Minnesota health insurance tax credit information

Home » Trend » Minnesota health insurance tax credit informationYour Minnesota health insurance tax credit images are ready. Minnesota health insurance tax credit are a topic that is being searched for and liked by netizens today. You can Get the Minnesota health insurance tax credit files here. Find and Download all royalty-free photos and vectors.

If you’re looking for minnesota health insurance tax credit pictures information connected with to the minnesota health insurance tax credit topic, you have come to the ideal blog. Our website frequently gives you hints for downloading the highest quality video and image content, please kindly hunt and find more enlightening video content and images that match your interests.

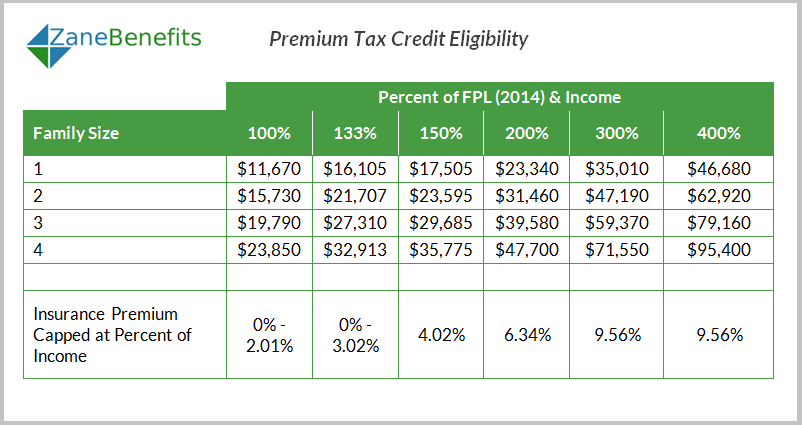

Minnesota Health Insurance Tax Credit. Premium tax credits for those with incomes up to 400% of the federal poverty level (fpl), (about $47,000 for an individual and $96,000 for a family of four) and will limit what a person has to pay toward the premium to a specified percentage ranging from 2% of income to 9.5% of income for those with income between 300 and 400 % of the fpl. If eligible for the premium tax credit, you can use it to lower your monthly insurance premium when you enroll in a private health insurance plan through mnsure. Personalized coverage you can trust. See if you can get 2022 coverage.

Help Is at Hand New Health Insurance Tax Credits Health From pinterest.com

Help Is at Hand New Health Insurance Tax Credits Health From pinterest.com

Open enrollment has ended, but you may qualify to enroll now. In 2022, the federal government will once again offer a premium tax credit (ptc) to qualifying taxpayers who buy health coverage from an approved health insurance exchange. 2021 minnesota health plans portfolio. If you�re not eligible for lower costs on a health plan because your income is too high, you can still buy health coverage through the health insurance marketplace®. To apply, create an account or log in to your existing one. See understanding your letter 6129 for more information.

The maximum total credit is $200 annually on a joint return or $100 for individual filers.

The amount of your premium tax credit is based on the income estimate and household information you put on your mnsure application, including: The credit is 25% of the policy premiums, up to $100 per beneficiary. Under the federal approval that was granted in september 2017, the federal government is giving minnesota the money that they save on premium tax credits, and that money is combined with state funds to implement the reinsurance program (lower premiums — as a result of the reinsurance program — result in the federal government having to pay a smaller. If you are not eligible for federal tax credits, you may be eligible for a 25 percent credit on health insurance premiums. Individual & family health plans. Once you input your families information and your tax information the system will automatically calculate your subsidies.

Source: youtube.com

Source: youtube.com

The maximum minnesota credit is equal to the lesser of $100 or 25 percent of the amount paid for each beneficiary. These new tax credits, which will offset a To get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc). This tax credit is limited to one per person, per year. See if you can get 2022 coverage.

Source: minnesotareformer.com

Source: minnesotareformer.com

The amount of your premium tax credit is based on the income estimate and household information you put on your mnsure application, including: By a noonan moose on november 1, 2021. In 2022, the federal government will once again offer a premium tax credit (ptc) to qualifying taxpayers who buy health coverage from an approved health insurance exchange. The credit is 25% of the policy premiums, up to $100 per beneficiary. You can also get insurance other ways — through a private insurance company, an.

