Medicare levy and private health insurance information

Home » Trend » Medicare levy and private health insurance informationYour Medicare levy and private health insurance images are ready. Medicare levy and private health insurance are a topic that is being searched for and liked by netizens now. You can Download the Medicare levy and private health insurance files here. Download all royalty-free photos.

If you’re searching for medicare levy and private health insurance pictures information related to the medicare levy and private health insurance interest, you have come to the ideal blog. Our website frequently provides you with hints for downloading the highest quality video and image content, please kindly surf and locate more informative video articles and images that fit your interests.

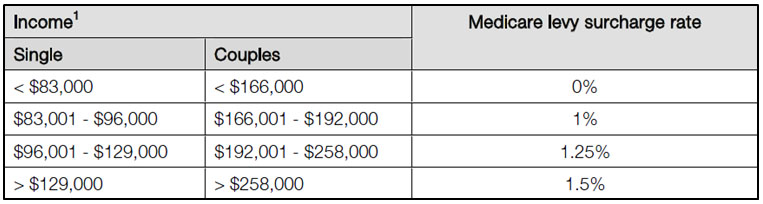

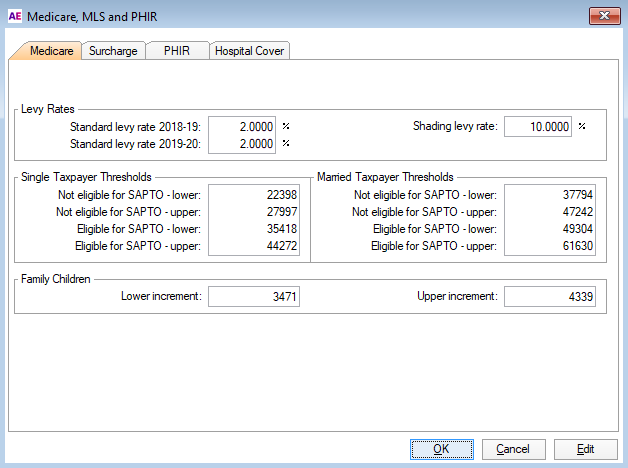

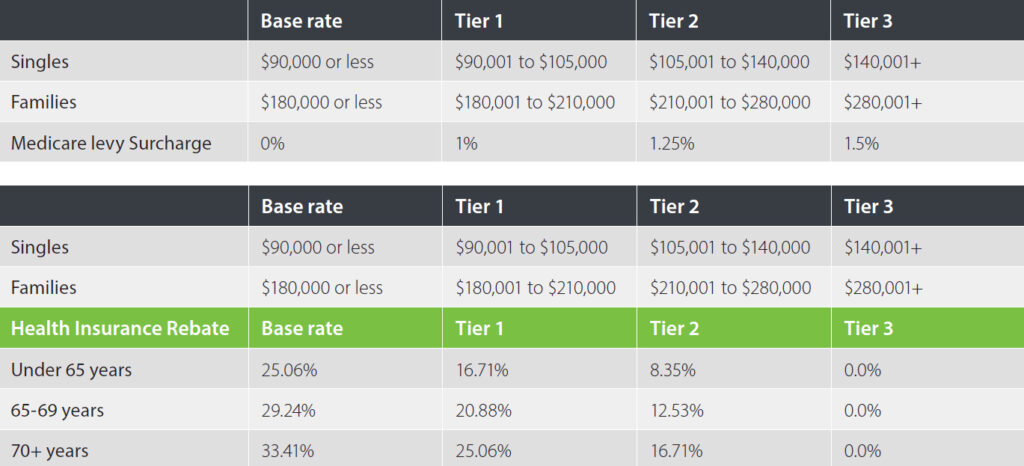

Medicare Levy And Private Health Insurance. Medicare and private health insurance medicare levy medicare levy the medicare levy helps fund some of the costs of australia�s public health system known as medicare. The government subsidises the premiums for all health insurance cover, including hospital and ancillary. The medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income. It’s in addition to the compulsory medicare levy of two per cent, which is paid by most australian taxpayers to help fund medicare.

