Medical stop loss insurance Idea

Home » Trend » Medical stop loss insurance IdeaYour Medical stop loss insurance images are available. Medical stop loss insurance are a topic that is being searched for and liked by netizens now. You can Get the Medical stop loss insurance files here. Find and Download all free photos and vectors.

If you’re searching for medical stop loss insurance pictures information related to the medical stop loss insurance topic, you have visit the right site. Our website frequently provides you with suggestions for refferencing the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that fit your interests.

Medical Stop Loss Insurance. Medical stop loss insurance from tokio marine hcc is designed to protect employers from that risk. Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. Msl is made up of specific stop loss and aggregate stop loss coverage. Benefits of medical stop loss.

Medical Stop Loss The Horton Group From thehortongroup.com

Medical Stop Loss The Horton Group From thehortongroup.com

Extensive eligible industry list including: Medical stop loss insurance provides protection to self funded employer health plans. Specific stop loss can be purchased on a stand alone basis or specific and aggregate stop loss coverage can be combined. Once deductibles and copayments have been met, the stop loss provision is activated. Our underwriting, claims, policy administration, marketing and sales, premium accounting and licensing departments stand ready to help you. Specific (also called individual) stop loss is the form of excess risk coverage that provides protection for the employer

Msl is intended to provide self funded.

Under a stop loss policy, the insurance company reimburses the employer for legitimate health claims that exceed certain limits. Medical stop loss insurance provides protection to self funded employer health plans. This is a specific clause that is contained within any policy that has a deductible as a core component. Extensive eligible industry list including: An association or employer) liable for the payment of. Specific (also called individual) stop loss is the form of excess risk coverage that provides protection for the employer

Source: varipro.com

Source: varipro.com

Medical stop loss insurance provides protection to self funded employer health plans. Medical stop loss insurance from tokio marine hcc is designed to protect employers from that risk. Stealth partner group provides you with instant access to more than 150 years of collective stop loss insurance experience—along with the extensive knowledge, established relationships, and proven processes and results that go with it. Our underwriting, claims, policy administration, marketing and sales, premium accounting and licensing departments stand ready to help you. An increasing number of businesses of all sizes are choosing to forego traditional group health.

Source: ullico.com

Source: ullico.com

Specific (also called individual) stop loss is the form of excess risk coverage that provides protection for the employer Medical stop loss insurance from tokio marine hcc is designed to protect employers from that risk. Medical stop loss insurance comes in two forms: Medical stop loss insurance (also known as excess insurance) can help protect organizations against unexpected surges in the healthcare costs of their plan participants. What is stop loss insurance?

Source: slideshare.net

Source: slideshare.net

Medical stop loss insurance discover smart, practical, and complete stop loss insurance solutions. Medical stop loss insurance provides protection to self funded employer health plans. Medical stop loss insurance comes in two forms: Great american insurance group offers medical stop loss insurance through its relationship with radion health, a turnkey stop loss solutions provider to brokers, consultants and tpas. Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses.

Source: bfpartners.ca

Source: bfpartners.ca

What is stop loss insurance? Benefits of medical stop loss. Msl is intended to provide self funded. Medical stop loss insurance provides protection to self funded employer health plans. Msl is made up of specific stop loss and aggregate stop loss coverage.

Source: guardiananytime.com

Source: guardiananytime.com

Once deductibles and copayments have been met, the stop loss provision is activated. As a result, traditional insurers may be expensive, or coverage from the traditional market is simply unavailable. Medical stop loss insurance discover smart, practical, and complete stop loss insurance solutions. Msl is made up of specific stop loss and aggregate stop loss coverage. With the law�s mandate to remove plan coverage limits, many face the challenge of maintaining quality coverage, benefit selections and access to service.

Source: springgroup.com

Source: springgroup.com

What is stop loss insurance? Under a stop loss policy, the insurance company reimburses the employer for legitimate health claims that exceed certain limits. Medical stop loss insurance (also known as excess insurance) can help protect organizations against unexpected surges in the healthcare costs of their plan participants. Medical stop loss insurance from tokio marine hcc is designed to protect employers from that risk. Welcome to national stop loss.

Source: slideshare.net

Source: slideshare.net

More control over medical coverage offerings to employees. There are two types of stop loss excess risk coverage: As a result, traditional insurers may be expensive, or coverage from the traditional market is simply unavailable. Benefits of medical stop loss. Medical stop loss insurance provides protection to self funded employer health plans.

Source: youtube.com

Source: youtube.com

Extensive eligible industry list including: Financial stability and the ability to manage claims costs more effectively. Specific stop loss can be purchased on a stand alone basis or specific and aggregate stop loss coverage can be combined. An increasing number of businesses of all sizes are choosing to forego traditional group health. Medical stop loss insurance from tokio marine hcc is designed to protect employers from that risk.

Source: esosojazosazules.blogspot.com

Source: esosojazosazules.blogspot.com

Great american insurance group offers medical stop loss insurance through its relationship with radion health, a turnkey stop loss solutions provider to brokers, consultants and tpas. Medical stop loss insurance provides protection to self funded employer health plans. Welcome to national stop loss. As a result, traditional insurers may be expensive, or coverage from the traditional market is simply unavailable. Once deductibles and copayments have been met, the stop loss provision is activated.

