National insurance allowance for employers Idea

Home » Trending » National insurance allowance for employers IdeaYour National insurance allowance for employers images are ready. National insurance allowance for employers are a topic that is being searched for and liked by netizens now. You can Download the National insurance allowance for employers files here. Download all royalty-free vectors.

If you’re looking for national insurance allowance for employers pictures information linked to the national insurance allowance for employers topic, you have come to the ideal blog. Our website frequently gives you hints for refferencing the highest quality video and picture content, please kindly hunt and locate more enlightening video articles and images that match your interests.

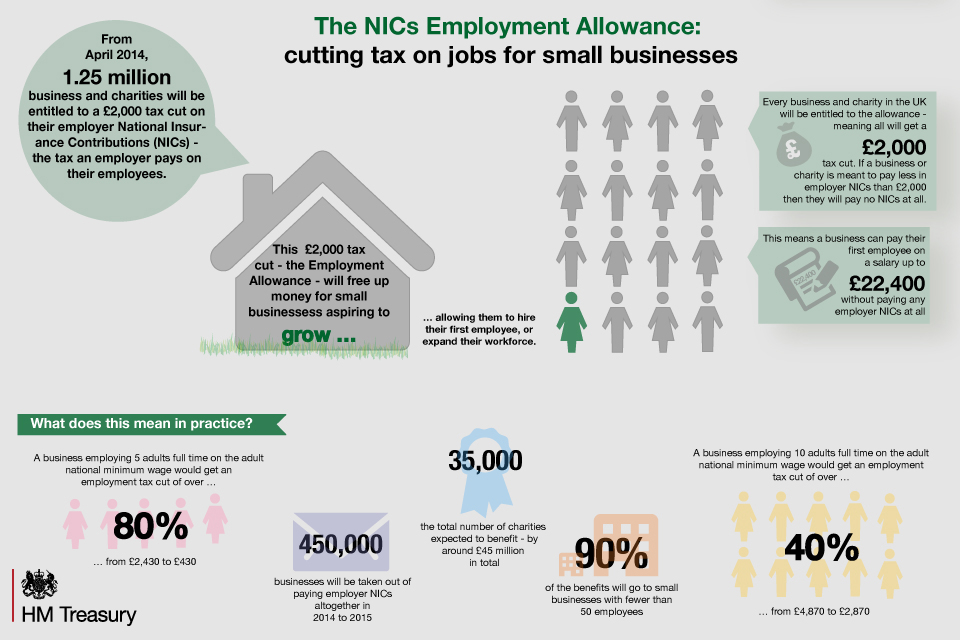

National Insurance Allowance For Employers. With the allowance, you pay less employer’s national insurance each time you run your payroll until the £4,000 has gone or the tax year ends, whichever comes sooner. It’s designed to support smaller employers with their employment costs. You can view these earnings thresholds by week (table 1.1) or by month (table 1.2). Employers and employees pay class 1 national insurance depending on how much the employee earns.

What does the new Employment Allowance Mean for Employers From firstcallfinancials.co.uk

What does the new Employment Allowance Mean for Employers From firstcallfinancials.co.uk

Employers can reduce the amount of national insurance contributions (nics) they pay for their employees by up to £3,000. Can i opt out of national insurance? It is also worth highlighting that in addition to employers being entitled to reclaim for ni payments, employees receiving less than 40p per mile for. You don’t need to be paying more than £4,000 to qualify, either. 2% is the rate paid for any earnings over £805. The employment allowance lets eligible employers reduce their national insurance liability by up to £4,000 for the 2021/22 tax year.

The employment allowance reduces the amount of employer nics payable by some businesses up to the allowance limit (currently £4,000 per year).

