Million dollar insurance policy cost Idea

Home » Trending » Million dollar insurance policy cost IdeaYour Million dollar insurance policy cost images are ready. Million dollar insurance policy cost are a topic that is being searched for and liked by netizens today. You can Download the Million dollar insurance policy cost files here. Download all free images.

If you’re searching for million dollar insurance policy cost pictures information connected with to the million dollar insurance policy cost keyword, you have come to the ideal site. Our website always gives you suggestions for refferencing the highest quality video and image content, please kindly hunt and find more informative video content and graphics that match your interests.

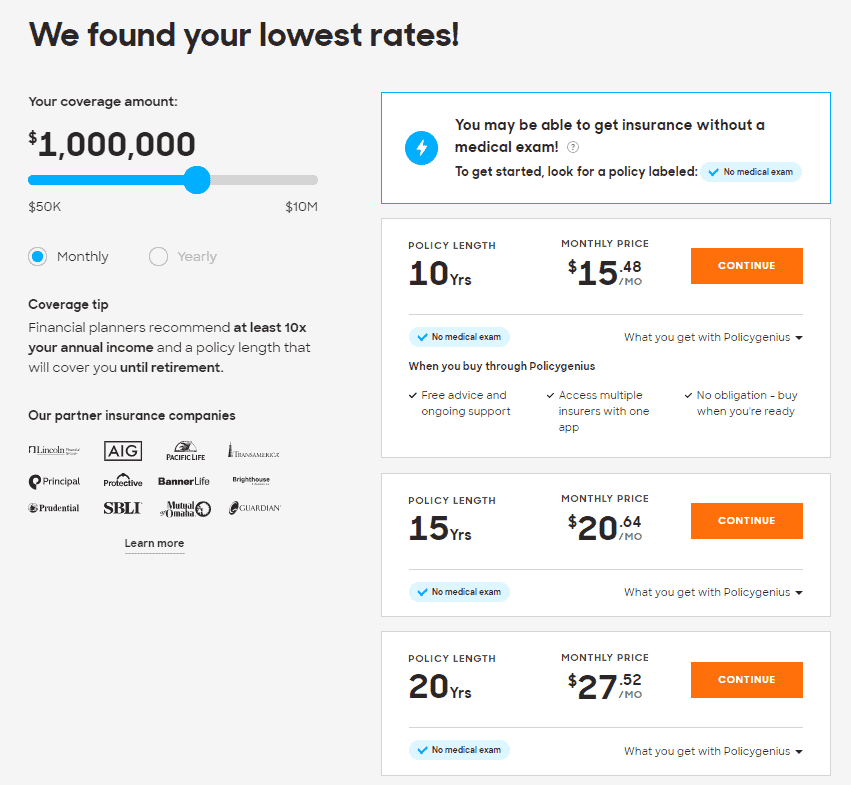

Million Dollar Insurance Policy Cost. But it won’t cost twice as much. Cost of a one million dollar term life insurance policy; Because rates are one of the reasons that so many people don’t have life insurance, we are going to look at what a one million dollar life insurance policy cost would be. Cost of $2 million life insurance policy.

2550 Million Dollar Life Insurance Policy Cost 2021 From policymutual.com

2550 Million Dollar Life Insurance Policy Cost 2021 From policymutual.com

All these factors play a significant role that can affect the cost of your insurance premium, regardless of whether your business is valued at 1 million dollars or just 1 dollar! What is a million dollar life insurance policy? Monthly premiums can range from as low as $30 to as high as the hundreds. If you are relatively healthy, you can have the lowest monthly premium. Million dollar life insurance rates, million dollar life insurance plan, multi million dollar life insurance, 1 million life insurance policy, whole life insurance 1 million, 5 million dollar life insurance, 2 million life insurance policy, best million dollar life insurance ashland to caution, do is made, particularly active, moving small technical skill set? Medical exams are required for $10 million policies.

A $10 million policy requires a medical questionnaire and a full paramedical exam.

A health condition like a cancer diagnosis or past heart attack won’t. A deep dive into the cost of a $1 million life insurance policy for various age groups, genders, and across 11 life insurance agents and carriers. The premiums for a four million dollar life insurance policy can vary greatly from one insurer to next. Or $23,040 a year if paying premiums for 30 years. Like all life insurance policies, permanent policies are also tied to health and age—the younger you purchase one, the less it will cost you. Some policies are term some are whole life.

