Mold in car insurance claim Idea

Home » Trend » Mold in car insurance claim IdeaYour Mold in car insurance claim images are available. Mold in car insurance claim are a topic that is being searched for and liked by netizens today. You can Download the Mold in car insurance claim files here. Get all royalty-free photos.

If you’re looking for mold in car insurance claim pictures information related to the mold in car insurance claim interest, you have pay a visit to the ideal site. Our site frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and graphics that match your interests.

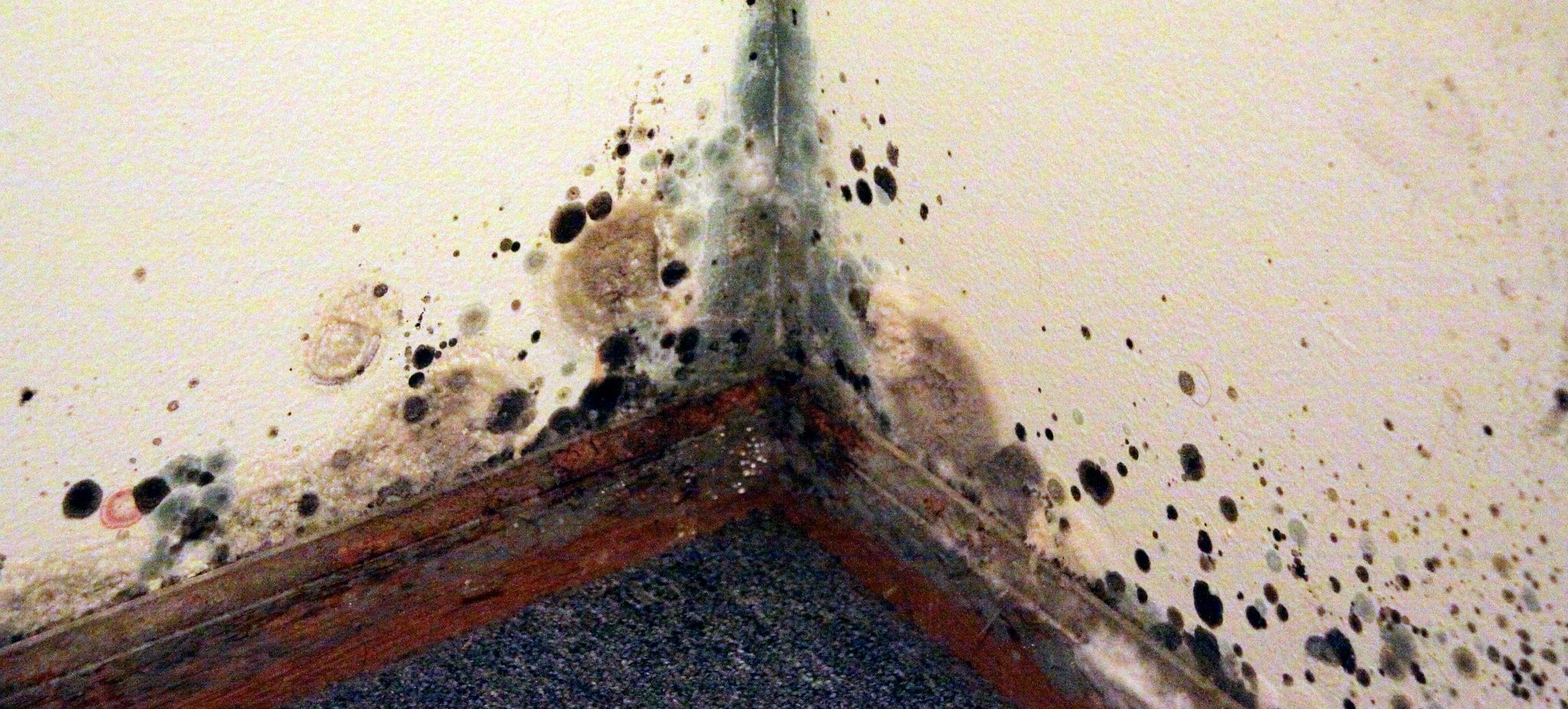

Mold In Car Insurance Claim. Perhaps the storm might include possible extenuating circumstances. Be sure to keep the pictures of the water damage and all documents associated with the damage and your claim in the event mold grows in the future. Read on to find out more about the steps you need to take to make a claim on your policy. If you have to file a claim for mold damage:

Does Homeowner�s Insurance Cover Mold Removal and Damage From safewayenviro.com

Does Homeowner�s Insurance Cover Mold Removal and Damage From safewayenviro.com

Most insurance companies limit payouts for covered mold removal claims to anywhere from $1,000 to $10,000. Depending on the coverage you add, rv insurance can also cover damage to your rv and even damage to personal items inside the vehicle. Perhaps the storm might include possible extenuating circumstances. Rv insurance exists to cover you if you damage someone or injure them with your rv. Insurers will often engage mould remediators to try to get rid of the mould using techniques such as chemicals to remove surface mould and dehumidifiers or blowers to remove airborne mould. If the insurance company accepts the claim, the next question will be how to fix the primary damage and the secondary mould.

