Naming a charity as beneficiary of life insurance information

Home » Trending » Naming a charity as beneficiary of life insurance informationYour Naming a charity as beneficiary of life insurance images are ready in this website. Naming a charity as beneficiary of life insurance are a topic that is being searched for and liked by netizens today. You can Find and Download the Naming a charity as beneficiary of life insurance files here. Find and Download all royalty-free vectors.

If you’re searching for naming a charity as beneficiary of life insurance images information connected with to the naming a charity as beneficiary of life insurance topic, you have come to the ideal blog. Our site always provides you with suggestions for seeing the highest quality video and image content, please kindly hunt and locate more enlightening video articles and graphics that fit your interests.

Naming A Charity As Beneficiary Of Life Insurance. If you’re a charitable person and hold a specific organization near and dear to your heart, you can name it as a beneficiary of your life insurance policy. Your favorite charity may benefit by naming them the beneficiary of your life insurance policy. Giving usa foundation, 2017 web.1894.02.16 Confirm that the charity you want to list as a beneficiary of your life insurance or retirement plan qualifies.

Charitable Giving Gervais Wealth Management From gervaiswm.com

Charitable Giving Gervais Wealth Management From gervaiswm.com

A life insurance beneficiary is typically the person or people who get the payout on your life insurance policy after you die; You can set up a life insurance trust and name a trustee to oversee the funds and distribute the money to your children or whomever you wish. Contact the charity to verify that it will accept the proceeds of your life insurance policy or retirement plan. Confirm that the charity you want to list as a beneficiary of your life insurance or retirement plan qualifies. Naming a nonprofit as your life insurance beneficiary is a common and relatively simple way to give the gift of life insurance to charity. Leaving life insurance to charity.

Contact the charity to verify that it will accept the proceeds of your life insurance policy or retirement plan.

How to list a charity as your beneficiary? A life insurance beneficiary is a party explicitly named as the intended recipient of the policys death benefit the amount payable to the beneficiary ies when a policyholder passes away. For many business cases, the company may be the beneficiary of the policy. Naming a charity as a beneficiary another option some people choose is naming a charity as beneficiary of their life insurance policies. Gifting a life insurance policy or naming a charity as beneficiary, you can provide the charity of your choice with the financial resources to ensure that their good work will continue. So make sure you know the restrictions and details before signing up for something.

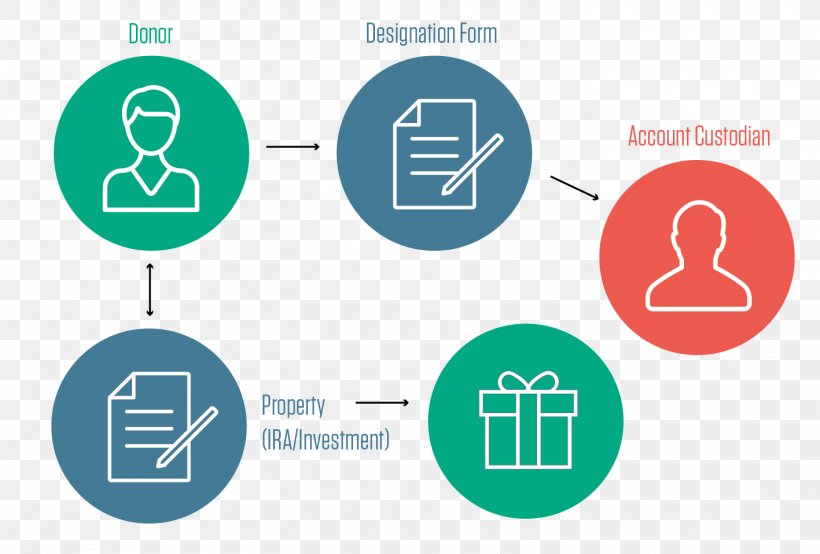

Source: hhretirement.com

Source: hhretirement.com

Because you can name more than one beneficiary, you can. In fact, you can name more than one beneficiary, and can even specify the percentage of the payout you want to go to each one. Because you can name more than one beneficiary, you can. How to list a charity as your beneficiary step 1. Because of this, you may choose to name a charitable organization as a beneficiary in your life insurance policy or retirement account, or to include a charitable donation, that won’t go into effect until you pass away, in your will or living trust.

