My car insurance is too high information

Home » Trend » My car insurance is too high informationYour My car insurance is too high images are ready. My car insurance is too high are a topic that is being searched for and liked by netizens now. You can Download the My car insurance is too high files here. Find and Download all royalty-free photos and vectors.

If you’re looking for my car insurance is too high images information connected with to the my car insurance is too high interest, you have visit the ideal site. Our site frequently provides you with suggestions for viewing the highest quality video and picture content, please kindly surf and find more informative video content and images that match your interests.

My Car Insurance Is Too High. For example, a full coverage policy in maine costs an average of just $831 a year, while a full coverage policy in florida would set you back an average of $2,587 a year. You’re a young, or new, driver. And recently, women have been paying more for car insurance than men. Insurance is expensive in new york.

There’s a few different reasons why the cost of car insurance is so high, including: In most cases the discounts are substantial! First of all, there are a number of factors that determine the cost of your car insurance premium and excess, including your: This is because younger drivers have a higher chance of crashing.for insurance purposes, a young driver is classed as anyone under the age of 25,. I believe that means that insurers will be able to surcharge you for three years. Buy your home and auto insurance from the same insurance company.

Try to avoid any bad credit ratings.

This is because younger drivers have a higher chance of crashing.for insurance purposes, a young driver is classed as anyone under the age of 25,. Therefore, buying a higher deductible is a good idea. If you bought a vehicle with a theft deterrent system, or you have one installed, your car insurance company might give you a discount. And recently, women have been paying more for car insurance than men. You’re a young, or new, driver. If your car insurance is too high, your location could have a lot to do with it.

Source: bbc.co.uk

Source: bbc.co.uk

Rates mostly depend on ; The average cost of car insurance varies by state. Best advice to give is tell the insurance company you drive 3,000 miles a year. Try to avoid any bad credit ratings. The average car insurance premium has also become more expensive as it increased by more than 50% in the past 10 years.

Source: wrennefinancial.com

Source: wrennefinancial.com

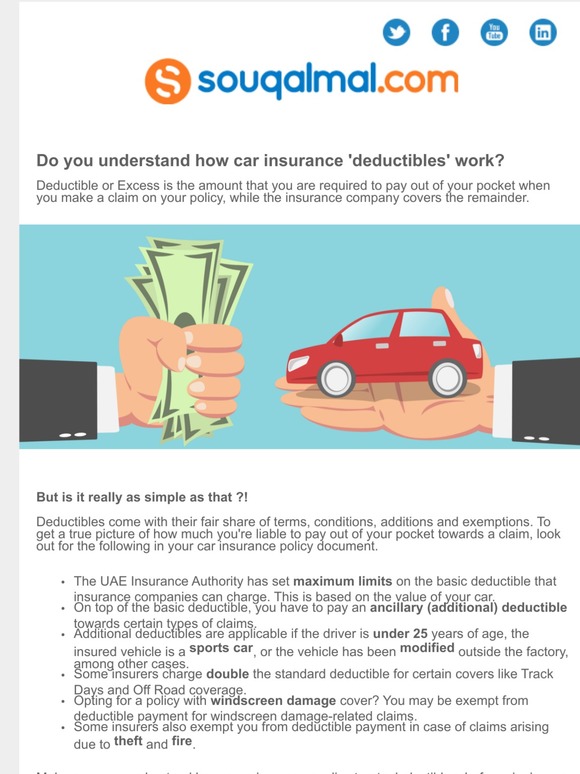

Another reason car insurance companies raise your deductible is because of the increase in your usage of your car. Car insurance is the single biggest component in your car maintenance cost, and a high premium amount severely impacts your ownership experience. In most cases the discounts are substantial! And recently, women have been paying more for car insurance than men. Therefore, buying a higher deductible is a good idea.

Source: dynamicwayofliving.com

Source: dynamicwayofliving.com

Auto insurance coverage costs are on the rise too. Buy your home and auto insurance from the same insurance company. Passing your test and getting your first car, or insuring yourself on a parent’s car, can be an amazing milestone.however, as a new driver, you’re likely to be facing a high insurance cost. If you’re thinking, “my car insurance is too high,” chances are something is wrong somewhere. Usually, if you use the same company for more than one policy, you can earn a discount.

Source: milled.com

Source: milled.com

If you bought a vehicle with a theft deterrent system, or you have one installed, your car insurance company might give you a discount. Insufficient coverage is the first reason your car insurance is too high. Insurance is expensive in new york. As of 2020, the average annual auto insurance cost was $2,388. Always compare rates and ask about discounts.

Source: teamausman-pictureaday.blogspot.com

Source: teamausman-pictureaday.blogspot.com

Drivers under 25 and older than 65 pay more for auto coverage because they are statistically more likely to be involved in serious and fatal accidents. For example, a full coverage policy in maine costs an average of just $831 a year, while a full coverage policy in florida would set you back an average of $2,587 a year. Credit history affects your premium amount. The average cost of car insurance varies by state. Believe it or not, insurance companies also look at age and gender to determine insurance rates.

