Micro captive insurance Idea

Home » Trending » Micro captive insurance IdeaYour Micro captive insurance images are ready in this website. Micro captive insurance are a topic that is being searched for and liked by netizens today. You can Download the Micro captive insurance files here. Get all free photos and vectors.

If you’re looking for micro captive insurance images information linked to the micro captive insurance interest, you have visit the right blog. Our website frequently provides you with suggestions for seeing the highest quality video and picture content, please kindly hunt and locate more informative video content and graphics that match your interests.

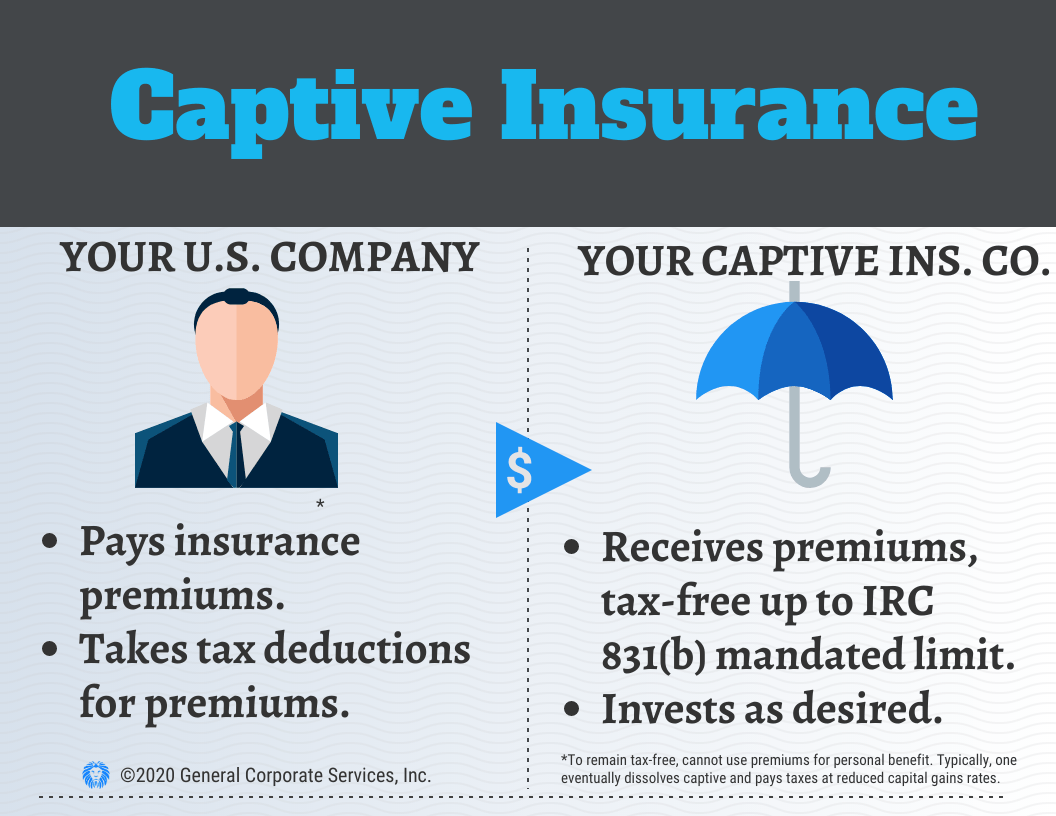

Micro Captive Insurance. The underwriting profit can either be returned as a dividend or subject to. A micro captive is a small captive insurer that has special taxation rules. A micro captive is a small captive insurance company that’s taxed based on the stipulations of section 831(b) of the u.s. In the united states, qualified under internal revenue code 831 (b), a micro captive will pay tax only on investment income and not on underwriting profit.

How the IRS Is Cracking Down on MicroCaptive Insurance From savedbythecents.com

How the IRS Is Cracking Down on MicroCaptive Insurance From savedbythecents.com

But first, what is a captive insurance company (“captive”)? A micro captive is a small captive insurer that has special taxation rules. The irs will disallow tax benefits from transactions that are determined to be abusive and may also require domestic captives to include premium payments in income and. Potential civil outcomes can include full disallowance of claimed captive insurance deductions, inclusion of income by the captive entity and imposition of applicable penalties. A micro captive insurance policy and premiums are customs made to tailor the unique financial standing. Like regular insurance companies, captives perform better when there is a larger premium pool with a wider risk distribution.

A micro captive is a small captive insurer that has special taxation rules.

