National insurance rebate leaving uk information

Home » Trend » National insurance rebate leaving uk informationYour National insurance rebate leaving uk images are ready in this website. National insurance rebate leaving uk are a topic that is being searched for and liked by netizens today. You can Download the National insurance rebate leaving uk files here. Get all free vectors.

If you’re looking for national insurance rebate leaving uk pictures information related to the national insurance rebate leaving uk interest, you have come to the ideal blog. Our website frequently provides you with hints for downloading the maximum quality video and picture content, please kindly surf and find more informative video content and graphics that match your interests.

National Insurance Rebate Leaving Uk. The uk deed poll office says that if you change your name via deed poll, you cannot change your national insurance number. How does this work with ni though? How does national insurance work if i leave the uk? You maintain ownership of uk property after you leave and rent it out whilst you are living abroad.

Boris asked eight times on National Insurance change From sport.desnouvelles.info

Boris asked eight times on National Insurance change From sport.desnouvelles.info

I left my job in june so i can return to study and have already applied for and received my tax rebate. If you have left the uk you could be owed a national insurance refund for the last six tax years and a paye tax rebate for the tax year you leave the uk. If you have a form p45 from a former employer, you should send parts 2 and 3 to hmrc together with form p85. The uk government will not refund your ni contributions when you go home. If the employer is unable to sort out the refund, the employee should write to hmrc after the end of the tax year, stating: Nic’s refund leaving the uk if you have left the uk you could be entitled to a ni refund or be able to transfer the nic’s you have made into a pension scheme in the country you now reside.

This letter should include which tax years you are applying for, the reason for your refund request and your national insurance number.

Iirc, backdating is only for the current tax year? Whether you are a taxpaying foreign national or uk citizen, there are three main reasons why you could be due a tax refund from the uk tax office. The uk deed poll office says that if you change your name via deed poll, you cannot change your national insurance number. Claim a national insurance refund. If you have left the uk you could be owed a national insurance refund for the last six tax years and a paye tax rebate for the tax year you leave the uk. If you have been sent to the uk to work by your employer and you leave the uk, it is possible to reclaim any national insurance contributions made for the first 52 weeks of your stay in the uk.

Source: begrudge.co.uk

Source: begrudge.co.uk

The tax year or tax years for which there is an overpayment. P85 form leaving the uk getting your tax right subject: For ease, a glossary can be found at the end of the article. Most working travellers are in the uk for a good time and not necessarily a long time so many won�t be around to claim their national insurance contributions in the uk when they reach retirement age. The tax year or tax years for which there is an overpayment.

Source: dleith.co.uk

Source: dleith.co.uk

This tool helps you apply for a refund on your national insurance contributions from hm revenue and customs ( hmrc ). You can call hmrc on 0300 200 3500. If you have left the uk you could be owed a national insurance refund for the last six tax years and a paye tax rebate for the tax year you leave the uk. Nic’s refund leaving the uk if you have left the uk you could be entitled to a ni refund or be able to transfer the nic’s you have made into a pension scheme in the country you now reside. Tax and nic paid in the tax year for which a refund is sought (include a copy of the p60)

Source: smallbusiness.co.uk

Source: smallbusiness.co.uk

Most working travellers are in the uk for a good time and not necessarily a long time so many won�t be around to claim their national insurance contributions in the uk when they reach retirement age. How does national insurance work if i leave the uk? How does national insurance work if i leave the uk? You may be able to transfer this personal pension plan to a gambian one after leaving the uk. In addition, a paye tax rebate may be owed to you for the tax year in which you leave the uk.

Source: inews.co.uk

Source: inews.co.uk

The tables in this article show both the earnings thresholds and the contribution rates. If you have been sent to the uk to work by your employer and you leave the uk, it is possible to reclaim any national insurance contributions made for the first 52 weeks of your stay in the uk. P85 printable form created date: How does this work with ni though? If you have been sent to the uk to work by your employer and you leave the uk, it is possible to reclaim any national insurance contributions made for.