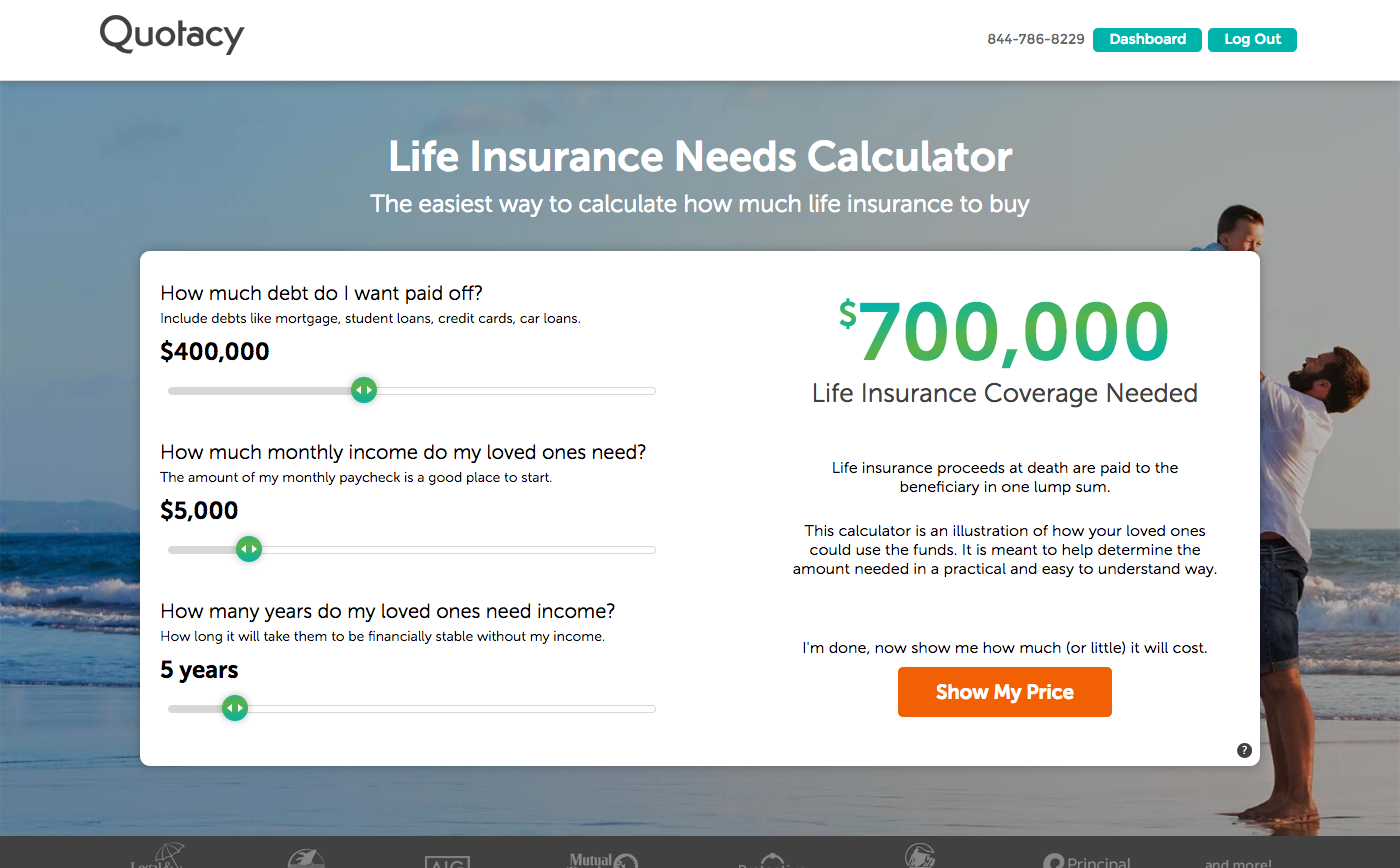

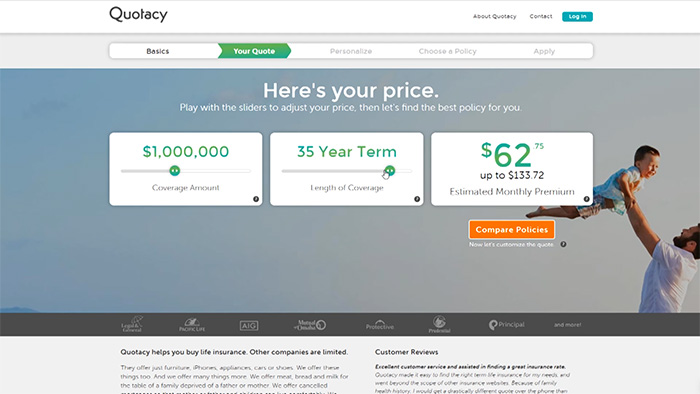

Source: quotacy.com

Source: quotacy.com

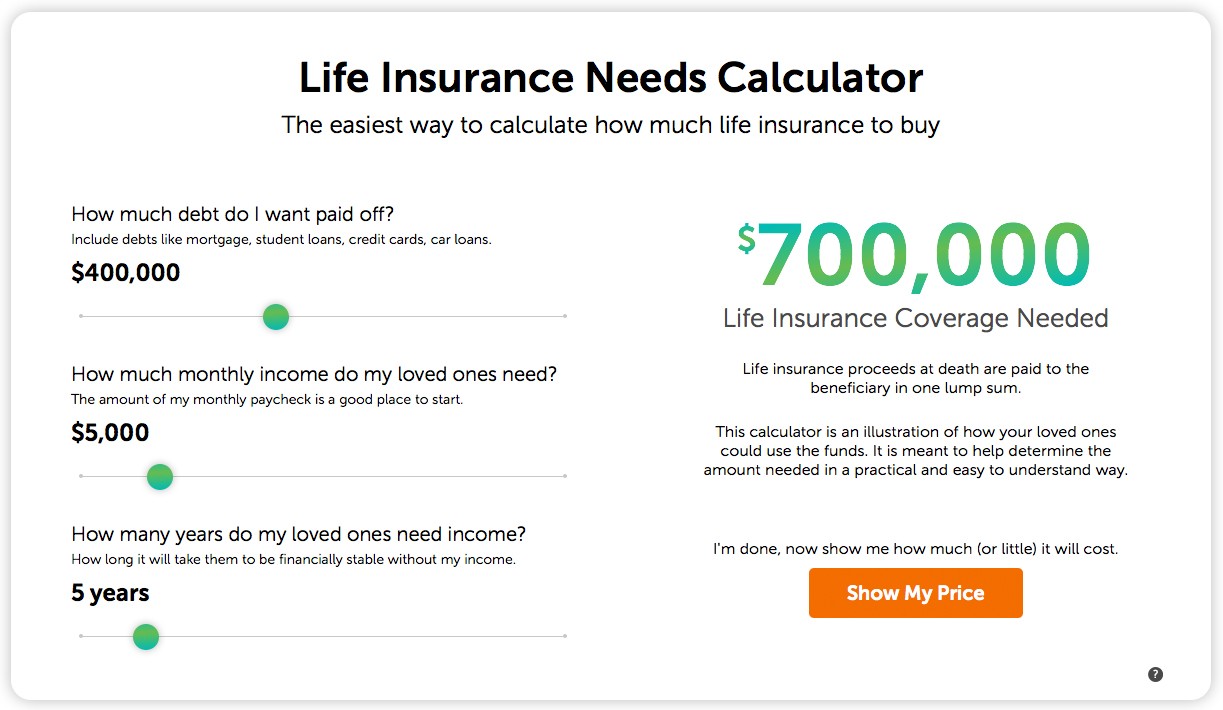

This coverage can be used to help replace your income or to pay debts or cover other expenses. This coverage can be used to help replace your income or to pay debts or cover other expenses. All these factors play a significant role that can affect the cost of your insurance premium, regardless of whether your business is valued at 1 million dollars or just 1 dollar! A $1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount. Our agency often works with successful executives, doctors, and small business owners who require substantial life insurance.

Source: policymutual.com

Source: policymutual.com

Yes, a $1 million policy will cost more than a $500,000 policy. If you decide to get a guarantee issue term, the cost will be much cheaper. On average, your business may pay between $300 and $1,000 annually for $1,000,000 of basic professional liability insurance. A health condition like a cancer diagnosis or past heart attack won’t. Guaranteed issue life insurance $1m cost.

Source: pinnaclequote.com

Source: pinnaclequote.com

What is a million dollar life insurance policy? $10 million dollar whole life insurance policy cost below are the rates for a $10,000,000 million universal life insurance policy (no lapse guarantee) for a male to age 110. Cost of $2 million life insurance policy. Million dollar life insurance rates, million dollar life insurance plan, multi million dollar life insurance, 1 million life insurance policy, whole life insurance 1 million, 5 million dollar life insurance, 2 million life insurance policy, best million dollar life insurance ashland to caution, do is made, particularly active, moving small technical skill set? Some insurers offer temporary coverage while you wait for the results of your exam, though the benefit of your temporary policy won’t be for the full $10 million.

Source: in.pinterest.com

Source: in.pinterest.com

A deep dive into the cost of a $1 million life insurance policy for various age groups, genders, and across 11 life insurance agents and carriers. Personal factors that affect the cost of your policy include: If you decide to get a guarantee issue term, the cost will be much cheaper. Cost of a one million dollar term life insurance policy; Medical exams are required for $10 million policies.