A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; What is a micro captive? Like regular insurance companies, captives perform better when there is a larger premium pool with a wider risk distribution. These tax incentives exist to encourage their formation where it is suitable for businesses to efficiently finance insurable risks. Potential civil outcomes can include full disallowance of claimed captive insurance deductions, inclusion of income by the captive entity and imposition of applicable penalties. The irs will disallow tax benefits from transactions that are determined to be abusive and may also require domestic captives to include premium payments in income and.

Source: offshorecompany.com

Source: offshorecompany.com

Potential civil outcomes can include full disallowance of claimed captive insurance deductions, inclusion of income by the captive entity and imposition of applicable penalties. A micro captive is a small captive insurer that has special taxation rules. The underwriting profit can either be returned as a dividend or subject to. What is a micro captive? A micro captive is a small captive insurance company that’s taxed based on the stipulations of section 831(b) of the u.s.

Source: taxcontroversyposts.postschell.com

Source: taxcontroversyposts.postschell.com

Tax code — hence, their alternate designation of “831(b) captives.” captive resources’ (cri) approach to these smaller captives aligns with our overall group captive concept: A micro captive insurance policy and premiums are customs made to tailor the unique financial standing. The irs will disallow tax benefits from transactions that are determined to be abusive and may also require domestic captives to include premium payments in income and. The irs put micro captives. It provides coverage to that business against risks—risks that are often not readily insurable in the commercial market.

Source: drakesoftware.com

Source: drakesoftware.com

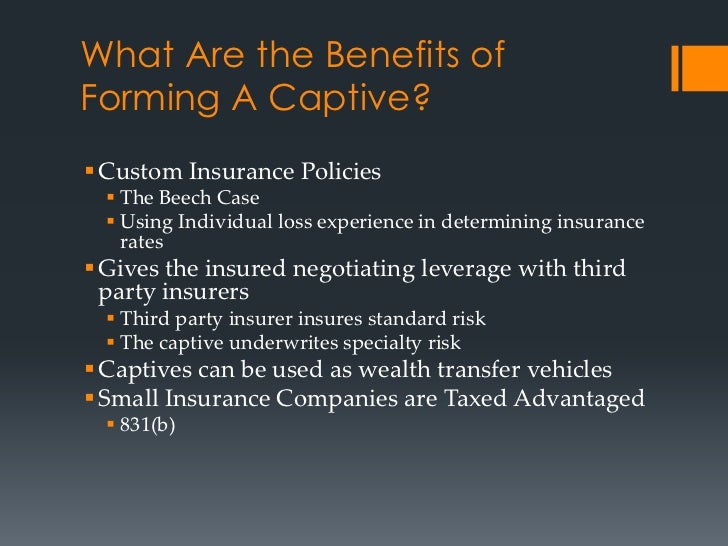

Like regular insurance companies, captives perform better when there is a larger premium pool with a wider risk distribution. Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. A captive insurance company is an insurance company that is formed or owned by a related business owner or group of owners. A captive insurance company is an insurance company that is formed or owned by a related business owner or group of owners. The underwriting profit can either be returned as a dividend or subject to.

Source: captiveresources.com

Source: captiveresources.com

A micro captive insurance policy and premiums are customs made to tailor the unique financial standing. A micro captive is a small captive insurance company, typically with only one owner. A captive insurance company is an insurance company that is formed or owned by a related business owner or group of owners. Potential civil outcomes can include full disallowance of claimed captive insurance deductions, inclusion of income by the captive entity and imposition of applicable penalties. Like regular insurance companies, captives perform better when there is a larger premium pool with a wider risk distribution.

Source: inspiralviral.com

Source: inspiralviral.com

In the united states, qualified under internal revenue code 831(b), a micro captive will pay tax only on investment income and not on underwriting profit. A micro captive is a small captive insurance company that’s taxed based on the stipulations of section 831(b) of the u.s. It provides coverage to that business against risks—risks that are often not readily insurable in the commercial market. Tax code — hence, their alternate designation of “831(b) captives.” captive resources’ (cri) approach to these smaller captives aligns with our overall group captive concept: A micro captive insurance policy and premiums are customs made to tailor the unique financial standing.

Source: cpaacademy.org

Source: cpaacademy.org

In addition, moore ingram johnson & steele llp, a law firm that also provides captive management services, is appealing a georgia district court order granting. A captive insurance company is an insurance company that is formed or owned by a related business owner or group of owners. In the united states, qualified under internal revenue code 831(b), a micro captive will pay tax only on investment income and not on underwriting profit. In addition, moore ingram johnson & steele llp, a law firm that also provides captive management services, is appealing a georgia district court order granting. It provides coverage to that business against risks—risks that are often not readily insurable in the commercial market.

