of those efforts to reduce medical malpractice insurance premiums is a pennsylvania law that was passed in 2002. The required pennsylvania medical malpractice insurance limits for physicians and surgeons must maintain are $1,000,000 per claim and $3,000,000 as an annual aggregate. We understand your struggle to deliver quality health care and avoid medical malpractice claims.

Source: pennlive.com

Source: pennlive.com

The law made it more difficult for medical malpractice plaintiffs to arrange for the removal of their lawsuits to a jurisdiction known to have generous juries. 159 east county line road. Since april of 2002, the pennsylvania department of insurance has licensed or approved 57 new entities to offer medical malpractice insurance coverage to hospitals and. At the mcare fund, it is our responsibility to serve citizens of the commonwealth of pennsylvania in three key ways: Medical malpractice 2014 market share report created date:

Source: insurancejournal.com

Source: insurancejournal.com

159 east county line road. Direct premiums rank naic # company name domicile written 46 15865 ncmic ins co ia 2,493,475 47. Like many states pennsylvania’s medical malpractice insurance market has had its ups and downs. Laser focused on medical malpractice insurance, it’s all we do ; That means that if a doctor of hospital conducts more than half of its business in pennsylvania, it is mandated to participate in mcare.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title medical malpractice insurance pennsylvania by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.