Missouri minimum insurance coverage information

Home » Trend » Missouri minimum insurance coverage informationYour Missouri minimum insurance coverage images are available. Missouri minimum insurance coverage are a topic that is being searched for and liked by netizens now. You can Download the Missouri minimum insurance coverage files here. Find and Download all free images.

If you’re searching for missouri minimum insurance coverage images information connected with to the missouri minimum insurance coverage topic, you have pay a visit to the ideal site. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more enlightening video articles and images that match your interests.

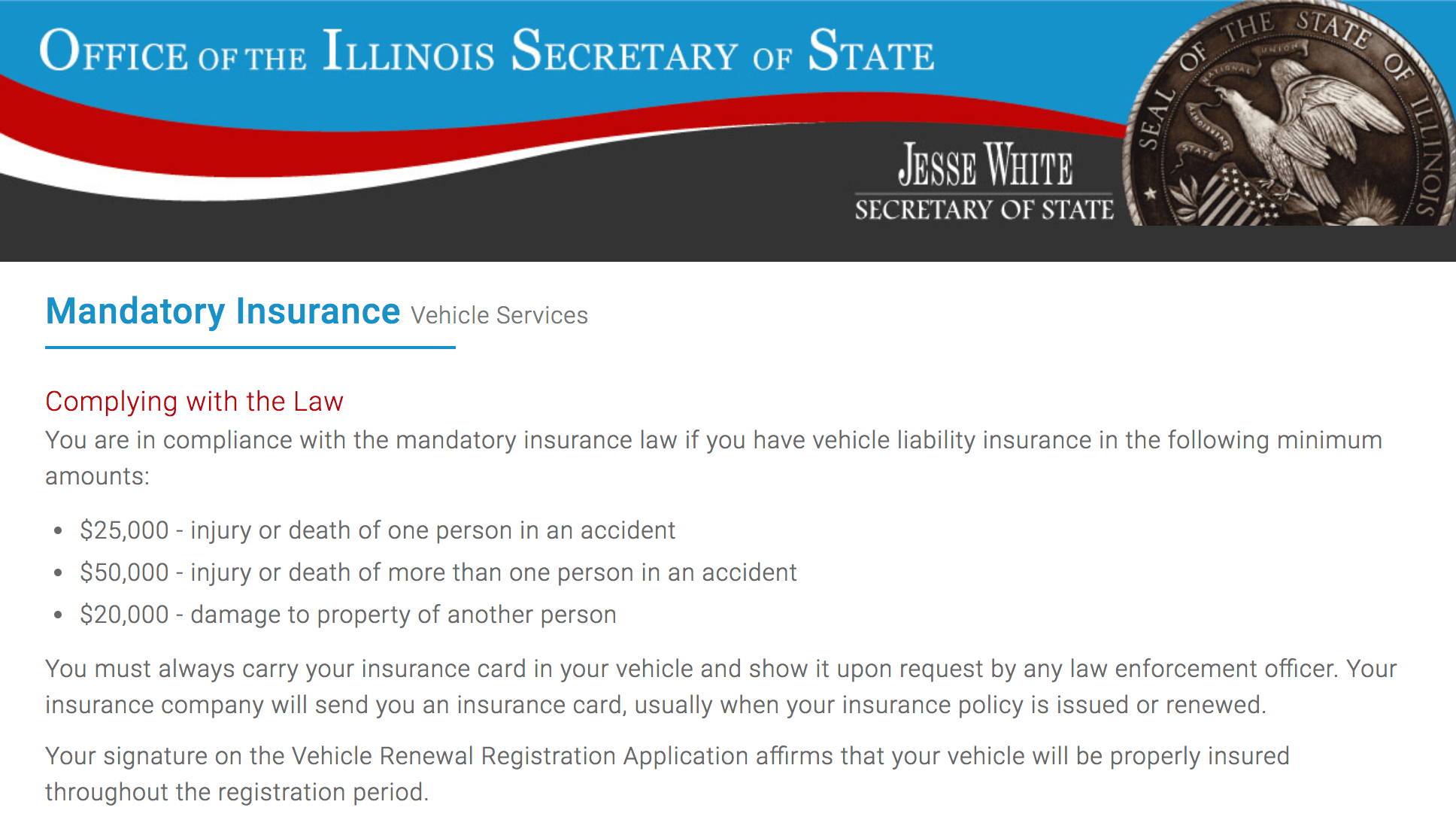

Missouri Minimum Insurance Coverage. Auto insurance requirements in missouri. In missouri, if you carry the mandatory minimum liability insurance, your coverage would be expressed as 25/50/25. Liability insurance covers your legal liability when injuries or property damage happen as a result of your actions. $25,000 for total property damage.