Source: alpha.frasesdemoda.com

Source: alpha.frasesdemoda.com

6 years from the tax year in question. Use this form to claim tax relief or a repayment if you�re leaving the uk keywords: If you have a form p45 from a former employer, you should. You may be able to transfer this personal pension plan to a gambian one after leaving the uk. Use the online form service.

Source: cloudpro.co.uk

Source: cloudpro.co.uk

How does national insurance work if i leave the uk? I used to live in germany, and when i left there i could reclaim the money paid in to the state pension. Iirc, backdating is only for the current tax year? How does national insurance work if i leave the uk? For ease, a glossary can be found at the end of the article.

Source: fittedlibraries.co.uk

Source: fittedlibraries.co.uk

This tool helps you apply for a refund on your national insurance contributions from hm revenue and customs ( hmrc ). If you have a form p45 from a former employer, you should send parts 2 and 3 to hmrc together with form p85. Posted by 3 years ago. The uk deed poll office says that if you change your name via deed poll, you cannot change your national insurance number. The cbi, which represents 190,000 uk businesses, said increasing national insurance would risk curtailing growth at a critical moment in the.

Source: holbornassets.com

Source: holbornassets.com

Have i overpaid and am entitled to. The p85 is a form where you basically establish that you are leaving the uk and you have no intention in the short term to return to work there and you won�t keep any business activities in the uk that could mean you�re still liable to pay taxes in the uk. Nic’s refund leaving the uk if you have left the uk you could be entitled to a ni refund or be able to transfer the nic’s you have made into a pension scheme in the country you now reside. If you have a form p45 from a former employer, you should. The cbi, which represents 190,000 uk businesses, said increasing national insurance would risk curtailing growth at a critical moment in the.

Source: ageuk.org.uk

Source: ageuk.org.uk

Whether you are a taxpaying foreign national or uk citizen, there are three main reasons why you could be due a tax refund from the uk tax office. To claim a refund of uk national insurance contributions paid while working abroad, you can either: There is a tool for reclaiming national insurance on the gov.uk website here. National insurance rates & thresholds for 2022/23 08 nov 21 the 2022/23 national insurance (ni) rates have been confirmed by hmrc in an email that was sent to software developers. You can call hmrc on 0300 200 3500.

Source: taxrebates.co.uk

Source: taxrebates.co.uk

Once you apply for and are allocated a national insurance number, it’s yours for life. Our leaving the uk tax refund service How does this work with ni though? To claim a refund of uk national insurance contributions paid while working abroad, you can either: The uk deed poll office says that if you change your name via deed poll, you cannot change your national insurance number.

Source: uktaxcalculators.co.uk

Source: uktaxcalculators.co.uk

If you have been sent to the uk to work by your employer and you leave the uk, it is possible to reclaim any national insurance contributions made for. I was just wondering if there was some similar kind of rule for people who will have no entitlement to a state pension here. Most working travellers are in the uk for a good time and not necessarily a long time so many won�t be around to claim their national insurance contributions in the uk when they reach retirement age. However there is a way to get something back from your contributions. For ease, a glossary can be found at the end of the article.

Source: taxrebates.co.uk

Source: taxrebates.co.uk

P85 form leaving the uk getting your tax right subject: Most working travellers are in the uk for a good time and not necessarily a long time so many won�t be around to claim their national insurance contributions in the uk when they reach retirement age. The tax year or tax years for which there is an overpayment. Use this form to claim tax relief or a repayment if you�re leaving the uk keywords: You may be able to transfer this personal pension plan to a gambian one after leaving the uk.

Source: quickrebates.co.uk

Source: quickrebates.co.uk

Have i overpaid and am entitled to. The uk government will not refund your ni contributions when you go home. In addition, a paye tax rebate may be owed to you for the tax year in which you leave the uk. You can call hmrc on 0300 200 3500. Most working travellers are in the uk for a good time and not necessarily a long time so many won�t be around to claim their national insurance contributions in the uk when they reach retirement age.

