Morale hazard insurance information

Home » Trend » Morale hazard insurance informationYour Morale hazard insurance images are ready. Morale hazard insurance are a topic that is being searched for and liked by netizens now. You can Get the Morale hazard insurance files here. Get all royalty-free images.

If you’re looking for morale hazard insurance images information connected with to the morale hazard insurance topic, you have visit the ideal site. Our site frequently provides you with suggestions for seeking the highest quality video and image content, please kindly hunt and locate more enlightening video content and graphics that match your interests.

Morale Hazard Insurance. More specifically, it’s a risk that someone takes because they know someone else will pay the consequences of that risk. Age and condition of health, quality of packing. We begin by defining the object of interest: It also is considered a physical hazard in regard to health insurance because it increases the probability of severe illness.

What is the difference between moral and morale hazards in From quora.com

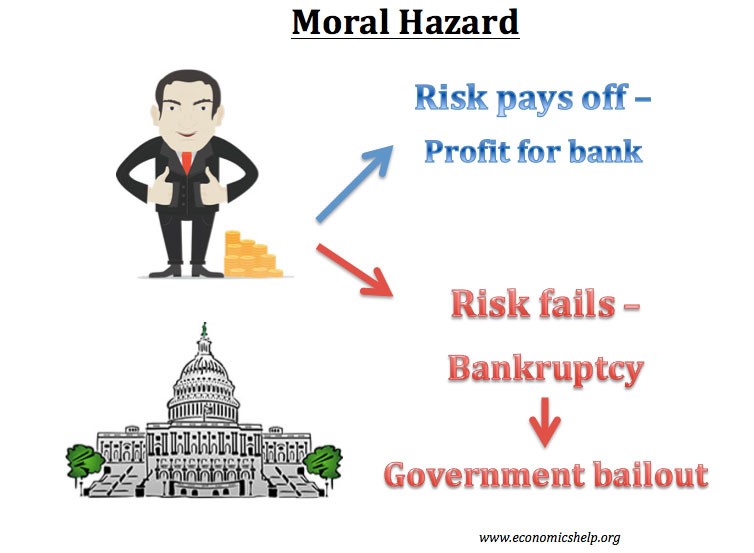

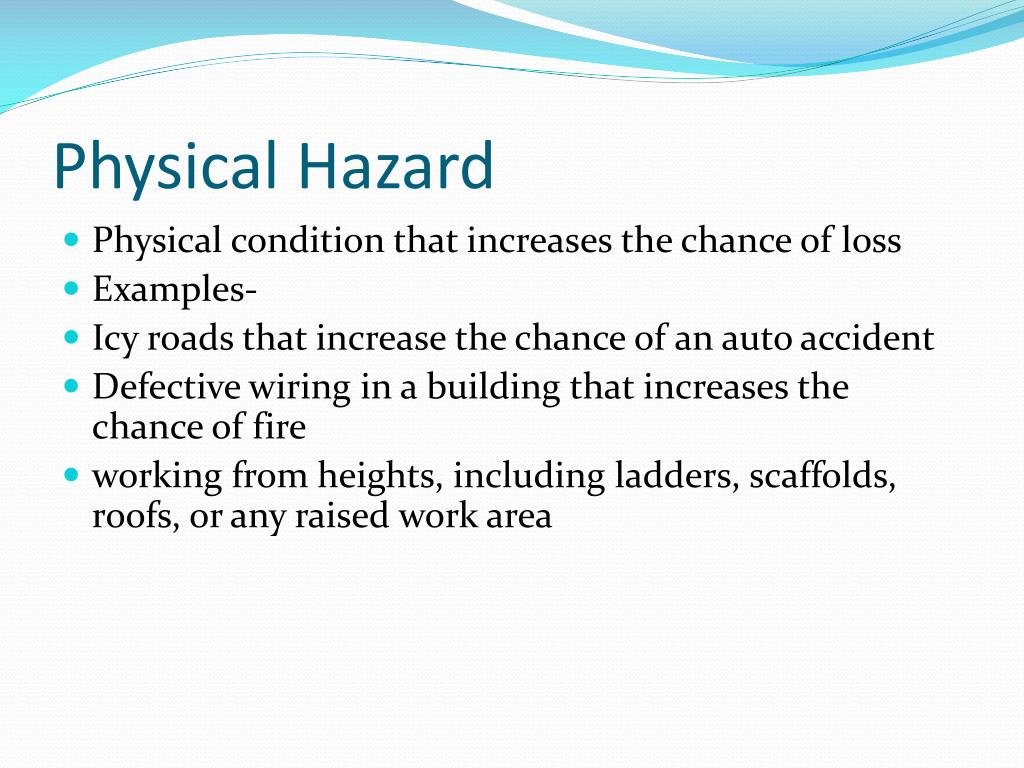

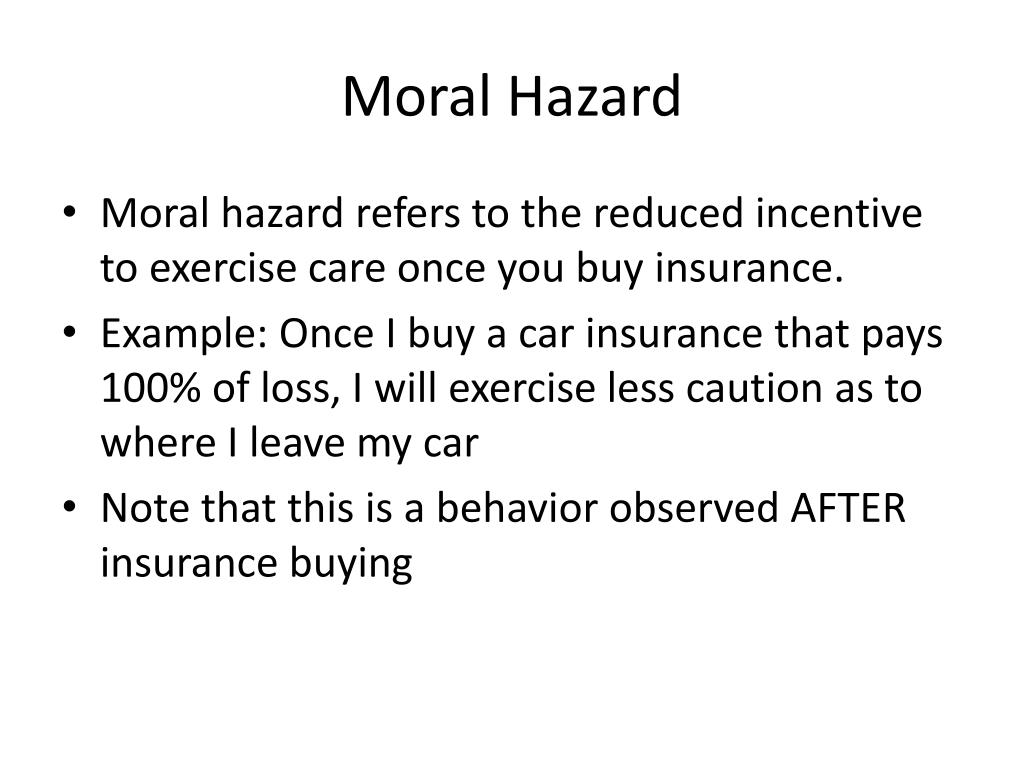

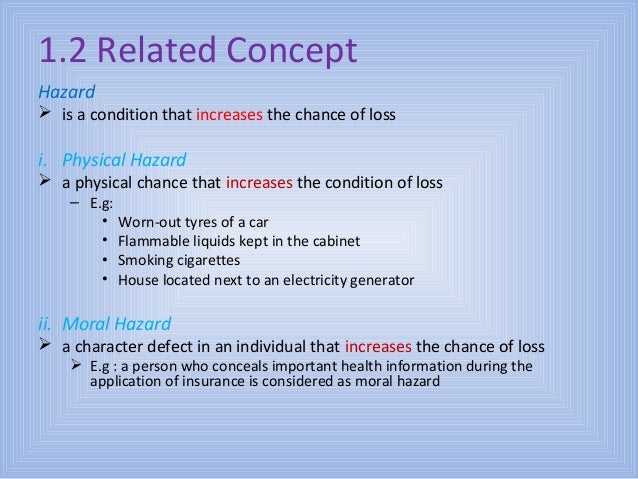

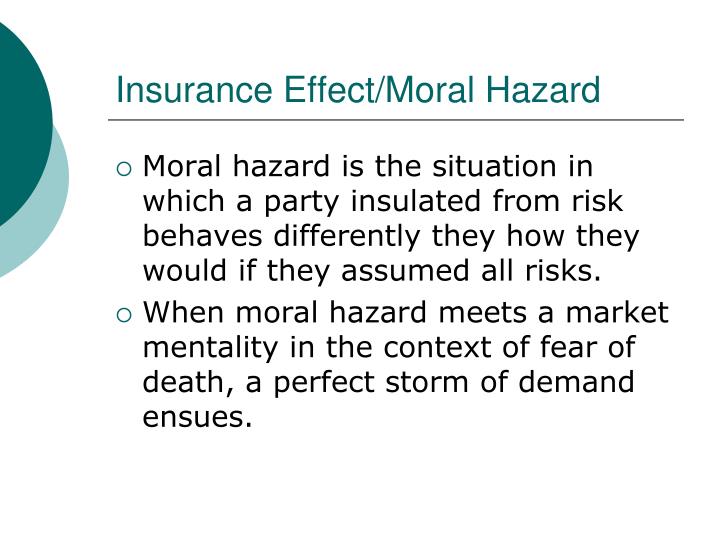

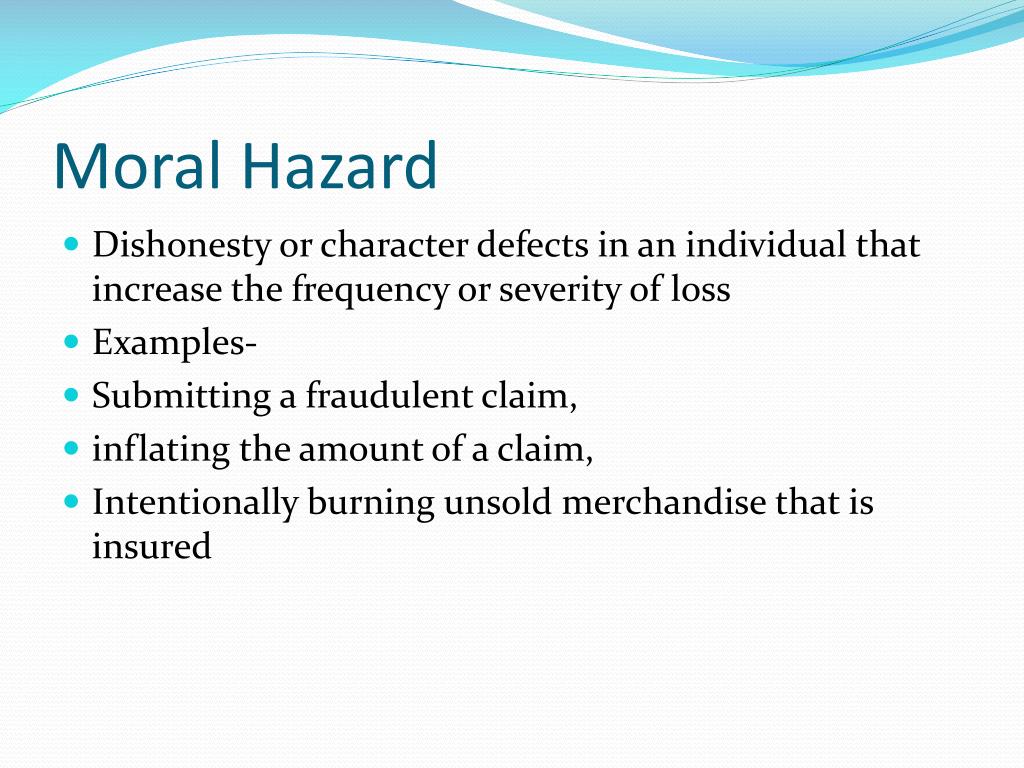

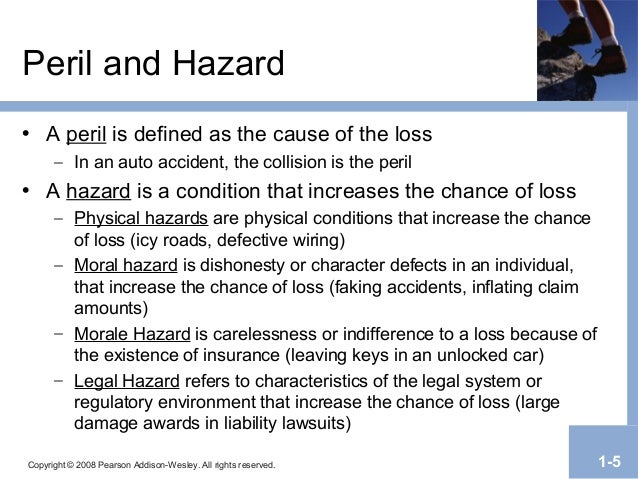

Early in one’s insurance career, a newcomer will more than likely be introduced to the concepts of morale and moral hazards. A moral hazard is an idea that a party protected from risk in some way will act differently than if they didn�t have that protection. 2 types of insurance hazards are physical hazards and moral hazards. Examples of morale hazards include filing false insurance claims or misrepresenting oneself on a life insurance application in order to obtain coverage or more favorable coverage terms. Insurance hazard means the conditions or situations that increase the chances of a loss arising from a peril. It can be described as one’s indifference to loss or increased carelessness due to the presence of insurance.

