National insurance rates 2018 2019 information

Home » Trending » National insurance rates 2018 2019 informationYour National insurance rates 2018 2019 images are ready in this website. National insurance rates 2018 2019 are a topic that is being searched for and liked by netizens today. You can Download the National insurance rates 2018 2019 files here. Download all free photos.

If you’re looking for national insurance rates 2018 2019 images information related to the national insurance rates 2018 2019 interest, you have come to the right site. Our website frequently gives you hints for viewing the maximum quality video and image content, please kindly surf and find more enlightening video content and images that fit your interests.

National Insurance Rates 2018 2019. The federal deposit insurance corporation (fdic) is an independent agency created by the congress to maintain stability and public confidence in the nation�s financial system. 45 pence for all business miles: You paid 2% on any earnings above £50,000. If you earn less than this amount you�ll pay no national insurance contributions.

2019 National Night Out From cityofhoquiam.com

2019 National Night Out From cityofhoquiam.com

Are you ready for the new era of digital tax? You usually pay the current rate when you make a voluntary contribution. Find out how making tax digital will affect you! 6 rows for national insurance purposes: 2018 to 2019 lel £116 per week. If your profits are £8,632 or above then you will also need to pay class 4 ni as well as class 2 ni payments.

20th september, 2019 statutory instruments 269 in exercise of the powers contained in section 57 of the national health insurance act, 2018, the following regulations are made:

Class 4 applies to profits for the whole year and has it’s own brackets: The rates for the 2021 to 2022 tax year are: Salary and business income, pensions (persons aged under 17 or over 69) 5.1%: Liability above primary threshold at 12% / 13.25%. Profits on or over £8,632 for 2019/20. These regulations may be cited as the national health insurance (general) regulations, 2019.

Source: canada.ca

Source: canada.ca

13.8% class 1a and 1b rate rate paid on taxable expenses and benefits. £15.40 a week for class 3; Profits on or over £8,632 for 2019/20. Previous rates and rate cap page. You usually pay the current rate when you make a voluntary contribution.

Source: contracteye.co.uk

Source: contracteye.co.uk

13.8% class 1 rate above the secondary threshold (£737/month). Are you ready for the new era of digital tax? The rates for the 2021 to 2022 tax year are: Previous rates and rate cap page. Salary income, sickness benefit, etc.

Source: parasolgroup.co.uk

Source: parasolgroup.co.uk

20th september, 2019 statutory instruments 269 in exercise of the powers contained in section 57 of the national health insurance act, 2018, the following regulations are made: 13.8% class 1a and 1b rate rate paid on taxable expenses and benefits. Find out how making tax digital will affect you! 13.8% class 1 rate above the secondary threshold (£737/month). Lower limit in personal income/basis for calculating national insurance contributions

Source: brightpay.co.uk

Source: brightpay.co.uk

Profits over £50,000 for 2019/20 You paid 2% on any earnings above £50,000. Find out how making tax digital will affect you! Employer national insurance rates this table shows how much employers pay towards employees’ national insurance for the. Class 2 nic rate applies for any earnings over £6,205 per annum and is payable for each week.

Source: liquidfriday.co.uk

Source: liquidfriday.co.uk

Rates, automobile repair costs, economic conditions, and state laws related to automobile insurance. Alongside the planned abolition of class 2 nics from april 2018, the rate of class 4 will. Find out how making tax digital will affect you! Credit life and credit accident and health premiums: You paid 2% on any earnings above £50,000.