Source: restlessworld.com.au

Source: restlessworld.com.au

P85 printable form created date: If you intend to claim a uk state pension or to return to live in the uk in the future, you need to decide whether or not you want to continue to pay uk national insurance contributions while you are overseas to maintain your contributions record (assuming you are eligible to do so). Posted by 3 years ago. If the employer is unable to sort out the refund, the employee should write to hmrc after the end of the tax year, stating: How does this work with ni though?

Source: pinterest.com

Source: pinterest.com

If you intend to claim a uk state pension or to return to live in the uk in the future, you need to decide whether or not you want to continue to pay uk national insurance contributions while you are overseas to maintain your contributions record (assuming you are eligible to do so). Because of this it is essential that you act fast so that you don’t miss out on claims for earlier years. How does national insurance work if i leave the uk? However there is a way to get something back from your contributions. If you have left the uk you could be owed a national insurance refund for the last six tax years and a paye tax rebate for the tax year you leave the uk.

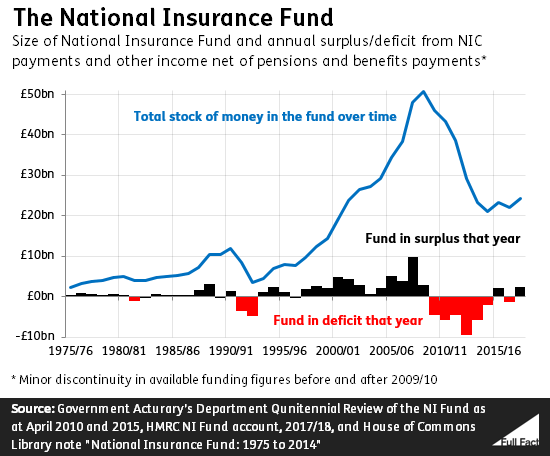

Source: fullfact.org

Source: fullfact.org

If you intend to claim a uk state pension or to return to live in the uk in the future, you need to decide whether or not you want to continue to pay uk national insurance contributions while you are overseas to maintain your contributions record (assuming you are eligible to do so). This form tells hm revenue & customs (hmrc) that you are leaving the uk and makes a claim for repayment of any overpaid tax for the year of departure. This letter should include which tax years you are applying for, the reason for your refund request and your national insurance number. If you intend to claim a uk state pension or to return to live in the uk in the future, you need to decide whether or not you want to continue to pay uk national insurance contributions while you are overseas to maintain your contributions record (assuming you are eligible to do so). You may be able to transfer this personal pension plan to a gambian one after leaving the uk.

Source: mahendraguru.com

Source: mahendraguru.com

Use this form to claim tax relief or a repayment if you�re leaving the uk keywords: Claim a national insurance refund. The p85 is a form where you basically establish that you are leaving the uk and you have no intention in the short term to return to work there and you won�t keep any business activities in the uk that could mean you�re still liable to pay taxes in the uk. I used to live in germany, and when i left there i could reclaim the money paid in to the state pension. Tax and nic paid in the tax year for which a refund is sought (include a copy of the p60)

Source: polishexpress.co.uk

Source: polishexpress.co.uk

You may be able to transfer this personal pension plan to a gambian one after leaving the uk. Tax and nic paid in the tax year for which a refund is sought (include a copy of the p60) This tool helps you apply for a refund on your national insurance contributions from hm revenue and customs ( hmrc ). If you intend to claim a uk state pension or to return to live in the uk in the future, you need to decide whether or not you want to continue to pay uk national insurance contributions while you are overseas to maintain your contributions record (assuming you are eligible to do so). P85 form leaving the uk getting your tax right subject:

This site is an open community for users to do sharing their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site good, please support us by sharing this posts to your preference social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title national insurance rebate leaving uk by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.