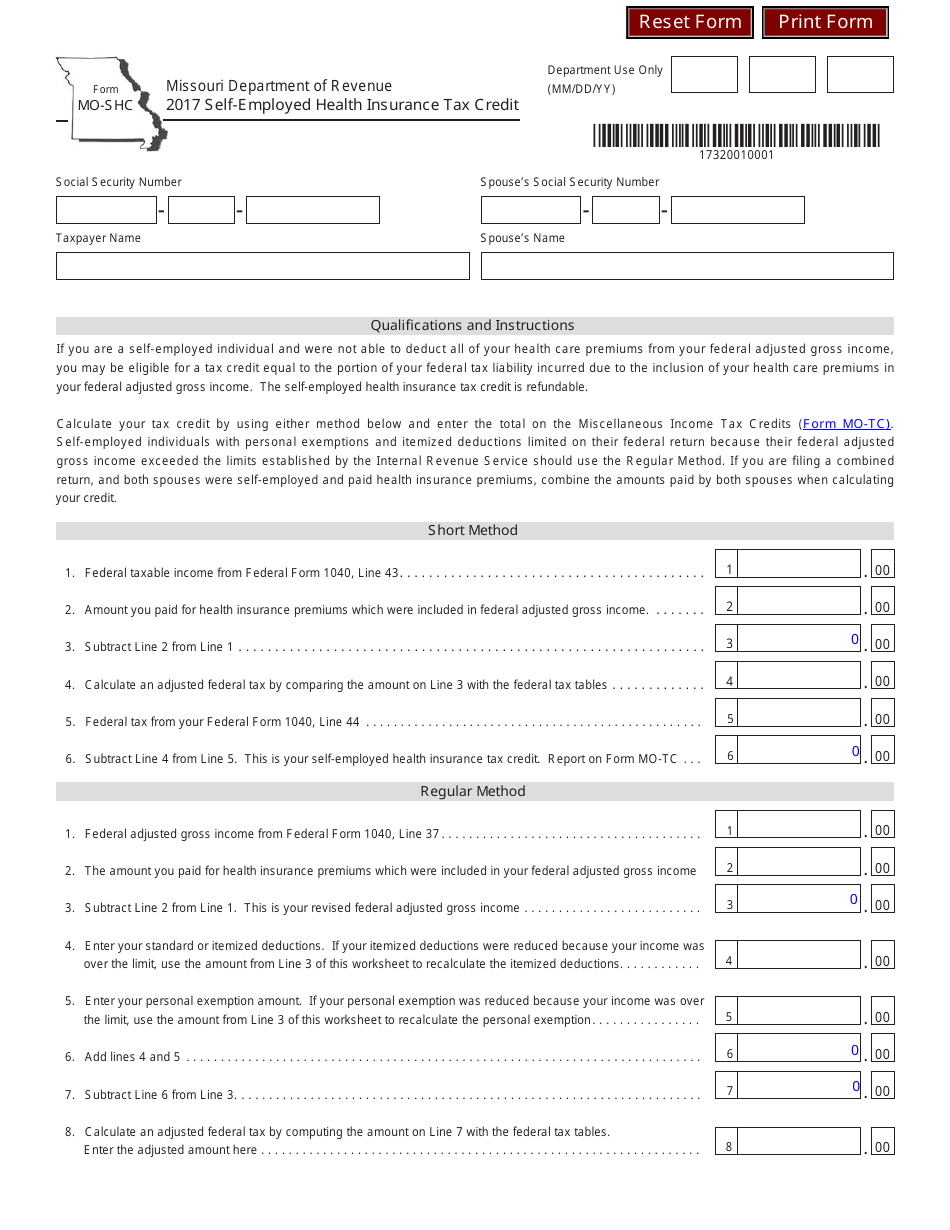

Source: templateroller.com

Source: templateroller.com

Open enrollment has ended, but you may qualify to enroll now. You will still be able to utilize the services of a health insurance broker to purchase a plan through mnsure or outside of the exchange. Applying for subsidies, tax credits and cost assistance on the minnesota health insurance exchange in order to get subsidies all you need to do is sign up with the insurance exchange. The maximum minnesota credit is equal to the lesser of $100 or 25 percent of the amount paid for each beneficiary. This tax credit is limited to one per person, per year.