Private Health Cover vs Medicare Levy Surcharge From etax.com.au

Private Health Cover vs Medicare Levy Surcharge From etax.com.au

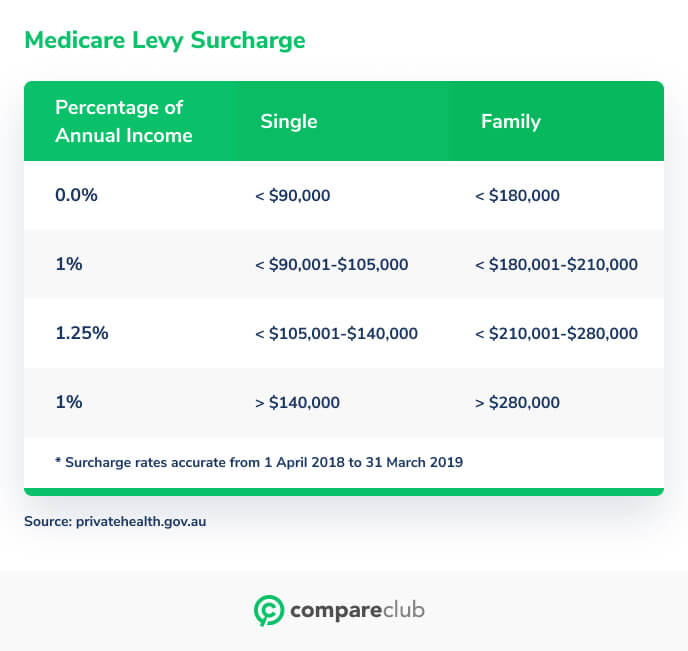

You can check out if you need to pay mls and how much with this calculator below: You may be required to pay the medicare levy surcharge (mls) if: Private health insurance and the medicare levy surcharge. Find out more about the medicare levy surcharge and whether it applies to you. However, if your adjusted taxable income is greater than $90,000 for singles or $180,000 for families, this is where private health insurance comes in to play. Read more about medicare and tax.

Medicare levy surcharge and private health insurance rebate.

Private health insurance and tax you may also have to pay an extra charge on top of the normal medicare levy if you: Medicare and private health insurance. The medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income. Read more about medicare and tax. The medicare levy surcharge of 1% to 1.5% applicable for higher income earners who don’t have private hospital cover. Meet certain medical requirements are a foreign resident

Source: abc.net.au

Source: abc.net.au

Don’t have private hospital cover earn income over a certain level. The medicare levy surcharge (mls) is a levy paid by australian taxpayers who don’t have an appropriate level of private hospital cover and who earn above a certain annual income. In australia, you can choose to have medicare cover only or have a combination of medicare and private health insurance. Most people are eligible for a rebate. If you don’t have adequate hospital cover and earn over the income threshold, you’ll be paying the medicare levy surcharge in addition to the 2% medicare levy (if applicable).

Source: iselect.com.au

Source: iselect.com.au

Most people are eligible for a rebate. This is called the medicare levy surcharge. If you are not covered by a private hospital insurance policy and you earn above a certain income threshold, you may have to pay the medicare levy surcharge when you lodge your tax return. As an australian resident for tax purposes you are subject to the medicare levy. Private health insurance isn’t available for the lhc loading portion of your premium (if applicable).

Source: wilkes.com.au

Source: wilkes.com.au

The state health insurance, medicare, is partially funded through the medicare levy under income tax and is therefore not a social security fund such as e.g. You can check out if you need to pay mls and how much with this calculator below: If you are not covered by a private hospital insurance policy and you earn above a certain income threshold, you may have to pay the medicare levy surcharge when you lodge your tax return. The medicare levy surcharge of 1% to 1.5% applicable for higher income earners who don’t have private hospital cover. The mls is a rate of 1%, 1.25% or 1.5% and is levied on:

Source: iselect.com.au

Source: iselect.com.au

In australia, you can choose to have medicare cover only or have a combination of medicare and private health insurance. You, your spouse and dependent children don�t have an appropriate level of private patient hospital cover, and; This is how private health cover can create tax savings. Don’t have private hospital cover earn income over a certain level. Does the entire family need private hospital cover?

