Multiple life insurance policies information

Home » Trending » Multiple life insurance policies informationYour Multiple life insurance policies images are available. Multiple life insurance policies are a topic that is being searched for and liked by netizens now. You can Find and Download the Multiple life insurance policies files here. Find and Download all royalty-free photos and vectors.

If you’re searching for multiple life insurance policies pictures information related to the multiple life insurance policies interest, you have pay a visit to the ideal blog. Our site frequently provides you with hints for refferencing the maximum quality video and picture content, please kindly hunt and find more informative video content and graphics that match your interests.

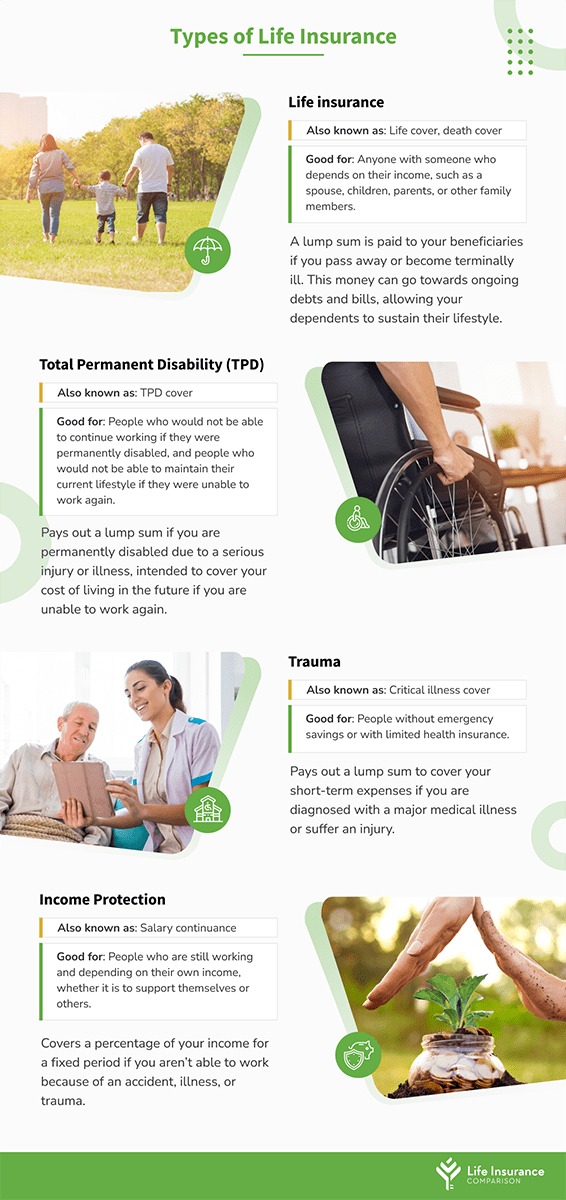

Multiple Life Insurance Policies. For sure, purchasing multiple life insurance policies is more tedious than purchasing one. It is perfectly legal to buy multiple life insurance policies and your family will not face problem in filing multiple claims. Holding multiple policies is a common way for one to increase their life insurance coverage, but an insurance provider approves policies not only based on your health but also on the legitimacy of your coverage needs and your perceived ability to keep up with your monthly insurance premiums. Buying multiple life insurance policies makes sense if you have multiple loans running.

The Strategy of Multiple Life Insurance Policies Episode From partners4prosperity.com

The Strategy of Multiple Life Insurance Policies Episode From partners4prosperity.com

Joint life insurance covers two lives but normally pays out upon the death of the first insured person during the policy term, after which the policy ends. But the more important question is,. In contrast, taking out two single life insurance policies means the surviving partner will still have cover in place after the first death. 1 insure.com gives the example of having a “permanent life insurance policy like whole life and also a term life policy for a shorter need.” you should speak with a. With multiple life insurance policies, a policyholder essentially ensures that their beneficiaries can access the benefits of their hlv even if they are no longer around. If you have one policy for $200,000, and you have a second policy for $200,000, you have $400,000 in life insurance coverage.

In the event that you pass away during the policy’s term, your beneficiaries will be asked to provide a copy of your death certificate to confirm the cause and date of death.

Multiple life insurance policies = more life insurance coverage. Joint life insurance covers two lives but normally pays out upon the death of the first insured person during the policy term, after which the policy ends. Can you have more than one life insurance policy? Can i buy more than one life insurance policy? Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own. Life insurance solution based on buying multiple policies.

Source: indiablooms.com

Source: indiablooms.com

Joint life insurance covers two lives but normally pays out upon the death of the first insured person during the policy term, after which the policy ends. With multiple life insurance policies, a policyholder essentially ensures that their beneficiaries can access the benefits of their hlv even if they are no longer around. Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own. Yes, it is possible to claim more than one policy. A level term assurance for £550,000 over 30 years will cost around £45 per month amounting to £16,200 over the 30 years.