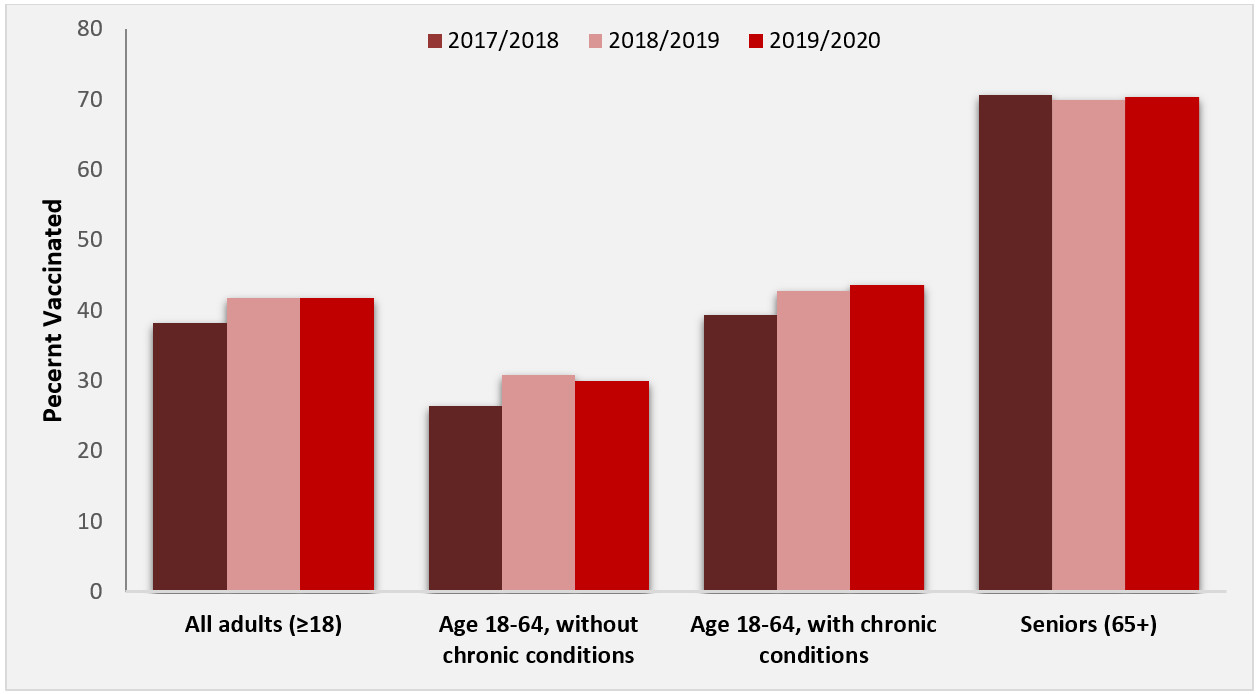

Source: ahip.org

Source: ahip.org

If your profits are £8,632 or above then you will also need to pay class 4 ni as well as class 2 ni payments. 13.8% class 1a and 1b rate rate paid on taxable expenses and benefits. 6 rows for national insurance purposes: (persons aged 17 to 69) 8.0%: £15.40 a week for class 3;

Source: suryaandco.co.uk

Source: suryaandco.co.uk

This means your national insurance payment will be £94.62 for the week. Rates, automobile repair costs, economic conditions, and state laws related to automobile insurance. 2018 to 2019 lel £116 per week. Class 4 ni is charged at 9% of profits between £8,632 and £50,000. Profits over £50,000 for 2019/20

Source: moneysoft.co.uk

Source: moneysoft.co.uk

Salary and business income, pensions (persons aged under 17 or over 69) 5.1%: Credit life and credit accident and health premiums: Lower limit in personal income/basis for calculating national insurance contributions If your profits are £8,632 or above then you will also need to pay class 4 ni as well as class 2 ni payments. Rates, automobile repair costs, economic conditions, and state laws related to automobile insurance.

Source: intosport.co.uk

Source: intosport.co.uk

(persons aged 17 to 69) 8.0%: £6,032 per year primary threshold (pt) £162 per week. You paid 2% on any earnings above £50,000. Class 2 nic rate applies for any earnings over £6,205 per annum and is payable for each week. Class 4 ni is charged at 9% of profits between £8,632 and £50,000.

Source: charterwealth.com

Source: charterwealth.com

Profits over £50,000 for 2019/20 45 pence for all business miles: You usually pay the current rate when you make a voluntary contribution. Lower limit in personal income/basis for calculating national insurance contributions Find out how making tax digital will affect you!

Source: youtube.com

Source: youtube.com

£6,032 per year primary threshold (pt) £162 per week. Lower earnings limit (lel) employees do not pay national insurance but get the. You usually pay the current rate when you make a voluntary contribution. Find out how making tax digital will affect you! If you earned more, you paid 12% of your earnings between £9,500 and £50,00.

Source: worldnationaldays.com

Source: worldnationaldays.com

The rates for the 2021 to 2022 tax year are: You usually pay the current rate when you make a voluntary contribution. Class 4 ni is charged at 9% of profits between £8,632 and £50,000. Previous rates and rate cap page. Credit life and credit accident and health premiums:

Source: npa1.org

Source: npa1.org

Credit life and credit accident and health premiums: Liability above primary threshold at 12% / 13.25%. 20th september, 2019 statutory instruments 269 in exercise of the powers contained in section 57 of the national health insurance act, 2018, the following regulations are made: If your profits are £8,632 or above then you will also need to pay class 4 ni as well as class 2 ni payments. Salary and business income, pensions (persons aged under 17 or over 69) 5.1%:

Source: liquidfriday.co.uk

Source: liquidfriday.co.uk

Alongside the planned abolition of class 2 nics from april 2018, the rate of class 4 will. Previous rates and rate cap page. 2018 to 2019 lel £116 per week. (persons aged 17 to 69) 8.0%: 3 rows 2018 to 2019;

Source: tmechsnhs.weebly.com

Source: tmechsnhs.weebly.com

Profits on or over £8,632 for 2019/20. Are you ready for the new era of digital tax? Profits on or over £8,632 for 2019/20. This means your national insurance payment will be £94.62 for the week. 13.8% class 1 rate above the secondary threshold (£737/month).