Source: iselect.com.au

Source: iselect.com.au

The medicare levy helps fund some of the costs of australia�s public health system known as medicare. Medicare and private health insurance medicare levy medicare levy the medicare levy helps fund some of the costs of australia�s public health system known as medicare. The medicare levy surcharge of 1% to 1.5% applicable for higher income earners who don’t have private hospital cover. Medicare levy surcharge and private health insurance rebate. The mls is a rate of 1%, 1.25% or 1.5% and is levied on:

Source: billingsellis.com.au

Source: billingsellis.com.au

The mls is designed to encourage higher income earners to take out private health insurance which assists in relieving the load on the public health system. The medicare levy surcharge (mls) is an australian government income based tax designed to motivate people to take out private health insurance hospital cover and not rely on the public healthcare system. Most people are eligible for a rebate. The medicare levy is in addition to the tax you pay on your taxable income, unless you qualify for a reduction or exemption. Private health insurance isn’t available for the lhc loading portion of your premium (if applicable).

Source: vdocuments.mx

Source: vdocuments.mx

The mls is a rate of 1%, 1.25% or 1.5% and is levied on: Medicare and private health insurance. You pay this medicare levy surcharge as part of your income tax. Medicare levy surcharge2 the medicare levy surcharge applies to australian taxpayers who don’t have private hospital cover and who earn above a certain income ($90,000 per year for singles and $180,000 for families in 2020/2021). Medicare and private health insurance medicare levy medicare levy the medicare levy helps fund some of the costs of australia�s public health system known as medicare.

Source: medibank.com.au

Source: medibank.com.au

The medicare levy surcharge of 1% to 1.5% applicable for higher income earners who don’t have private hospital cover. Medicare and private health insurance medicare levy surcharge medicare levy surcharge if you have to pay the medicare levy, you may have to pay the medicare levy surcharge (mls) if you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover and you earn above a certain income. The medicare levy helps fund some of the costs of australia�s public health system known as medicare. Medicare levy surcharge what is the medicare levy surcharge? The mls is a rate of 1%, 1.25% or 1.5% and is levied on:

Source: missowealth.com

Source: missowealth.com

Private health insurance and tax you may also have to pay an extra charge on top of the normal medicare levy if you: Medicare levy surcharge and private health insurance rebate. Once you have a permanent right of residence (permanent visa) or have requested the permanent residence within australia, you are. People whose income for mls purposes is greater than a specified amount and who do not have an appropriate level of cover pay the mls in addition to the standard medicare levy. The medicare levy is 2% of your taxable income, in addition to the tax you pay on your taxable income.

Source: etax.com.au

Source: etax.com.au

The medicare levy surcharge (mls) individuals and families on income(s) above the mls thresholds, who do not have an appropriate level of private hospital cover for themselves and their dependents, may be required to pay the mls for any period during the financial year that they or their dependents did not. Medicare and private health insurance. The medicare levy is in addition to the tax you pay on your taxable income, unless you qualify for a reduction or exemption. Your income for medicare levy surcharge (mls) purposes is above a certain threshold. The state health insurance, medicare, is partially funded through the medicare levy under income tax and is therefore not a social security fund such as e.g.