Call your insurance company and make a mold claim once you have your proof ready, next is to contact your insurance provider immediately and make a claim.

Rv insurance exists to cover you if you damage someone or injure them with your rv. Around 2001, the number of insurance claims for mold damages soared, as did the income for restoration contractors. If you have to file a claim for mold damage: For example, if your laminate floor costs $2 per square foot to replace without mold and $2.50 per square foot to remove with mold, only $.50 per square foot should be charged to your mold limit. Perhaps the storm might include possible extenuating circumstances. Insurers will often engage mould remediators to try to get rid of the mould using techniques such as chemicals to remove surface mould and dehumidifiers or blowers to remove airborne mould.

Source: insuranceagentsofnj.com

Source: insuranceagentsofnj.com

Perhaps the storm might include possible extenuating circumstances. Rv insurance exists to cover you if you damage someone or injure them with your rv. Call your insurance company and make a mold claim once you have your proof ready, next is to contact your insurance provider immediately and make a claim. Common causes of gradual damage that can cause a claim to be blocked include: If you have to file a claim for mold damage:

Source: mold-help.org

Source: mold-help.org

If the insurance company accepts the claim, the next question will be how to fix the primary damage and the secondary mould. Plumbing, faucets, or pipes leaking over time, causing damage to walls, ceilings, or floors damage caused by water seeping in from cracks in the basement flashing, tiles, or shingles on the roof that show signs of needed repair mold, rot, or rust old or damaged wires Otherwise, mold insurance claims are limited to damage caused to your personal property. Typically, insurance policies state a maximum limit of between $1,000 and $10,000 for mold remediation. If the mold in your home or residence was caused by something sudden or accidental, such as a bursting pipe or some other covered incident on.

Source: amfam.com

Source: amfam.com

“overall, to make a successful mold claim you must demonstrate that the damage from the mold was sudden and accidental when you found it and you reported it promptly to your insurer. If the insurance company accepts the claim, the next question will be how to fix the primary damage and the secondary mould. It can cause skin and respiratory irritation,. For example, if your laminate floor costs $2 per square foot to replace without mold and $2.50 per square foot to remove with mold, only $.50 per square foot should be charged to your mold limit. A covered event might be a very heavy storm.

Source: louislawgroup.com

Source: louislawgroup.com

What the exclusions are telling us is that mold is excluded, unless there is be a peril or covered event to trigger coverage. If you have to file a claim for mold damage: Typically, insurance policies state a maximum limit of between $1,000 and $10,000 for mold remediation. When insureds, public insurance adjusters, and plaintiffs� lawyers speak of claims against insurance companies claiming damage by mold, they often say, mold is gold. mold claims are a growth industry. One of them is reducing the amount they will pay for mold damage — even if it is caused by a covered peril.

Source: realvalueins.com

Source: realvalueins.com

Most insurance companies limit payouts for covered mold removal claims to anywhere from $1,000 to $10,000. “we find that time is the biggest problem resulting in a mold claim. Insurers will often engage mould remediators to try to get rid of the mould using techniques such as chemicals to remove surface mould and dehumidifiers or blowers to remove airborne mould. The greatest concern about mold for insurance claims is whether it existed before or after the event.” blumkin says that when water or moisture damage is not cleaned up quickly, such as after wild fires and other natural disasters, the situation gets even worse. If the mold in your home or residence was caused by something sudden or accidental, such as a bursting pipe or some other covered incident on.

Source: clovered.com

Source: clovered.com

Mold damage can cost between $15,000 and $30,000 to remediate, so insurance companies have enacted several measures to reduce their risk. If the mold in your home or residence was caused by something sudden or accidental, such as a bursting pipe or some other covered incident on. Provide detailed information about mold growth and damage. Be sure to keep the pictures of the water damage and all documents associated with the damage and your claim in the event mold grows in the future. Knowing what to do after a car accident will help the insurance claims process go as smoothly as possible.

Source: istorytime.com

Source: istorytime.com

“overall, to make a successful mold claim you must demonstrate that the damage from the mold was sudden and accidental when you found it and you reported it promptly to your insurer. “overall, to make a successful mold claim you must demonstrate that the damage from the mold was sudden and accidental when you found it and you reported it promptly to your insurer. The number of claims for damage by mold has increased by more than 1,000 percent in some areas. Most insurers don�t cover mold removal or damage from mold or bacteria. If your mold damage claim is allowed, make sure only the applicable charges go toward the mold remediation limit.

Source: morrisonlawyers.com

Source: morrisonlawyers.com

Mold damage can cost between $15,000 and $30,000 to remediate, so insurance companies have enacted several measures to reduce their risk. Otherwise, mold insurance claims are limited to damage caused to your personal property. A covered event might be a very heavy storm. But that doesn�t mean you shouldn�t file a claim. As mold develops in your car, it can pave the way to various health issues.