Missouri Auto Insurance Laws Buchanan Williams & O�Brien From bwoattorneys.com

Missouri Auto Insurance Laws Buchanan Williams & O�Brien From bwoattorneys.com

If you own or operate a motor vehicle in missouri, you are required by law to insure that automobile with coverage for injuries you cause to another, for at least $25,000 per person, $50,000 per accident, and $25,000 for property damage. All missouri drivers are required to purchase and maintain the following minimum amounts of liability coverage: Liability insurance covers your legal liability when injuries or property damage happen as a result of your actions. But if you’re thinking of moving to the state, you’ll need to have the required insurance coverage for your vehicle. The missouri minimum auto insurance requirements are 25/50/25 coverage: $50,000 for total bodily injury (when multiple people are injured).

But if you’re thinking of moving to the state, you’ll need to have the required insurance coverage for your vehicle.

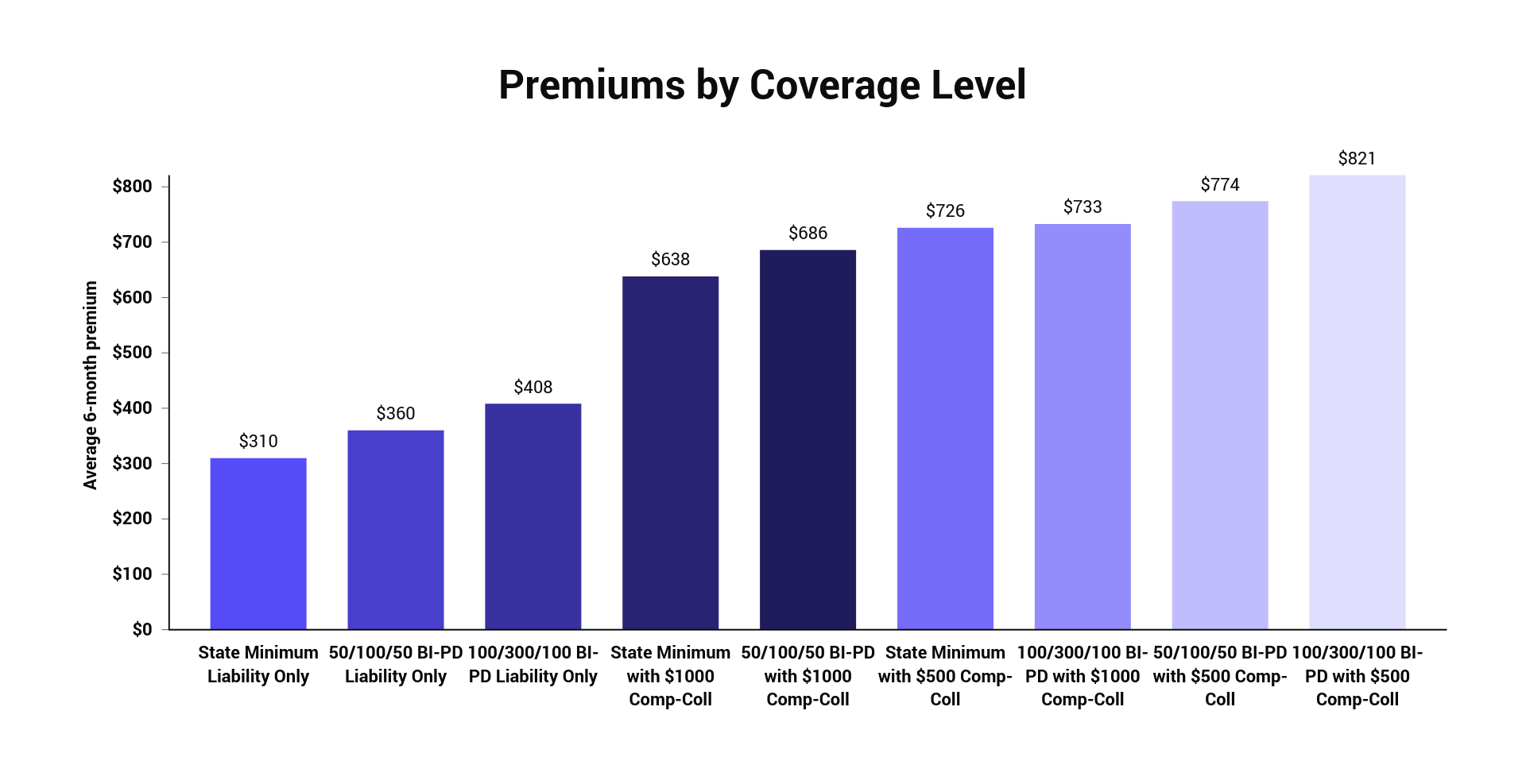

This is also known as proof of financial responsibility. There isn�t an insurance product called full coverage. The state of missouri boasts 1,380 miles of highway, the fifth most in the country. All missouri drivers are required to purchase and maintain the following minimum amounts of liability coverage: Missouri has a strong, competitive insurance market and average insurance costs in the state tend to fall slightly below the national average. Full coverage insurance in missouri is usually defined as a policy that provides more than the state’s minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $50,000 per accident, and $25,000 in property damage coverage.