Source: dekatoo.blogspot.com

Source: dekatoo.blogspot.com

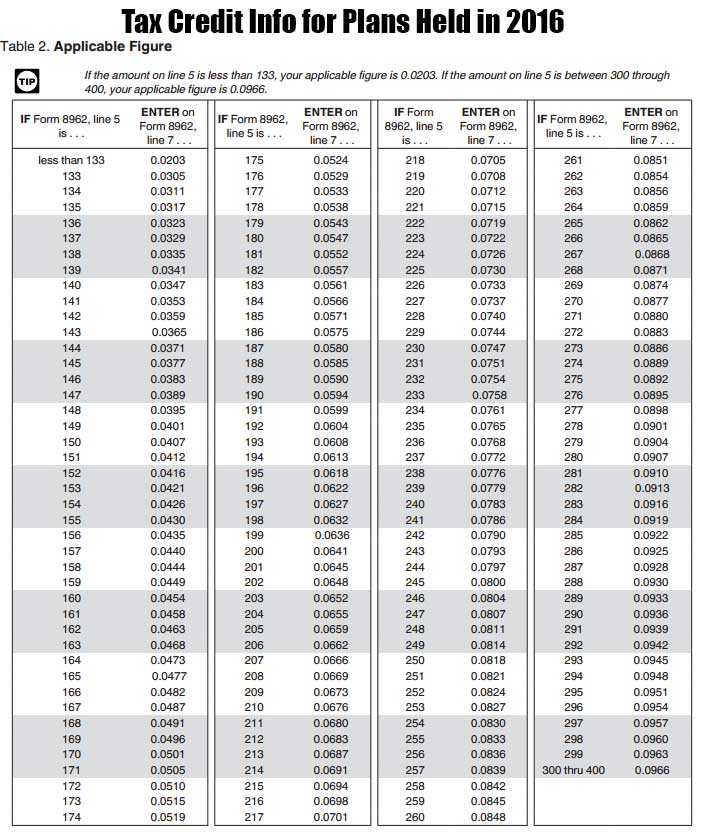

If you are not eligible for federal tax credits, you may be eligible for a 25 percent credit on health insurance premiums. How tax credits are calculated. By a noonan moose on november 1, 2021. In 2022, the federal government will once again offer a premium tax credit (ptc) to qualifying taxpayers who buy health coverage from an approved health insurance exchange. Form 8962 is used to compare how much.

Source: info.gutweinlaw.com

Source: info.gutweinlaw.com

Once you input your families information and your tax information the system will automatically calculate your subsidies. In 2022, the federal government will once again offer a premium tax credit (ptc) to qualifying taxpayers who buy health coverage from an approved health insurance exchange. If the cost of a health plan burns up too much income, the premium tax credits kick in to lower a consumer’s portion from too high to just. The amount of your premium tax credit is based on the income estimate and household information you put on your mnsure application, including: How tax credits are calculated.

Source: commongroundhealthcare.org

Source: commongroundhealthcare.org

You will still be able to utilize the services of a health insurance broker to purchase a plan through mnsure or outside of the exchange. The maximum minnesota credit is equal to the lesser of $100 or 25 percent of the amount paid for each beneficiary. The maximum total credit is $200 annually on a joint return or $100 for individual filers. Applying for subsidies, tax credits and cost assistance on the minnesota health insurance exchange in order to get subsidies all you need to do is sign up with the insurance exchange. One policy covering both spouses qualifies for the $200 maximum credit for more information, review minnesota statute 290.0672.

The maximum minnesota credit is equal to the lesser of $100 or 25 percent of the amount paid for each beneficiary. If eligible for the premium tax credit, you can use it to lower your monthly insurance premium when you enroll in a private health insurance plan through mnsure. Under the american rescue plan, any household with income above 200% of the federal poverty guidelines (fpg) may potentially qualify for a tax credit, but there is an income amount at which the tax credit will be $0. In 2022, the federal government will once again offer a premium tax credit (ptc) to qualifying taxpayers who buy health coverage from an approved health insurance exchange. If you are not eligible for federal tax credits, you may be eligible for a 25 percent credit on health insurance premiums.

Source: aghlc.com

Source: aghlc.com

Under the american rescue plan, any household with income above 200% of the federal poverty guidelines (fpg) may potentially qualify for a tax credit, but there is an income amount at which the tax credit will be $0. To get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc). One policy covering both spouses qualifies for the $200 maximum credit for more information, review minnesota statute 290.0672. By a noonan moose on november 1, 2021. New health insurance tax credits in minnesota s tarting in 2014, the.

