Modified life insurance policy information

Home » Trend » Modified life insurance policy informationYour Modified life insurance policy images are ready. Modified life insurance policy are a topic that is being searched for and liked by netizens now. You can Download the Modified life insurance policy files here. Download all royalty-free photos and vectors.

If you’re looking for modified life insurance policy pictures information related to the modified life insurance policy topic, you have visit the ideal blog. Our site always provides you with suggestions for seeking the highest quality video and picture content, please kindly hunt and locate more enlightening video content and images that match your interests.

Modified Life Insurance Policy. If you die within that time, the insurance company refunds the premiums you’ve paid plus a set interest rate, usually around 8. A term policy would last for a particular time before it expires, while a whole life policy would last for the insured person’s entire life. Here are some facts that you might want to consider: With a modified premium whole life insurance contract, the amount of premium due is lower in the first years of the policy.

Modified Whole Life Insurance Pros, Cons and Benefits by From medium.com

Modified Whole Life Insurance Pros, Cons and Benefits by From medium.com

After the period of lower premiums expires, the cost of the policy is typically a bit higher than a traditional level. Modified life insurance is any policy with an alternative premium payment structure. In addition, if you die from an accident it pays out on day one. Modified whole life insurance is a whole life insurance policy with a waiting period. The difference with the traditional insurance policy is that in a modified insurance policy, the premiums paid by the insured tend to be lower during the first few years. Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period.

Here are some facts that you might want to consider:

A term policy would last for a particular time before it expires, while a whole life policy would last for the insured person’s entire life. Modified life insurance works just like a regular life insurance policy but it has lower premium prices for the first three to five years. You should only accept a modified life insurance policy after all other options have been exhausted. Modified whole life insurance is the most common type but modified term life insurance also exists. With a modified premium whole life insurance contract, the amount of premium due is lower in the first years of the policy. A modified whole life insurance policy (policy form no.

Source: superpages.com

Source: superpages.com

The modified premium whole life policy is used for offering comprehensive protection and coverage for the rest of one�s life. Modified whole life insurance is a whole life insurance policy with a waiting period. A term policy would last for a particular time before it expires, while a whole life policy would last for the insured person’s entire life. This may make them ideal for individuals who anticipate an increase in their income over the coming years. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

![Modified Whole Life Insurance in 2021 [Prices, Pros & Cons] Modified Whole Life Insurance in 2021 [Prices, Pros & Cons]](https://gx0ri2vwi9eyht1e3iyzyc17-wpengine.netdna-ssl.com/wp-content/uploads/2020/04/proscons-1.jpg) Source: choicemutual.com

Source: choicemutual.com

Modified life insurance works just like a regular life insurance policy but it has lower premium prices for the first three to five years. A term policy would last for a particular time before it expires, while a whole life policy would last for the insured person’s entire life. This may make them ideal for individuals who anticipate an increase in their income over the coming years. Modified life insurance — an ordinary life insurance policy with premiums adjusted so that, during the first 3 to 5 years, the premiums are lower than a standard policy, and, in subsequent years, the premiums are higher than a standard policy. A modified whole life insurance policy (policy form no.

![Modified Whole Life Insurance in 2021 [Prices, Pros & Cons] Modified Whole Life Insurance in 2021 [Prices, Pros & Cons]](https://gx0ri2vwi9eyht1e3iyzyc17-wpengine.netdna-ssl.com/wp-content/uploads/2020/04/best-price.png) Source: choicemutual.com

Source: choicemutual.com

A modified policy is similar to a graded policy. Modified whole life insurance is a whole life insurance policy with a waiting period. During this time, you’ll get all your premiums back with interest. The premium goes up only once after the introductory period and then remains. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad.

Source: insurancenoon.com

Source: insurancenoon.com

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. You should only accept a modified life insurance policy after all other options have been exhausted. In addition, if you die from an accident it pays out on day one. What does modified life insurance mean? With liberty national division’s modified life plan, coverage may be available to you even if you have health problems.

Source: theinsuranceproblog.com

Source: theinsuranceproblog.com

Premiums usually start lower, then increase after five to 10 years. If you can’t afford or qualify for a traditional policy, modified life insurance might be a suitable option for you. This may make them ideal for individuals who anticipate an increase in their income over the coming years. The modified premium whole life policy is used for offering comprehensive protection and coverage for the rest of one�s life. Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period.