Source: epilawg.com

Source: epilawg.com

In fact, you can name more than one beneficiary, and can even specify the percentage of the payout you want to go to each one. When you’re given a beneficiary designation form by the insurer, you can dictate the distribution of your insurance payout. Naming a charity as a life insurance beneficiary is simple: Gifting a life insurance policy or naming a charity as beneficiary, you can provide the charity of your choice with the financial resources to ensure that their good work will continue. Identify the charity or cause you want to support determine what type of gift you’d like to make include the gift in your.

Source: gervaiswm.com

Source: gervaiswm.com

Because you can name more than one beneficiary, you can. Leaving life insurance to charity. Charities can include entities like churches that may have brought someone a sense of community during their life, or perhaps an organization fighting for a cause that gave the policyholder a sense of purpose. How to list a charity as your beneficiary step 1. Gifting a life insurance policy or naming a charity as beneficiary, you can provide the charity of your choice with the financial resources to ensure that their good work will continue.

Source: blog.highlandbrokerage.com

Find the life insurance policy for you with david pope insurance services, llc You can set up a life insurance trust and name a trustee to oversee the funds and distribute the money to your children or whomever you wish. You write in the charity name on your beneficiary designation form. So make sure you know the restrictions and details before signing up for something. All life insurance policies require the policyholder to name a beneficiary who will receive payment after they die.

Source: everplans.com

Source: everplans.com

All life insurance policies require the policyholder to name a beneficiary who will receive payment after they die. Although this strategy is a bit more involved than merely purchasing a. Although no income tax deduction will be allowed for the gift, no income tax is reportable regardless of how much the employer has paid. Giving usa foundation, 2017 web.1894.02.16 How to list a charity as your beneficiary step 1.

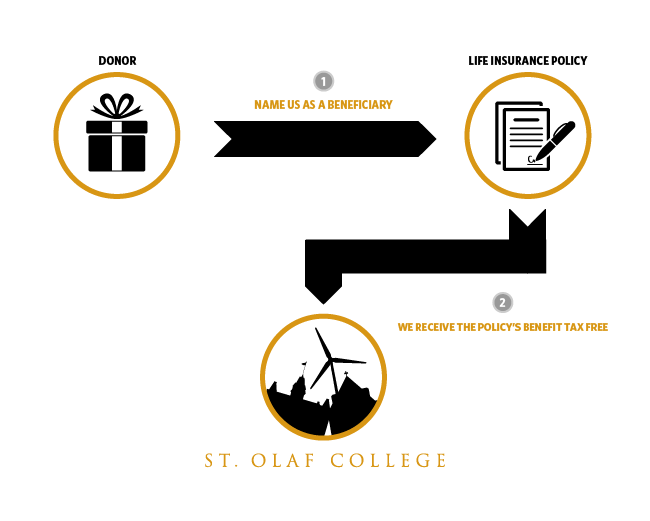

Source: wp.stolaf.edu

Source: wp.stolaf.edu

Charities can include entities like churches that may have brought someone a sense of community during their life, or perhaps an organization fighting for a cause that gave the policyholder a sense of purpose. You write in the charity name on your beneficiary designation form. Although this strategy is a bit more involved than merely purchasing a. Because you can name more than one beneficiary, you can. It may also be a trust, charity or your estate.

Source: ccf-mn.org

Source: ccf-mn.org

You write in the charity name on your beneficiary designation form. Confirm that the charity you want to list as a beneficiary of your life insurance or retirement plan qualifies. It may also be a trust, charity or your estate. Because you can name more than one beneficiary, you can. Life insurance policies allow you to pick multiple beneficiaries and even specify what percentage of the death benefit should go.

Source: socialtechsummit.org

Source: socialtechsummit.org

Contact the charity to verify that it will accept the proceeds of your life insurance policy or retirement plan. You can set up a life insurance trust and name a trustee to oversee the funds and distribute the money to your children or whomever you wish. Identify the charity or cause you want to support determine what type of gift you’d like to make include the gift in your. As an alternative, a charity can be designated as the beneficiary of a life insurance policy. So make sure you know the restrictions and details before signing up for something.