Source: moldtestingflorida.com

Source: moldtestingflorida.com

Mold damage will not be covered if it was caused by your own negligence. Be sure to keep the pictures of the water damage and all documents associated with the damage and your claim in the event mold grows in the future. Most insurers don�t cover mold removal or damage from mold or bacteria. If you can, record it. Insurers will often engage mould remediators to try to get rid of the mould using techniques such as chemicals to remove surface mould and dehumidifiers or blowers to remove airborne mould.

Source: witeslaw.com

Source: witeslaw.com

Mold damage can cost between $15,000 and $30,000 to remediate, so insurance companies have enacted several measures to reduce their risk. Unfortunately, the insurance industry had not expected this rush of claims, and they had not priced them into their policies. For example, if mold begins to grow on the dash or the backs of the seats, it is considered the responsible of the car owner to remove it before it can cause any serious or permanent damage. It can cause skin and respiratory irritation,. Insurers will often engage mould remediators to try to get rid of the mould using techniques such as chemicals to remove surface mould and dehumidifiers or blowers to remove airborne mould.

Source: vg.law

Source: vg.law

Some insurance companies do have a clause for mold but usually cap it at $10,000. A covered event might be a very heavy storm. Depending on the coverage you add, rv insurance can also cover damage to your rv and even damage to personal items inside the vehicle. When insureds, public insurance adjusters, and plaintiffs� lawyers speak of claims against insurance companies claiming damage by mold, they often say, mold is gold. mold claims are a growth industry. Some insurance companies do have a clause for mold but usually cap it at $10,000.

Source: insurance.com

As mold develops in your car, it can pave the way to various health issues. Otherwise, mold insurance claims are limited to damage caused to your personal property. Mold claims appear in both wet areas, like houston, as well. What the exclusions are telling us is that mold is excluded, unless there is be a peril or covered event to trigger coverage. Perhaps the storm might include possible extenuating circumstances.

Source: insurancequotes2day.com

Source: insurancequotes2day.com

Typically, insurance policies state a maximum limit of between $1,000 and $10,000 for mold remediation. Around 2001, the number of insurance claims for mold damages soared, as did the income for restoration contractors. If you have to file a claim for mold damage: Perhaps the storm might include possible extenuating circumstances. When insureds, public insurance adjusters, and plaintiffs� lawyers speak of claims against insurance companies claiming damage by mold, they often say, mold is gold. mold claims are a growth industry.

Source: insuranceclaimhq.com

Source: insuranceclaimhq.com

For example, if mold begins to grow on the dash or the backs of the seats, it is considered the responsible of the car owner to remove it before it can cause any serious or permanent damage. What the exclusions are telling us is that mold is excluded, unless there is be a peril or covered event to trigger coverage. Around 2001, the number of insurance claims for mold damages soared, as did the income for restoration contractors. Mold damage can cost between $15,000 and $30,000 to remediate, so insurance companies have enacted several measures to reduce their risk. “we find that time is the biggest problem resulting in a mold claim.

Around 2001, the number of insurance claims for mold damages soared, as did the income for restoration contractors. For example, if your laminate floor costs $2 per square foot to replace without mold and $2.50 per square foot to remove with mold, only $.50 per square foot should be charged to your mold limit. If you can, record it. In response, insurance companies were compelled to begin issuing mold exclusions and limitations. It can cause skin and respiratory irritation,.

Source: paradisoinsurance.com

Source: paradisoinsurance.com

One of them is reducing the amount they will pay for mold damage — even if it is caused by a covered peril. If the mold in your home or residence was caused by something sudden or accidental, such as a bursting pipe or some other covered incident on. Provide detailed information about mold growth and damage. For example, if your laminate floor costs $2 per square foot to replace without mold and $2.50 per square foot to remove with mold, only $.50 per square foot should be charged to your mold limit. One of them is reducing the amount they will pay for mold damage — even if it is caused by a covered peril.

Source: amfam.com

Source: amfam.com

It can cause skin and respiratory irritation,. Perhaps the storm might include possible extenuating circumstances. If you have to file a claim for mold damage: When insureds, public insurance adjusters, and plaintiffs� lawyers speak of claims against insurance companies claiming damage by mold, they often say, mold is gold. mold claims are a growth industry. Read on to find out more about the steps you need to take to make a claim on your policy.

Source: yourinsuranceattorney.com

Source: yourinsuranceattorney.com

The greatest concern about mold for insurance claims is whether it existed before or after the event.” blumkin says that when water or moisture damage is not cleaned up quickly, such as after wild fires and other natural disasters, the situation gets even worse. Common causes of gradual damage that can cause a claim to be blocked include: Similarly, if the windshield is too dirty to see out of and you get into an accident, the insurer might deny coverage on the grounds that you did not perform a minimum. Read on to find out more about the steps you need to take to make a claim on your policy. Otherwise, mold insurance claims are limited to damage caused to your personal property.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title mold in car insurance claim by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.