Monoline insurance policy information

Home » Trending » Monoline insurance policy informationYour Monoline insurance policy images are ready in this website. Monoline insurance policy are a topic that is being searched for and liked by netizens today. You can Download the Monoline insurance policy files here. Find and Download all royalty-free photos.

If you’re looking for monoline insurance policy images information connected with to the monoline insurance policy keyword, you have pay a visit to the right blog. Our website frequently gives you suggestions for seeing the maximum quality video and picture content, please kindly surf and locate more enlightening video content and images that match your interests.

Monoline Insurance Policy. In fact, there are insurance companies who specialize in only writing worker’s compensation policies. Generally, companies purchase monoline insurance policies when they can�t find what they need or want in a standard package or business owners policy (bop policy). Monoline cargo insurance | nw truck insurance truck cargo insurance trucking companies are required by law to purchase auto liability or truck liability insurance. For example, workers’ compensation and commercial auto are often written as single, or monoline, coverage.

A Short Guide To Monoline Property Insurance Pyramid Squared From pyramidsquared.com

A Short Guide To Monoline Property Insurance Pyramid Squared From pyramidsquared.com

In other cases, insurance companies who offer other. Covered property — this will specifically list the covered. Here are a couple of reasons why: A monoline insurance company is an insurance company that is focused on providing only one specific type of insurance product. Building and personal property (bpp) coverage form. Dwelling property forms what perils are covered by the standard fire policy?

Within the industry, some brokers and agents may consider clients with only one type of insurance policy with their company as a monoline client.

In other cases, insurance companies who offer other. For example, workers’ compensation and commercial auto are often written as single, or monoline, coverage. A monoline policy is a policy that covers one type of insurance; A monoline insurance company is an insurance company that is focused on providing only one specific type of insurance product. Usplate also reinsures and manages claims on glass endorsement for property policies of other insurers. So, the agency must show a retail storefront to both potential and renewal customers.

Source: acfinsurance.com

Source: acfinsurance.com

For example, workers’ compensation and commercial auto are often written as single, or monoline, coverage. A monoline policy is a policy that covers one type of insurance; And if the accident / insurance event occurs, the insurance company. Leveraged split dollar life insurance modified collateral split dollar life insurance plan under which the employee purchases and owns a life insurance policy on the employee�s own life. Covered property — this will specifically list the covered.