Source: bemoneyaware.com

Source: bemoneyaware.com

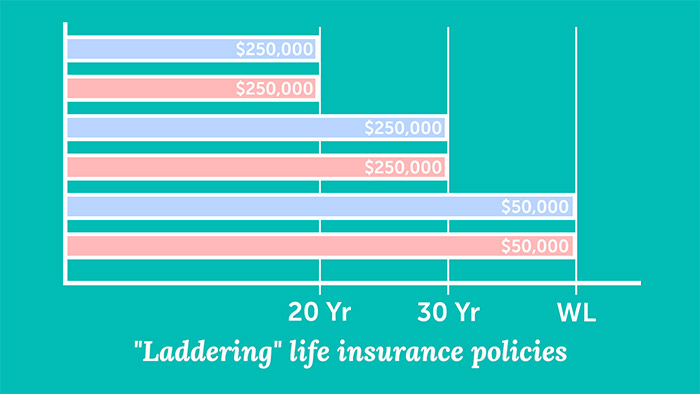

You can have more than one life insurance policy, and you don’t have to get them from the same company. Buying multiple life insurance policies can be a smart way to get additional coverage to insure against a specific debt, like a mortgage, or if you want to implement a more complicated financial strategy, like the ladder strategy. With multiple life insurance policies, a policyholder essentially ensures that their beneficiaries can access the benefits of their hlv even if they are no longer around. Life insurance policies that cover each need for person a separately: Generally, people do have multiple life insurance policies, wherein one is provided by the employer, and the other is through their own.

Source: esmaltesdagaby.blogspot.com

Source: esmaltesdagaby.blogspot.com

The good news is that it�s possible to have more than one life insurance policy at the same time. The application, interview, possible medical exam, and the waiting can be cumbersome. Purchasing multiple policies can help you find the right combination of protection at the right price, rather than opting for a high level of coverage beyond the time when your family needs it. You can own multiple life insurance policies as long as the amounts are justified and you do not go over your insurability limit. Yes, it is possible to claim more than one policy.

Source: ailife.com

Source: ailife.com

But the more important question is,. Multiple life insurance policies = more life insurance coverage. Purchasing multiple policies can help you find the right combination of protection at the right price, rather than opting for a high level of coverage beyond the time when your family needs it. 1 insure.com gives the example of having a “permanent life insurance policy like whole life and also a term life policy for a shorter need.” you should speak with a. However, here is a list of five crucial factors you should keep in mind:

Source: pinterest.com

Source: pinterest.com

A level term assurance for £550,000 over 30 years will cost around £45 per month amounting to £16,200 over the 30 years. Discover how the process works and how many policies you can have. An important thing to mention here is the restrictions life insurance policies have in case you have more than one policy. It’s possible to have more than one life insurance policy. However, here is a list of five crucial factors you should keep in mind:

Source: alexandra-artnstuff.blogspot.com

Source: alexandra-artnstuff.blogspot.com

Buying multiple life insurance policies can be a smart way to get additional coverage to insure against a specific debt, like a mortgage, or if you want to implement a more complicated financial strategy, like the ladder strategy. Joint life insurance covers two lives but normally pays out upon the death of the first insured person during the policy term, after which the policy ends. It is perfectly legal to buy multiple life insurance policies and your family will not face problem in filing multiple claims. Can you have more than one life insurance policy? Carrying multiple life insurance policies can be a savvy way to protect your family as your needs change.

Source: johnscottinsurance.com

Source: johnscottinsurance.com

This will start the claim process, although, if you have multiple life insurance policies, your beneficiaries will. However, here is a list of five crucial factors you should keep in mind: Yes, you can have multiple life insurance policies in 2022. Discover how the process works and how many policies you can have. Before making a decision on whether taking out more than one life.

Source: greatoutdoorsabq.com

Source: greatoutdoorsabq.com

Joint life insurance covers two lives but normally pays out upon the death of the first insured person during the policy term, after which the policy ends. Multiple life insurance policies = more life insurance coverage. Can i buy more than one life insurance policy? 1 insure.com gives the example of having a “permanent life insurance policy like whole life and also a term life policy for a shorter need.” you should speak with a. In the event that you pass away during the policy’s term, your beneficiaries will be asked to provide a copy of your death certificate to confirm the cause and date of death.

Source: insurancebrokersusa.com

Source: insurancebrokersusa.com

Why should you consider multiple life insurance policies? Life insurance solution based on buying multiple policies. It’s possible to have more than one life insurance policy. In contrast, taking out two single life insurance policies means the surviving partner will still have cover in place after the first death. Purchasing an additional life insurance policy can increase your coverage to meet your current financial needs that may not be met with your existing policy.

Source: justicesnows.com

Source: justicesnows.com

An important thing to mention here is the restrictions life insurance policies have in case you have more than one policy. Buying multiple life insurance policies makes sense if you have multiple loans running. Even when you buy private life insurance, it’s common to have multiple policies to cover different death benefit needs. Multiple life insurance policies = more life insurance coverage. For most people, having more life insurance is an outstanding idea.