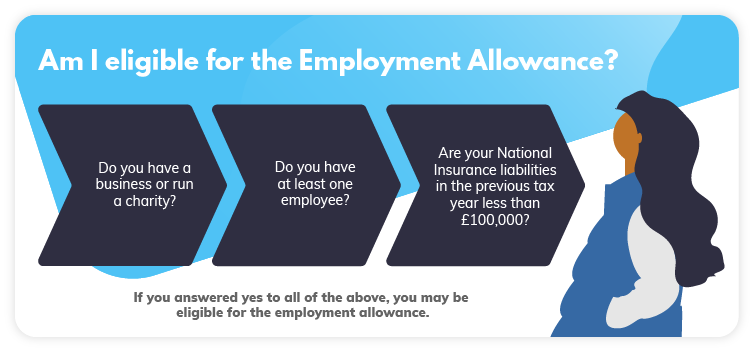

The current employment allowance for employers who pay national insurance for their employees is £3,000.00, that is the full allowance for the 2022 tax year. In april 2014 hmrc introduced an allowance which would allow almost all employers to reclaim £2,000 per year from their employers national insurance contributions. Even if your bill for employer’s ni is less than £4,000 in a year, you can still benefit from the employment allowance. You can view these earnings thresholds by week (table 1.1) or by month (table 1.2). Can i opt out of national insurance? From april 2020, the reduction is only available to organisations with a total nic bill below £100,000.

Source: londonandzurich.co.uk

Source: londonandzurich.co.uk

This allowance has now risen to £3,000 per year from 6th april 2016. Employers and employees pay class 1 national insurance depending on how much the employee earns. Once you’ve used up your full £4,000 allowance in a tax year, you’ll need to start paying any remaining employer contributions towards national insurance. But there are certain changes to the rules, you need to apply again, see below for change of procedure. These are payable on employee earnings and the current rate is 13.8% for earnings of £153 and over.

Source: theaccountancy.co.uk

Source: theaccountancy.co.uk

Employers can reduce the amount of national insurance contributions (nics) they pay for their employees by up to £3,000. Secondary threshold (st) employers start paying national insurance: It is also worth highlighting that in addition to employers being entitled to reclaim for ni payments, employees receiving less than 40p per mile for. The current employment allowance for employers who pay national insurance for their employees is £3,000.00, that is the full allowance for the 2022 tax year. Can i opt out of national insurance?

Source: formsbirds.com

Source: formsbirds.com

This means at least 90% of small businesses can claim the allowance. Secondary threshold (st) employers start paying national insurance: National insurance employment allowance what is the incentive/subsidy on offer? This allowance has now risen to £3,000 per year from 6th april 2016. You can claim employment allowance if you’re a business or charity (including community amateur sports clubs) and your employers’ class 1 national insurance liabilities were.

Source: makesworth.co.uk

Source: makesworth.co.uk

National insurance employment allowance what is the incentive/subsidy on offer? From april 2020, the reduction is only available to organisations with a total nic bill below £100,000. This continues at £4,000 for the 2021/22 tax year. You can view these earnings thresholds by week (table 1.1) or by month (table 1.2). It increased from £3,000 to £4,000 in.

Source: theaccountancysolutions.com

Source: theaccountancysolutions.com

Even if your bill for employer’s ni is less than £4,000 in a year, you can still benefit from the employment allowance. It is also worth highlighting that in addition to employers being entitled to reclaim for ni payments, employees receiving less than 40p per mile for. Records exist to verify the business mileage paid; All employers are liable for paying employers national insurance contributions if they. Once you’ve used up your full £4,000 allowance in a tax year, you’ll need to start paying any remaining employer contributions towards national insurance.

Source: finerva.com

Source: finerva.com

Employment allowance allows eligible employers to reduce their annual national insurance liability by up to £4,000. This allowance has now risen to £3,000 per year from 6th april 2016. Employers can reduce the amount of national insurance contributions (nics) they pay for their employees by up to £3,000. 7 rows employment allowance allows eligible employers to reduce their annual national insurance. Who has to pay employers ni?

Source: gov.uk

Source: gov.uk

You don’t need to be paying more than £4,000 to qualify, either. This continues at £4,000 for the 2021/22 tax year. How to process the employer’s allowance for national insurance. Who is eligible for ni employment allowance? The national insurance employment allowance enables eligible employers to reduce the amount of employer’s national insurance that they pay over to hmrc.

Source: firstcallfinancials.co.uk

Source: firstcallfinancials.co.uk

This is a simple tool that provides emlploee ni and employers ni calculations withour the employment allowance factored in. You don’t need to be paying more than £4,000 to qualify, either. As part of a government scheme to help support small businesses, those that qualify can apply for employment allowance to lower their outgoings. Who has to pay employers ni? You’ll pay less employers’ class 1.

Source: accountingtaxacademy.com

Source: accountingtaxacademy.com

How to process the employer’s allowance for national insurance. It’s designed to support smaller employers with their employment costs. From april 2020, the reduction is only available to organisations with a total nic bill below £100,000. 2% is the rate paid for any earnings over £805. Employers and employees pay class 1 national insurance depending on how much the employee earns.