Source: sec.gov

Source: sec.gov

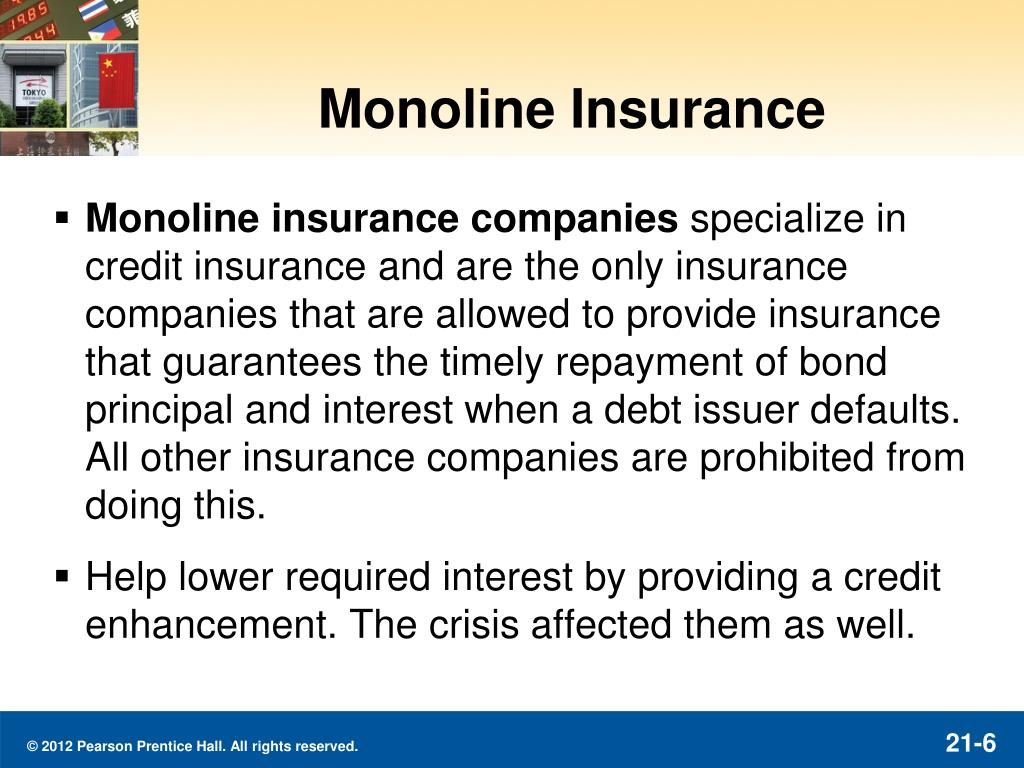

The term monoline does not mean that insurers operate only in one securities market, such as municipal bonds, as the term has sometimes been misconstrued. Generally, companies purchase monoline insurance policies when they can�t find what they need or want in a standard package or business owners policy (bop policy). Dwelling property forms what perils are covered by the standard fire policy? Here are a couple of reasons why: For instance, enterprise homeowners insurance policies bundle common legal responsibility, business property and enterprise interruption insurance coverage.

Source: ftalphaville.ft.com

Source: ftalphaville.ft.com

Monoline or package a monoline policy is a policy that covers one type of insurance; A package policy is generally less expensive than insurance coverage purchased separately. For example, workers compensation or commercial auto are often written as single, or monoline, coverage. Bond insurers are monoline by statute, which means that companies that write bond insurance do not participate in other lines of insurance such as life, health, or property and casualty. A monoline policy is an insurance policy that covers only one specific risk.

Source: slideshare.net

Source: slideshare.net

The employer makes the unscheduled. Monoline or package a monoline policy is a policy that covers one type of insurance; And if the accident / insurance event occurs, the insurance company. An example of a monoline policy would be a single auto insurance policy covering only one vehicle. Common legal responsibility monoline insurance coverage is a coverage that isn’t a part of a business insurance coverage bundle.

Source: prosurancegroup.com

Source: prosurancegroup.com

Usplate also reinsures and manages claims on glass endorsement for property policies of other insurers. A monoline insurance company is an insurance company that is focused on providing only one specific type of insurance product. A monoline policy is an insurance policy that covers only one specific risk. This is in contrast to a business owner’s package (bop) policy or a commercial package policy (cpp). A package policy includes two or more lines of insurance coverage.

Source: slideshare.net

Source: slideshare.net

Dwelling property forms what perils are covered by the standard fire policy? A monoline commercial insurance policy is simply a policy that covers one type of insurance; So, the agency must show a retail storefront to both potential and renewal customers. For example, workers compensation or commercial auto are often written as single, or monoline, coverage. Common legal responsibility monoline insurance coverage is a coverage that isn’t a part of a business insurance coverage bundle.

Source: nasz-heartland-pl.blogspot.com

Source: nasz-heartland-pl.blogspot.com

Leveraged split dollar life insurance modified collateral split dollar life insurance plan under which the employee purchases and owns a life insurance policy on the employee�s own life. A standalone common legal responsibility insurance coverage coverage. Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. What is a �monoline insurance company� a monoline insurance company is an insurance company that provides guarantees to issuers, often in the form of credit wraps, that enhance the credit of the issuer. A monoline policy is a policy that covers one type of insurance;

Source: pyramidsquared.com

Source: pyramidsquared.com

This insurance provides protection for the motor carrier for legal liability arising out of the ownership, maintenance, and use of any insured automobile. Monoline insurance companies are typically associated with insurance. For example, workers’ compensation and commercial auto are often written as single, or monoline, coverage. A package policy includes two or more lines of insurance coverage. A standalone common legal responsibility insurance coverage coverage.

Source: eduardomolea.blogspot.com

Source: eduardomolea.blogspot.com

Covered property — this will specifically list the covered. Bond insurers are monoline by statute, which means that companies that write bond insurance do not participate in other lines of insurance such as life, health, or property and casualty. For example, workers compensation or commercial auto are often written as single, or monoline, coverage. A monoline policy is a policy that covers one type of insurance; For example, workers’ compensation and commercial auto are often written as single, or monoline, coverage.