If the insurance company estimate and payout is greater than the cost to fix the vehicle… that money is yours. First of all, there are a number of factors that determine the cost of your car insurance premium and excess, including your: Part of why your price is so high is because your car is, basically, brand new, and you have only been driving for a couple years. If the insurance company estimate and payout is greater than the cost to fix the vehicle… that money is yours. If you drive an older.

Source: abacusnews.com

Source: abacusnews.com

In order to find out if you’re paying too much for car insurance, and if so how to secure a better deal, you first need to understand how car insurance is calculated. Try to avoid any bad credit ratings. Going without car insurance—even during a period when you aren�t driving or don�t own a car—could translate to higher rates the next time you apply for insurance. Passing your test and getting your first car, or insuring yourself on a parent’s car, can be an amazing milestone.however, as a new driver, you’re likely to be facing a high insurance cost. Buy your home and auto insurance from the same insurance company.

Therefore, buying a higher deductible is a good idea. Car insurance is the single biggest component in your car maintenance cost, and a high premium amount severely impacts your ownership experience. If your vehicle’s value is less than $3,000, you may want to consider eliminating comprehensive and collision coverage. Insufficient coverage is the first reason your car insurance is too high. Drivers under 25 and over 75 tend to have higher rates.

Source: flipboard.com

Source: flipboard.com

In most cases the discounts are substantial! Car insurance is the single biggest component in your car maintenance cost, and a high premium amount severely impacts your ownership experience. Best advice to give is tell the insurance company you drive 3,000 miles a year. Insufficient coverage is the first reason your car insurance is too high. That�s why it can be hard to pinpoint the reasons for high rates.

Source: yourmoney.com

Source: yourmoney.com

Best advice to give is tell the insurance company you drive 3,000 miles a year. If your driving record is clean and your rates are still high, your car insurance might be expensive because of your: Part of why your price is so high is because your car is, basically, brand new, and you have only been driving for a couple years. As of 2020, the average annual auto insurance cost was $2,388. If your car insurance is too high, your location could have a lot to do with it.

Source: autoinsuranceape.com

Source: autoinsuranceape.com

Another reason car insurance companies raise your deductible is because of the increase in your usage of your car. Insufficient coverage is the first reason your car insurance is too high. Shop around too, insurance rates vary vastly from company to company. Credit history affects your premium amount. Buy your home and auto insurance from the same insurance company.

Source: milled.com

Source: milled.com

And recently, women have been paying more for car insurance than men. Going without car insurance—even during a period when you aren�t driving or don�t own a car—could translate to higher rates the next time you apply for insurance. If any of these are high, your insurance rate will be high too. If you don’t have enough coverage, your rates will be higher than they would be if you had the right amount of coverage. Age, driving record, and frequency of accidents in the zipcode you live in, other factors are included too.

Source: blog.directauto.com

Source: blog.directauto.com

In order to find out if you’re paying too much for car insurance, and if so how to secure a better deal, you first need to understand how car insurance is calculated. Insufficient coverage is the first reason your car insurance is too high. Buy your home and auto insurance from the same insurance company. For example, a full coverage policy in maine costs an average of just $831 a year, while a full coverage policy in florida would set you back an average of $2,587 a year. Going without car insurance—even during a period when you aren�t driving or don�t own a car—could translate to higher rates the next time you apply for insurance.

Source: lowestrates.ca

Source: lowestrates.ca

The average car insurance premium has also become more expensive as it increased by more than 50% in the past 10 years. Auto insurance coverage costs are on the rise too. As of 2020, the average annual auto insurance cost was $2,388. Part of why your price is so high is because your car is, basically, brand new, and you have only been driving for a couple years. Always compare rates and ask about discounts.

Source: zonotho.co.za

Source: zonotho.co.za

Going without car insurance—even during a period when you aren�t driving or don�t own a car—could translate to higher rates the next time you apply for insurance. In most cases the discounts are substantial! Therefore, buying a higher deductible is a good idea. The average cost of car insurance varies by state. If any of these are high, your insurance rate will be high too.

Source: omega-ins.com

Source: omega-ins.com

Your car insurance could be too high because the car insurance company sees you as a risk due to either driving record, credit history, age, and even where you live. You’re a young, or new, driver. Drivers under 25 and older than 65 pay more for auto coverage because they are statistically more likely to be involved in serious and fatal accidents. If any of these are high, your insurance rate will be high too. First of all, there are a number of factors that determine the cost of your car insurance premium and excess, including your:

Source: mirthspam.blogspot.com

Source: mirthspam.blogspot.com

For example, a full coverage policy in maine costs an average of just $831 a year, while a full coverage policy in florida would set you back an average of $2,587 a year. If you’re thinking, “my car insurance is too high,” chances are something is wrong somewhere. Get quotes for other insurance companies. If your vehicle’s value is less than $3,000, you may want to consider eliminating comprehensive and collision coverage. There’s a few different reasons why the cost of car insurance is so high, including:

Source: pinterest.com

Source: pinterest.com

If you’re thinking, “my car insurance is too high,” chances are something is wrong somewhere. Did you buy a different car? Age, driving record, and frequency of accidents in the zipcode you live in, other factors are included too. Will help reduce the coverage rates considerably. I believe that means that insurers will be able to surcharge you for three years.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site value, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title my car insurance is too high by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.