Source: tmechsnhs.weebly.com

Source: tmechsnhs.weebly.com

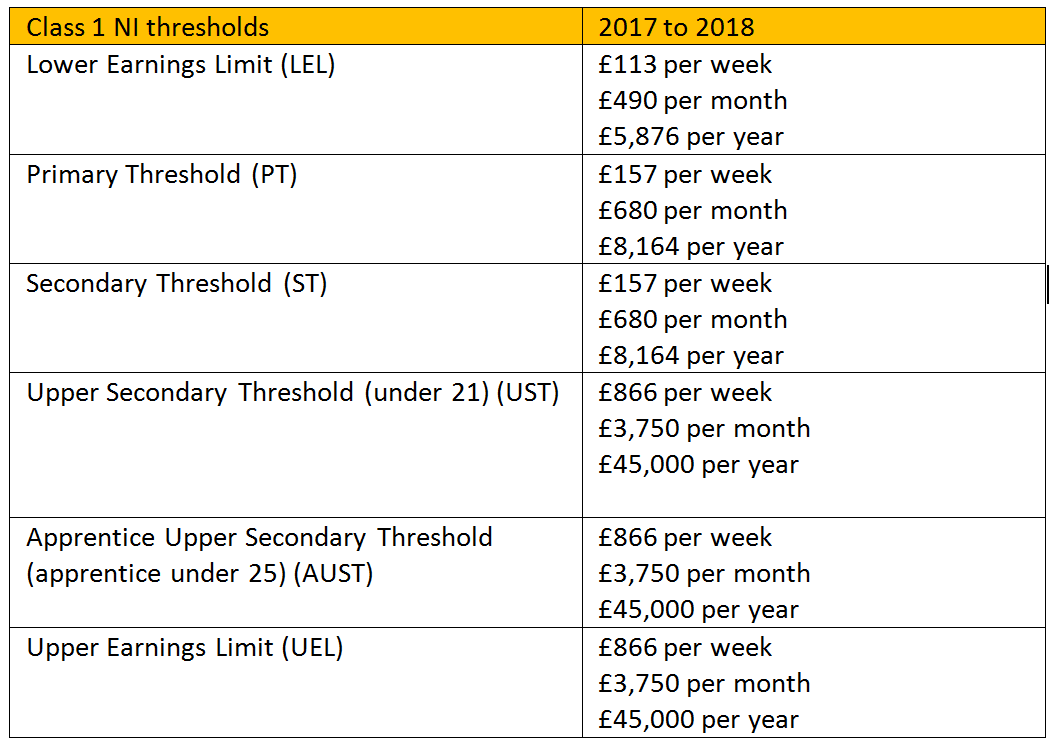

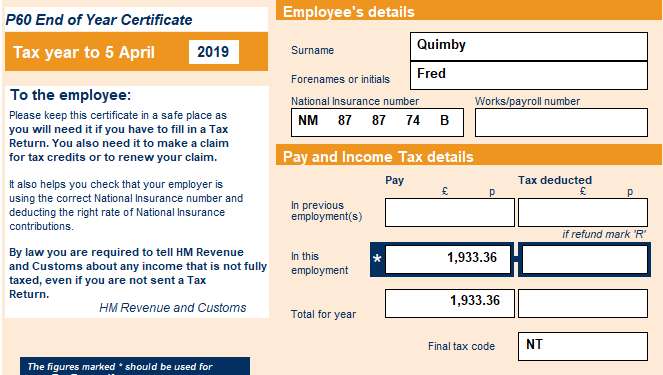

If you earned more, you paid 12% of your earnings between £9,500 and £50,00. Class 4 ni is charged at 9% of profits between £8,632 and £50,000. This means your national insurance payment will be £94.62 for the week. Employer national insurance rates this table shows how much employers pay towards employees’ national insurance for the. Class 1 national insurance thresholds.

Source: tmechsnhs.weebly.com

Source: tmechsnhs.weebly.com

Rates, automobile repair costs, economic conditions, and state laws related to automobile insurance. If you earned more, you paid 12% of your earnings between £9,500 and £50,00. Profits on or over £8,632 for 2019/20. Class 4 applies to profits for the whole year and has it’s own brackets: 13.8% class 1 rate above the secondary threshold (£737/month).

Source: parasolgroup.co.uk

Source: parasolgroup.co.uk

What is employer�s national insurance? Class 1 national insurance thresholds. Credit life and credit accident and health premiums: Profits on or over £8,632 for 2019/20. Find out how making tax digital will affect you!

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title national insurance rates 2018 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.