Source: captiveresources.com

Source: captiveresources.com

A micro captive is a captive insurance company operating with an annual gross premium up to $2.2 million. Like regular insurance companies, captives perform better when there is a larger premium pool with a wider risk distribution. Potential civil outcomes can include full disallowance of claimed captive insurance deductions, inclusion of income by the captive entity and imposition of applicable penalties. A captive insurance company is an insurance company that is formed or owned by a related business owner or group of owners. A “micro captive” is an insurance company that focuses on serving one taxpayer, or one group of taxpayers.

Source: chernoffdiamond.com

Source: chernoffdiamond.com

In addition, moore ingram johnson & steele llp, a law firm that also provides captive management services, is appealing a georgia district court order granting. A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; The irs will disallow tax benefits from transactions that are determined to be abusive and may also require domestic captives to include premium payments in income and. The captive typically pools its risk with other similar captives. But first, what is a captive insurance company (“captive”)?

Source: taxcontroversy.com

Source: taxcontroversy.com

Caylor land & dev., inc. Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. A captive insurance company is an insurance company that is formed or owned by a related business owner or group of owners. A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; What is a micro captive?

Source: slideshare.net

Source: slideshare.net

The underwriting profit can either be returned as a dividend or subject to. These tax incentives exist to encourage their formation where it is suitable for businesses to efficiently finance insurable risks. Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. Captive insurance companies enjoy certain tax advantages. The captive typically pools its risk with other similar captives.

Source: freemanlaw.com

Source: freemanlaw.com

These tax incentives exist to encourage their formation where it is suitable for businesses to efficiently finance insurable risks. These tax incentives exist to encourage their formation where it is suitable for businesses to efficiently finance insurable risks. A micro captive is a small captive insurer that has special taxation rules. A captive insurance company is an insurance company that is formed or owned by a related business owner or group of owners. A micro captive insurance policy and premiums are customs made to tailor the unique financial standing.

Source: savedbythecents.com

Source: savedbythecents.com

In the united states, qualified under internal revenue code 831(b), a micro captive will pay tax only on investment income and not on underwriting profit. What is a micro captive? While the concept behind micro captives is legitimate, micro captive companies are fast gaining a reputation for abusing the tax system and failing to follow through on providing coverage for those who are supposedly insured. Caylor land & dev., inc. It provides coverage to that business against risks—risks that are often not readily insurable in the commercial market.

Source: cmcaptives.com

Source: cmcaptives.com

The irs put micro captives. A captive insurer is generally defined as an insurance company that is wholly owned and controlled by its insureds; What is a micro captive? The underwriting profit can either be returned as a dividend or subject to. A micro captive is a small captive insurer that has special taxation rules.

Source: aat.cpa

Source: aat.cpa

Captive insurance companies enjoy certain tax advantages. What is a micro captive? Its primary purpose is to insure the risks of its owners, and its insureds benefit from the captive insurer�s underwriting profits. Caylor land & dev., inc. A micro captive is a small captive insurer that has special taxation rules.

Source: rogerrossmeislcpa.com

Source: rogerrossmeislcpa.com

Like regular insurance companies, captives perform better when there is a larger premium pool with a wider risk distribution. This allows these types of businesses to protect themselves against many risks that are not protectable with traditional insurance. What is a micro captive? A micro captive insurance policy and premiums are customs made to tailor the unique financial standing. It is also the fourth straight irs victory over such transactions.

Source: alliantgroup.com

Source: alliantgroup.com

A micro captive is a captive insurance company operating with an annual gross premium up to $2.2 million. A micro captive is a small captive insurance company, typically with only one owner. The captive typically pools its risk with other similar captives. While the concept behind micro captives is legitimate, micro captive companies are fast gaining a reputation for abusing the tax system and failing to follow through on providing coverage for those who are supposedly insured. The irs put micro captives.

Source: cmcaptives.com

Source: cmcaptives.com

The captive typically pools its risk with other similar captives. A micro captive is a small captive insurance company, typically with only one owner. In the united states, qualified under internal revenue code 831 (b), a micro captive will pay tax only on investment income and not on underwriting profit. These points do not clearly distinguish the captive insurer from a mutual insurance company. But first, what is a captive insurance company (“captive”)?

Source: offshorecorporation.com

Source: offshorecorporation.com

A micro captive is a captive insurance company operating with an annual gross premium up to $2.2 million. These points do not clearly distinguish the captive insurer from a mutual insurance company. Captive insurance companies enjoy certain tax advantages. In the united states, qualified under internal revenue code 831 (b), a micro captive will pay tax only on investment income and not on underwriting profit. This allows these types of businesses to protect themselves against many risks that are not protectable with traditional insurance.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title micro captive insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.