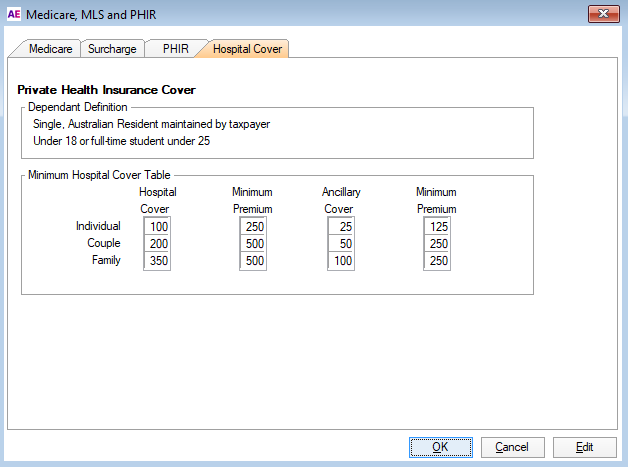

and”) Source: help.myob.com

Individuals medicare and private health insurance medicare levy medicare levy exemption medicare levy exemption you may qualify for an exemption from paying the medicare levy if you were in any of the following three exemption categories at any time in the financial year: Your income for medicare levy surcharge (mls) purposes is above a certain threshold. You pay this medicare levy surcharge as part of your income tax. Medicare and private health insurance medicare levy surcharge medicare levy surcharge if you have to pay the medicare levy, you may have to pay the medicare levy surcharge (mls) if you, your spouse and your dependent children do not have an appropriate level of private patient hospital cover and you earn above a certain income. This is called the medicare levy surcharge.

Source: forrestprivatewealth.com

Source: forrestprivatewealth.com

Medicare and private health insurance medicare levy medicare levy the medicare levy helps fund some of the costs of australia�s public health system known as medicare. Most people are eligible for a rebate. However, if your adjusted taxable income is greater than $90,000 for singles or $180,000 for families, this is where private health insurance comes in to play. Private health insurance and the medicare levy surcharge. Private health insurance and tax you may also have to pay an extra charge on top of the normal medicare levy if you:

Source: betterbills.com

Source: betterbills.com

In australia, you can choose to have medicare cover only or have a combination of medicare and private health insurance. It’s in addition to the compulsory medicare levy of two per cent, which is paid by most australian taxpayers to help fund medicare. Meet certain medical requirements are a foreign resident The statutory health insurance in germany.the medicare levy is low. Private health insurance and tax you may also have to pay an extra charge on top of the normal medicare levy if you:

Source: healthinsurancecomparison.com.au

Source: healthinsurancecomparison.com.au

The medicare levy surcharge (mls) individuals and families on income(s) above the mls thresholds, who do not have an appropriate level of private hospital cover for themselves and their dependents, may be required to pay the mls for any period during the financial year that they or their dependents did not. You, your spouse and dependent children don�t have an appropriate level of private patient hospital cover, and; The mls is a rate of 1%, 1.25% or 1.5% and is levied on: Meet certain medical requirements are a foreign resident The medicare levy surcharge (mls) is a levy paid by australian taxpayers who don’t have an appropriate level of private hospital cover and who earn above a certain annual income.

Source: compareclub.com.au

Source: compareclub.com.au

The medicare levy is in addition to the tax you pay on your taxable income, unless you qualify for a reduction or exemption. The mls is designed to encourage higher income earners to take out private health insurance which assists in relieving the load on the public health system. Meet certain medical requirements are a foreign resident Your taxable income total reportable fringe benefits, and any amount on which family trust distribution tax has been paid. Most people are eligible for a rebate.

Source: betootaadvocate.com

Source: betootaadvocate.com

Get a private health insurance rebate Medicare levy surcharge and private health insurance rebate. You pay this medicare levy surcharge as part of your income tax. The australian government provides the private health insurance rebate to encourage people to take out and maintain private health insurance. You, your spouse and dependent children don�t have an appropriate level of private patient hospital cover, and;

and”) Source: help.myob.com

In australia, you can choose to have medicare cover only or have a combination of medicare and private health insurance. The government subsidises the premiums for all health insurance cover, including hospital and ancillary. Your income for medicare levy surcharge (mls) purposes is above a certain threshold. The medicare levy surcharge is a levy of up to 1.5% of taxable income on people who: Private health insurance and the medicare levy surcharge.

Source: vdocuments.mx

Source: vdocuments.mx

People whose income for mls purposes is greater than a specified amount and who do not have an appropriate level of cover pay the mls in addition to the standard medicare levy. The medicare levy surcharge is a levy of up to 1.5% of taxable income on people who: The medicare levy is in addition to the tax you pay on your taxable income, unless you qualify for a reduction or exemption. The statutory health insurance in germany.the medicare levy is low. Your taxable income total reportable fringe benefits, and any amount on which family trust distribution tax has been paid.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site serviceableness, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title medicare levy and private health insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.