Source: thehortongroup.com

Source: thehortongroup.com

An increasing number of businesses of all sizes are choosing to forego traditional group health. Stealth partner group provides you with instant access to more than 150 years of collective stop loss insurance experience—along with the extensive knowledge, established relationships, and proven processes and results that go with it. As a result, traditional insurers may be expensive, or coverage from the traditional market is simply unavailable. The maximum liability employers take on can range from $10,000 to $1 million, and generally fall within 3 to 6 percent of the expected annual claim amount. Msl is made up of specific stop loss and aggregate stop loss coverage.

Source: knusurant.com

Specific stop loss can be purchased on a stand alone basis or specific and aggregate stop loss coverage can be combined. The maximum liability employers take on can range from $10,000 to $1 million, and generally fall within 3 to 6 percent of the expected annual claim amount. Medical stop loss insurance (also known as excess insurance) can help protect organizations against unexpected surges in the healthcare costs of their plan participants. More control over medical coverage offerings to employees. Stealth partner group provides you with instant access to more than 150 years of collective stop loss insurance experience—along with the extensive knowledge, established relationships, and proven processes and results that go with it.

Source: fotohijrah.blogspot.com

Source: fotohijrah.blogspot.com

An increasing number of businesses of all sizes are choosing to forego traditional group health. Great american insurance group offers medical stop loss insurance through its relationship with radion health, a turnkey stop loss solutions provider to brokers, consultants and tpas. Once deductibles and copayments have been met, the stop loss provision is activated. In essence, it provides insureds with protection against unpredictable or catastrophic losses related to healthcare. Medical stop loss insurance (also known as excess insurance) can help protect organizations against unexpected surges in the healthcare costs of their plan participants.

Source: guardiananytime.com

Source: guardiananytime.com

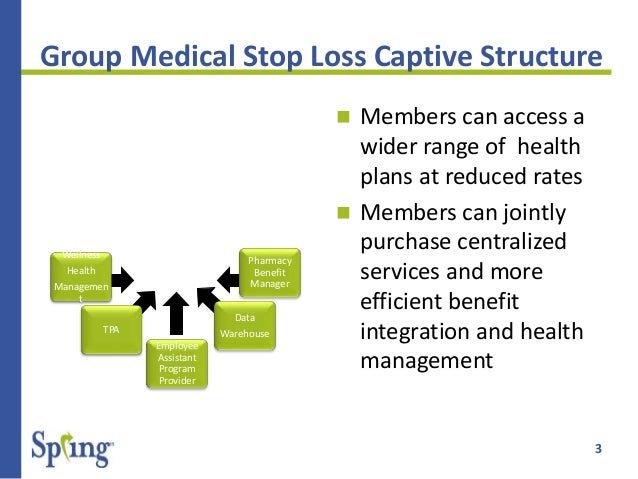

This is a specific clause that is contained within any policy that has a deductible as a core component. Medical stop loss captives offer benefits like: Our underwriting, claims, policy administration, marketing and sales, premium accounting and licensing departments stand ready to help you. Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. Medical stop loss insurance comes in two forms:

Source: slideshare.net

Source: slideshare.net

In essence, it provides insureds with protection against unpredictable or catastrophic losses related to healthcare. There are two types of stop loss excess risk coverage: Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. Medical stop loss insurance comes in two forms: Benefits of medical stop loss.

Source: youtube.com

Source: youtube.com

Medical stop loss insurance (also known as excess insurance) can help protect organizations against unexpected surges in the healthcare costs of their plan participants. Medical stop loss insurance (also known as excess insurance) can help protect organizations against unexpected surges in the healthcare costs of their plan participants. As a result, traditional insurers may be expensive, or coverage from the traditional market is simply unavailable. There are two types of stop loss excess risk coverage: What is stop loss insurance?

Source: slideshare.net

Source: slideshare.net

Financial stability and the ability to manage claims costs more effectively. Medical stop loss insurance comes in two forms: Msl is made up of specific stop loss and aggregate stop loss coverage. In essence, it provides insureds with protection against unpredictable or catastrophic losses related to healthcare. Welcome to national stop loss.

This is a specific clause that is contained within any policy that has a deductible as a core component. The maximum liability employers take on can range from $10,000 to $1 million, and generally fall within 3 to 6 percent of the expected annual claim amount. Once deductibles and copayments have been met, the stop loss provision is activated. Medical stop loss insurance from tokio marine hcc is designed to protect employers from that risk. More control over medical coverage offerings to employees.

Source: mercer.us

Source: mercer.us

Once the stop loss provision is enacted, the insured will no longer pay out of pocket for any qualifying medical expenses. Medical stop loss insurance comes in two forms: Great american insurance group offers medical stop loss insurance through its relationship with radion health, a turnkey stop loss solutions provider to brokers, consultants and tpas. Financial stability and the ability to manage claims costs more effectively. More control over medical coverage offerings to employees.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title medical stop loss insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.