Source: youtube.com

Source: youtube.com

Overall, though, the total amount remains the same. Premiums usually start lower, then increase after five to 10 years. It’s considered a form of limited pay permanent life insurance because it’s often purchased in one lump sum or over the course of a few annual payments, instead of level annual. Modified whole life insurance is a whole life insurance policy with a waiting period. The premium goes up only once after the introductory period and then remains.

Source: lifeinsuranceforelderlypeople.com

Source: lifeinsuranceforelderlypeople.com

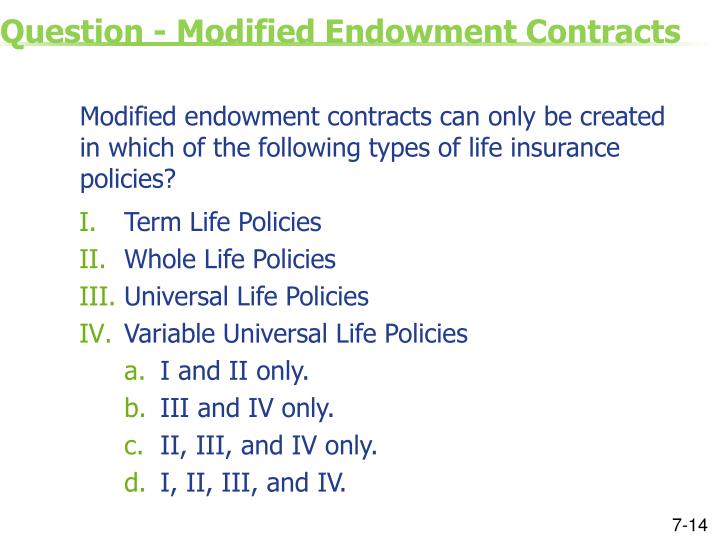

What is modified whole life insurance? Modified life insurance — an ordinary life insurance policy with premiums adjusted so that, during the first 3 to 5 years, the premiums are lower than a standard policy, and, in subsequent years, the premiums are higher than a standard policy. If you can’t afford or qualify for a traditional policy, modified life insurance might be a suitable option for you. It can either be whole life or a term insurance policy. The modified premium whole life policy is used for offering comprehensive protection and coverage for the rest of one�s life.

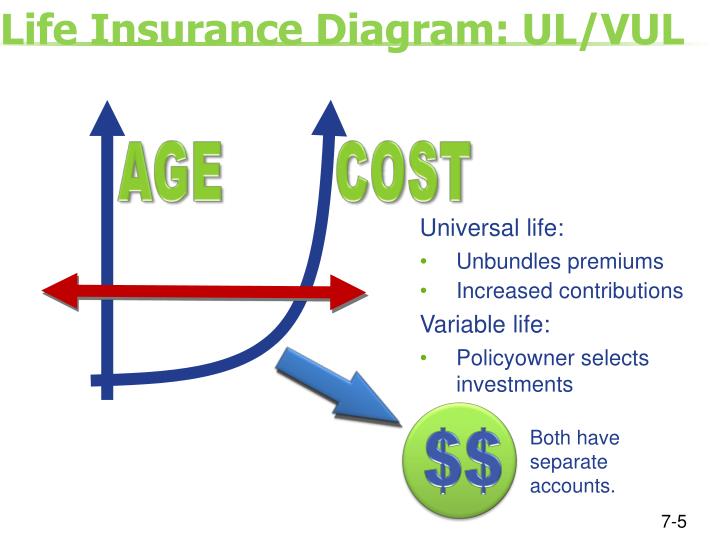

Source: slideserve.com

Source: slideserve.com

Have you ever thought about the expenses your family will incur after your death? Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period. What is modified whole life insurance? Modified whole life insurance is a whole life insurance policy with a waiting period. The difference with the traditional insurance policy is that in a modified insurance policy, the premiums paid by the insured tend to be lower during the first few years.

Source: slideserve.com

Source: slideserve.com

This period of lower premiums usually lasts through the first five to ten years of a policy’s life, depending upon the issuing company. If you can’t afford or qualify for a traditional policy, modified life insurance might be a suitable option for you. A modified policy is similar to a graded policy. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Modified life insurance is any policy with an alternative premium payment structure.

Source: insuranceandestates.com

Source: insuranceandestates.com

- life insurance underwritten by: Modified whole life insurance is a whole life insurance policy with a waiting period. In short, the premiums are lower during the first 5 years of the policy and then increase to a specified amount for the remaining life of the policy. Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period. Modified life insurance is any policy with an alternative premium payment structure.