Morale hazard — a term used to describe a subjective hazard that tends to increase the probable frequency or severity of loss due to an insured peril.

For insurance purposes, hazards are classified as one of four types: Morale hazard synonyms, morale hazard pronunciation, morale hazard translation, english dictionary definition of morale hazard. 2 types of insurance hazards are physical hazards and moral hazards. How is moral hazard calculated? What “moral hazard” means in the context of health insurance, and why it is of interest to economists. Morale hazard — a term used to describe a subjective hazard that tends to increase the probable frequency or severity of loss due to an insured peril.

Source: heravest.com

Source: heravest.com

More specifically, it’s a risk that someone takes because they know someone else will pay the consequences of that risk. The concept of a moral hazard is essential for insurance because people may be inclined towards. A moral hazard is an idea that a party protected from risk in some way will act differently than if they didn�t have that protection. What is the difference between moral hazard and morale hazard? A moral hazard is a situation where someone has limited responsibility for the risks they take.

Source: definitionus.blogspot.com

Source: definitionus.blogspot.com

What are the different types of hazards in insurance? Conversely, morale hazard describes an unconscious change. A morale hazard, as the name might suggest, results from fraudulent acts committed by an insured. Morale hazard is an insurance term used to describe an insured person�s attitude about their belongings. Moral versus morale morale hazards.

Source: youtube.com

Source: youtube.com

Examples of morale hazards include filing false insurance claims or misrepresenting oneself on a life insurance application in order to obtain coverage or more favorable coverage terms. What is the difference between moral hazard and morale hazard? What “moral hazard” means in the context of health insurance, and why it is of interest to economists. Morale hazards are controlled by active supervision, safety rule enforcement, disciplinary action and top management holding the workforce accountable for safety performance. It can be described as one’s indifference to loss or increased carelessness due to the presence of insurance.

Source: slideserve.com

Source: slideserve.com

Bad administration and resultant shabby maintenance of thy, property/premises is an example of bad moral hazard. We then discuss work on three specific questions related to moral hazard in health insurance. A morale hazard, as the name might suggest, results from fraudulent acts committed by an insured. What “moral hazard” means in the context of health insurance, and why it is of interest to economists. Regulasi yang baik dan stabil memang seharusnya tidak dapat disambangi, bisa diatur dengan baik, tidak menimbulkan.

Source: quora.com

Moral hazards are intentional claims with bad intent like projecting higher than actual loss, intentionally burning poor crop to claim insurance etc. Morale hazards are controlled by active supervision, safety rule enforcement, disciplinary action and top management holding the workforce accountable for safety performance. Regulasi yang baik dan stabil memang seharusnya tidak dapat disambangi, bisa diatur dengan baik, tidak menimbulkan. First, we describe work that has tested whether moral hazard in health insurance in fact exists. It also is considered a physical hazard in regard to health insurance because it increases the probability of severe illness.

Source: entangledbydesire.blogspot.com

Source: entangledbydesire.blogspot.com

Morale hazards are controlled by active supervision, safety rule enforcement, disciplinary action and top management holding the workforce accountable for safety performance. This behavioral change can be brought about by. A moral hazard is an idea that a party protected from risk in some way will act differently than if they didn�t have that protection. For insurance purposes, hazards are classified as one of four types: What are the different types of hazards in insurance?

Source: youtube.com

Source: youtube.com

Morale hazards are which increase the risk due to unsafe acts of the person although person is not intentionally trying to cause the damage to claim money from insurance company. Age and condition of health, quality of packing. We begin by defining the object of interest: Examples of physical hazards are; Moral hazards are intentional claims with bad intent like projecting higher than actual loss, intentionally burning poor crop to claim insurance etc.

Source: slideshare.net

Source: slideshare.net

A moral hazard is a type of risk. Examples of physical hazards are; It represents the rise of indifference to loss. A morale hazard, as the name might suggest, results from fraudulent acts committed by an insured. What “moral hazard” means in the context of health insurance, and why it is of interest to economists.

Source: slideshare.net

Source: slideshare.net

More specifically, it’s a risk that someone takes because they know someone else will pay the consequences of that risk. Morale hazard, as contrasted with moral hazard, does not imply a propensity to cause a loss but implies a certain indifference to loss simply because of the existence of insurance. It can be described as one’s indifference to loss or increased carelessness due to the presence of insurance. For insurance professionals these industry terms are quite known. It also is considered a physical hazard in regard to health insurance because it increases the probability of severe illness.