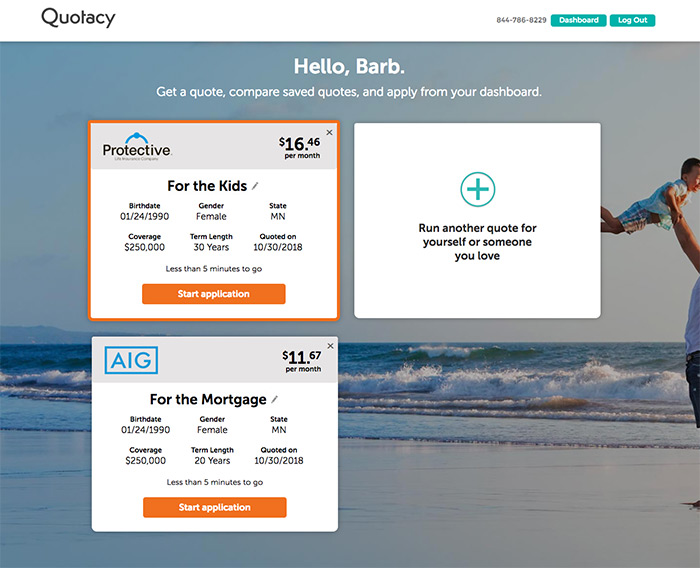

Source: quotacy.com

Source: quotacy.com

Life insurance solution based on buying multiple policies. Holding multiple policies is a common way for one to increase their life insurance coverage, but an insurance provider approves policies not only based on your health but also on the legitimacy of your coverage needs and your perceived ability to keep up with your monthly insurance premiums. As per the restriction, the total coverage amount for all your policies cannot be more than the future income that you would earn. Why should you consider multiple life insurance policies? Multiple life insurance policies = more life insurance coverage.

Source: partners4prosperity.com

Source: partners4prosperity.com

As per the restriction, the total coverage amount for all your policies cannot be more than the future income that you would earn. One life insurance policy to cover all of person a�s needs: For sure, purchasing multiple life insurance policies is more tedious than purchasing one. Can you have more than one life insurance policy? According to insure.com, “you can have multiple policies from the same or different life insurance companies,” and a reason for that may be to fill different needs.

Source: edmchicago.com

Source: edmchicago.com

Before making a decision on whether taking out more than one life. The application, interview, possible medical exam, and the waiting can be cumbersome. One life insurance policy to cover all of person a�s needs: In fact, there are many good. In contrast, taking out two single life insurance policies means the surviving partner will still have cover in place after the first death.

Source: sproutt.com

Source: sproutt.com

Multiple life insurance policies = more life insurance coverage. Discover how the process works and how many policies you can have. As per the restriction, the total coverage amount for all your policies cannot be more than the future income that you would earn. Buying multiple life insurance policies makes sense if you have multiple loans running. Carrying multiple life insurance policies can be a savvy way to protect your family as your needs change.

Source: pinterest.com

Source: pinterest.com

Life insurance solution based on buying multiple policies. With multiple life insurance policies, a policyholder essentially ensures that their beneficiaries can access the benefits of their hlv even if they are no longer around. As per the restriction, the total coverage amount for all your policies cannot be more than the future income that you would earn. Even when you buy private life insurance, it’s common to have multiple policies to cover different death benefit needs. Buying multiple life insurance policies makes sense if you have multiple loans running.

Source: insuranceblogbychris.com

Source: insuranceblogbychris.com

It’s absolutely possible and legal to have multiple life insurance policies at once. In the event that you pass away during the policy’s term, your beneficiaries will be asked to provide a copy of your death certificate to confirm the cause and date of death. You can own multiple life insurance policies as long as the amounts are justified and you do not go over your insurability limit. A level term assurance for £550,000 over 30 years will cost around £45 per month amounting to £16,200 over the 30 years. You can have more than one life insurance policy, and you don’t have to get them from the same company.

Source: topquotelifeinsurance.com

Source: topquotelifeinsurance.com

Joint life insurance covers two lives but normally pays out upon the death of the first insured person during the policy term, after which the policy ends. Can i buy more than one life insurance policy? The application, interview, possible medical exam, and the waiting can be cumbersome. This will start the claim process, although, if you have multiple life insurance policies, your beneficiaries will. As per the restriction, the total coverage amount for all your policies cannot be more than the future income that you would earn.

Source: quotacy.com

Source: quotacy.com

As per the restriction, the total coverage amount for all your policies cannot be more than the future income that you would earn. Life insurance policies that cover each need for person a separately: This is the most basic advantage. In technical terms, it is referred to as human life value. Purchasing an additional life insurance policy can increase your coverage to meet your current financial needs that may not be met with your existing policy.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title multiple life insurance policies by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.