Source: blog.myrickcpa.com

Source: blog.myrickcpa.com

One policy covering both spouses qualifies for the $200 maximum credit for more information, review minnesota statute 290.0672. Your household’s total expected income for the year (projected annual income or pai). The total number of people in your tax household that enroll in private health insurance through mnsure. New health insurance tax credits in minnesota s tarting in 2014, the. For married couples, separate policies or premiums are not required.

Source: pinterest.com

Source: pinterest.com

Form 8962 is used to compare how much. To apply, create an account or log in to your existing one. This tax credit is limited to one per person, per year. You will still be able to utilize the services of a health insurance broker to purchase a plan through mnsure or outside of the exchange. New health insurance tax credits in minnesota s tarting in 2014, the.

Source: formupack.com

Source: formupack.com

Under the federal approval that was granted in september 2017, the federal government is giving minnesota the money that they save on premium tax credits, and that money is combined with state funds to implement the reinsurance program (lower premiums — as a result of the reinsurance program — result in the federal government having to pay a smaller. The maximum total credit is $200 annually on a joint return or $100 for individual filers. See if you can get 2022 coverage. If eligible for the premium tax credit, you can use it to lower your monthly insurance premium when you enroll in a private health insurance plan through mnsure. In 2022, the federal government will once again offer a premium tax credit (ptc) to qualifying taxpayers who buy health coverage from an approved health insurance exchange.

Source: pinterest.com

Source: pinterest.com

How tax credits are calculated. To get this credit, you must meet certain requirements and file a tax return with form 8962, premium tax credit (ptc). To apply, create an account or log in to your existing one. 2021 minnesota health plans portfolio. If the cost of a health plan burns up too much income, the premium tax credits kick in to lower a consumer’s portion from too high to just.

Source: dekatoo.blogspot.com

Source: dekatoo.blogspot.com

The open enrollment deadline to purchase health insurance through mnsure or directly through blue plus or health partners is february 8. The level of assistance you receive is based on your household income by family size (see table below), along with other criteria. Individual & family health plans. See if you can enroll now income or other life change? Under the american rescue plan, any household with income above 200% of the federal poverty guidelines (fpg) may potentially qualify for a tax credit, but there is an income amount at which the tax credit will be $0.

Source: peoplekeep.com

Source: peoplekeep.com

See if you can enroll now income or other life change? Form 8962 is used to compare how much. These new tax credits, which will offset a Applying for subsidies, tax credits and cost assistance on the minnesota health insurance exchange in order to get subsidies all you need to do is sign up with the insurance exchange. The maximum total credit is $200 annually on a joint return or $100 for individual filers.

Source: carfare.me

Source: carfare.me

By a noonan moose on november 1, 2021. Applying for subsidies, tax credits and cost assistance on the minnesota health insurance exchange in order to get subsidies all you need to do is sign up with the insurance exchange. The maximum total credit is $200 annually on a joint return or $100 for individual filers. If you�re not eligible for lower costs on a health plan because your income is too high, you can still buy health coverage through the health insurance marketplace®. You can also get insurance other ways — through a private insurance company, an.

If you are not eligible for federal tax credits, you may be eligible for a 25 percent credit on health insurance premiums. See if you can enroll now income or other life change? If you�re not eligible for lower costs on a health plan because your income is too high, you can still buy health coverage through the health insurance marketplace®. See understanding your letter 6129 for more information. The credit is 25% of the policy premiums, up to $100 per beneficiary.

Source: obamacarefacts.com

Source: obamacarefacts.com

Premium tax credits for those with incomes up to 400% of the federal poverty level (fpl), (about $47,000 for an individual and $96,000 for a family of four) and will limit what a person has to pay toward the premium to a specified percentage ranging from 2% of income to 9.5% of income for those with income between 300 and 400 % of the fpl. Contact your health insurance company with any additional questions. The level of assistance you receive is based on your household income by family size (see table below), along with other criteria. By a noonan moose on november 1, 2021. Personalized coverage you can trust.

Source: pinterest.com

Source: pinterest.com

How tax credits are calculated. New health insurance tax credits in minnesota s tarting in 2014, the affordable care act will extend health coverage to millions of americans. If you�re not eligible for lower costs on a health plan because your income is too high, you can still buy health coverage through the health insurance marketplace®. If the cost of a health plan burns up too much income, the premium tax credits kick in to lower a consumer’s portion from too high to just. How tax credits are calculated.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title minnesota health insurance tax credit by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.