Source: researchgate.net

Source: researchgate.net

Morale hazard synonyms, morale hazard pronunciation, morale hazard translation, english dictionary definition of morale hazard. A moral hazard is a type of risk. We begin by defining the object of interest: What is the difference between moral hazard and morale hazard? For insurance purposes, hazards are classified as one of four types:

Source: istherelifeinsurancetanyogo.blogspot.com

Source: istherelifeinsurancetanyogo.blogspot.com

2 types of insurance hazards are physical hazards and moral hazards. Insurance is valuable because it creates a vehicle for transferring consumption from (contingent) states with low marginal utility of income (e.g., when one is healthy) to states with high marginal utility of income (e.g., when one is sick). First, we describe work that has tested whether moral hazard in health insurance in fact exists. Morale hazard synonyms, morale hazard pronunciation, morale hazard translation, english dictionary definition of morale hazard. What “moral hazard” means in the context of health insurance, and why it is of interest to economists.

Source: slideserve.com

Source: slideserve.com

Examples of physical hazards are; Morale hazards are which increase the risk due to unsafe acts of the person although person is not intentionally trying to cause the damage to claim money from insurance company. A morale hazard, as the name might suggest, results from fraudulent acts committed by an insured. Morale hazard is an insurance term used to describe an insured person�s attitude about their belongings. A moral hazard is a situation in which a person with insurance takes greater risks than they normally would without insurance, because they know their insurer will foot the bill if something bad happens.

Source: bilibili.com

Source: bilibili.com

A morale hazard, according to the international risk management institute (irmi), is defined as a subjective hazard that tends to increase the probable frequency or severity of loss due to an insured peril. Insurance is valuable because it creates a vehicle for transferring consumption from (contingent) states with low marginal utility of income (e.g., when one is healthy) to states with high marginal utility of income (e.g., when one is sick). For insurance professionals these industry terms are quite known. Moral hazard examples are carelessness, fraud. It can be described as one’s indifference to loss or increased carelessness due to the presence of insurance.

Source: slideserve.com

Source: slideserve.com

What “moral hazard” means in the context of health insurance, and why it is of interest to economists. A morale hazard is the unconscious change of behavior that might lead to the insurer paying for a risk. Moral hazard describes a conscious change in behavior to try to benefit from an event that occurs. Examples of physical hazards are; A moral hazard is a situation in which a person with insurance takes greater risks than they normally would without insurance, because they know their insurer will foot the bill if something bad happens.

Source: slideserve.com

Source: slideserve.com

A moral hazard is an idea that a party protected from risk in some way will act differently than if they didn�t have that protection. For insurance professionals these industry terms are quite known. Morale hazard is an insurance term used to describe an insured person�s attitude about their belongings. Age and condition of health, quality of packing. Morale hazard — a term used to describe a subjective hazard that tends to increase the probable frequency or severity of loss due to an insured peril.

Source: driverlayer.com

Source: driverlayer.com

A morale hazard, according to the international risk management institute (irmi), is defined as a subjective hazard that tends to increase the probable frequency or severity of loss due to an insured peril. A morale hazard, according to the international risk management institute (irmi), is defined as a subjective hazard that tends to increase the probable frequency or severity of loss due to an insured peril. Morale hazard — a term used to describe a subjective hazard that tends to increase the probable frequency or severity of loss due to an insured peril. Moral hazards are intentional claims with bad intent like projecting higher than actual loss, intentionally burning poor crop to claim insurance etc. A moral hazard is a situation in which a person with insurance takes greater risks than they normally would without insurance, because they know their insurer will foot the bill if something bad happens.

Source: en.ppt-online.org

Source: en.ppt-online.org

The concept of a moral hazard is essential for insurance because people may be inclined towards. For insurance purposes, hazards are classified as one of four types: Examples of morale hazards include filing false insurance claims or misrepresenting oneself on a life insurance application in order to obtain coverage or more favorable coverage terms. What is the difference between moral hazard and morale hazard? Insurance hazard means the conditions or situations that increase the chances of a loss arising from a peril.

Source: quora.com

Moral hazard examples are carelessness, fraud. A morale hazard, as the name might suggest, results from fraudulent acts committed by an insured. Age and condition of health, quality of packing. Conversely, morale hazard describes an unconscious change. A moral hazard is a type of risk.

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title morale hazard insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.