Source: youtube.com

Source: youtube.com

In missouri, if you carry the mandatory minimum liability insurance, your coverage would be expressed as 25/50/25. Providers must carry medical malpractice insurance a minimum of $500,000 if they are on staff at a hospital in a county with at least 75,000 residents: If you do not buy obamacare or other qualifying health coverage (also referred to as “minimum essential coverage”) you will be subject to a tax penalty for each month you go without coverage. Missouri car insurance & minimum coverage amounts read. There isn�t an insurance product called full coverage.

Source: autoinsuresavings.org

Source: autoinsuresavings.org

The state of missouri boasts 1,380 miles of highway, the fifth most in the country. $50,000 for total bodily injury (when multiple people are injured). For example, you might see $20,000/$40,000/$15,000, or 20/40/15. Missouri motor vehicle owners are required to show proof of insurance when registering a vehicle and renewing their license plates. Full coverage in missouri also includes optional collision and comprehensive insurance.

Source: govdocs.com

Source: govdocs.com

Missouri is no exception to this rule; $25,000 of bodily injury per person, $50,000 of bodily injury per accident, and $10,000 of property damage, as well as $25k/$50k of bodily injury by uninsured motorists.find missouri health insurance options at many price points. $25,000 bodily injury per person $50,000 bodily injury per accident $10,000 property damage per accident —or— 25/50/10 dairyland® coverage in missouri at dairyland, we’re proud to be able to help drivers in missouri meet their insurance needs. In the event of a covered accident, your limits for bodily injury are $25,000 per person, with a total maximum of $50,000 per incident. The missouri minimum auto insurance requirements are 25/50/25 coverage:

Source: revisi.net

Source: revisi.net

If you own or operate a motor vehicle in missouri, you are required by law to insure that automobile with coverage for injuries you cause to another, for at least $25,000 per person, $50,000 per accident, and $25,000 for property damage. Below you’ll find the amounts of car insurance coverage required in missouri. The missouri minimum car insurance liability limits are 25/50/25, plus 25/50 uninsured/underinsured motorist coverage. Full coverage insurance in missouri is usually defined as a policy that provides more than the state’s minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $50,000 per accident, and $25,000 in property damage coverage. Drivers need at least $25,000 in bodily injury liability insurance per person ($50,000 per accident) plus $25,000 in property damage.

Source: northlandinjurylaw.com

Source: northlandinjurylaw.com

Here are some of the parameters of our insurance coverage in missouri: All missouri drivers are required to purchase and maintain the following minimum amounts of liability coverage: Full coverage insurance in missouri is usually defined as a policy that provides more than the state’s minimum liability coverage, which is $25,000 in bodily injury coverage per person, up to $50,000 per accident, and $25,000 in property damage coverage. For example, you might see $20,000/$40,000/$15,000, or 20/40/15. The state of missouri boasts 1,380 miles of highway, the fifth most in the country.

Source: thezebra.com

Source: thezebra.com

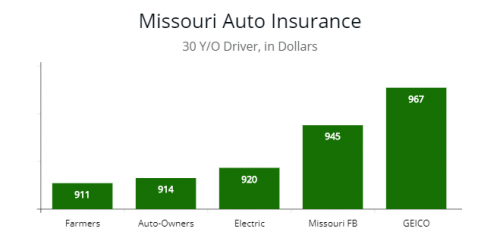

To register your car with missouri�s department of revenue (dor), you will need to provide proof of insurance. $50,000 in total bodily injury liability per accident. The missouri minimum car insurance liability limits are 25/50/25, plus 25/50 uninsured/underinsured motorist coverage. $25,000 for total property damage. That is roughly 8% more than the average missouri resident pays for car insurance.

Source: eliteass.blogspot.com

Source: eliteass.blogspot.com

Missouri has a strong, competitive insurance market and average insurance costs in the state tend to fall slightly below the national average. Buying auto insurance is not a legal requirement in missouri, but it is one of the more common ways for drivers to prove financial responsibility drivers who choose to buy car insurance in missouri for this purpose missouri requires a minimum of 25/50/10 of bodily. $50,000 in total bodily injury liability per accident. Missouri motor vehicle owners are required to show proof of insurance when registering a vehicle and renewing their license plates. If you do not buy obamacare or other qualifying health coverage (also referred to as “minimum essential coverage”) you will be subject to a tax penalty for each month you go without coverage.