Source: glistrategies.com

Source: glistrategies.com

Naming a charity as a beneficiary another option some people choose is naming a charity as beneficiary of their life insurance policies. Your favorite charity may benefit by naming them the beneficiary of your life insurance policy. It may also be a trust, charity or your estate. Leaving life insurance to charity. Here’s how to do it:

Source: esopralembrar.blogspot.com

Source: esopralembrar.blogspot.com

In the ideal situation, the life insurance benefit is greater than what you would have donated if you had given cash to the charity. However, not all insurers will do this through the life insurance, only their will process. Contact the charity to verify that it will accept the proceeds of your life insurance policy or retirement plan. About 1.54 million nonprofit organizations are currently registered in the united states. Your favorite charity may benefit by naming them the beneficiary of your life insurance policy.

Source: abundance.ca

Source: abundance.ca

You write in the charity name on your beneficiary designation form. Although no income tax deduction will be allowed for the gift, no income tax is reportable regardless of how much the employer has paid. Steps to naming a charity beneficiary leaving money to a charity is not very hard. Although this strategy is a bit more involved than merely purchasing a. Naming a nonprofit as your life insurance beneficiary is a common and relatively simple way to give the gift of life insurance to charity.

Source: everplans.com

Source: everplans.com

When you’re given a beneficiary designation form by the insurer, you can dictate the distribution of your insurance payout. Because of this, you may choose to name a charitable organization as a beneficiary in your life insurance policy or retirement account, or to include a charitable donation, that won’t go into effect until you pass away, in your will or living trust. As we’ve discussed, there is no issue with naming a charity as a beneficiary on a life insurance policy. Although no income tax deduction will be allowed for the gift, no income tax is reportable regardless of how much the employer has paid. Your favorite charity may benefit by naming them the beneficiary of your life insurance policy.

Source: aaaliving.acg.aaa.com

Source: aaaliving.acg.aaa.com

Using life insurance to make charitable donations charitable giving riders on life insurance. Naming a charity as a beneficiary is a noble way to create a legacy for yourself after you’ve passed. A life insurance beneficiary is a party explicitly named as the intended recipient of the policys death benefit the amount payable to the beneficiary ies when a policyholder passes away. Life insurance policies allow you to pick multiple beneficiaries and even specify what percentage of the death benefit should go to each beneficiary. It may also be a trust, charity or your estate.

Source: haikudeck.com

Source: haikudeck.com

Your favorite charity may benefit by naming them the beneficiary of your life insurance policy. The beneficiary is usually a child or spouse, but it can also be a trust, charity, or your estate. So make sure you know the restrictions and details before signing up for something. Naming a charity as a life insurance beneficiary is simple: You write in the charity name on your beneficiary designation form.

Source: hpmlawyers.com

Source: hpmlawyers.com

You can also name more than one beneficiary, as well as the percentage of the payout you want to go to each one—for instance, you could designate 50% to a spouse and 50%. Because you can name more than one beneficiary, you can. A life insurance beneficiary is typically the person or people who get the payout on your life insurance policy after you die; Identify the charity or cause you want to support determine what type of gift you’d like to make include the gift in your. However, not all insurers will do this through the life insurance, only their will process.

Source: reneecorwinrey.com

Source: reneecorwinrey.com

Charities can include entities like churches that may have brought someone a sense of community during their life, or perhaps an organization fighting for a cause that gave the policyholder a sense of purpose. Gifting a life insurance policy or naming a charity as beneficiary, you can provide the charity of your choice with the financial resources to ensure that their good work will continue. All life insurance policies require the policyholder to name a beneficiary who will receive payment after they die. Because you can name more than one beneficiary, you can. Because of this, you may choose to name a charitable organization as a beneficiary in your life insurance policy or retirement account, or to include a charitable donation, that won’t go into effect until you pass away, in your will or living trust.

Source: everplans.com

Source: everplans.com

Naming a charity as a life insurance beneficiary is simple: Naming a charity as a life insurance beneficiary is simple: Although this strategy is a bit more involved than merely purchasing a. You write in the charity name on your beneficiary designation form. Charities can include entities like churches that may have brought someone a sense of community during their life, or perhaps an organization fighting for a cause that gave the policyholder a sense of purpose.

Source: abramsinc.com

Source: abramsinc.com

It may also be a trust, charity or your estate. Naming a trust as the beneficiary of a life insurance policy or annuity is a very effective way of building flexibility into ones estate settlement planning. Find the life insurance policy for you with david pope insurance services, llc Here’s how to do it: The beneficiary is usually a child or spouse, but it can also be a trust, charity, or your estate.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title naming a charity as beneficiary of life insurance by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.