Source: uk.sageone.com

Source: uk.sageone.com

National insurance employment allowance what is the incentive/subsidy on offer? Once you’ve used up your full £4,000 allowance in a tax year, you’ll need to start paying any remaining employer contributions towards national insurance. Who has to pay employers ni? All employers are liable for paying employers national insurance contributions if they. The employment allowance lets employers registered with hmrc claim a reduction in their annual class 1a national insurance liability paid for the employees when they run payroll.

Source: snaccountants.co.uk

Source: snaccountants.co.uk

The employment allowance lets employers registered with hmrc claim a reduction in their annual class 1a national insurance liability paid for the employees when they run payroll. What is the national insurance employment allowance? This means at least 90% of small businesses can claim the allowance. Who has to pay employers ni? The national insurance employment allowance enables eligible employers to reduce the amount of employer’s national insurance that they pay over to hmrc.

Source: imbillionaire.net

Source: imbillionaire.net

Employment allowance rate 2021/2022 for 2021/2022, the maximum employment allowance an employer can claim is £4,000. The employment allowance lets eligible employers reduce their national insurance liability by up to £4,000 for the 2021/22 tax year. But there are certain changes to the rules, you need to apply again, see below for change of procedure. National insurance employment allowance what is the incentive/subsidy on offer? The current employment allowance for employers who pay national insurance for their employees is £3,000.00, that is the full allowance for the 2022 tax year.

Source: holdenassociates.co.uk

Source: holdenassociates.co.uk

These are payable on employee earnings and the current rate is 13.8% for earnings of £153 and over. The employment allowance was introduced in 2014 in the national insurance contributions act 2014 and when it was first introduced was a relief of up to £2,000. The employment allowance reduces the amount of employer nics payable by some businesses up to the allowance limit (currently £4,000 per year). Employers can reduce the amount of national insurance contributions (nics) they pay for their employees by up to £3,000. Employers and employees pay class 1 national insurance depending on how much the employee earns.

Source: smallbusiness.co.uk

Source: smallbusiness.co.uk

The national insurance employment allowance enables eligible employers to reduce the amount of employer’s national insurance that they pay over to hmrc. From april 2020, the reduction is only available to organisations with a total nic bill below £100,000. Once you’ve used up your full £4,000 allowance in a tax year, you’ll need to start paying any remaining employer contributions towards national insurance. Who has to pay employers ni? This means at least 90% of small businesses can claim the allowance.

Source: nationalinsurancenumber.org

Source: nationalinsurancenumber.org

From april 2020, the reduction is only available to organisations with a total nic bill below £100,000. It’s designed to support smaller employers with their employment costs. From april 2020, the reduction is only available to organisations with a total nic bill below £100,000. Employment allowance allows eligible employers to reduce their annual national insurance liability by up to £4,000. Even if your bill for employer’s ni is less than £4,000 in a year, you can still benefit from the employment allowance.

Source: nordens.co.uk

Source: nordens.co.uk

You don’t need to be paying more than £4,000 to qualify, either. You can claim employment allowance if you’re a business or charity (including community amateur sports clubs) and your employers’ class 1 national insurance liabilities were. These are payable on employee earnings and the current rate is 13.8% for earnings of £153 and over. Secondary threshold (st) employers start paying national insurance: You’ll pay less employers’ class 1.

Source: finerva.com

Source: finerva.com

With the allowance, you pay less employer’s national insurance each time you run your payroll until the £4,000 has gone or the tax year ends, whichever comes sooner. Who has to pay employers ni? It increased from £3,000 to £4,000 in. Secondary threshold (st) employers start paying national insurance: It is also worth highlighting that in addition to employers being entitled to reclaim for ni payments, employees receiving less than 40p per mile for.

Source: theaccountancy.co.uk

Source: theaccountancy.co.uk

You don’t need to be paying more than £4,000 to qualify, either. This allowance has now risen to £3,000 per year from 6th april 2016. With the allowance, you pay less employer’s national insurance each time you run your payroll until the £4,000 has gone or the tax year ends, whichever comes sooner. Employers and employees pay class 1 national insurance depending on how much the employee earns. Employment allowance rate 2021/2022 for 2021/2022, the maximum employment allowance an employer can claim is £4,000.

This site is an open community for users to share their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your own social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title national insurance allowance for employers by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.