Source: npa1.org

Source: npa1.org

Despite lower initial premiums, the death benefit doesn’t change over the life of a modified policy. Modified whole life insurance is the most common type but modified term life insurance also exists. Modified whole life insurance is a whole life insurance policy with a waiting period. 9561) life insurance underwritten by: If you can’t afford or qualify for a traditional policy, modified life insurance might be a suitable option for you.

Source: pocketsense.com

Source: pocketsense.com

This period of lower premiums usually lasts through the first five to ten years of a policy’s life, depending upon the issuing company. Here are some facts that you might want to consider: The modified premium whole life policy is used for offering comprehensive protection and coverage for the rest of one�s life. Overall, though, the total amount remains the same. In short, the premiums are lower during the first 5 years of the policy and then increase to a specified amount for the remaining life of the policy.

![Modified Whole Life Insurance in 2021 [Prices, Pros & Cons] Modified Whole Life Insurance in 2021 [Prices, Pros & Cons]](https://gx0ri2vwi9eyht1e3iyzyc17-wpengine.netdna-ssl.com/wp-content/uploads/2020/04/faqsmodifiedplan.jpg) Source: choicemutual.com

Source: choicemutual.com

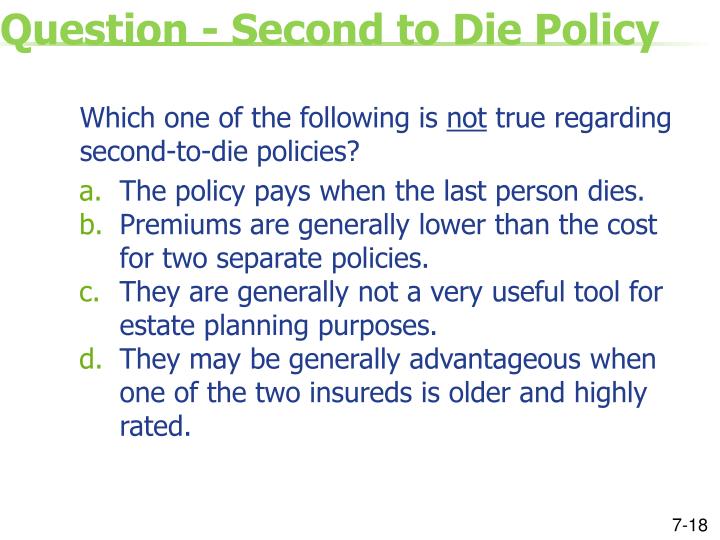

Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Modified life insurance policy health problems don’t have to mean insurance problems. Define modified guaranteed life insurance policy. This may make them ideal for individuals who anticipate an increase in their income over the coming years.

Source: eeelopibe.blogspot.com

Source: eeelopibe.blogspot.com

After the period of lower premiums expires, the cost of the policy is typically a bit higher than a traditional level. You should only accept a modified life insurance policy after all other options have been exhausted. Modified life insurance, also commonly modified whole life insurance, is a unique form of permanent life insurance that offers a much lower premium for the first few policy years in exchange for a higher premium after an introductory period. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. What is modified whole life insurance?

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Despite lower initial premiums, the death benefit doesn’t change over the life of a modified policy. This period of lower premiums usually lasts through the first five to ten years of a policy’s life, depending upon the issuing company. What is modified whole life insurance? Premiums usually start lower, then increase after five to 10 years. It can either be whole life or a term insurance policy.

Source: seniorinsurancepartner.com

Source: seniorinsurancepartner.com

A modified policy is similar to a graded policy. A modified life insurance policy is just like any other life insurance policy. It’s considered a form of limited pay permanent life insurance because it’s often purchased in one lump sum or over the course of a few annual payments, instead of level annual. Ad compare & save on life insurance plans designed for expats & foreign citizens abroad. Also known as modified premium whole life, a modified whole life policy comes with low introductory premiums.

Source: eeelopibe.blogspot.com

Source: eeelopibe.blogspot.com

- life insurance underwritten by: Modified whole life policies are whole life policies that feature a different premium structure to make them more affordable during the early life of the policy. Modified life insurance policy health problems don’t have to mean insurance problems. After that initial introductory period, the premium becomes significantly higher than a standard life insurance policy. Learn about its pros and cons in this guide.

Source: seniorslifeinsurancefinder.com

Source: seniorslifeinsurancefinder.com

Modified whole life insurance is the most common type but modified term life insurance also exists. Modified whole life insurance is the most common type but modified term life insurance also exists. A modified policy is similar to a graded policy. Here are some facts that you might want to consider: The modified premium whole life policy is used for offering comprehensive protection and coverage for the rest of one�s life.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title modified life insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.