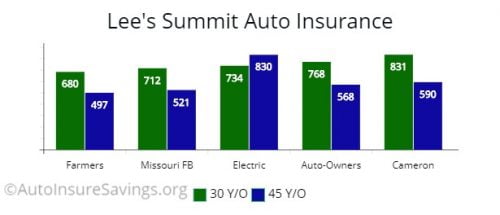

Source: autoinsuresavings.org

Source: autoinsuresavings.org

You may not need to cancel, but you may have to raise or lower your coverage. But if you’re thinking of moving to the state, you’ll need to have the required insurance coverage for your vehicle. That is roughly 8% more than the average missouri resident pays for car insurance. Bodily injury per person, bodily injury per accident, and property damage, respectively. Here are some of the parameters of our insurance coverage in missouri:

Source: howtostartanllc.com

Source: howtostartanllc.com

Bodily injury per person, bodily injury per accident, and property damage, respectively. Providers must carry medical malpractice insurance a minimum of $500,000 if they are on staff at a hospital in a county with at least 75,000 residents: In this guide, we’ll cover everything. The minimum amount of missouri auto insurance coverage is $25,000/$50,000/$10,000. The missouri minimum car insurance liability limits are 25/50/25, plus 25/50 uninsured/underinsured motorist coverage.

Source: bwoattorneys.com

Source: bwoattorneys.com

In missouri, if you carry the mandatory minimum liability insurance, your coverage would be expressed as 25/50/25. Missouri minimum insurance coverage.compare missouri health insurance plans with free quotes from ehealth! There isn�t an insurance product called full coverage. Missouri car insurance & minimum coverage amounts read. Buying auto insurance is not a legal requirement in missouri, but it is one of the more common ways for drivers to prove financial responsibility drivers who choose to buy car insurance in missouri for this purpose missouri requires a minimum of 25/50/10 of bodily.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

In some special cases, there are exemptions to this penalty. $25,000 in bodily injury liability per person. Auto insurance requirements in missouri. There’s certainly a lot to explore; A single limit of $50,000 means the company will pay up to $50,000 for bodily injury and property damage liability claims arising from any one accident without regard to how much of that limit is for bodily injury and/or property damage.

Source: slideshare.net

Source: slideshare.net

Here are some of the parameters of our insurance coverage in missouri: Auto insurance requirements in missouri. In some special cases, there are exemptions to this penalty. Missouri motor vehicle owners are required to show proof of insurance when registering a vehicle and renewing their license plates. In this guide, we’ll cover everything.

Source: ephesians-two-ten.blogspot.com

Source: ephesians-two-ten.blogspot.com

Here are some of the parameters of our insurance coverage in missouri: $25,000 for total property damage. $25,000 in bodily injury liability per person. If you own or operate a motor vehicle in missouri, you are required by law to insure that automobile with coverage for injuries you cause to another, for at least $25,000 per person, $50,000 per accident, and $25,000 for property damage. Liability insurance covers your legal liability when injuries or property damage happen as a result of your actions.

Source: revisi.net

Source: revisi.net

Full coverage in missouri also includes optional collision and comprehensive insurance. If you own or operate a motor vehicle in missouri, you are required by law to insure that automobile with coverage for injuries you cause to another, for at least $25,000 per person, $50,000 per accident, and $25,000 for property damage. If you do not buy obamacare or other qualifying health coverage (also referred to as “minimum essential coverage”) you will be subject to a tax penalty for each month you go without coverage. Auto insurance requirements in missouri. $25,000 bodily injury per person $50,000 bodily injury per accident $10,000 property damage per accident —or— 25/50/10 dairyland® coverage in missouri at dairyland, we’re proud to be able to help drivers in missouri meet their insurance needs.

Source: newyorktribunenews.blogspot.com

Source: newyorktribunenews.blogspot.com

It also covers up to $10,000 for damage to. $25,000 for total property damage. Louis city and the urbanized A single limit of $50,000 means the company will pay up to $50,000 for bodily injury and property damage liability claims arising from any one accident without regard to how much of that limit is for bodily injury and/or property damage. $25,000 per person for bodily injury

Source: ransin.com

Source: ransin.com

Ask your agent to explain the differences between single limit and split coverages. Drivers need at least $25,000 in bodily injury liability insurance per person ($50,000 per accident) plus $25,000 in property damage. If you are a resident of the state of missouri, you must maintain minimum liability insurance. It also covers up to $10,000 for damage to. $50,000 for total bodily injury (when multiple people are injured).

Source: krauseandkinsman.com

Source: krauseandkinsman.com

What are the minimum limits for missouri? All missouri drivers are required to purchase and maintain the following minimum amounts of liability coverage: Liability insurance covers your legal liability when injuries or property damage happen as a result of your actions. This is also known as proof of financial responsibility. Each number on the policy refers to a different aspect of liability insurance:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title missouri minimum insurance coverage by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.