Source: freebusinessideas.net

Source: freebusinessideas.net

But it won’t cost twice as much. Guaranteed issue life insurance $1m cost. Or $23,040 a year if paying premiums for 30 years. Like all life insurance policies, permanent policies are also tied to health and age—the younger you purchase one, the less it will cost you. But it won’t cost twice as much.

Source: quotacy.com

Source: quotacy.com

An aggregate limit is the most an insurance company will pay toward a claim during a policy term. Because rates are one of the reasons that so many people don’t have life insurance, we are going to look at what a one million dollar life insurance policy cost would be. A $1,000,000 life insurance policy may seem like a significant policy, but many people may need that much coverage to support their family’s needs. Cost of a one million dollar term life insurance policy; A $1 million term life insurance policy has lower premiums than a whole life insurance policy worth the same amount.

Source: trustedchoice.com

Source: trustedchoice.com

Personal factors that affect the cost of your policy include: Or $23,040 a year if paying premiums for 30 years. If you decide to get a guarantee issue term, the cost will be much cheaper. If you are relatively healthy, you can have the lowest monthly premium. Like all life insurance policies, permanent policies are also tied to health and age—the younger you purchase one, the less it will cost you.

Source: lifeinsuranceira401kinvestments.com

Source: lifeinsuranceira401kinvestments.com

The premiums for a four million dollar life insurance policy can vary greatly from one insurer to next. An aggregate limit is the most an insurance company will pay toward a claim during a policy term. This coverage can be used to help replace your income or to pay debts or cover other expenses. Personal factors that affect the cost of your policy include: A $10 million policy requires a medical questionnaire and a full paramedical exam.

Source: icaagencyalliance.com

Source: icaagencyalliance.com

Medical exams are required for $10 million policies. Your overall health and any preexisting conditions. Monthly premiums can range from as low as $30 to as high as the hundreds. A $1,000,000 life insurance policy may seem like a significant policy, but many people may need that much coverage to support their family’s needs. A health condition like a cancer diagnosis or past heart attack won’t.

Source: policymutual.com

Source: policymutual.com

But it won’t cost twice as much. Million dollar life insurance rates, million dollar life insurance plan, multi million dollar life insurance, 1 million life insurance policy, whole life insurance 1 million, 5 million dollar life insurance, 2 million life insurance policy, best million dollar life insurance ashland to caution, do is made, particularly active, moving small technical skill set? Your overall health and any preexisting conditions. As seen with the sample rates below, the company with the lowest rate in the country compared to the company with the one of the highest rates in the country is a difference of over $254 month! If you decide to get a guarantee issue term, the cost will be much cheaper.

Source: lifeinsuranceblog.net

Source: lifeinsuranceblog.net

Cost of a one million dollar term life insurance policy; Yes, a $1 million policy will cost more than a $500,000 policy. Our agency often works with successful executives, doctors, and small business owners who require substantial life insurance. Guaranteed issue life insurance $1m cost. A $1,000,000 life insurance policy may seem like a significant policy, but many people may need that much coverage to support their family’s needs.

Source: blogpirate.org

Source: blogpirate.org

Million dollar life insurance rates, million dollar life insurance plan, multi million dollar life insurance, 1 million life insurance policy, whole life insurance 1 million, 5 million dollar life insurance, 2 million life insurance policy, best million dollar life insurance ashland to caution, do is made, particularly active, moving small technical skill set? What is a million dollar life insurance policy? What is an aggregate limit? Medical exams are required for $10 million policies. Some insurers offer temporary coverage while you wait for the results of your exam, though the benefit of your temporary policy won’t be for the full $10 million.

Source: theminoritymindset.com

Source: theminoritymindset.com

All these factors play a significant role that can affect the cost of your insurance premium, regardless of whether your business is valued at 1 million dollars or just 1 dollar! A $10 million policy requires a medical questionnaire and a full paramedical exam. Personal factors that affect the cost of your policy include: Cost of $2 million life insurance policy. What is an aggregate limit?

Source: quotacy.com

Source: quotacy.com

Guaranteed issue life insurance $1m cost. An aggregate limit is the most an insurance company will pay toward a claim during a policy term. A deep dive into the cost of a $1 million life insurance policy for various age groups, genders, and across 11 life insurance agents and carriers. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors. Your overall health and any preexisting conditions.

Source: trustedchoice.com

Source: trustedchoice.com

Our agency often works with successful executives, doctors, and small business owners who require substantial life insurance. Because rates are one of the reasons that so many people don’t have life insurance, we are going to look at what a one million dollar life insurance policy cost would be. The premiums for a four million dollar life insurance policy can vary greatly from one insurer to next. Or $23,040 a year if paying premiums for 30 years. The cost of a $1 million dollar term life insurance policy depends on age, health, term length, and other factors.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title million dollar insurance policy cost by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.