Source: slideshare.net

Source: slideshare.net

For instance, enterprise homeowners insurance policies bundle common legal responsibility, business property and enterprise interruption insurance coverage. But as times are changing, agencies must adapt to. Comprehensive personal liability fire insurance goes by which 3 names? An example of a monoline policy would be a single auto insurance policy covering only one vehicle. Leveraged split dollar life insurance modified collateral split dollar life insurance plan under which the employee purchases and owns a life insurance policy on the employee�s own life.

Source: landesblosch.com

Source: landesblosch.com

For example, workers’ compensation and commercial auto are often written as single, or monoline, coverage. A monoline policy is a policy that covers one type of insurance; Your insurance policy — what does it really mean? Usplate also reinsures and manages claims on glass endorsement for property policies of other insurers. Monoline insurance companies are typically associated with insurance.

Source: iruhl.com

Source: iruhl.com

For instance, enterprise homeowners insurance policies bundle common legal responsibility, business property and enterprise interruption insurance coverage. Comprehensive personal liability fire insurance goes by which 3 names? A package policy is generally less expensive than insurance coverage purchased separately. Generally, companies purchase monoline insurance policies when they can�t find what they need or want in a standard package or business owners policy (bop policy). What is a �monoline insurance company� a monoline insurance company is an insurance company that provides guarantees to issuers, often in the form of credit wraps, that enhance the credit of the issuer.

Source: slideshare.net

Source: slideshare.net

Your insurance policy — what does it really mean? Removal what are dwelling fire policies? A monoline policy is an insurance policy that covers only one specific risk. But as times are changing, agencies must adapt to. For example, workers’ compensation and commercial auto are often written as single, or monoline, coverage.

Source: abbateins.com

Source: abbateins.com

Leveraged split dollar life insurance modified collateral split dollar life insurance plan under which the employee purchases and owns a life insurance policy on the employee�s own life. Usplate also reinsures and manages claims on glass endorsement for property policies of other insurers. A monoline policy is an insurance policy that covers only one specific risk. Building and personal property (bpp) coverage form. And if the accident / insurance event occurs, the insurance company.

![]() Source: eduardomolea.blogspot.com

Source: eduardomolea.blogspot.com

Depending on the chosen program, you can partially or completely protect yourself from unforeseen expenses. A package policy includes two or more lines of insurance coverage. Monoline insurers a monoline insurance company is an insurance company that provides coverage for only a specific kind of insurable risk. For example, workers compensation or commercial auto are often written as single, or monoline, coverage. Bond insurers are monoline by statute, which means that companies that write bond insurance do not participate in other lines of insurance such as life, health, or property and casualty.

Source: eduardomolea.blogspot.com

Source: eduardomolea.blogspot.com

Usplate is the country�s largest monoline glass insurer.usplate writes policies that cover glass in commercial buildings like stores, hotels, schools. So, the agency must show a retail storefront to both potential and renewal customers. In other cases, insurance companies who offer other. But as times are changing, agencies must adapt to. What is a �monoline insurance company� a monoline insurance company is an insurance company that provides guarantees to issuers, often in the form of credit wraps, that enhance the credit of the issuer.

Source: getfilings.com

Source: getfilings.com

And if the accident / insurance event occurs, the insurance company. Monoline cargo insurance | nw truck insurance truck cargo insurance trucking companies are required by law to purchase auto liability or truck liability insurance. The employer makes the unscheduled. Monoline policy definition of monoline policy plan sponsor employer, association, labor union, or other group. Usplate also reinsures and manages claims on glass endorsement for property policies of other insurers.

Source: amapubs-activation.org

Source: amapubs-activation.org

For example, workers compensation or commercial auto are often written as single, or monoline, coverage. Comprehensive personal liability fire insurance goes by which 3 names? The term monoline does not mean that insurers operate only in one securities market, such as municipal bonds, as the term has sometimes been misconstrued. A package policy includes two or more lines of insurance coverage. Monoline insurance is a tool to reduce your risks.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title monoline insurance policy by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.